Section 44AD of the Income Tax Act, 1961

SPECIAL PROVISIONS FOR COMPUTATION OF PROFIT AND GAIN OF BUSINESS ON PRESUMPTIVE BASIS

(After Budget 2016)

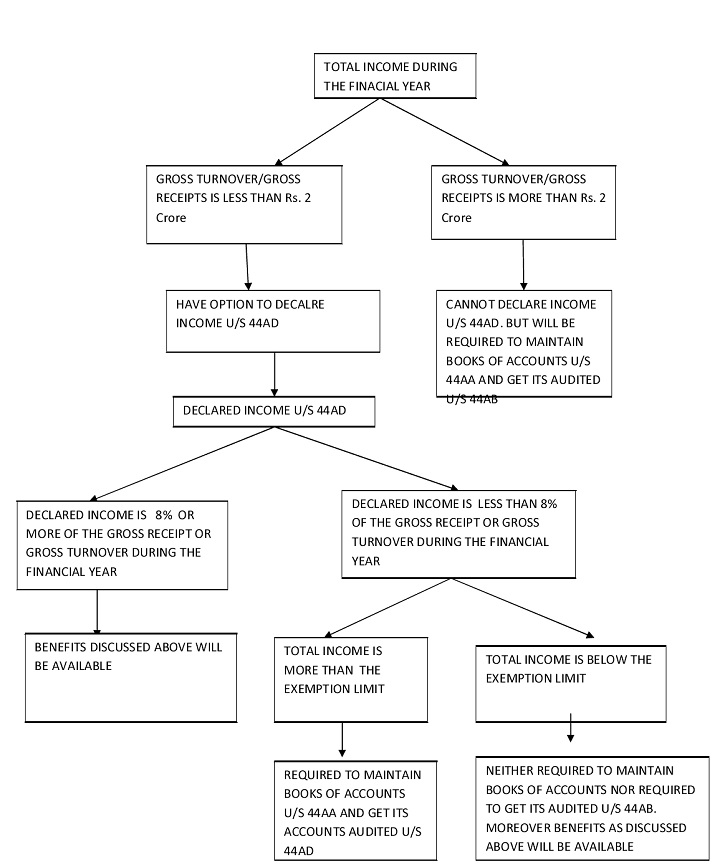

This section is nothing but provides a relaxation to the tax payers to declare income on presumptive basis, which should not be less than 8% of the gross turnover or gross receipt during the financial year. However this relaxation is provided to certain persons and certain business subject to specified conditions which are provided under Sec 44AD of Income Tax Act, 1961. These certain business and certain persons are named as Eligible Business and Eligible Assessee in the Act. Let us discuss this Section.

This section provides that ELIGIBLE ASSESSEES in respect of ELIGIBLE BUSINESS can declare his business income on estimated basis if not maintaining the books of accounts or because of other reasons unable to calculate the business income. This declared income on estimated basis should not be less than 8% of Gross turnover or gross receipts of the business during the financial year.

Now the question arises what’s the meaning of eligible business and eligible assesses as given above. Here the eligible assessee means –

a) An individual, HUF or a partnership firm who is resident other than a LLP. and

b) Who has not claimed any deductions under section 10A, 10AA, 10B, 10BA, or deductions under any provisions of Chapter VIA under the heading ‘C’ i.e Deductions in respect of certain incomes in relevant assessment year.

Interpretation : – Only resident individual, HUF and Partnership firm can declare income under SEC 44AD. An LLP can not declare income under this section. Moreover in case a resident individual, HUF or a partnership firm claims any deduction under section mentioned above also can not declare income under this section

These eligible assesses can declare income on estimated basis in respect of any business except the business mentioned below ,if his gross turnover or gross receipts in the previous year does not exceed Rs. 2 Crore:-

1. A person carrying on profession as referred u/s44AA(1)

2. A person carrying income in the nature of Commission or brokerage.

3. A person carrying on any agency business

4. A person who is in the business of plying , hiring or leasing goods carriages.

Thus income on estimated basis can not be declared u/s 44AD if the gross turnover or gross receipts exceeds Ra. 2 crore during the financial year.This is because if we declare income u/s 44AD, which is not less than 8% ,then we are not required to maintain books of accounts as per the provisions of Sec 44AD however sec 44AB states that audit is compulsory in case the turnover exceeds Rs. 2 crore during the year which requires proper maintenance of books of accounts . Hence an assessee can not apply Sec 44 AD and declare income on estimated basis if the gross trnover or gross receipts exceeds Rs. 2 crore during the financial year.

However the Budget 2016 provides that where an eligible assessee declares profit for any previous year under Sec 44AD and the elegible assessee has not declared income u/s 44AD in any of the five consecutive assessment years succeeding the assessment year in which the income was declared u/s 44AD, , then he shall not be eligible to claim the benefit of declaring the income on presumptive basis u/s 44AD for five assessment years subsequent to the assessment year in which the profit has not been declared under sec 44AD.This limitation will take effect from F.Y. 2016-17.Let us have a clarification of this Budget amendment with an example :-

Suppose an eligible assessee declared income U/s 44AD for A.Y. 2017-18. He continues to declare the income u/s 44ad for A.Y 2018-19 and 2019-20. However for A.Y 2020-21 he has not declared income u/s 44AD, Then the eligible assessee will not be able to avail the benefit of declaring income u/s 44AD for five assessment years succeeding the AY in which he fails to declare income u/s 44AD i.e he will not be allowed to declare income u/s 44AD from A.Y 2021-22 to 2025-26.

Allowability of the Expenses from the Income Declared under Section 44AD

All the expenses are already deemed to be already deducted from the income under this section. It means no further deductions are allowed under this section from the income declared , for expenses. Even the interest , salary , remuneration etc paid to partners by the partnership firm will not be allowed as deduction if income declared u/s 44AD wef F.Y. 2016-17 as the provision in this respect prvided under Section 44AD(2) has been deleted by the Finance Act 2016.

Depreciation : The assessee can provide deprecation to the assets of the business in respect of which the provisions of Section 44AD is claimed and can show WDV value of the assets in the balance sheet. However the depreciation amount will be assumed to be already deducted from the income and no further amount of deprecation can be deducted from the income declared under section 44AD.

Advance Tax : After Budget 2016 , the person declaring income u/s 44AD will also be required to pay the advance tax. However he can pay the advance tax by 15th March of the financial year..

Applicabilty of Section 44AB : if the assessee is covered u/s 44AD(4) and his total incomeand his total income exceeds the maximum amount which is not chargeable to tax , then such assessee is required to maintain the books of accounts and get his accounts audited under Section 44AD and furnish the prescribed report.

Current year losses and brought forward losses: Since this section overrides Section 28 to Sec 43C but does not overrides Chapter VI , so current year losses and brought forward losses can be set off from the income declared under this section

To have a clarification of Sec .let us have some classifications.

Current Year Depreciation and Brought Forward Depreciation

Since the provision of current year depreciation and brought forward deprecation are provided under Section 32 and Section 44AD overrides Section 28 to sec 43C , so current year depreciation and brought forward deprecation can not be set off against the income declared under Sec 44AD.

Deduction under section 80C to 80GGC : This section provides that the assessee who opt for Section 44AD can claim deductions under section 80C to 80GGC. However no deduction can be claimed from Section 80IA to 80RRB.

What if for the AY 2016-17, Assessee declares u/s 44AD, a Loss to the Tune of Rs.20Lakhs because of Interest on Term Loan , Depreciation and other expenses. Does he need to maintain books ???

Any decided cases in this regard?

dear sir tell me provision of 44ad as amendment of 6%.

if Gross receipts is 45 lakhs and profit is below 8%. if audit is compulsory or not.

As amended in 44AD, interest and remuneration to partners is not allowed after declaring profit at 8%. However in my case I maintain books of accounts and my Turnover is 1.5Cr. as I can opt for 44AD upto 2Cr i am opting for 44AD and i dont want my Books Audited. Now After allowing all expenses including Remuneration to Partners and Interest on capital is 9%. My question is Remuneration and Interest allowed or not as 44AD Says it deemed to be allowed Sec 30 to 38 but Int and Rem. Mentioned in 40(b). Kindly Resolve

if we file ITR 4S where one house property Income in the Year F.Y 2015-16 further after 2 year One More House property Added & We have to opted out of Presumptive Income U/s 44AD Because of ITR Do not permit to Declare more the one property Income than in such case Audit is Compulsory or not??

For 44AD Business

Is Chapter Vi a Deductions can be Availed?

is Partners interest and remuneration is allowable as deduction?

if my agriclture income more than rs.5000 , can i fie ITR 4S??can i select SECTION 44AD schme???

return of firm for a.y.16-17 filed u/s 44AD net income was nil after deducting interest 75500 and remuneration 145000 total oft his reflected

BP CPC has processed adding both and taxed after rectification stated there is variance in p n l in part BT1 because mistake in filing up items in sch BP AND CORRESPONDING SCH.So whether no figures will be entered in BP

Your chart says..if income declared under 44 ad

and.. if declared income is less than 8 % and total income is less than exemption limit..

then no need to maintain books and no need for audit…

what is the exemption limit..???

In one of the case of partnership firm, the total turnover is Rs. 157.40 Lacs and net loss of Rs. 150,000/-. If the firm does not want to show income u/s. 44AD of the I.T. Act @ 8% of Rs. 157.40 Lacs, whether the firm has to gets its accounts audited u/s. 44AB inspite of loss for ay 17-18?

if assessee has not availed section 44AD(1) in the preceeding previous year and now in the current previous year his turnover is below 1 crore and profit less than 8% then whether he should audit under section 44 AB.

as per our view in such cases also audit under 44 AB is not applicable.please confirm or give contrary view with reasons.

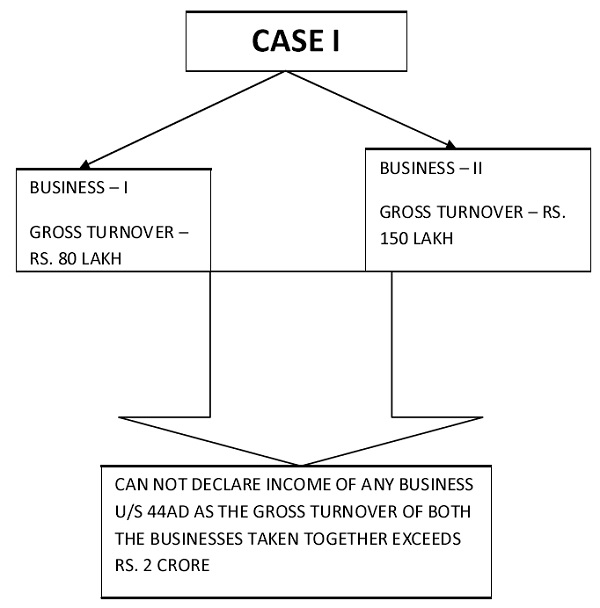

Business I has Sales less than Rs. 1 Crore and hence, can opt for 44AD.

what will be the impact on Sales Tax (CST or VAT) under this. Is this required to deposit sales tax by assesses ??

Can a person declare income at 8% even if the actual net profit is 15% under presumptive tax

If I am promoting some products at overseas market and take fees (fixed negotiated) for the same, under sales promotion. Can I treat this as business income under 44AD ?. Hope this is service business and if amount exceeds 10 Lakhs, service tax to be paid. Please clarify

Manshi ji, if i have incurred loss in F&O equity market during the year and the turnover is also less than 2 crore then –

1. whether 44 AD compulsory to opt or not to opt ?

2. whether to claim the loss without getting the audit done.

3. If i do not want to claim loss and do not want to set off ,as I am not going to do this business activities or any other business activities in future.

Then what would be your kind advise.

Manshi ji, if i have incurred loss in F&O equity market during the year and the turnover is also less than 2 crore then –

1. whether 44 AD compulsory to opt or not to opt ?

2. whether to claim the loss without getting the audit done.

3. If i do not want to claim loss and do not want to set off ,as I am not going to do this business activities or any other business activities in future.

Then what would be your kind advise.

hi, this is sreekanth

Ca Ipcc student

it says that consecutive 5 years rule is applicable to business under 44AD(1), well it is for civil constructions,

is that means other business covered under this sec 44AD is releived?

Happy day,

i’m a student of CA IPCC.

My Question is

”My father is providing export service by way of autocad of building constructions employing some employees”

Is he doing business or profession for the purpose of section 44AD and 44ADA?

in the consequetive 5 years after I declare less than 8%, where I may not be getting 44AD benefit. I am offering more than 8%. Did I subject to tax audit, since I am not convered by section 44AD

Hi ,

I m a professional , I would like to know as my income will be approx 12 lakhs till the end of current financial year. Can I apply for 44ad for the tax payment ?

Dear Manshi,

Is it compulsory for audit when i have loss in F&O business during the year and turnover also less than 8%.

Is 44AD compulsory to opt or we can chose not to opt and claim the loss withou geting the audit done.

In the event for a partnership firm opting for 44AD, if the actual income is more than 8%, how does the partner file his Return to claim the excess of the Income, as share from partnership firm ??

Tax audit limit u/s 44AB is still Rs.1Cr and it has not been changed to Rs.2Cr.

THANKS MADAM

VERY CLEAR CUT IDEAS HAVE BEEN PRESENTED…..

5 succeeding Asst. Years would be from Asst. Year 2021-22 to 2025-26.

5 succeeding Assessment years will be from 2021-22 to Asst. year 2025-26.

very good article on 44Ad.. I have a confusion that 1. 44Ab limit has not been increased to 2 cr..in budget… so is it conflict between 44Ad & 44AB ?? 2. what about implications on Firm , if they want to file return on presumptive income basis ?

The section does not exempt entities from keeping books of accounts under section 44AA, which in case are required for VAT, S.tax, determining turnover. Hence, use of 44AD does not reduce cost of compliance, except tax audit fee and possible scrutiny litigation costs.

Further, logic of 5 continuous years’ condition is incomprehensible.

Very Good Article Manshi..