Issue & Redemption of Preference Shares

Warning: Undefined variable $show_all_cats in /home/taxguru/public_html/wp-content/themes/tgv5/single.php on line 63

CA, CS, CMA |

Warning: Undefined variable $show_all_types in /home/taxguru/public_html/wp-content/themes/tgv5/single.php on line 71

Articles

Warning: Undefined variable $all_cats in /home/taxguru/public_html/wp-content/themes/tgv5/single.php on line 80

The Redeemable Preference Shares are those, the amount of which can be paid back to the holders of such shares. That is, the capital raised through the issue of Redeemable Preference Shares can be paid back by the Company to such shares. The paying back of capital is called the Redemption.The redemption of redeemable preference shares does not reduce the Company’s authorized capital. From the Creditors’ point of view the capital remains intact because the share capital redeemed is simply replaced by the nominal value of the new shares issued for the purpose of redemption or by a Capital Redemption Reserve Account, for practical purposes, is equal to the paid up capital of the company.

ISSUE AND REDEMPTION OF PREFERENCE SHARES

- Company cannot issue irredeemable preference shares or redeemable preference shares with the redemption period beyond 20 years.

- Section 55 (1) states that no company limited by shares shall issue any preference shares which are irredeemable.

- Section 55(2) further states that a company limited by shares may, if so authorised by its articles, issue preference shares which are liable to be redeemed within a period not exceeding 20 years from the date of their issue subject to such conditions as may be prescribed.

Exceptions

Issue and redemption of preference shares by company in infrastructure projects

A company engaged in the setting up and dealing with of infrastructural projects may issue preference shares for a period exceeding 20 years but not exceeding 30 years,

(However redemption subject to minimum 10% of such preference shares per year from the twenty first year onward or earlier on proportionate basis, at the option of the preference shareholders)

The term “infrastructure projects” means the infrastructure projects specified in Schedule VI.

- Other conditions attached

Proviso to Section 55(2) states that

> Preference Shares shall be redeemed

a) Out of divisible profits (Profits available for dividend) or

b) Out of proceeds of fresh issue of shares

> Preference Shares shall be redeemed only if they are fully paid.

> Premium payable on redemption of preference shares shall be provided for (write off) :-

a) Security Premium Reserve or

b) Profits of the company

> When Preference shares are proposed to be redeemed out of the profits of the company, a sum equal to the nominal amount of the shares to be redeemed, should be transferred to Capital Redemption Reserve Account.

Note: – The Capital Redemption Reserve shall be treated as the paid up share capital of the company for all purposes and can only be utilized for bonus issue of shares.

- Section 55 (3) states that

> If a company is not in a position to redeem any preference shares or to pay dividend, if any, on such shares in accordance with the terms of issue, it may, with the consent of the holders of 3/4th in value of such preference shares and with the approval of the Tribunal on a petition made by it in this behalf, issue further redeemable preference shares equal to the amount due, including the dividend thereon, in respect of the unredeemed preference shares. [Section 55(3)]

> On the issue of such further redeemable preference shares, the unredeemed preference shares shall be deemed to have been redeemed. [Section 55(3)]

> The Tribunal shall, while giving approval, order the redemption forthwith of preference shares held by such persons who have not consented to the issue of further redeemable preference shares. [Proviso to Section 55(3)]

> The issue of further redeemable preference shares or the redemption of preference shares under this section shall not be deemed to be an increase or, as the case may be, a reduction, in the share capital of the company. [Explanation to Section 55(3)]

- Redemption of preference shares

Rule 9(6) of companies (share capital and debentures) rules, 2014 states that a company may redeem its preference shares only on the terms on which they were issued or as varied after due approval of preference shareholders under section 48 of the Act and the preference shares may be redeemed:-

(a) At a fixed time or on the happening of a particular event;

(b) Any time at the company’s option; or

(c) Any time at the shareholder’s option

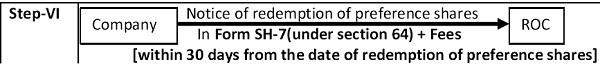

Process of redemption of preference shares

Step-I

Issue not less than 7 days notice and agenda of board meeting, or a shorter notice and agenda in case of urgent business, in writing to every director of the company at his address registered with the company.

Step-II

Hold meeting of the board of directors

| (a) | (b) |

| To pass Board Resolution (BR) for approving the redemption of preference shares

i) Premium amount payable on redemption, if any and mode of payment i.e. – Whether out of profits, or – Security premium reserve ii) Mode of repayment:- Divisible profit*, or – Fresh Issue iii) Date of redemption, i.e. date of making payment of redemption amount iv) Approving the amount to be transferred to CRR from distributable profits, if shares are redeemed out of distributable profits of the company. *Divisible Profit includes Profit and Loss (Surplus), General reserve and Dividend equalization reserve) |

To authorize CS or any director to sign and file relevant form with ROC and to do such acts, deed and things as may be necessary to give effect to Board decision |

| Step-III |

Prepare and circulate draft minutes within 15 days from the date of the conclusion of the Board Meeting , by hand/speed post/registered post/courier/e-mail/ to all the directors for their comments. Also follow the procedure prescribed for preparing, circulation, signing and compiling of Board minutes. [Secretarial Standard-1] |

| Step-IV | Transfer the nominal amount of shares to be redeemed to a reserve fund called Capital Redemption Reserve from the distributable profits of the company, if the shares are redeemed out of distributable profits of the company. |

| Step-V | Making the payment of the redemption amount and the premium amount, if any to the preference shareholder. |

Attachments:-

- Certified true copy of board resolution authorizing redemption of redeemable preference shares is displayed and mandatory in case of redemption of redeemable preference shares.

- Minutes of Meeting

| Step-VII | Make necessary enteries regarding redemption in the register of members and register of directors and key managerial personnel and their shareholding, if ny [Rule 5(4) of companies (share capital and debenture)rules, 2014. |

Comments are closed.