In the realm of Goods and Services Tax (GST), businesses often find themselves entangled in legal intricacies, as exemplified by the DRC-01 penalty notice. This guide aims to dissect the intricacies of responding to a DRC-01 notice for the fiscal year 2018-19 due to non-issuance of e-invoices. A dated response to the GST Officer, becomes crucial for businesses navigating penalty considerations under Section 122.

Draft Format of Reply on DRC-01 for FY 2018-19 for Non Issuance of e-invoice

Dated :

To,

The GST Officer,

Ward – ,

Delhi GST,

T&T Building,

Delhi.

Dear Sir,

IN THE MATTER OF .

GSTIN –

Reg : REPLY OF DRC – 01 DT. .

Notice Period : August, 2023 to December, 2023

Penalty under Section 122

That the tax payer wants to submit as under :-

1. That the tax payer is a retail and wholesale merchant of Rice, Pulses etc. The tax payer is dealing purely in Nil rated or wholly exempted goods from tax.

2. That the DRC-01 issued was not containing any digital signature of the proper officer. Therefore, the above notice is not sustainable in the eyes of Law and such Penalty notice to be considered as invalid.

3. Without prejudice to above, the various discrepancies were noticed by your good-self are :-

No E-invoice was issued

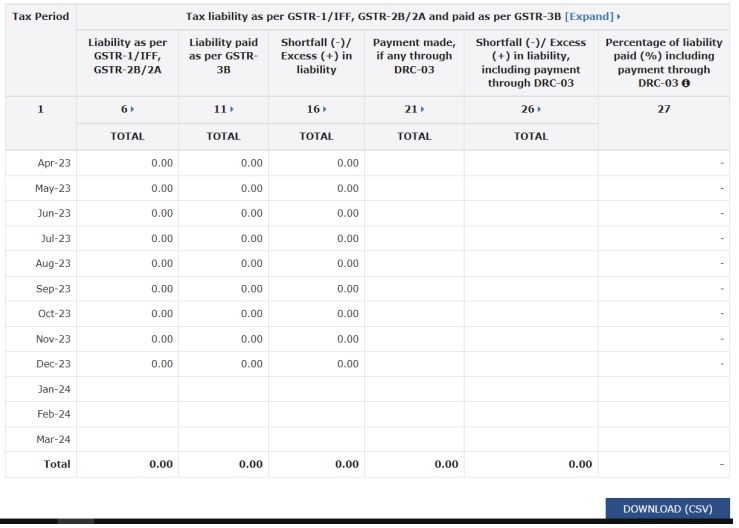

That your goodself issued DRC-01 for the period of August, 2023 to December, 2023 for non-issuance of e-invoice during the abovesaid period. The tax payer wants to submit that during the above-mentioned period, the tax payer had sold only exempted good(s) and therefore, applicability of e-invoicing was not applicable on him. The Tax Payer had made a tax-free sale from August 2023 to December 2023 which can be easily available on the GST Portal at the Tax Liability Comparison tab which is as follows for your ready reference :-

The above screenshot of the GST Portal shows that the tax payer had sold only exempted goods and no taxable supplies were made. Therefore, the tax payer is outside the purview of E-invoicing under GST.

Secondly, the e-invoicing is applicable to only for B2B supplies, Export supplies and is not applicable for Exempted or Nil Rated Supplies. The same was clarified in CBIC nstruction No. 20006/15/2023-GST dated 18th October, 2023. Therefore, the tax payer is dealing in Nil rated or Exempted supplies. As a result, the penalty of Rs 75000/- may be deleted in full.

Thirdly, the penalty under section 122 of CGST/DGST Act, 2017 may be levied at the time of any offence committed by the tax payer by making any taxable supplies without E-invoicing. But in the present case, the tax payer had made only exempted supplies of Rice as per the Tax Liability Comparison sheet of GST Portal and the tax payer has not committed any breach of law by making the tax free supplies and therefore, the final outcome is that the tax payer does qualify the requirements for e-invoicing as per Rule 48 of CGST Rules of the CGST /DGST Act.

Therefore, looking into the facts and circumstances of the case, the tax payer is ready to fully co-operate with you and request you to quash the notice and delete the proposed penalty of Rs 75,000/- on account of non-issuance of e-invoice which is not applicable on the tax payer and further, issue the DRC-05 accordingly and oblige.

Thanking you,

Yours faithfully,

For

Tax Payer.

*****

Author: Naman Gupta, B.Com (Hons), F.C.A., C.C.A., I.D.(M.C.A.), L.L.B. | 9891468846 | namangupta2003@gmail.com | Elected Executive Member – Delhi Sales Tax Bar Association (STBA)

Very good article Thank You Sir