Introduction

The Letter of Undertaking (LUT), filed using Form RFD-11, is a crucial document for registered entities engaged in exporting goods or services outside India under the GST Act. This guide outlines the key considerations, documentation requirements, and procedural steps involved in applying for an LUT.

Letter of Undertaking (Form RFD-11)

Any Registered Person who is supply Goods or Service outside India i.e. Export of Goods or Service as per provision of GST act, is eligible to apply for LUT (Letter of Undertaking) before supply of goods or service.

Followings Points need to be consider while applying for LUT

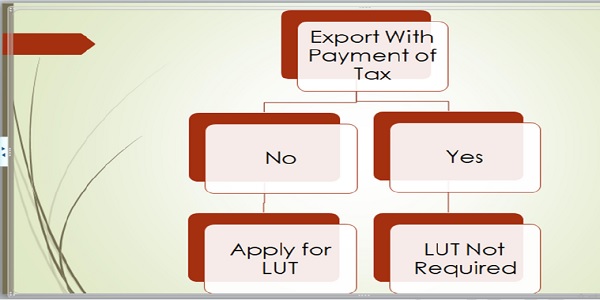

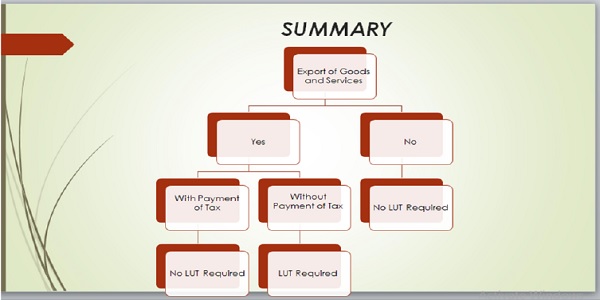

- If Goods or Service Export with payment of tax then there is no need to apply for LUT

- If Goods or service supply within country i.e. within India then there is no need for LUT.

- LUT should be apply before Supply of goods or service.

- Form RFD 11 need to file for applying LUT.

- For each financial year need to apply separate LUT.

- LUT is optional not compulsory but if you are exporting goods or service without payment of tax then you have to apply for LUT.

- Need to select all the points of self-declaration while applying for LUT.

–

List of Documents required for applying LUT

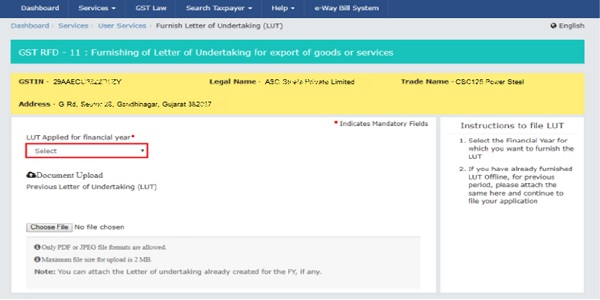

- Previous copy of Filled LUT

- 2 Independent witness aadhar card copies for filling details like name, address and occupation.

Procedure for applying LUT

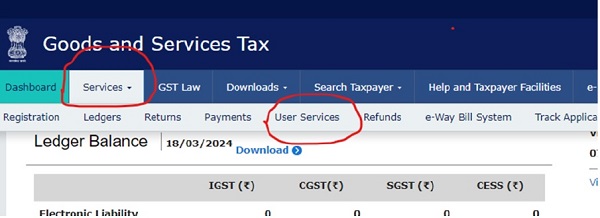

(A) Login to GST

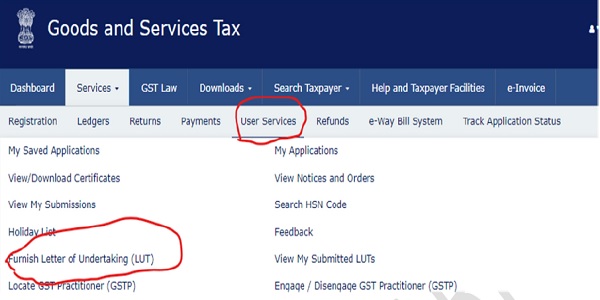

(B) Go to the menu bar and select service option and under service options go to the user service option

(C) Under user service select the tab Furnishing letter of undertaking

(D) Now First you will have to select the financial year for which you are applying LUT and also upload the previous LUT if filled

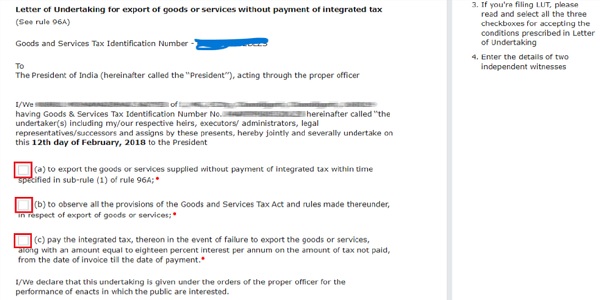

(E) Now you will have to click the each and every self-declaration box

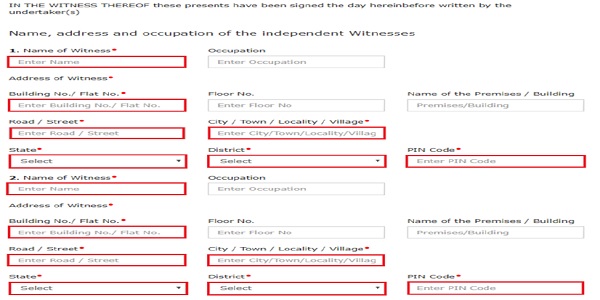

(F) Now you will have to add the details of Independent witness

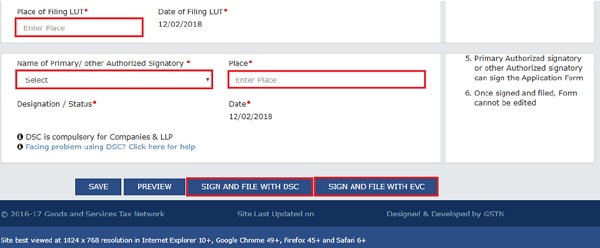

(G) At last step you will have to sign the application form i.e. RFD 11 by DSC or through EVC

Now LUT Filling process is complete

Now I am summarized all details through this small chart

Conclusion

The Letter of Undertaking (LUT) is a critical document for GST-registered entities engaged in exporting goods or services outside India without tax payment. Understanding the eligibility criteria, documentation requirements, and procedural steps for applying for an LUT using Form RFD-11 is essential for seamless compliance with GST regulations.

By following the outlined process diligently, exporters can ensure timely submission of LUT applications, thereby avoiding any disruptions in their export operations. For further clarifications or assistance, the author provides contact details for direct communication.

*****

The author can be however contacted for further clarification at 9654182791 or via mail at caajay92@gmail.com

DISCLAIMER:- This Blog is for the purposes of information / knowledge and shall not be treated as solicitation in any manner or of for any other purposes whatsoever