Short Summary:

In this spark editorial, the author begins by referring the provisions of section 124,125,126 of Companies Act, 2013 relating to Dividend, Investor Education Protection Fund etc. Author shall Shed Some Light on Creation of IEPF, Process of transfer of fund & shares to IEPF, Compliance Calendar under these sections. The main thrust of the article, however, is upon the “IEPF” along with discussion of circulars, notifications, amendments made by MCA.

This document tries to incorporate all major amendments to IEPF Rules at one place.

This editorial would assist in understanding the provisions of Investor Education Protection Fund “IEPF” under CA, 2013.

DIVIDEND:

The word “Dividend” has origin from the Latin word “Dividendum”. It means a thing to be divided. Dividend means the portion of the profit received by the shareholders from the company’s net profit, which is legally available for distribution among the members. Therefore, dividend is a return on the share capital subscribed for and paid to its shareholders by a company. Dividend defined under section 2(35) of the Companies Act, 2013, includes any interim dividend.

A. UNPAID DIVIDEND ACCOUNT:

I. Provisions of Unpaid Dividend Account:

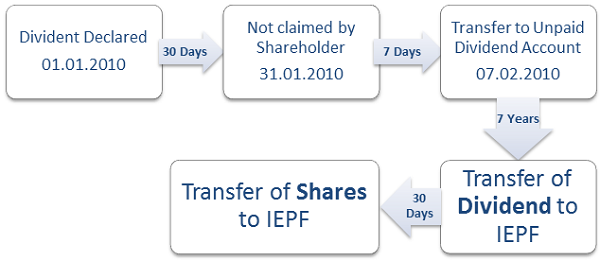

- Once dividend transferred in Dividend Account but not has not been claimed by the shareholder within 30 days of declaration of dividend.

- The Company shall transfer such unpaid amount within 37 days from the date of declaration in a special account ‘Unpaid Dividend Account’

- The company shall, within a period of 90 days of making any transfer of an amount under sub-section (1) to the Unpaid Dividend Account,

– Prepare a statement containing the names, their last known addresses and the unpaid dividend to be paid to each person ; and

– Place it on the website of the company, if any ; and

– Also on any other website approved by the Central Government for this purpose, in such form, manner and other particulars as may be prescribed.

B. INVESTOR EDUCATION AND PROTECTION FUND

II. History:

Investor Education and Protection Fund (IEPF) has been set-up under Section 205C of the Companies Act, 1956 by way of the Companies (Amendment) Act, 1999. The Fund has been established with a view to support the activities relating to investor education, awareness and protection. For the purpose of administration of IEPF, the Investor Education and Protection Fund (awareness and protection of investors) Rules 2001 were notified on 1st October 2001.

III. Provisions of Investor Education and Protection fund:

Transfer of Dividend: Any money transferred to the Unpaid Dividend Account of a company in pursuance of this section which remains unpaid or unclaimed for a period of seven years (7 year and 37 days from the date of declaration of dividend) from the date of such transfer shall be transferred by the company along with interest accrued, if any, thereon to Investor education and protection fund.

- The company shall send a statement in the prescribed form of the details of such transfer to the authority which administers the said Fund and that authority shall issue a receipt to the company as evidence of such transfer.

Transfer of Shares: All shares in respect of which [dividend has not been paid or claimed for seven consecutive years or more shall be] transferred by the company in the name of Investor Education and Protection Fund along with a statement containing such details as may be prescribed:

IV. Process of transfer of DIVIDEND to Investor Education and Protection fund:

As per MCA Investor Education and Protection Fund Authority (Accounting, Audit, Transfer and Refund) Rules, 2016 dated 05th September, 2016:

1. The Company shall credit the fund due for transfer in investor Education and protection Fund within 30 days of becomes due.

2. The amount shall be tendered by the companies along with challan (in triplicate) to the specified Bank Branches who will return two copies of the challan, duly stamped in token of having received the amount, to the Company.

3. Every company shall file with the concerned Authority one copy of the challan indicating deposit of the amount to the Fund and shall fill in the full particulars of the amount tendered, including the head of account to which it has been credited.

4. The company shall, along with the copy of the challan furnish a Statement in Form No. IEPF 1 containing details of such transfer to the Authority within thirty days of submission of challan.

5. The Company shall maintain record consisting of name, last known address, amount, folio number or client ID, certificate number, beneficiary details etc. of the person in respect f whom unpaid or unclaimed amount has remained unpaid or unclaimed for a period of 7 years and has been transferred to the fund and the authority shall have the power to inspect such records.

V. Manner of transfer of SHARES to Investor Education and Protection fund:

As per Section 124(6) of Act, 2013 All shares in respect of which dividend has not been paid or claimed for seven consecutive years or more shall be transferred by the company in the name of Investor Education and Protection Fund.

As per Rule 6(1) The shares shall be credited to DEMAT Account of the IEPF Authority opened by the Authority for the said purpose, within a period of [1]thirty days of such shares becoming due to be transferred to the Fund.

1. The IEPF Authority has opened Demat Account with NSDL and CDSL through PNB and SBICAP Securities Limited respectively, as Depository Participants. The details of said account are given on the link below link http://www.iepf.gov.in/IEPF/pdf/GC12TranferofShares_16102017.pdf.

2. The procedure to be followed for transmission of shares shall be followed by the companies while transferring the shares to the fund. Procedure for transmission of shares given under section 56 of the Act.

Compliances by the Company:

I. The Board shall authorise the Company Secretary or any other person to sign the necessary documents for the purposes of effecting transfer of such shares.

II. The company shall inform, at the latest available address, the shareholder concerned regarding transfer of shares three months before the due date of transfer of shares and also simultaneously publish a notice in the leading newspaper in English and regional language having wide circulation informing the concerned that the names of such shareholders and their folio number or DP ID – Client ID are available on their website duly mentioning the website address.

III. Where Shares are in Demat Form:

a. The Company shall inform the depository by way of corporate action, where the shareholders have their accounts for transfer in favour of the Authority.

b. On receipt of such intimation, the depository shall effect the transfer of shares in favour of DEMAT account of the Authority.

IV. Where Shares are in Physical Form

a. The Company Secretary or the person authorised by the Board shall make an application, on behalf of the concerned shareholder, to the company, for issue of a new share certificate;

b. On receipt of the application under clause (a), a new share certificate for each such shareholder shall be issued and it shall be stated on the face of the certificate that “Issued in lieu of share certificate No….. for the purpose of transfer to IEPF” and the same be recorded in the register maintained for the purpose;

c. Particulars of every share certificate shall be in Form No. SH-1 as specified in the Companies (Share Capital and Debentures) Rules, 2014;

d. After issue of a new share certificate, the company shall inform the depository by way of corporate action to convert the share certificates into DEMAT form and

transfer in favour of the Authority.

Note:

All Companies which are required to transfer shares of IEPF Authority, shall transfer such shares, whether held in dematerialized form or physical form, to the Demat account of IEPF Authority by way of corporate action. The information related to the shareholders, whose shares are being transferred to IEPF’s demat accounts with PNB or SBICAP shall be provided by the companies to NCDL and CDSL respectively as per the prescribed format by the concerned depository

V. While affecting such transfer, the company shall send a statement to the Authority in Form No. IEPF 4 containing details of such transfer.

VI. The company shall furnish details of such shares and unpaid dividend to the Authority in Form No. IEPF 3 within thirty days from the end of financial year.

VII. The company shall maintain the details of shareholding of each individual shareholders whose shares have been credited to the DEMAT account of the Authority.

IMPORTANT:

i. The voting rights on shares transferred to the Fund shall remain frozen until the rightful owner claims the shares.

ii. Benefit: All benefits accruing on such shares e.g., bonus shares, split, consolidation, fraction shares etc., except right issue shall also be credited to such DEMAT account.

iii. Delisted: If the company is getting delisted, the Authority shall surrender shares on behalf of the shareholders in accordance with the Securities and Exchange Board of India (Delisting of Equity Shares) Regulations, 2009 and the proceeds realised shall be credited to the Fund and a separate ledger account shall be maintained for such proceeds.

iv. Company Wound up: In case the company whose shares or securities are held by the Authority is being wound up, the Authority may surrender the securities to receive the amount entitled on behalf of the security holder and credit the amount to the Fund and a separate ledger account shall be maintained for such proceeds.

V. Dividend: Any further dividend received on such shares shall be credited to the Fund and a separate ledger account shall be maintained for such proceeds

VI. Process to claim DIVIDEND refund from Investor Education and Protection fund:

Section 125(3) of Companies Act,2013 enabling investors to claim their unpaid dividends, matured deposits or debentures etc. transferred to Investor Education and Protection Fund(IEPF) by companies has been commenced with effect from 7TH September,2016. Claimants may file their applications to the IEPF Authority, as per the procedure hereunder: The claimant shall file only one consolidated claim in respect of a Company in a financial year.

1. Download the Form IEPF-5 from the website of IEPF (http://www.iepf.gov.in) for filing the claim for refund. Read the instructions provided on the website/instruction kit along with the e-form carefully before filing the form .

2. After filing the form save it on your computer and submit the duly filled form by following the instructions given in the upload link on the website. On successful uploading an acknowledgement will be generated indicating the SRN. Please note the SRN for future tracking of the form.

3. Take a printout of the duly filled IEPF-5 and the acknowledgement issued after uploading the form.

4. Submit indemnity bond in original, copy of acknowledgement and self attested copy of e-form along with the other documents as mentioned in the Form IEPF-5 to Nodal Officer (IEPF) of the company at its registered office in an envelope marked “Claim for refund from IEPF Authority”.

5. Claim forms completed in all aspects will be verified by the concerned company and on the basis of company’s verification report, refund will be released by the IEPF Authority in favor of claimants’ Aadhaar linked bank account through electronic transfer

VII. Process to claim SHARES refund from Investor Education and Protection fund:

Any person, whose shares, unclaimed dividend, matured deposits, matured debentures, application money due for refund, or interest thereon, sale proceeds of fractional shares, redemption proceeds of preference shares, etc. has been transferred to the Fund, may claim the shares under provision to sub-section (6) of section 124 or apply for refund under clause (a) of sub-section (3) of section 125 or under proviso to sub-section (3) of section 125, as the case may be, to the Authority.

Note:

√ The claimant shall file only one consolidated claim in respect of a company in a financial year.

√ In case, claimant is a legal heir or successor or administrator nominee of the registered security holder, he has to ensure that the transmission process is completed by the company before filing any claim with the Authority.

Step- I

Claimant to Authority

I. Person have to make application to MCA in eform IEPF-5 by mentioning following details:

i. Particular of Applicant

ii. Particular of Company

iii. Details of Shares to be claimed

iv. Details of amount claimed

v. Year wise details of securities/deposits

vi. Aadhaar Number or Passport/OCI/PIO Card No. (in case of NRI/foreigners)

vii. Details of Bank account (Aadhar linked, in case applicant is not NRI/foreigner)in which refund of claim to be made

II. No need to affix DSC on the eform

III. There is no option to attach any document in the form.

Step- II

Claimant to Company

The claimant and after filing the refund claim in this form online, shall to send the attachments prescribed below to Nodal Officer (IEPF) of the company at its registered office in an envelope marked “claim for refund form IEPF Authority” for initiating the verification for claim:

i. Print out of duly filled claim form (IEPF-5) with claimant signature

ii. Copy of acknowledgement

iii. Indemnity Bond (original) with claimant signature

- On a non-judicial Stamp Paper of the value as prescribed under the Stamp Act if the amount of the claim is Rs.10, 000 or more.

- On a plain paper if the amount claimed does not exceed Rs.10,000.

- In case of refund of shares, on a non-judicial Stamp Paper of the value as prescribed under the Stamp Act.

iv. Advance Stamped receipt (original) with signature of claimant and two witnesses

v. In case of refund of matured deposit or debenture, original certificate thereto

vi. Copy of Aadhaar Card(For Indian Nationals)

vii. Proof of entitlement (certificate of share/Interest warrant Application No. etc.)

viii. Cancelled Cheque leaf

ix. Copy of Passport, OCI and PIO card in case of foreigners and NRI

Step- III

Company to Authority

The company shall within 15 days of receipt of claim form, send a verification report to the Authority in the format specified by the Authority along with all documents submitted by the claimant.

In case of non receipt of documents by the Authority after the expiry of ninety days from the date of filing of Form IEPF-5, the Authority may reject Form IEPF-5, after giving an opportunity to the claimant to furnish response within a period of thirty days.

Step- IV

Authority to Claimant

After verification of the entitlement of the claimant-

To the Amount Claimed, the Authority and then Drawing and Disbursement Officer of the Authority shall present a bill to the Pay and Accounts Office for e- payment as per the guidelines.

To the Shares Claimed. the Authority shall issue a refund sanction order with the approval of the Competent Authority and shall either credit the shares which are lying with depository participant in IEPF suspense account (name of the company) to the Demat account of the claimant to the extent of the claimant’s entitlement or in case of the physical certificates, if any, cancel the duplicate certificate and transfer the shares in favour of the claimant.

Time Period: An application received for refund of any claim under this rule duly verified by the concerned company shall be disposed of by the Authority within sixty days from the date of receipt of the verification report from the company

C. Compliances b y the Company:

I. IEPF-2

Every company shall within a period of ninety days after the holding of Annual General Meeting and every year thereafter till completion of the seven years period, identify the unclaimed amounts, as referred in sub-section 2 of section 125 of the Act, as on the date of holding of Annual General Meeting, separately furnish and upload on its own website and also on website of Authority or any other website as may be specified by the Government, a statement or information through Form No. IEPF 2, separately for each year, containing following information, namely:-

(a) The names and last known addresses of the persons entitled to receive the sum;

(b) The nature of amount;

(c) The amount to which each person is entitled;

(d) The due date for transfer into the Investor Education and Protection Fund; and

(e) Such other information as may be considered relevant for the purposes.

II. IEPF-6

(1) The company shall furnish a statement to the Authority in Form No. IEPF 6 within thirty days of end of financial year stating therein the amounts due to be transferred to the Fund in next financial year.

(2) The company shall also furnish a statement to the authority within thirty days of the closure of its accounts for the financial year stating therein the reasons of deviation, if any, of amounts detailed in sub-rule (1) above and actual amounts transferred to the Fund.

III. Report from Company to Authority:

The Company shall, within 15 days of receipt of claim form, send a verification report to the authority in the format specified by the authority along with all the documents submitted by the claimant.

IV. An application received for refund of any claim under this rule duly verified by the concerned company shall be disposed of by the Authority within 60 days from the date of receipt of the verification report from the Company, complete in all respects and any delay beyond 60 days shall be recorded in writing specifying the reasons for the delay and the same shall be communicated to the claimant in writing or by electronic means.

V. Every company which has deposited the amount to the Fund shall nominate a Nodal Officer for the purpose of coordination with IEPF Authority and communicate the contact details of the Nodal Officer duly indicating his or her designation, postal address, telephone and mobile number and company authorized e-mail ID to the IEPF Authority, within fifteen days from the date of publication of these rules and the company shall display the name of Nodal Officer and his e-mail ID on its website.

VI. The company shall be liable under all circumstances whatsoever to indemnify the Authority in case of any dispute or lawsuit that may be initiated due to any incongruity or inconsistency or disparity in the verification report or otherwise and the Authority shall not be liable to indemnify the security holder or Company for any liability arising out of any discrepancy in verification report submitted etc., leading to any litigation or complaint arising thereof.

D. QUICK QUESTIONS

Page Contents

- A. Whether entitled shareholder can claim amount from the unpaid dividend account?

- B. Whether Shareholder can claim transfer of shares/Dividend from Investor Education and Protection Fund?

- C. Whether Company required to Issue “Duplicate Shares” for transfer of share in the favour of IEPF?

- D. In case any dividend is paid or claimed for any year during the said period of seven consecutive years, whether the share shall be transferred to Investor Education and Protection Fund?

Ans. Any person claiming to be entitled to any money transferred under sub-section (1) to the Unpaid Dividend Account of the company may apply to the company for payment of the money claimed.

Ans: Yes, any claimant of shares transferred above shall be entitled to claim the transfer of shares from Investor Education and Protection Fund in accordance with such procedure and on submission of such documents as discussed above.

Ans: At the time of applicability of Section 125 read with applicable rules, there was some confusion regarding issue of duplicate shares under rule 6(3)(d) of IEPF Rules, 2016. As per rule 6 Company shall issue duplicate shares in favour of IEPF.

Ans: However, through [2]General Circular No. 07/2017 dated: 05th June, 2017 MCA came with clarification i.e. this transaction of transfer of shares takes place on account of operation of Law. Hence, the procedure followed during transmission of shares may be followed in such cases and duplicate shares need not be issued in such cases.

Ans: it is hereby clarified that in case any dividend is paid or claimed for any year during the said period of seven consecutive years, the share shall not be transferred to Investor Education and Protection Fund.

E. Compliance Calendar:

Compliance Calendar for Company

| S. No. | Form No. | Rule No. | Particular of Form | Time period of fling |

| 1. | IEPF-6

Statement to Authority |

Rule 8(1) | The company shall furnish a statement to the Authority stating therein the amounts due to be transferred to the Fund in next financial year. | 30 days of end of financial year. |

| 2. | IEPF-3 | Rule 6

Details of shares and unpaid dividend |

Transfer of shares to the IEPF | 30 days of end of the financial year. |

| 3. | Rule 8(2) | A statement Stating therein the reasons of deviation, if any, of amounts detailed in IEPF-6 and actual amounts transferred to the Fund. | 30 days of the closure of its accounts for the financial year. | |

| 4. | IEPF-4 | Rule 6(5) | A Statement to the Fund by Company | After transfer of shares. |

| 5. | IEPF-2

Annual Statement |

Rule 5(8) | All companies which have unclaimed and unpaid amounts are required to file an annual statement of the amounts transferred to the designated account maintained by the company, till the period of 7 years by identifying the unclaimed amounts as on the date of holding of Annual General Meeting | 90 days from Annual General Meeting (AGM) every yea.

|

| 6. | Rule-5(1)

Transfer of Amount to Fund |

Remittance of amount of section 125(2) (a-n) into the specified Bank Branch. | within a period of 30 days of such amounts becoming due to be credited to the Fund | |

| 7. | IEPF-1 | Rule-5(4)

Statement to be furnish to Fund |

Transfer of Amount to the IEPF | Within 30 days of submission of Challan |

Records to be maintained by the Company:

As stated in Rule 5(6c): The Company shall maintain of the persons in respect of whom unpaid or unclaimed amount has remained unpaid or unclaimed for a period of seven years and has been transferred to the Fund record consisting of

- Name

- Last known Address

- Amount

- Folio Number

- Client ID

- Certificate Beneficiary Details etc.

The Authority shall have the powers to inspect such records.

Compliance Calendar for Shareholder

| S. No. | Form No. | Rule No. | Particular of the Form |

| 1. | IEPF-5 | Rule 7(1) | Application to the Authority for claiming unpaid amounts and shares out of IEPF |

| 2. | IEPF-5 | Rule 7(1) | Copy to the Company |

Compliance Calendar for Authority;

| S. No. | Name of Statement | Rule No. | Particular of Statement | Time period of filing |

| 1. | Abstract of Details | Rule 5 (6b)

Bank – Authority |

Each Designated bank shall furnish an abstract of receipts of amount during the month to the authority within 7 days after the close of every month. | 7 days after closure of every month |

| 2. | Refund to claimant | Rule 7(3)

Company – Authority |

The Company sends a verification report to the Authority in the format specified by the Authority along with all documents submitted by the claimant. | 15 days of receipt of IEPF-5 form |

| 3. | Disposed off application | Rule 7(6) | An application received for refund of any claim under this rule duly verified by the concerned company shall be disposed of by the Authority | 60 days of receipt of verification report from the Company |

| 4. | Report to CG | Authority – Central Government | Authority shall furnish report to the Central Government giving details of who have failed to transfer the due amount to the Fund | 60 days of end of the financial year |

| 5. | Rule 10(2)

Return & Report |

Authority – Central Government | A report in such form, giving true and full account of its activities during the previous financial year. | 180 days of end of the financial year |

REGISTERS AND BOOKS OF ACCOUNT TO BE MAINTAINED BY THE AUTHORITY

i. Register of Shares transferred under sub-section (6) of section 124

ii. Central Cash Book

iii. Company wise Ledger

iv. General Ledger

v. Cashier’s Cash Book

vi. Bank Ledger

vii. Register of Assets

viii. Investment Register

ix. Claim Register

x. Refund Register

xi. Suspense Register

xii. Documents Register

xiii. Any other register or Book as decided by Authority

[1] Relaxation by Ministry: However, MCA has amended the Rules by Second Amendment Rules, dated 13.10.2017 i.e. “in cases where the period of seven years provided under sub-section (5) of section 124 has been completed or being completed during the period from 7th September, 2016 to 31st October, 2017, the due date of transfer of such shares shall be deemed to be 31st October, 2017.” Accordingly, the last date for completing all the formalities in connection with transfer shall be 30th November, 2017.

[2] http://www.iepf.gov.in/IEPF/pdf/IEPFGcircular07_05062017.pdf

(Author can be reached at csdiveshgoyal@gmail.com )

Thanks for your valueable advice

You are helping the agrieved a lot. Carry on. I pray the Almighty to shower all success in your career, long life with health,wealth & prosperity.

Sincerely yours

Er.Devindra Nath Executive Engineer9Retd) 1997

I submitted the IEPF form 5,showing it has been successfully uploaded and SRN popped up in a window on the screen showing transaction details .However, no other ACKNOWLEDGEMENT has been received and status is showing pending for approval.

How can i generate acknowledgement now or should I resubmit a new form with same SRN without any further communication from IEPF.

Any queries related to IEPF and shares/dividends reclamation can be addressed to ankitgarg.attorney@gmail.com or 9315645898.

Regards,

Ankit Garg, Advocate

Garg Law Chambers