The Central Government has brought into effect the provisions of Finance Act, 2021 effective from 1st January 2022. In the Budget of 2021-22, changes in Finance Bill, 2021 were proposed to make changes in CGST Act, 2017. Accordingly, CGST Act, 2017, CGST Rules, 2017, and IGST Act, 2017 has been amended.

Major Important Amendments being:-

1. Amendment to Section 7- Definition of “Supply”

2. Amendment to Sections 74 and 107 of the CGST Act, 2017 deals with recovery of tax by Seizure and Confiscation

3. Amendment to Sections 129 and 130 of the CGST Act, 2017 deals with provision related to e-Way Bills.

4. Mandatory Aadhaar authentication in certain cases.

5. GST Input Tax Credit (“ITC”) available when reflected in GSTR 2A/ GSTR 2B.

6. Notification of provisions on Recovery of Self Assessed Tax , Recovery of Tax cases where GSTR-1 is furnished but GSTR -3B is not furnished.

7. Amendment to the definition of Zero-Rated Supplies (Section 16 of IGST Act, 2017).

Above amendments are explained below in summarized form for better understanding:-

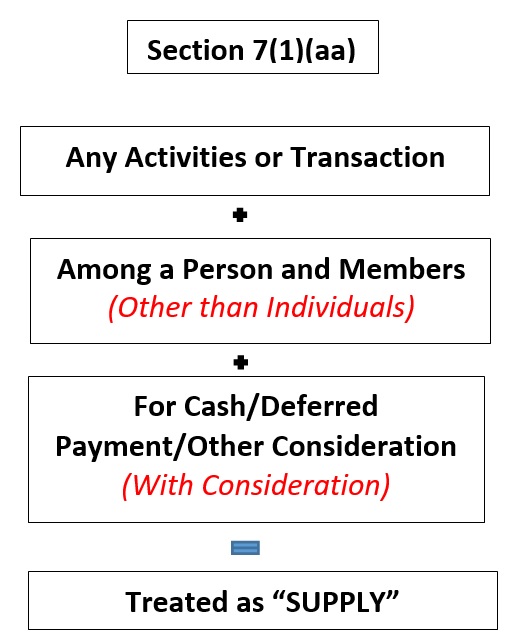

1. Insertion of clause (aa) of sub-section (1) of Section 7 of the CGST Act

(retrospective apply w.e.f. 01-07-2017)

Supply of activities or transactions inter se between a person and its members or constituents (other than an individuals) or vice-versa for cash, deferred payment or other valuable consideration and henceforth shall be treated as a supply.

Explanation:- The person and its members or constituents shall be deemed to be two separate persons and overriding effect has been given to the said explanation over anything contained in any other law for the time being in force and even to the judgement of any Court, Tribunal or any other authority

Explanation:- The person and its members or constituents shall be deemed to be two separate persons and overriding effect has been given to the said explanation over anything contained in any other law for the time being in force and even to the judgement of any Court, Tribunal or any other authority

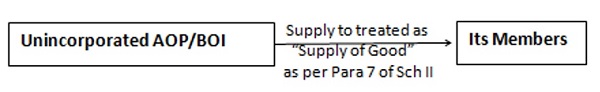

Effect:- Para 7 of Schedule II of the CGST Act has been proposed to be deleted retrospectively (w.e.f. July 1, 2017) which is related to ‘supply of goods by unincorporated associations or body of persons to a member thereof for cash, deferred payment or other valuable consideration’ being activity/ transaction treated as supply of goods.

2. Amendment to Sections 74 and 107 of the CGST Act, 2017 –

a. Recovery of tax vs. Seizure and Confiscation:

Amendment has been made in Explanation 1(ii) of Section 74 of the CGST Act so as to make seizure (Section 129 of the CGST Act) and confiscation of goods and conveyances in transit (Section 130 of the CGST Act), a separate proceeding from recovery of tax under Section 73 (determination of tax in non-fraud cases) or Section 74 (determination of tax in fraud cases) of the CGST Act.

b. Pre-deposit for Appeal before Appellate Authority

Amendment has been made to insert a proviso to Section 107(6) of the CGST Act, to provide that appeal against order passed under Section 129(3) of the CGST Act in Form MOV-09, can be filed before the Appellate Authority only after depositing 25% of the penalty imposed to the department (the limit has been enhanced from 10% of the pre-deposit)

3. Amendment to Sections 129 and 130 of the CGST Act, 2017 (Provisions related to E-Way Bills)-

Amendment to Section 129 (Detention, seizure and release of goods and conveyances in transit)

a) Enhancement of Penalty:-

| Cases | Taxable Goods | Exempted Goods |

| When owner comes forward

– Sec 129(1)(a) |

Penalty equal to 200% of tax Payable

(Earlier penalty – 100% Tax) |

Lowest of 2% of the value of goods or Rs. 25,000/- (no change) |

| When owner does not come forward

– Sec 129(1)(b) |

Penalty equal to higher of 50% of value of goods or 200% of the tax payable on such goods

(Earlier penalty – 50% of value of goods) |

Lowest of 5% of the value of goods or Rs. 25,000/- (no change) |

b) Section 129(2) has been omitted: Now the goods seized shall not be released on provisional basis upon execution of a bond and furnishing security and the penalty imposed by the officer will have to be paid in cash by the taxpayer.

c) Under Section 129 (3): The proper officer detaining/seizing the goods, have to issue a notice (GST MOV-07) within 7 days specifying the penalty payable and pass a order (GST MOV 09) within next 7 days after service of such notice (earlier there was no such time limit)

– Amendment to Section 130 (Confiscation of goods or conveyances and levy of penalty)

Prior to amendment:– If the person does not pay tax and penalty within 14 days of seizure, the conveyance and goods detained were liable for confiscation as per Section 130.

Post current amendment:– The goods or conveyance detained or seized shall become liable to be sold or disposed off in the manner prescribed, in case the payment of imposed penalty is not made within 15 days from the date of receipt of copy of the order imposing such penalty.

Conveyance used for transportation of the goods may be released on payment of penalty or Rs 1 Lakh whichever is less.

4. Aadhaar Authentication for already registered persons in specified cases

– Cases where Aadhaar Authentication would be mandatory:-

The existing registered persons in the following cases are required to do Aadhar Authentication of their registeration:

I) Revocation of cancellation of registeration

II) IGST refund on the export of goods under Rule 96 of CGST Rules or

III) Refund under rule 89 of CGST Rules

Some amendments have also been made in above provisions (I.e. registeration, refund etc.) to provide that Aadhaar Authentication would be a pre-requisite for filing application

– Registered Person whose Aadhaar would required to be authenticated:-

Following persons are notified whose Aadhaar would be required to be authenticated:

I) Authorized Signatory of the registered persons; and

II) A specified individual as per below table

| S.NO. | Registered Person | Aadhaar Individual persons is to be authenticated |

| 1. | Proprietorship Firm | Proprietor |

| 2. | Partnership Firm | Any Partner |

| 3. | HUF | Karta |

| 4. | Company | Managing Director or any Whole-Time Director |

| 5. | AOP/BOI/Society | Any Member of the Managing Committee |

| 6. | Trust | Trustee |

– e-KYC would be done where Aadhaar is not available:-

Where Aadhaar number has not been assigned to an individual, e-KYC would be required to be done.

Following documents are required to be submitted for e-KYC:

I. Aadhar Enrolment ID Slip, and

II. Any Document such as

– Bank passbook with photograph or

– Voter Id Card issued by Election Commission of India or

– Passport or

– Driving License issued by the Licensing Authority under the Motor Vehicles Act, 1988

III. Further Aadhar authentication would be done within 30 days from the date of allotment of Aadhar Number.

– Exemptions (Notified category of persons are not required to do Aadhaar Authentication):-

I. A person who is not a citizen of India

II. Department or establishment of the CG or SG

III. Local Authority

IV. Statutory Body

V. Public Sector Undertaking

VI. Person to whom Unique Identification Number (UIN) is generated.

5. Appearance of transaction in GSTR-2A/2B (mandatory condition for availment of ITC)e. 100% matching of ITC between GSTR 2A/2B and 3B

Section 16(2) deals with Eligibility and Conditions for availing ITC. Under these section new provision is inserted :-

Section 16(2)(aa) – the details of the invoice or debit note referred to in clause (a) has been furnished by the supplier in the statement of outward supplies and such details have been communicated to the recipient of such invoice or debit note in the manner specified under section 37.

Problem before Amendment:– The condition for availment of ITC was only depend upon the declaration given by supplier that he has paid the taxes to the government. To a certain extent, this condition is not always be verified in the hands of the recipient where the supplier has mis -declared the tax values in GSTR-3B. On the another way there is not a provision in GST to deny the ITC based on the matching of the details declared by supplier through GSTR-1 and the ITC availed by the recipient. So the credit matching between GSTR-2A and 3B was not a precondition for availment of ITC under section 16(2).

Solution :- The law now prescribes a pre-condition that ITC on invoice or debit note have been furnished by the supplier in his GSTR-1 and it is communicated to the recipient in GSTR-2A/ 2B.

6. Notification of provisions on Recovery of Self Assessed Tax , Recovery of Tax cases where GSTR-1 is furnished but GSTR -3B is not furnished.

As per Section 75 (12) “Notwithstanding anything contained in section 73 or section 74, where any amount of self-assessed tax in accordance with a return furnished under section 39 remains unpaid, either wholly or partly, or any amount of interest payable on such tax remains unpaid, the same shall be recovered under the provisions of section 79.”

Here new explanation is inserted

For the purposes of this sub-section, the expression “self-assessed tax” shall include the tax payable in respect of details of outward supplies furnished under section 37(GSTR-1) , but not included in the return furnished under section 39 (GSTR-3B).’

Now, it has been provided that if a supplier only provides outward supplies in GSTR-1 without including such supplies in GSTR-3B, then the government can directly opt for recovery of taxes under Section 79 without issuance of any show cause notice under section 73 or 74. So the ambit of “Self Assessed Tax” is to be widened.

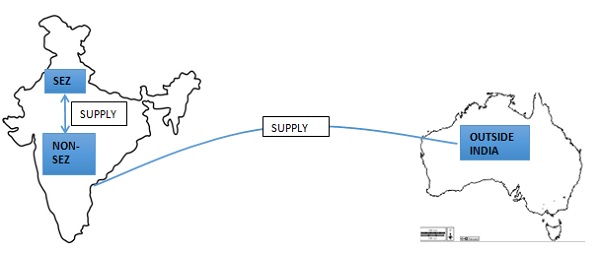

7. Amendment to the definition of Zero-Rated Supplies (Section 16 of IGST Act, 2017).

I. Insertion of “Authorized Operations” in Section 16(1)(b)

“Zero rated supply” means any of the following supplies of goods or services or both, namely:

(a) export of goods or services or both; or

(b) supply of goods or services or both for Authorized Operations to a Special Economic Zone developer or a Special Economic Zone unit.

The above all are Exports. No GST is paid on Exports (I.e. Zero Rated Supply). Government Thumb Rule “Import the Goods, Higher Taxes and Export the Goods, No Taxes”

II. Substitution of Sub-Section (3) to Section 16 deals with Realization of export proceeds

A registered person making zero rated supply shall be eligible to claim refund of unutilised ITC n supply of goods or services or both, without payment of IGST, under bond or Letter of Undertaking in accordance with the provisions of section 54 of CGST Act or rules made there under.

The government discontinued the option of payment route except for certain category of person notified by government. The payment route of IGST was beneficial for exporters as the refund of credit on capital goods was allowed which is not allowed under Letter of Undertaking method.

In case of non realization of sale proceeds, the exporter has to deposit the refund amount along with interest as per section 50 of the CGST Act within 30 days from the expiry of period prescribed under FEMA Act, 1999 for receipt of foreign remittances in manner prescribed.

The provision of bank guarantee are still applicable, not revised as stated by you. Bank guarantee is still accepted with Bond in GST MOV08.

After the removal of Mutatis mandi clause both CGST and SGST Act will not be apply together. Penalty under both Act will NOT be taken in section 129 (1) (b). Same will be for release of empty vehicle by paying Rs 1,00,000/- only.