Availability of input tax credit ought to be viable only up to the extent it is used as against taxable supplies. There exists no ambiguity in determining input tax credit where a supplier is engaged exclusively in either taxable or on otherwise exclusively in exempted goods, inputs for former business being totally eligible as against inputs for latter business being fully disallowed.

ambiguity surely arises when it’s it matter of determining the availability of “right” credit to the supplier when he is engaged in both supply.

Rule 42 comes in as a tax filter to only allow those “eligible tax” in respect of inputs or input services credit to pass through to be stated as an available credit.

Examine a XYZ Pvt Ltd. having an oil mill of extracting cotton oil from cotton seeds, in this particular case the oil is a taxable item under gst regime and the residue i.e. cotton seed cake being an exempted good.

Let us jump directly to example

Let’s have assumable list of input credits co. have in Jan 2018 month (gst rates may differ from actuals)

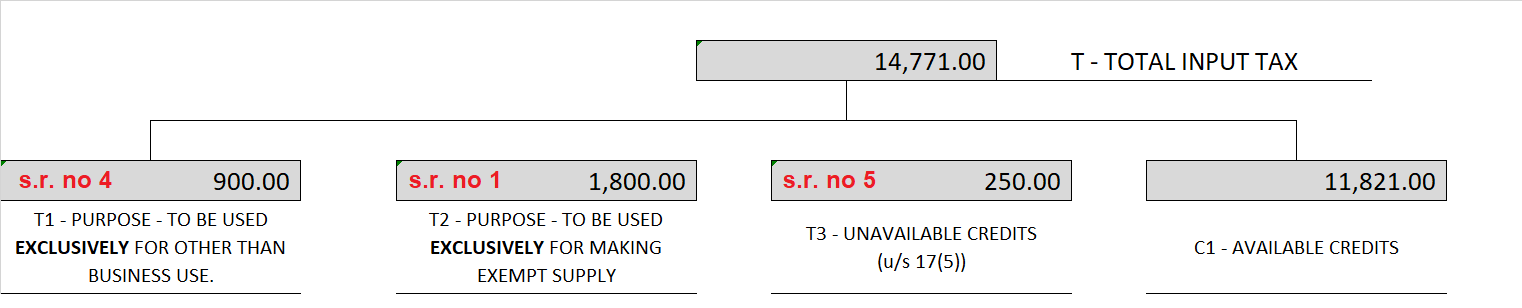

Taking into consideration Subsections 1,2 and 5 of Section 17 of Cgst Act

on first instance while proportioning the input credits, it is no doubt to place the exclusive credits in its own place.

1. Credits exclusively relatable to purposes other than business activities.

2. Credits exclusively relatable to exempted goods.

3. Credits which are not available u/s 17(5)

Former 3 credits will be thus straight away disallowed.

Thus in above eg. credits of s.r. no 4,1,5 will be directly disallowed

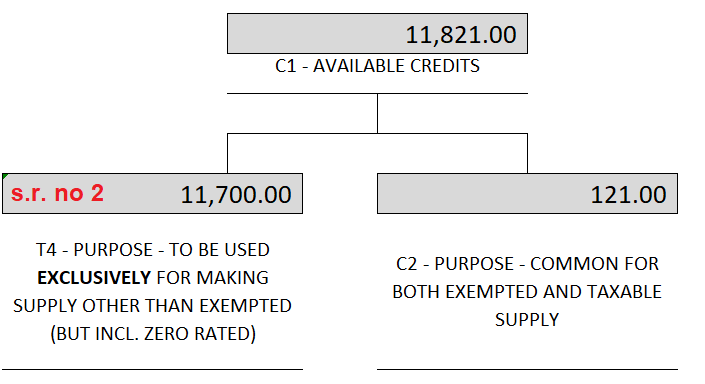

Leaving us with balance credits which can be further bifurcated in to two categories:

1. Credit Purpose – to be used exclusively for making supply other than exempted (but incl. Zero rated). This credit shall be fully available w/o restrictions. (∅1)

2. Credit Purpose – Common for both exempted and taxable supply (incl. Zero rated). This shall further be processed.

Now, we would be left with two credits :

1. credits purpose : common (taxable supply + exempt supply + non business)

2. credits purpose : common (taxable supply + exempt supply)

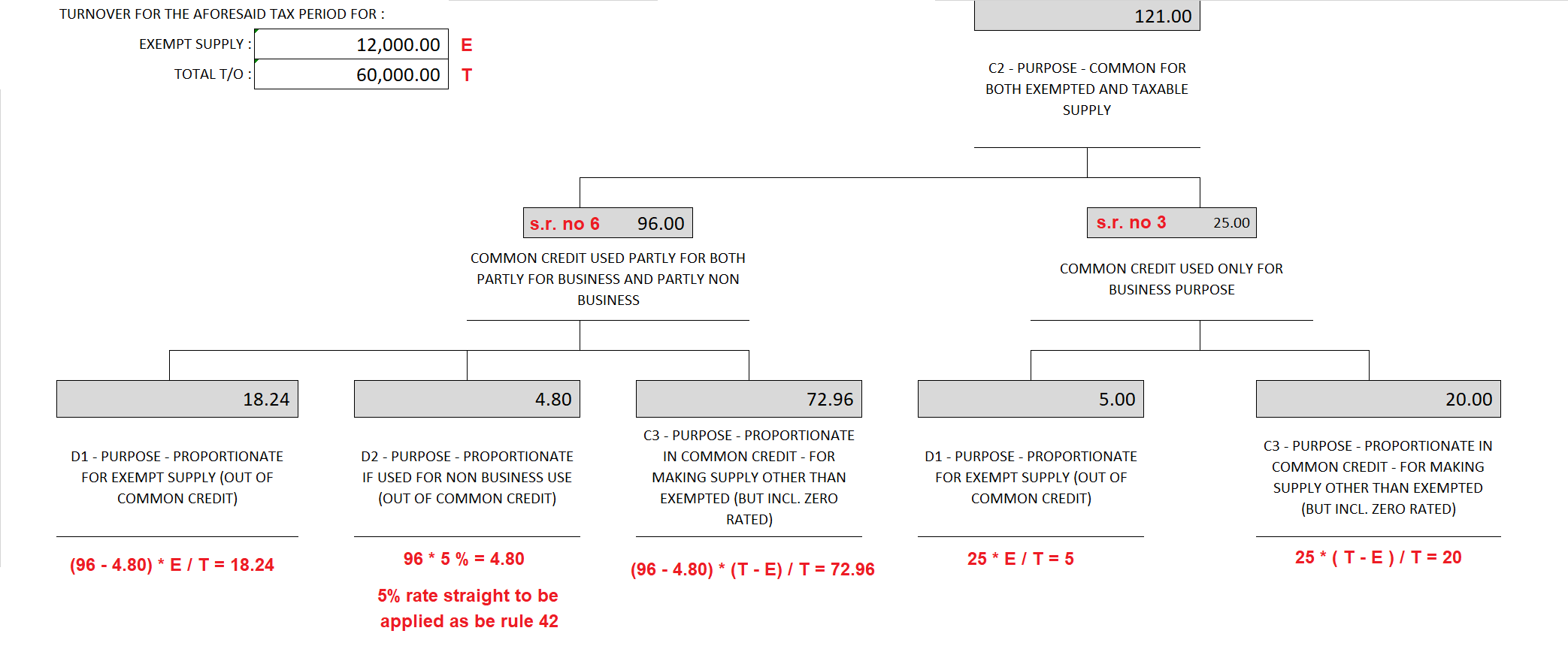

now according to rule 42 of cgst rules, apportion them into 3 parts

- ineligible common credits used for exempt supplies common credit * exempt t.o. for the period / total t.o. of the period

- ineligible common credits purpose – non business common credit * 5%

- eligible common credits (∅2) common credit * (total – exempt) t.o. for the period / total t.o. of the period

In manner and process explained in image below:

Thus, T3(∅1) and C3(∅2) shall constitute total eligible credit which is available as per rule 42 of cgst rules

Other important points to note :

1. Provided that where the registered person does not have any turnover during the said tax period or the aforesaid information is not available, the value of ‘E/F’ shall be calculated by taking values of ‘E’ and ‘F’ of the last tax period for which the details of such turnover are available, previous to the month during which the said value of ‘E/F’ is to be calculated

2. The value of exempt supply under sub-section (2) shall be such as may be prescribed, and shall include

i. supplies on which the recipient is liable to pay tax on reverse charge basis,

ii. transactions in securities,

iii. sale of land and, subject to clause (b) of paragraph 5 of Schedule II, sale of building

3. For the purposes of this clause, it is hereby clarified that the aggregate value of exempt supplies and the total turnover shall exclude the amount of any duty or tax levied under entry 84 of List I of the Seventh Schedule to the Constitution and entry 51 and 54 of List II of the said Schedule;

Is Total Turnover inclusive of Advance payment against supply of service ?

good one … can you share rule 43 in above manner ,,

cmaindranilbasu05@gmail.com

how 12000 worked out pls explain.