A. FAQs on Amendment of Registration – Core and Non-Core Fields

Q.1 Can amendments be made to the information submitted in the Registration Application?

Ans: Once the applicant is registered under GST, the need for amendments in registration may arise due to several factors such as a change in address, change in contact number, change in business details and so on. In order to amend any information post registration, the taxpayer needs to file an Application for Amendment of Registration.

Application for Amendment of Registration, can be categorized in two types:

- Application for Amendment of Core fields in Registration

- Application for Amendment of Non-Core fields in Registration

Q.2 Who can file the Application for Amendment of Registration?

Ans: Any taxpayer of following category, registered under GST, can file Application for Amendment of Registration:

a) New Registrants & Normal Taxpayers

b) TDS/ TCS Registrants, UN Bodies, Embassies & Other Notified person having UIN

d) Non Resident Taxable Person

e) GST Practitioner

f) Online Information and Database Access or Retrieval Service Provider

Q.3 What are core fields?

Ans: Following fields of the registration application are called core fields.

- Name of the Business, (Legal Name) if there is no change in PAN

- Addition / Deletion of Stakeholders

- Principal Place of Business (other than change in State) or Additional Place of Business (other than change in State)

Q.4 What are non-core fields?

Ans: Fields of the registration application except legal name of the business, Addition/ deletion of stakeholder details and principal place of business or Additional place of business are called non-core fields.

Non-core fields are available for editing, and changes in it are auto populated in registration of the taxpayer. No approval is required from the Tax Official if any amendments are made to these fields by the taxpayers.

Q.5 Which fields CANNOT be amended using the application for Amendment of Registration?

Ans: Application for Amendment of Registration cannot be filed when there is:

- Change in PAN.

- Change in Constitution of Business resulting in change of PAN.

- Change in Place of Business from one State to other.

Application for Amendment of Registration cannot be filed for change in PAN because GST registration is PAN-based. You need to make fresh application for registration in case there is change in PAN.

Application for Amendment of Registration form cannot be filed for change in Constitution of Business as it results in change of PAN.

Similarly, Application for Amendment of Registration form cannot be filled if there is change in place of business from one state to the other because GST registrations are state-specific. If you wish to relocate your business to another state, you must voluntarily cancel your current registration and apply for a fresh registration in the state you are relocating your business.

Q.6 By when should I file an application for Amendment of Registration in case of any change of my registration?

Ans: You must submit the application for Amendment of Registration within 15 days from the date of the particular change which has warranted change in the registration application.

Q.7 Can I save the application for Amendment of Registration? If yes, for how long?

Ans: Yes, you can save your application for Amendment of Registration after modification for 15 days. However, if you fail to submit your application for amendment of Registration within 15 days of starting/filing/initiating it, the application for amendment in registration will be automatically purged.

Q.8 Is it mandatory to add reason for amendment?

Ans: “Reasons” for amendment is entered in the Reasons Text box. It is mandatory for taxpayer to specify reasons for each amendment.

Q.9 How can I add Bank Account details?

Ans: You can add Bank details by filing a non-core amendment application.

Q.10 Do I need to digitally authenticate the application for Amendment of Registration before submitting it on the GST Portal?

Ans: Yes, just like your original registration application, you need to digitally authenticate the application for Amendment of Registration before submitting it on the GST Portal using DSC, E-Sign or EVC as the case may be.

Q.11 Can I delete the Primary authorized signatory?

Ans: Primary Authorized Signatory can be deleted subject to the condition that a new Primary Signatory is added/ provided.

Q.12 My office has moved to another SEZ. Can the SEZ Unit/ SEZ Developer details I had used while Registration be amended?

Ans: Yes, SEZ details entered while registering as an SEZ unit/SEZ Developer can be amended by filing the application for amendment (core fields). Navigate to the below path on the ‘GST Portal Home > Services > Registration > Amendment of Registration Core Fields’ link.

Q.13 I have an ARN for amendment of core fields. Can I file application for amendment of another non-core field?

Ans: If you have already applied for amendment of core field(s) and an ARN is generated and the application is still not approved by any tax authority, then you cannot apply for amendment of non-core field till the time application is approved.

Q.14 Can amendment application be filed by any one of the existing authorized signatory or do I need to make authorized signatory as PRIMARY authorized signatory on GST Portal to file amendment application?

Ans: Amendment application can be filed by any of the existing Authorized signatories. In case, existing authorized signatory is made as PRIMARY authorized signatory on GST Portal then the newly set primary authorized signatory will have to validate the email ID and mobile number through an OTP authentication.

Q.15 Do I need to upload any document for amendment relating to additional place of business?

Ans: In case of amendment relating to additional place of business, no documents are required to be uploaded.

Q.16 Does amendment of non-core field require processing by the Tax Official?

Ans: Amendment to Non-Core fields is auto approved after successful filing by the taxpayer and does not require any processing by the Tax Official.

Q.17 Does amendment of core field require processing by the Tax Official?

Ans: Amendment to Core fields require approval by the Tax Official. If no action is taken by tax official, then application is auto approved after stipulated time.

Q.18 What will happen once the application for amendment of registration is processed by the Tax Official?

Ans: Once the amendment application is approved or rejected, you will receive a notification through SMS and e-mail message. Also the approval order (REG 15) can be viewed/downloaded by you at the dashboard. Also amended registration certificate containing the amended details will be available for the taxpayer to download at his dashboard.

Q.19 What will happen after submission of application for amendment of registration?

Ans: Once digitally signed application for amendment of registration is filed, the message of successful submission of application is displayed. You will receive the acknowledgement in next 15 minutes on your registered e-mail address and mobile phone number. SMS and email will be sent to the primary authorized signatory intimating ARN and successful filing of the Form.

B. Manual on Amendment of Core Fields

How can I apply for change in core fields of the Registration Applications that were submitted during registration?

Amendment to Core fields require approval by the Tax Officials. Core fields include the following:

- Any change in legal/ trade name of business, not involving change in PAN

- Principal place of business

- Additional Place of Business (Other than change in State)

- Addition or deletion of Partners/Karta/Managing Directors and whole time Director / Members of Managing Committee of Associations / Board of Trustees/ Chief Executive officer or equivalent etc.

Note:

- If you have already applied for amendment of core field and ARN is generated and the application is under processing by any Tax authority, then you cannot apply for amendment of core field till the time your earlier application for core amendment is disposed by the concerned tax authority.

- Since any change in the “Trade Name” triggers issuance of new Registration Certificate, it is kept as core amendment process flow.

To amend the information provided in the core fields during registration, you need to perform the following steps:

1. Access the www.gst.gov.in URL. The GST Home page is displayed.

2. Login to the GST Portal with valid credentials.

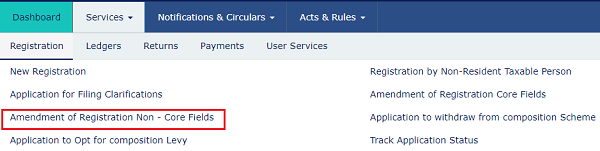

3. Click the Services> Registration > Amendment of Registration Core Fields link.

As required, the Taxpayer can amend information in the editable fields in the tabs as mentioned below:

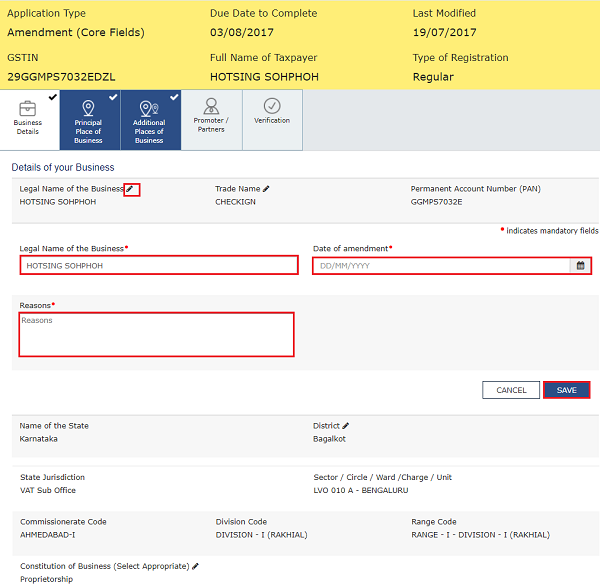

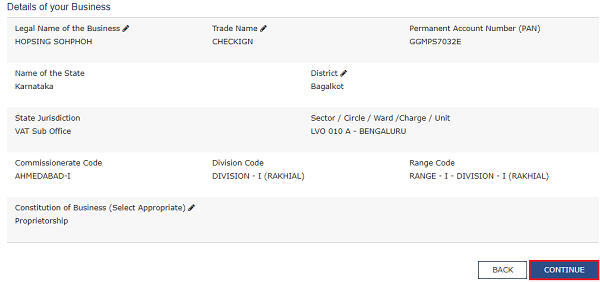

Business Details tab:

The Business Details tab is selected by default.

a) Select the field which you wish to edit by clicking on the Edit icon (white black pen icon).

b) Edit the desired details and select the Date of Amendment using the calendar.

c) In the Reasons field, enter the reason for amendment of information provided in the Core fields.

d) Click the SAVE

e) Once all the changes are done, click the CONTINUE

Principal Place of Business tab:

a) Scroll down the page and click the EDIT button.

The form is displayed for editing. Edit the desired fields.

b) In the Reasons field, enter the reason for amendment of information.

c) Select the Date of Amendment using the calendar.

d) Click the SAVE button.

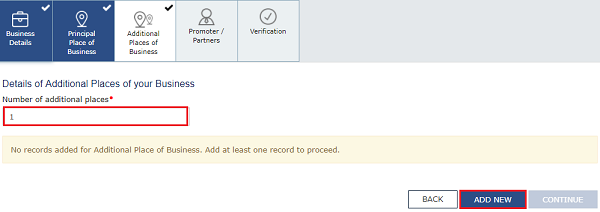

Additional Places of Business tab:

a) In the Number of additional places field, enter the number of additional places for which information is to be added.

b) Click the ADD NEW button.

The form is displayed for editing. Edit the desired details.

b) In the Reasons field, enter the reason for amendment in information.

Note: In case of amendment relating to additional place of business, no documents are required to be uploaded.

c) Select the Date of Amendment using the calendar.

d) Click the SAVE& CONTINUE button.

e) Click the SAVE button.

Note: You can click the EDIT and DELETE button to edit or delete the additional place of business

Promoter / Partners tab:

To view the details of Promoter or Partners, click the VIEW button.

To edit the details of Promoter or Partners, click the EDIT button.

To delete the details of Promoter or Partners, click the DELETE button.

a) Click the ADD NEW button to add details of Promoter or Partners.

b) Enter the details of the Promoter/Partner and upload the necessary documents required as a proof for amendment.

c) In the Reasons field, enter the reason for amendment in information.

d) Select the Date of Amendment using the calendar.

e) Click the SAVE Button.

f) Once details are added, click the CONTINUE Button.

Verification tab:

4. In the Verification tab, select the Verification checkbox.

5. In the Name of Authorized Signatory drop-down list, select the authorized signatory.

6. In the Place field, enter the name of the place.

7. After filling the application for Amendment of Registration, you need to digitally sign the application using Digital Signature Certificate (DSC)/ E-Signature or EVC.

Once digitally signed application for amendment of registration is filed, the message of successful submission of application is displayed. You will receive the acknowledgement in next 15 minutes on your registered e-mail address and mobile phone number. SMS and email will be sent to the primary authorized signatory intimating ARN and successful filing of the Form.

Amendment to Core fields require approval by the Tax Official. Once the amendment application is approved or rejected, you will receive a notification through SMS and e-mail message. Also the approval order (REG 15) can be viewed/ downloaded by you at the dashboard. Also, amended registration certificate containing the amended details will be available for the taxpayer to download at his dashboard.

To view the various status types refer the FAQs available at -> https://tutorial.gst.gov.in/userguide/registration/index.htm#t=Track_Application_Status.htm

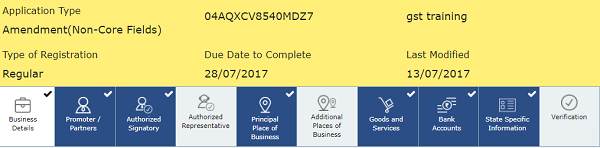

C. Manual on Amendment of Non-Core Fields

How can I apply for change in non-core fields information submitted during registration?

Amendment to Non-Core fields does not require approval by the Tax Official. All fields other than Core fields are Non-core fields. Examples of non-core fields are details of the authorized signatory, modification of Stake holder details like promoter partner karta etc. The amended information is submitted by the Registrant and is updated in the registration particulars of the taxpayers in GST database automatically.

Note: If you have already applied for amendment of core field and ARN is generated and the application is still not approved by any tax authority, then you will receive the below message while you apply for amendment of non-core field. Click the YES button in case you want to proceed or else click NO.

In case you click Yes, core application changes that have been applied for amendment will not be reflected in the Form.

To amend the information provided in the non-core fields during registration, you need to perform the following steps:

1. Access the www.gst.gov.in URL. The GST Home page is displayed.

2. Login to the GST Portal with valid credentials.

3. Click the Services > Registration > Amendment of Registration Non – Core Fields link.

4. The application form for editing is displayed and non-core fields is available in editable form. Edit the details in the desired tab.

5. In the Verification tab, select the Verification checkbox.

6. In the Name of Authorized Signatory drop-down list, select the authorized signatory.

7. In the Place field, enter the name of the place.

8. After filling the application for Amendment of Registration, you need to digitally sign the application using Digital Signature Certificate (DSC)/ E-Signature or EVC.

On submission of application for amendment of registration, a message of successful submission of application is displayed. You will receive the acknowledgement in next 15 minutes on your registered e-mail address and mobile phone number. SMS and email will be sent to the primary authorized signatory intimating ARN and successful filing of the Form.

Amendment to Non-Core fields is auto approved after successful filing by the taxpayer and does not require any processing by the Tax Official.

(Republished with amendments)

****

Disclaimer: The contents of this article are for information purposes only and does not constitute an advice or a legal opinion and are personal views of the author. It is based upon relevant law and/or facts available at that point of time and prepared with due accuracy & reliability. Readers are requested to check and refer relevant provisions of statute, latest judicial pronouncements, circulars, clarifications etc before acting on the basis of the above write up. The possibility of other views on the subject matter cannot be ruled out. By the use of the said information, you agree that Author / TaxGuru is not responsible or liable in any manner for the authenticity, accuracy, completeness, errors or any kind of omissions in this piece of information for any action taken thereof. This is not any kind of advertisement or solicitation of work by a professional.

Even after filling mandatory fields authorized signatory in GST non core field can not be changed Why

Sir, my client have a principal place of business at chennai. Now he had a branch at karaikal which is registered as additional place of business in the same jurisdiction. If he need to register as a seperate business under the same PAN at karaikal. After getting seperate GSTIN for karaikal (it comes under other state of Pondicherry), can I remove the additional place of business from my chennai business registration. Shall I remove it after getting new GST registration? Please clarify the doubt ASAP. It is urgent requirement.

Please tell me, can I edit the stakeholder (proprietor) name GST core filed amendment.

The resignation of Director was in Jun 2019. If the amendment is done today, on 23rd Jul 2021, is there any penalty to be paid. Please clarify