Background: In the recent past, several taxpayer’s GST portals were flooded with notices and orders from the GST Department due to the expiry of the period of limitation for the issuance of notices and orders under Section 73 of the CGST Act 2017.

One of the modes of serving any decision, order, summons, notice, or other communications under the GST is by making it available on the GST portal [Section 169 of CGST Act 2017].

At times, it was difficult for taxpayers to locate the notices and orders as they were available under ‘User services’ in two separate windows, namely View Notices and Orders and View Additional Notices and Orders. Some taxpayers missed checking the notices made available on the GST portal, which led to non-response to the notices and the issuance of orders by the Department officer.

To address this challenge and streamline the GST portal, the notices tabs are being revamped by integrating ‘View Notices and Orders’ and ‘View Additional Notices and Orders’ into a single window. The detailed discussion on the same is enumerated below.

View Notices and Orders:

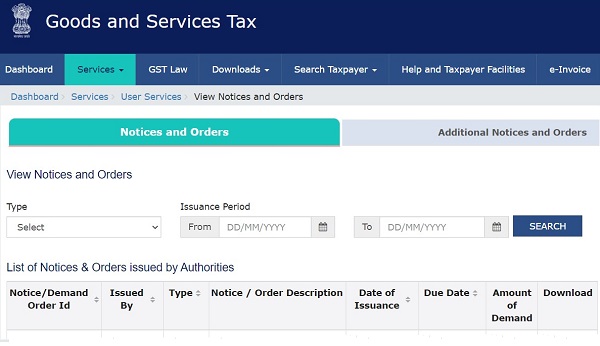

Dashboard–> Services–> User Services–> Notices and Orders

The following Notices/Orders issued by tax authorities are available under “Notices and Orders”:

- Registration: Notice/Orders/Intimations pertaining to registration including new registration, amendment, cancellation, revocation and other communications.

- Return defaulters: Notices issued by System to return defaulters in Form GSTR-3A.

- Return discrepancies: Notices pertaining to Return module comprising

- GST DRC-01B and

- GST DRC-01C.

- Summary of assessment orders issued in Form GST DRC-07 where notices and other proceedings were held offline.

View Additional Notices and Orders:

Dashboard–> Services–> User Services–> Additional Notices and Orders

The following Notices/Orders issued by tax authorities are available under “Additional Notices and Orders”:

- Notices /Orders pertaining to modules-

- Advance Ruling,

- Appeal,

- Assessment/ Adjudication,

- Audit,

- Enforcement,

- Prosecution and Compounding,

- Recovery,

- LUT etc.

Notices/ Orders pertaining to ‘Refund’ Module:

Dashboard–> Services–>User Services–> My Applications–>‘REFUNDS’ [Application type]

Key Benefits:

- The above integration of notices and orders of different types would enable the tax payers to navigate the GST Department communications in an effective manner enabling them to respond promptly.

Action points

- It is suggested for the GST registered persons, to check for the notices or orders issued by the GST Department using the above functionality at least twice in a week, as the notices under GST are time bound.

- Reply to the Notices or orders received from the GST Department promptly within the timelines.

- Further, it gives the tax payers sufficient time to examine the issue in depth and respond promptly.

*****

Suggestions or feedback can be sent to thulasiram@hnaindia.com

The author extends special thanks to CA Roopa Nayak roopa@hnaindia.com for vetting this article.