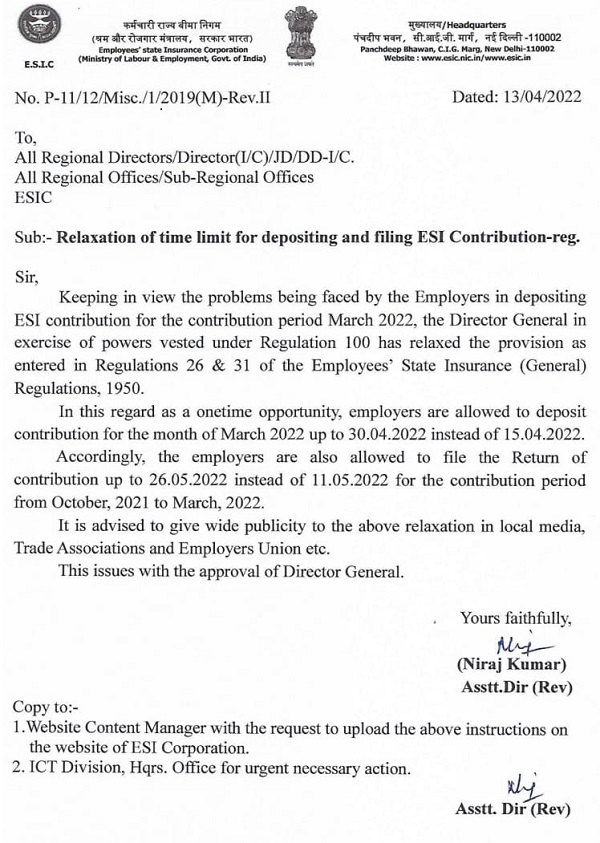

Employees State Insurance Corporation

(Ministry of Labour & Employment Govt. of India)

No. P-11/12/Misc./1/2019(M)-Rev.II | Dated: 13/04/2022

To,

All Regional Directors/Director(I/C)/JD/DD-I/C.

All Regional Offices/Sub-Regional Offices

ESIC

Sub:- Relaxation of time limit for depositing and filing ESI Contribution-reg.

Sir,

Keeping in view the problems being faced by the Employers in depositing ESI contribution for the contribution period March 2022, the Director General in exercise of powers vested under Regulation 100 has relaxed the provision as entered in Regulations 26 & 31 of the Employees’ State Insurance (General) Regulations, 1950.

In this regard as a onetime opportunity, employers are allowed to deposit contribution for the month of March 2022 up to 30.04.2022 instead of 15.04.2022.

Accordingly, the employers are also allowed to file the Return of contribution up to 26.05.2022 instead of 11.05.2022 for the contribution period from October, 2021 to March, 2022.

It is advised to give wide publicity to the above relaxation in local media, Trade Associations and Employers Union etc.

This issues with the approval of Director General.

Yours faithfully,

(Niraj Kumar)

Asstt.Dir (Rev)

Copy to:-

1.Website Content Manager with the request to upload the above instructions on the website of ESI Corporation.

2. ICT Division, Hqrs. Office for urgent necessary action.

Asstt. Dig (Rev)

DOWNLOAD FACILITY HAS IT BEEN WIRHDRAWN?