In a significant collaborative effort, Indian and Hong Kong Customs have exposed a major Trade-Based Money Laundering (TBML) network. This illicit operation involved the misdeclaration of synthetic diamonds as natural, leading to the remittance of foreign currency out of India. The mastermind, based in Hong Kong, orchestrated a complex scheme, ultimately resulting in the arrest of four individuals and the freezing of assets.

Ministry of Finance

Indian and Hong Kong Customs bust Trade-Based Money Laundering network, 4 held

Foreign currency was remitted out of India in lieu of import of cheap synthetic diamonds mis-declared as natural diamonds

Mastermind of the Trade-Based Money Laundering based in Hong Kong

Posted On: 29 DEC 2023 6:11PM by PIB Delhi

The Indian Customs and Hong Kong Customs have unearthed a major case of Trade-Based Money Laundering (TBML) involving Hong Kong based exporters and Indian importers located in Special Economic Zone (SEZ) in an exemplary case of bilateral cooperation and exchange of information. This crackdown showcases investigation and enforcement actions taken by both administrations under their respective laws to expose an international cartel.

The collaborative bust comes close on the heels of recently concluded Global Conference of Cooperation in Enforcement Matters (GCCEM) organised by Indian Customs and Directorate of Revenue Intelligence (DRI), with the theme of ‘It takes a network to fight a network’.

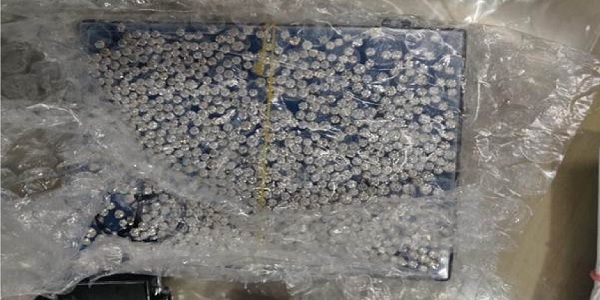

DRI had unearthed a case of Trade-Based Money Laundering from a SEZ, wherein cheap synthetic diamonds were being imported into India in the guise of natural diamonds, to remit foreign currency out of India. Investigations revealed that cheap synthetic diamonds were being mis-declared as natural diamonds and overvalued more than 100 times and being imported from firms based in Hong Kong to SEZ in India.

During the investigation, it was also observed that some real diamonds were imported but replaced with synthetic diamonds and smuggled outside the SEZ. The importing entity was also found to be exporting jewellery studded with diamonds at a very inflated value to Hong Kong and few other countries. Interestingly, while most of the declared inflated value of the imports was remitted out of the country through banking channels, the remittances received for the exports was seen to be only marginal at around 0.2%, indicating that this trade has been a cover to launder money outside.

Investigations also indicated that the inflow of money into importing entity’s bank account took place through bank transactions by various dummy firms in India and then the said money was transferred (laundered) from this single bank account to overseas suppliers in Hong Kong; under the pretext of payment towards import of ‘diamonds’. Gathered evidence also indicates that the mastermind of this trade-based money laundering was based in Hong Kong.

Further investigations resulted in arrest of four persons in India under the provisions of the Section 104 of the Customs Act, 1962. The Indian Customs issued Show Cause Notice (SCN) for seized goods, wherein Hong Kong based entities were also made notices, who however refused to respond and present themselves in front of Indian Customs. It is pertinent to note that in almost all cases offenders of TBML operate through front companies overseas in a bid to escape enforcement action in India.

DRI, under the existing bilateral international cooperation tools and network, had previously reached out to Hong Kong Customs to inquire into the existence of the suspected Hong Kong based firms. The communication channel was further strengthened to locate the kingpins based in Hong Kong.

Last week, Hong Kong Customs undertook an enforcement operation unearthing large-scale transnational money laundering syndicate that had laundered about $65 million using diamond trade. During the operation, Hong Kong Customs raided eight premises across multiple areas in Hong Kong, including four residential premises and four commercial units. Customs arrested four persons suspected to be connected with the case and has already arranged to freeze a total of $1 million assets held by the arrestees. This action was initiated based on enforcement action taken by Indian Customs in India earlier.

This latest case involving arrests made both in Hong Kong and earlier in India, will send a clear message to criminal cartels globally that they cannot escape law, and should act as a strong deterrence.

****