Sponsored

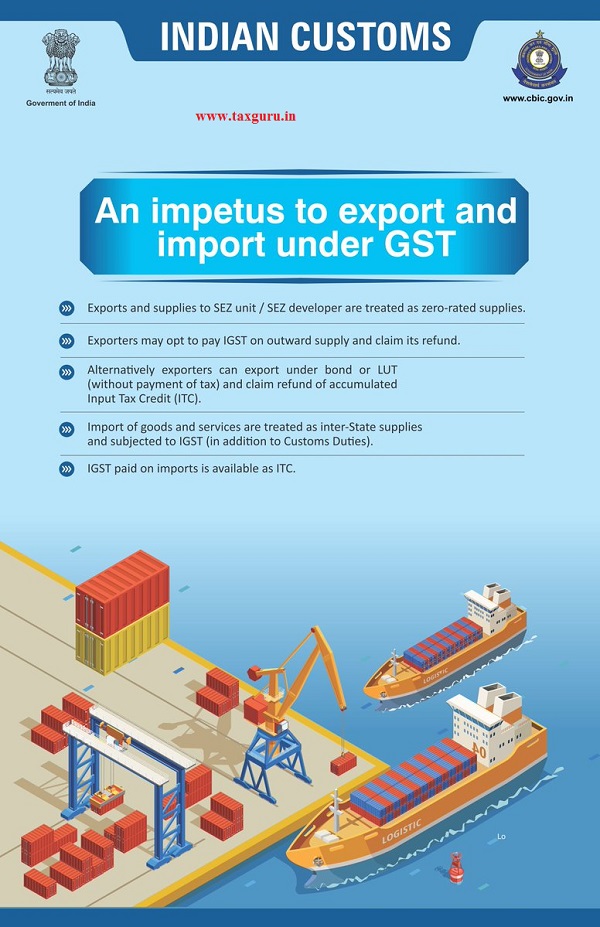

INDIAN CUSTOMS

An impetus to export and import under GST.

- Exports and supplies to SEZ unit / SEZ developer are treated as zero-rated supplies.

- Exporters may opt to pay IGST on outward supply and claim its refund.

- Alternatively exporters can export under bond or LUT (without payment of tax) and claim refund of accumulated Input Tax Credit (ITC).

- Import of goods and services are treated as inter-State supplies and subjected to IGST (in addition to Customs Duties).

- IGST paid on imports is available as ITC.

Sponsored

Kindly Refer to

Privacy Policy &

Complete Terms of Use and Disclaimer.