In a bid to foster economic consolidation, transparency, and security, the Income Tax Department has issued a resounding advisory against cash transactions. This article delves into the societal, individual, and national aspects that drive the preference for cash, the implications of excessive cash transactions, and the provisions laid out by the Income Tax Act, 1961 to regulate and optimize cash dealings.

Say no to Cash Transactions- Income Tax Dept. Advises

A. Introduction: Individuals prefer to receive, pay and transfer cash when the amounts of transactional value (money) involved are marginal to small. Primarily, this happens because:

B. Societal: The presence of large agricultural, informal and non-formal components in the socio-economy necessitate individuals to engage in bartersand cash transactions;

C. Individual: The existence of factors like:

a) the lack of ready means to access digital banking and money transfer facilities;

b) cost and resource considerations;

c) Mental blocks about the digital-world financial transactions driven by security, confidentiality and other factors, et al; and

d) the presence of domains, networks and channels-often global:

- aimed at creating trails of unaccounted incomes and evasion of taxes and duties; and

- designed to conceal and prevent detections of offences and crimesfunded by unrecorded actions/events/moneys.

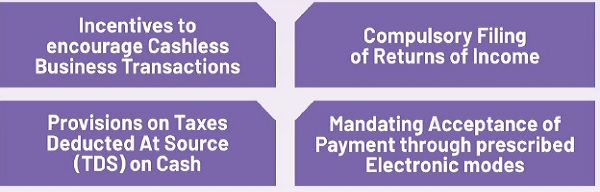

National interest demands economic consolidation, productivity, progress, harmony and security, and rapid transition from barters and metallic and paper money towards electronic transactions and digital money. Transactions in cash need be optimized and monitored. Against this backdrop, the Income-tax Act, 19 61 restricts/optimizes transactions in cash through various provisions which are frequently amended in keeping with contemporary needs, which include:

Permitting Cash Transactions in the Agriculture Sector

Restrictions on:

a) Expenditure (Capital & Revenue) in Cash;

b) Cash Loans, Deposits & Advances;

c) Cash Transactions in Real Estate;

d) Income Tax Deductions;

e) Cash Transactions of Rs. 2 Lacs or more;

f) Charitable Trusts

B. When viewed through the Income-tax prism, reducing cash transactions will help the socio-economy by:

a) Counteracting money laundering, tax evasion, fake (counterfeit) money and other financial crimes;

b) Financial tracking and preventing corruption, crimes, terrorism and other anti-social activities financed by un-reported moneys;

c) Encouraging transparent business practices;

d) Enabling the growth of value-adding businesses and economic drivers;

e) Easing audits and investigations;

f) Increasing physical convenience and reducing the likelihood of theft/loss for individuals;

g) Harmonizing the productive actions of the economic actors with national needs;

h) Increasing tax revenues and inflows into the nation’s coffers through use of financial data to track income generation.

| CATEGORY A | CATEGORY B |

| Penalizing cash transactions above stipulated thresholds to create effective deterrence(i) by imposing a penalty directly for dealing in cash;(ii) by imposing a penalty for not facilitating prescribed electronic modes;(iii)through denials of tax exemptions; and(iv)through the deeming of incomes |

Restricting cash transactions and incentivizing cashless transactions:

(I)through the disallowing of expenses; (ii) by reducing deductions under Chapter VIA in computing taxable income; (iii)by incentivizing deductions under Chapter VIA for better compliance; and (iv)by leveraging the thresholds above which tax audit is mandatory; (v) by reducing the presumptive rate of tax |

–

| CATEGORY C | CATEGORY D |

| (i) Applying Tax Deductibility at Source (TDS)on withdrawals/payments in cash. | (I) Mandating the filing of Returns of Income for cash transactions above a prescribed threshold level. |

–

| D. The relevant parts of the provisions are showcased as under: | |

| Category A (i): Provisions of Penal Nature Setting of Thresholds for dealing in Cash | |

| S. No. | Details of Provisions |

| 1 | Taking/Accepting certain loans Section269ss

° ‘Specified sum’ » any sum of money receivable, as advance or otherwise, in relation to the transfer of an immovable property, whether the transfer takes place ornot. º The amount or the aggregate amount shall include any cash received earlier and remaining unpaid.

(a) the Government; (b) a banking company, post office savings bank or cooperative bank (but not all co-operative societies whether or not involved in banking or related activities); (c) a corporation established by a Central, State or Provincial Act; (d) a Government company as defined in section 2(45)of the Companies Act, 2013; (e) a notified institution, association or body (or class of institutions, associations or bodies).

The penal consequence of violating the mandate above Section 271D imposition/levy on the recipient » a penalty = amount taken in cash |

–

| 2 | Receiving other Amount in cash |

| No person -whether assessed to tax or not-shall take (receive) in cash any amount(s)totalling Rs. 2,00,000/-or more

(a) in aggregate from a person in a day; or (b) in respect of a single transaction; or (c) in respect of transactions relating to one event or occasion from a person. The mandate as above will apply to: (i) receipt of fees by educational institutions and hospitals; (ii)donations by religious institutions; (iii) transactions between two related persons or where both the payer and the payee are exempt from payment of tax.

(i) any receipt by the Government or any banking company, the post office savings bank or any cooperative bank [but not all co-operative societies whether or not involved in banking or related activities]; (ii) transactions of the nature referred to in section 269SS; persons or class of persons or receipts as separately notified for the purpose. The penal consequence of violating mandate above Imposition/levy on the recipient a penalty =amount received in cash |

–

|

3 |

Payment of certain loans or Deposits section 269T |

will repay in cash any loan or deposit or any specified advance if the amount (or the aggregate amount) involved with the applicable interest totals Rs. 20,000/- or more. o tpecified advance’ means any sum of money in the nature of advance, by whatever name called, in relation to the transfer of an immovable property, whether or not the transfer has taken place. o The aggregate amount shall include amounts held by the person in his own name or jointly with any other person on the date of such repayment. The mandate as above shall not apply to repayment of any loan or deposit or specified advance taken or accepted from: (a) the Government; (b) any banking company, post office savings bank or cooperative bank [but not all co-operative societies whether or not involved in banking or related activities]; (c) any corporation established by a Central, State or Provincial Act; (d) any Government company as defined in Section 2(45) of the Companies Act, 2013. (e) notified institution, association or body or class of institutions, associations or bodies. The penal consequence of violating the above mandate Section 271E Imposition/levy on the repayer a penalty =amount repaid in cash |

–

|

Category A(ii);provision of penal Nature Setting of Thresholds for facilities Prescribed Electronic Modes |

|

| 4 | Acceptance of payment through prescribed electronic modes Section 269SU |

Penalty=Rs. 5000/-for every day during which such failure continues |

|

–

| Category A(iii): Provisions of Penal Nature Denials of Exemptions | |

| S. No.

|

Details of Provisions |

Exempting incomes (Voluntary Contributions) of Electoral Trusts donating to Political Parties registered under Section 29A of the Representation of the People Act,1951

|

|

–

|

Category A(iv): Provisions of Penal Nature The Deeming of Income |

|

| S. No. | Details of Provisions |

| 6 | Amount borrowed or repaid on hundi Section 69D

Where any amount is borrowed on a hundi from, or any amount due thereon is repaid to, any person in cash, such amount is deemed to be income of the person borrowing or repaying the amount in the financial year of borrowing or repayment. |

–

| Category B(I): Restricting Cash Transactions Disallowances of Expenses | |

| S. No. | Details of Provisions |

| 7 | Disallowance of expenses incurred in Cash Section 40A(3)

Deemed Income of business or profession if the payment towards expenditure incurred in one year is made in cash in the subsequent year Section 40A(3A)

Exceptions to the above include payments made by purchasers to th cultivators of agricultural produce. NB: Quoting PAN and furnishing Form No. 60 under Rule 1146 do not apply to sale transactions of Rs. 2 lakh or less of agricultural produce. |

–

| 8 | Disallowance of depreciation |

A payment or aggregate of payments in cash exceeding Rs. 10,000 made by a person to any other person on a given day towards acquiring an asset

|

–

|

9 |

Deduction in respect of expenditure on specified business Section 35AD |

|

–

|

Category B(ii): Restriction Cash Transactions Reducing Deduction under chapter VIA |

|

| S. No | Details of Provision |

| 10 | Cash Donation exceeding Rs.2,000 Section 80G (5D)

Donations made to certain funds, charitable institutions etc., are deductible under Section 80G. To avail of this benefit, any such sum exceeding Rs. 2000/- needs to be paid in any mode other than in cash. |

–

|

11 |

Cash Donations exceeding Rs. 10,000 made towards Scientific Research or Rural Development |

| Section 80GGA allows deduction in respect of certain donations made towards scientific research or rural development. From 01.06.2020, no such deduction will be allowed in respect of any sum exceeding Rs. 2,000/- not paid in any mode other than in cash. |

–

| 12 | Cash Contributions made to Political Parties Section 80GGB Section 80GGC

|

Allows deduction to

NO deduction as above is allowed for any contribution made in cash. |

–

|

13 |

Deduction in respect of employment of new employees Section 80JJAA |

|

–

|

Category B(iii): Restricting Cash Transaction (Incentivising Deduction under premium Section 80D(2B) |

|

| S. No. | Details of Provision Section 80D(2B) |

| 14 | Payments made towards health insurance premiums in any mode otherthan in cash are deductible under Section 80D. However, payments towards preventive health check-up can be made in cash. Section 80D(2B) |

–

|

Category B(iv): Restriction Cash Transaction Leveraging Tax Audit Thresholds |

|

| S. No. | Details of Provision |

| 15 | Threshold for the audit of accounts increased if cash transaction do not exceed 5%applicableW.e.f. Assessment year 2022-23 Provision to Section 44AB(a) |

(i) Aggregate receipts in cash in a year do not exceed 5% of the total; and (ii)Aggregate payments in cash in a year do not exceed 5% of the total Until the AY 2021-22, the above threshold was Rs. 5 Crore if the above criteria were satisfied. The normal threshold for the tax audit of a business is otherwise Rs.1Crore. |

|

–

|

Category B(V): Incentivizing cashless Transaction Reducing the Presumptive Rate of Tax |

|

| S. No. | Details of Provision |

| 16 | Reducing the presumptive rate of income from 8% to 6% of total turnover or gross receipts |

| The Provision to Section 44D(1) applies a lower presumption rate of tax @6% of total turnover or gross receipts on amount received in cashless mode, whether by account payee cheque or bank draft, electronic bank-clearing or other prescribed electronic mode.

The amount may be received during the previous year or before the due date of filling of the Return of income under Section 139(1). |

|

–

|

Category C: Applying Text Deductibility at Source (TDS) Withdrawals/Payment in Cash |

|

| S. No. | Details of Provision |

| 17 | TDS on Payment of certain amount in cash Section 194N |

|

|

–

| 18 | TDS on payment of certain amounts in cash Section 194M |

The above will apply whether or not the payments are made in cash, on credit or through non-cash channels |

–

|

Category D: Mandating the filling of Returns of Income |

|

| S. No. | Details of provision |

| 19 | From 1st April 2020, specified persons mandated to file Returns of Income Seventh proviso to Section 139(1) |

imposition/levy on the repayer » a fee = Rs. 50W

|

|