Ministry of Finance

GST Revenue collection for August, 2020

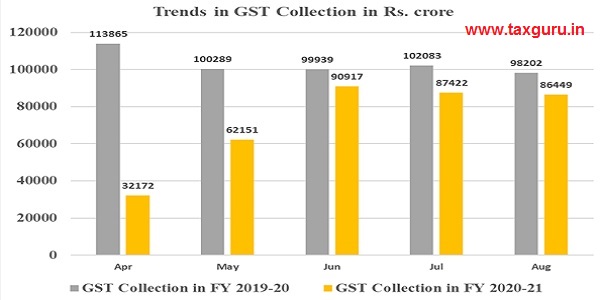

₹ 86,449 crore of gross GST revenue collected in the month of August

Posted On: 01 SEP 2020

The gross GST revenue collected in the month of August, 2020 is ₹ 86,449 crore of which CGST is ₹ 15,906 crore, SGST is ₹ 21,064 crore, IGST is ₹ 42,264 crore (including ₹ 19,179 crore collected on import of goods) and Cess is ₹7,215 crore (including ₹ 673 crore collected on import of goods).

The government has settled ₹ 18,216 crore to CGST and ₹ 14,650 crore to SGST from IGST as regular settlement. The total revenue earned by Central Government and the State Governments after regular settlement in the month of August, 2020 is ₹ 34,122 crore for CGST and ₹ 35,714 crore for the SGST.

The revenues for the month are 88% of the GST revenues in the same month last year. During the month, the revenues from import of goods were 77% and the revenues from domestic transaction (including import of services) were 92% of the revenues from these sources during the same month last year. It may also be noted that the taxpayers with turnover less than Rs. 5 crore continue to enjoy relaxation in filing of returns till September.

The chart shows trends in monthly gross GST revenues during the current year. The table shows the state-wise figures of GST collected in each State during the month of August 2020 as compared to August 2019 and for the full year

Table: State-wise collection till August[1]

| Aug-19 | Aug-20 | Growth | ||

| 1 | Jammu and Kashmir | 302 | 326 | 8% |

| 2 | Himachal Pradesh | 676 | 597 | -12% |

| 3 | Punjab | 1,255 | 1,139 | -9% |

| 4 | Chandigarh | 160 | 139 | -13% |

| 5 | Uttarakhand | 941 | 1,006 | 7% |

| 6 | Haryana | 4,474 | 4,373 | -2% |

| 7 | Delhi | 3,517 | 2,880 | -18% |

| 8 | Rajasthan | 2,550 | 2,582 | 1% |

| 9 | Uttar Pradesh | 4,975 | 5,098 | 2% |

| 10 | Bihar | 981 | 967 | -1% |

| 11 | Sikkim | 163 | 147 | -10% |

| 12 | Arunachal Pradesh | 45 | 35 | -22% |

| 13 | Nagaland | 27 | 31 | 17% |

| 14 | Manipur | 37 | 26 | -29% |

| 15 | Mizoram | 28 | 12 | -56% |

| 16 | Tripura | 58 | 43 | -26% |

| 17 | Meghalaya | 117 | 108 | -7% |

| 18 | Assam | 768 | 709 | -8% |

| 19 | West Bengal | 3,503 | 3,053 | -13% |

| 20 | Jharkhand | 1,770 | 1,498 | -15% |

| 21 | Odisha | 2,497 | 2,348 | -6% |

| 22 | Chattisgarh | 1,873 | 1,994 | 6% |

| 23 | Madhya Pradesh | 2,255 | 2,209 | -2% |

| 24 | Gujarat | 6,185 | 6,030 | -3% |

| 25 | Daman and Diu | 103 | 70 | -32% |

| 26 | Dadra and Nagar Haveli | 159 | 145 | -9% |

| 27 | Maharashtra | 13,407 | 11,602 | -13% |

| 29 | Karnataka | 6,201 | 5,502 | -11% |

| 30 | Goa | 325 | 213 | -34% |

| 31 | Lakshadweep | 1 | 0 | -72% |

| 32 | Kerala | 1,582 | 1,229 | -22% |

| 33 | Tamil Nadu | 5,973 | 5,243 | -12% |

| 34 | Puducherry | 161 | 137 | -15% |

| 35 | Andaman and Nicobar Islands | 30 | 13 | -59% |

| 36 | Telangana | 3,059 | 2,793 | -9% |

| 37 | Andhra Pradesh | 2,115 | 1,955 | -8% |

| 38 | Ladakh | 0 | 5 | |

| 97 | Other Territory | 170 | 180 | 6% |

| 99 | Centre Jurisdiction | 100 | 161 | 61% |

| Grand Total | 72,543 | 66,598 | -8% |

[1] Does not include GST on import of goods