Introduction

Ind AS 116 sets out the principles for the recognition, measurement, presentation, and disclosure of leases. The objective is to ensure that lessees and lessors provide relevant information in a manner that faithfully represents those transactions. This information gives a basis for users of financial statements to assess the effect that leases have on the financial position, financial performance and cash flows of an entity.

Lessee Accounting

Ind AS 116 introduces a single lessee accounting model and requires a lessee to recognise assets and liabilities for all leases with a term of more than 12 months, unless the underlying asset is of low value. A lessee is required to recognise a right-of-use asset representing its right to use the underlying leased asset and a lease liability representing its obligation to make lease payments. Under Ind AS 116, a lessee measures right-of-use assets similarly to other non-financial assets (such as property, plant and equipment) and lease liabilities similarly to other financial liabilities. As a consequence, a lessee recognises depreciation of the right-of-use asset and interest on the lease liability, and also classifies cash repayments of the lease liability into a principal portion and an interest portion and presents them in the statement of cash flows applying Ind AS 7.

Lessor Accounting

A lessor shall classify each of its leases as either an operating lease or a finance lease. A lease is classified as a finance lease if it transfers substantially all the risks and rewards incidental to ownership of an underlying asset. A lease is classified as an operating lease if it does not transfer substantially all the risks and rewards incidental to ownership of an underlying asset. Whether a lease is a finance lease or an operating lease depends on the substance of the transaction rather than the form of the contract.

Recognition

At the commencement date, a lessee shall recognise a right-of-use asset and a lease liability (Para 22)

Right-of-use asset

- At the commencement date, a lessee shall measure the right-of-use asset at cost. (Para 23)

- The cost of the right-of-use asset shall comprise: (Para 24)

(a) the amount of the initial measurement of the lease liability, as described in paragraph 26;

(b) any lease payments made at or before the commencement date, less any lease incentives received;

(c) any initial direct costs incurred by the lessee; and

Lease Liability

At the commencement date, a lessee shall measure the lease liability at the present value of the lease payments that are not paid at that date. The lease payments shall be discounted using the interest rate implicit in the lease, if that rate can be readily determined. If that rate cannot be readily determined, the lessee shall use the lessee’s incremental borrowing rate. (Para 26)

Accounting Entry in the books of Lessee

i) At the time entering Lease (One-time entry)

Lease Asset A/c Dr XXXX (Non-Current Assets)

To Lease Rent Payable XXXX (Non-Current Liabilities)

ii) Entry to be made every lease payment

a) Amortisation Cost A/c Dr XXXX (Depreciation Cost Debited to P&L)

To Accumulated Amortization XXXX (Reduced from Lease Asset)

b) Finance Cost A/c Dr XXXX (Finance Cost Debited to P&L)

To Lease Rent Payable XXXX (Increased to Lease Rent Payable)

c) Lease Rent Payable A/c Dr XXXX (Decreased from Lease Rent Payable)

To Lessor XXXX (Actual Lease Rent paid)

Let’s understand by way of Example:

- Lease Period – 10 Years

- Lease Rent Rs.12,00,000 per annum

(Incremental Rent @ 5% for every three years once)

- Deposit of one-month lease rent to lessor i.e. Rs. 1 Lakh

- Stamp Duty on Registration Rs.1,50,000

- Expenses incurred for Registration Rs. 10,000

- Discounting Rate – 5% p.a

- Rate of Interest for Finance Cost – 5% p.a

# Present Value of Lease Rent payable Rs.97,73,302 + Initial cost Rs.2,60,000 = Rs.1,00,33,302 (Cost of the right-of-use asset / Lease Rent Payable)

At the time entering Lease (One-time entry)

Lease Asset A/c Dr 1,00,33,302 (Non-Current Assets)

To Lease Rent Payable 1,00,33,302 (Non-Current Liabilities)

Entry to be made in first year

a) Amortisation Cost A/c Dr 2,09,027 (Depreciation Cost Debited to P&L)

To Accumulated Amortization 2,09,027 (Reduced from Lease Asset)

b) Finance Cost A/c Dr 4,88,665 (Finance Cost Debited to P&L)

To Lease Rent Payable 4,88,685 (Increased to Lease Rent Payable)

c) Lease Rent Payable A/c Dr 12,00,000 (Decreased from Lease Rent Payable)

To Lessor 12,00,000 (Actual Lease Rent paid)

Hi POUNRAJ GANESAN

what will be the calculation if the lease deed is terminated before maturity , Suppose in 5th year

INDAS 116 is applicable on lease residential flat for employee residence?

No economic benefits from the property. This is treat as perquisite to employee.

Hi. Prabhat Kumar, Thanks for correcting me. There is a calculation mistaken. Find the below revised calculation.

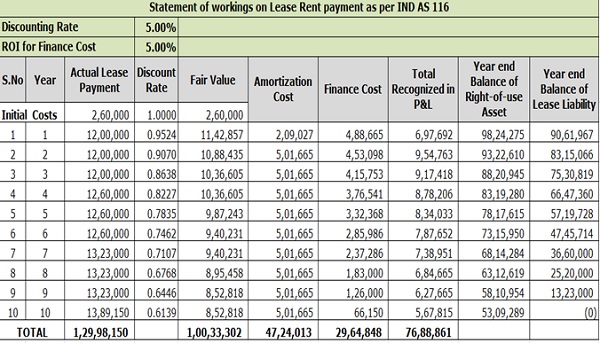

Statement of workings on Lease Rent payment as per IND AS 116

Discounting Rate 5.00%

ROI for Finance Cost 5.00%

S.No Year Actual Lease Payment Discount Rate Yearly Fair Value Amortization Cost Finance Cost Total Recognized in P&L Closing Balance of Right-of-use Asset Closing Balance of Lease Liability

Intital Costs 2,60,000 1.0000 2,60,000

1 1 12,00,000 0.9524 11,42,857 10,03,330 4,88,665 14,91,995 90,29,972 90,61,967

2 2 12,00,000 0.9070 10,88,435 10,03,330 4,53,098 14,56,429 80,26,642 83,15,066

3 3 12,00,000 0.8638 10,36,605 10,03,330 4,15,753 14,19,084 70,23,312 75,30,819

4 4 12,60,000 0.8227 10,36,605 10,03,330 3,76,541 13,79,871 60,19,981 66,47,360

5 5 12,60,000 0.7835 9,87,243 10,03,330 3,32,368 13,35,698 50,16,651 57,19,728

6 6 12,60,000 0.7462 9,40,231 10,03,330 2,85,986 12,89,317 40,13,321 47,45,714

7 7 13,23,000 0.7107 9,40,231 10,03,330 2,37,286 12,40,616 30,09,991 36,60,000

8 8 13,23,000 0.6768 8,95,458 10,03,330 1,83,000 11,86,330 20,06,660 25,20,000

9 9 13,23,000 0.6446 8,52,818 10,03,330 1,26,000 11,29,330 10,03,330 13,23,000

10 10 13,89,150 0.6139 8,52,818 10,03,330 66,150 10,69,480 – (0)

TOTAL 1,29,98,150 1,00,33,302 1,00,33,302 29,64,848 1,29,98,150

Sir, the calculation of chart is not matching please provide the same excel sheet with formulas or please defined all things with details and formulas.