Arjuna (Fictional Character): Krishna, Christmas is a festival which is celebrated happily all over the world. In this festival, Santa Claus gives many gifts. What kind of gifts are given by the Income Tax Department to small scale traders on this occasion of Christmas?

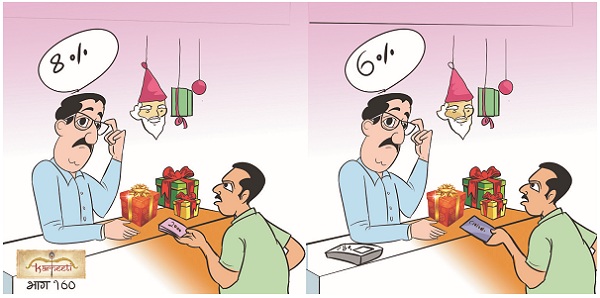

Krishna (Fictional Character): Arjuna, Everywhere people give and take gifts in this festival. After demonetisation of currency on 8th November 16, there is a shortage of cash in hand everywhere. Because of that gifts are purchased by making payments through bank accounts, Paytm vaults, credit cards, etc. Traders are liable to pay taxes on the profit made by them. According to the section 44AD of Income-tax Act, traders having eligible businesses under this section have to pay tax @8% of their total turnover. Businesses like- grocery stores, medicals, cloth stores, retailers etc. The government is promoting these traders to do their trading through bank accounts as there is a shortage of cash. The government has given option to these traders under section 44AD to pay 6% tax on total turnover made through bank accounts. For this Income-tax Department has given a press note on 19th December 2016. The changes made in the sections will be presented in coming budget. If customers will make payment through the bank instead of cash than trader will get benefit of tax.

Arjuna (Fictional Character): Krishna, who all persons are eligible under section 44AD?

Krishna (Fictional Character): Arjuna, According to section 44AD assessee having a turnover of less than 1Crore in the financial year 2015-16 are eligible. The assessee can show a profit of 8% or more and pay taxes accordingly. In the Financial year 2016-17, this limit of 1Crore has been increased to 2Crores. In this, the assessee is required to keep records relating to sales i.e for the purpose of turnover. The assessee need not maintain other books specified in the section 44AA. That’s why this provision is simpler than any other.

Arjuna (Fictional Character): Krishna, what are new options available to show 6% profit under section 44AD of Income-tax Act?

Krishna (Fictional Character): Arjuna, Government has brought up this provision to promote purchase-sale transaction through the bank instead of cash. Under section 44AD, 8% profit on the turnover made through cash transactions and 6% profit on the turnover made through bank transactions will have to be shown. Before this, the assessee has to show profit @ 8% on the total turnover made by him. Because of this provision, the traders will get a benefit of 2% profit if they made sales through the bank account. For example- If a trader having turnover through sales or receipt of 50Lacks in cash and 30Lacks through bank i.e a total of 80Lacks than he is liable to pay 8% on 50Lacks i.e 4Lacks and 6% on 30Lacks i.e 1.80Lacks on the sales which comes to 5.80Lacks on which tax have to be paid. Deduction under section 80 will be available to the assessee. Due date to file the return under section 44AD is 31st July.

Arjuna (Fictional Character): Krishna, Who all can take benefit of this option?

Krishna (Fictional Character): Arjuna,

1. This option is applicable to Individual, HUF and Partnership firms. This option is not applicable to Company, LLP and other tax payers.

2. Taxpayers carrying on business can take benefit of it for an e.g. retailer, wholesaler, and manufacturer, etc.

3. It is not applicable for professionals for e.g. C.A, Advocate, Doctors, etc. and also it is not applicable for the taxpayers having income from the commission, brokerage and leasing, plying goods carriages.

Arjuna (Fictional Character): Krishna, What are the main features of section 44AD?

Krishna (Fictional Character): Arjuna, the important points to keep in mind while opting for this option are:

1. The tax payer can show profit @ 8% and 6% or more.

2. Taxpayer will not get the deductions of expenses under section 30 to 38,

3. Expenses of the business as per section 40, 40A, 43B will not be disallowed. For e.g. if the tax payer has not paid VAT before filing return then it will not be disallowed.

4. Income tax department had made available very easy form ITR 4 S (SUGAM). Only the taxpayer has to give information on debtors, creditors, cash and closing stock value as on 31st March in this form.

5. If the taxpayer has paid tax on profit at 8% and 6% or more then he may not have to face scrutiny.

6. Partnership firms cannot take the deduction of salary and interest given to partner under section 40 (b) from the financial year 2016-17.

7. In this section, the assessee is liable to pay one instalment of advance tax on 15th March from the financial year 2016-17.

Arjuna (Fictional Character): Krishna, what if the tax payer opt for the tax audit?

Krishna (Fictional Character): Arjuna, if tax payer’s 1] profit is less than 8% and 6% or 2] if its taxable income is more than the tax exemption limit (Rs. 2.5 lakh) then he has to maintain the books of accounts as per section 44AA. Further he has to get his books of accounts audited from a Chartered Accountant. For e.g. If the annual turnover or receipt of the cloth merchant is Rs. 80 lakhs and his net profit is 4% i.e. Rs. 3,20,000, then he has to maintain the books of account and also he has to get his accounts audited by Chartered Accountant. Tax payer should choose appropriate and right option considering the income and expenses. If the tax payer wants to opt for this option i.e. to get his accounts audited then the due date for filling return is 30th September. If the assessee opts the option of tax audit then he has to get his books of account audited for minimum next 4 financial years and he will not be eligible to take benefit of 8% and 6% under section 44AD. That’s why the assessee should take decision carefully.

Arjuna (Fictional Character): Krishna, What lesson should be taken by tax payers from this section?

Krishna (Fictional Character): Arjuna, the coming the new year 2017 will lead to the tremendous increase in the trading through bank transactions. Before this, there were excessively cash trading according to the traders’ wish but now this will not happen. More changes will be presented in the coming budget relating to provisions of business and Income Tax. Santa Claus gives his blessings to have happy and prosperous lives. In a similar manner, there are lot of gifts in the coming budget for the honest taxpayers and persons doing their business through banking. And there are punishments and fines for the one who do tax evasion. So everyone should take benefit by doing their business through banking.

Super presentation

Pl clarify whether share trader will be eligible for 6% scheme?

Very useful for me doing jobwork in factory, but I have ltcg on sale of listed equity. So which Itr to file?

Sugam has no provision for declaring ltcg, though fully exempt from income tax?

Good.

My source of income is F&O trading only. This is my 1st year of trading. Though am at net loss of 2L until now. Is the content of this article applicable upon me ? If yes, then how ?

Thanks in advance 🙂

Superb article!!