The Goods and Services Tax (GST) was introduced in India on July 1, 2017, as a comprehensive, multi-stage, destination-based tax that replaced a complex web of indirect taxes previously levied by the central and state governments. GST aims to create a single, unified market to streamline the indirect tax regime, enhance compliance, and reduce the cascading effect of taxes on goods and services.

One of the fundamental features of GST is the Input Tax Credit (ITC) mechanism, which allows businesses to offset the tax paid on inputs (inward supplies) against the tax payable on outputs (outward supplies). This mechanism is designed to ensure that tax is paid only on the value added at each stage of the supply chain, thereby minimizing the tax burden on end consumers.

In the realm of taxation, the term “Inverted Duty Structure” often surfaces, particularly within the context of the Goods and Services Tax (GST) in India. This structure can have significant implications for businesses, particularly regarding the “refund of Input Tax Credit (ITC).” In this article, we will explore what the Inverted Duty Structure entails, its impact on businesses, and how the refund of ITC works under this system

Inverted Duty Structure

An Inverted Duty Structure arises when the GST rate on inputs (raw materials or components) is higher than the GST rate on the finished products. This mismatch can result in an accumulation of unutilized ITC, as businesses pay higher taxes on their inputs than they collect on their outputs. This situation is particularly prevalent in industries where the manufacturing process involves inputs taxed at higher rates than the finished goods.

With the advent of GST, the Indian government aimed to address many of the inefficiencies of the previous tax regime. However, the problem of the Inverted Duty Structure persisted in certain sectors. Under GST, if the rate of tax on inputs exceeds the rate of tax on outputs, businesses continue to face the issue of accumulated ITC.

In simple terms, an Inverted Duty Structure arises when the rate of tax on inward supplies is higher than the rate of tax on outward supplies. This indicates that the inverted tax structure is related to the rate of taxes, not merely the absolute quantum of taxes.

Refund of ITC

The accumulation of Input Tax Credit (ITC) due to unutilized ITC will have to be carried over to the next financial year until it can be utilized by the registered taxpayer for payment of output tax liability. This can result in higher tax costs for businesses and/or an increase in the hidden tax cost for consumers. The GST law permits a refund of unutilized ITC under the Inverted Duty Structure, as outlined in Section 54 of the Act.

Relevant provision in the GST Act

Chapter XI – Refunds – Section 54 Refund of tax

As per clause (ii) of proviso to section 54(3) of Central Goods & Service Tax Act, 2017 (hereafter ‘the CGST Act’) refers where the credit has accumulated on account of rate of tax on inputs being higher than the rate of tax on output supplies (other than nil rated or fully exempt supplies), except supplies of goods or services or both as may be notified by the Government on the recommendations of the Council:

Chapter X – Refund – Rule 89 – Application for refund of tax, interest, penalty, fees or any other amount

As per sub-rule 5 to rule 89 of Central Goods & Service Tax Rules, 2017 (hereafter ‘the CGST Rules’) refers In the case of refund on account of inverted duty structure, refund of input tax credit shall be granted as per the following formula: –

Maximum Refund Amount = {(Turnover of inverted rated supply of goods and services) x Net ITC Adjusted Total Turnover} – [{tax payable on such inverted rated supply of goods and services x (Net ITC ÷ ITC availed on inputs and input services)}].

Explanation: – For the purposes of this sub-rule, the expressions –

(a) “Net ITC” shall mean input tax credit availed on inputs during the relevant period other than the input tax credit availed for which refund is claimed under sub-rules (4A) or (4B) or both; and

[“Adjusted Total turnover” and “relevant period” shall have the same meaning as assigned to them in sub-rule (4).]

Procedure for Filing Inverted Duty Refund

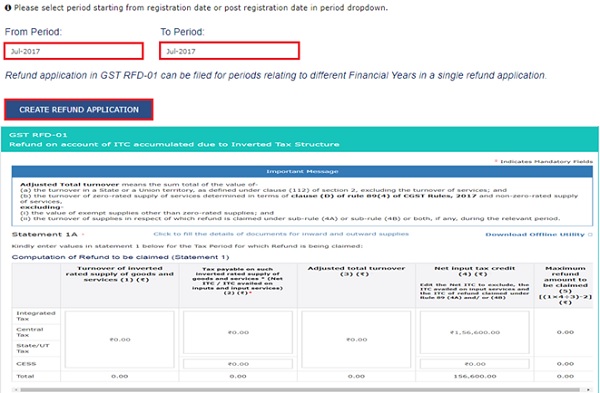

- The refund application in Form RFD-01 needs to be filed within 2 years from the due date for furnishing the return for the period in which the claim for refund arises.

- To file for a refund of IGST/CGST/SGST on account of ITC accumulated due to the Inverted Tax Structure, you must have filed Form GSTR-1 and GSTR-3B returns for the relevant tax period for which the refund is to be claimed.

- The prescribed statements—Statement 1 and Statement 1A of Form GST RFD-01A—have to be filled out. Drawback of all taxes under GST (IGST/CGST/SGST) should not have been availed while claiming a refund of accumulated ITC under Section 54(3)(ii) of the CGST Act, 2017. A declaration to this effect forms part of Form GST RFD-01A as well.

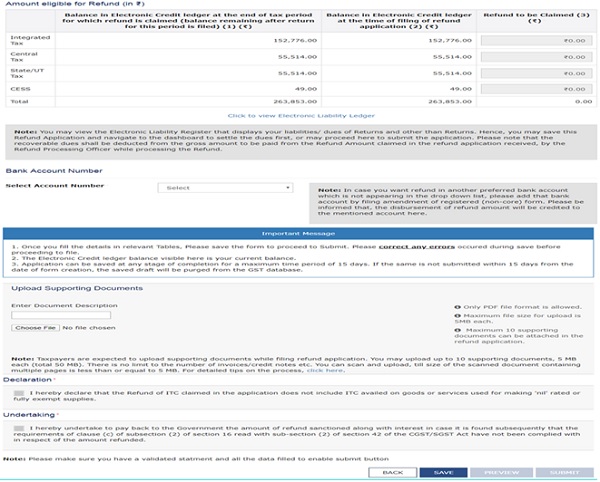

- The refund amount to be claimed should be such that: a. The amount in each head is equal to or lower than the balance in each head of the electronic credit ledger. b. The total refund amount should not exceed the “Maximum Refund amount to be claimed” in Statement 1A. c. The total refund amount should not exceed the amount calculated at the aggregate level (IGST+CGST+SGST) in the table “Balance in Electronic Credit Ledger at the end of the tax period for which refund is claimed.”

- Total Refund Claimed to be entered must be less than or equal to the “Maximum Refund amount to be claimed” in Statement 1A.

- For example, if the “Maximum Refund amount to be claimed” in Statement 1A is 100,000 INR and the amount in the table “Balance in Electronic Credit Ledger at the end of the tax period for which refund is claimed” is (CGST=0, SGST=0, IGST=150,000), the aggregate amount is 150,000 INR. The amount available in the Electronic Credit Ledger is (CGST=80,000, SGST=10,000, IGST=0). Now, the total refund to be claimed cannot exceed:

a. The “Maximum Refund amount to be claimed” – 100,000 INR.

b. The aggregate level of the table “Balance in Electronic Credit Ledger at the end of the tax period for which refund is claimed” – 150,000 INR.

c. The total refund amount cannot exceed the balance available in the Electronic Credit Ledger at the individual level, i.e., (CGST=80,000, SGST=10,000, IGST=0).

Hence, the total refund amount claimed can be (CGST=80,000, SGST=10,000, IGST=0), and the total refund amount that can be claimed is 90,000 INR.

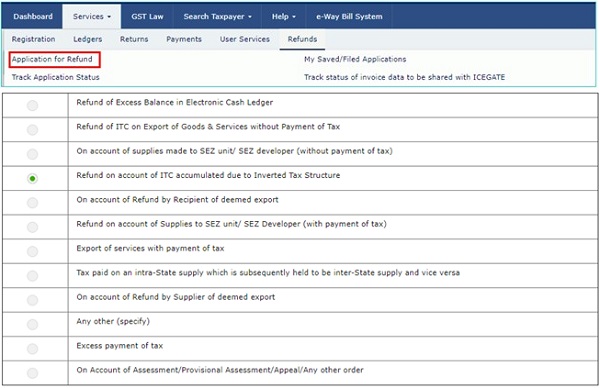

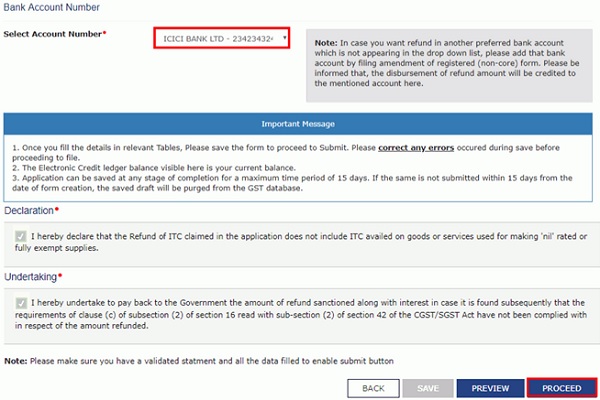

What are the steps to file for refund of ITC accumulated due to Inverted Tax Structure, on the GST Portal?

–

–

–

Other applicable Sections under CGST Act 2017 relevant to refund

| Sections | Description |

| 54(4) | Documents required to be accompanied |

| 54(5) | Order for Refund and credited to the Fund referred to in section 57 |

| 54(7) | Order for Refund within 60 days from the date of receipt of application |

| 54(8)(b) | Refundable amount shall be paid to the applicant |

| 54(10) | Withholding the refund in certain cases |

Other applicable Rules under CGST Rules 2017 relevant to refund

| Rules | Description |

| 89(1) | Refund application electronically in FORM GST RFD-01 |

| 89(2) | Documents to be attached with application |

| 89(3) | Electronic credit ledger shall be debited by the applicant by an amount equal to refund claimed |

| 89(4) and 89(5) | Refund Calculation Formula |

| 90(2) | Acknowledgement in FORM GST RFD-02 within 15days of filing the application |

| 90(3) | Deficiencies if any will be communicated in FORM GST RFD-03 |

| 91(2) | The Proper Officer shall pass an order in FORM GST RFD-04 on a provisional basis within a period 7 days from the date of the acknowledgement |

| 91(3) | The Proper Officer shall issue a payment order in FORM GST RFD-05 |

| 92 (1) | The Proper Officer shall pass an order in FORM GST RFD-06 within 60days of receipt of the application |

Restriction of refund under IDS for certain goods & services

The following notifications restrict the eligibility of goods and services for a refund under the Inverted Duty Structure (IDS), based on the HSN (Harmonized System of Nomenclature) of the outward supply of goods or services:

a) Notification No. 5/2017 – Central Tax dated 19/06/2017

b) Notification No. 15/2017 – Central Tax dated 01/07/2017

c) Notification No. 29/2017 – Central Tax dated 22/09/2017

d) Notification No. 44/2017 – Central Tax (Rate) dated 14/11/2017

e) Notification No. 20/2018 – Central Tax dated 26/07/2018

f) Notification No. 9/2022 – Central Tax dated 13/07/2022

Taxpayers should verify these notifications, as well as any further notifications in this regard, to check if the goods or services supplied in the given scenario are specifically restricted from claiming a refund under IDS before making the refund application.

Notifications and circulars issued by the CBIC pertain to refunds under the Inverted Duty Structure (IDS).

| Notifications / Circulars | Description |

| Notification No. 26/2018 – Central Tax – dated 13th June, 2018 | Changes in Rule 89(5) with retrospective effect from 1st July 2017 and allowed refund only for the inputs of goods. Input doesn’t include input services and capital goods for this purpose |

| Circular No. 79/53/2018 – dated 31st December, 2018 | Net ITC includes ITC of all inputs whether or not used directly consumed in the manufacturing process |

| Circular No. 125/44/2019 – dated 18th November, 2019 | Concessional rate is also eligible for refund on account of inverted tax structure |

| Notification No. 13/2022 – Central Tax – dated 05th July 2022 | Excludes the period from 01/03/2020 to 28/02/2022 for computation of period of limitation for filing refund application under section 54 of the said Act |

| Notification No. 14/2022 – Central Tax – dated 05th July, 2022 | Amendment in the formula under Rule 89(5) |

| Circular No. 181/13/2022 – dated 10th November, 2022 | Notification No. 14/2022-Central Tax dated 05/07/2022 is applicable prospectively with effect from 05/07/2022 |

| Circular No. 135/05/2020 – dated 31st March, 2020 | The restriction on bunching of refund claims across financial years shall not apply |

| Circular No. 173/05/2022 – dated the 6th July, 2022 | Clarification on issue of claiming refund under inverted duty structure where the supplier is supplying goods under some concessional notification |

Case Law pertains to Refund under Inverted Duty Structure

♦ VKC Footsteps India Pvt Ltd vs. Union of India & Others dated 24.07.2020 (R/Special Civil Application No. 2792 of 2019) its judgment dated 24th July 2020 the Division Bench of the Hon’ble Gujarat High Court, held that:

“Explanation (a) to Rule 89(5) which denies the refund of “unutilized input tax” paid on “input services” as part of “input tax credit” accumulated on account of inverted duty structure is ultra vires the provision of Section 54(3) of the CGST Act, 2017.”

The High Court therefore directed the Union Government to allow the claim for refund made by the petitioners before it, considering unutilized ITC on input services as part of “Net ITC” for the purpose of calculating refund in terms of Rule 89(5), in furtherance of Section 54(3).

♦ Tvl. Transtonnelstroy Afcons Joint Venture vs Union of India dated 21.09.2020 (W.P No. 8596 of 2019) its judgment dated 21st September 2020, the Division Bench of the Madras High Court came to a contrary conclusion, after having noticed the view of the Gujarat High Court, which it has declined to follow. The Madras High Court has concluded that:

Section 54(3)(ii) does not infringe Article 14.

Refund is a statutory right and the extension of the benefit of refund only to the unutilized credit that accumulates on account of the rate of tax on input goods being higher than the rate of tax on output supplies by excluding unutilized input tax credit that accumulated on account of input services is a valid classification and a valid exercise of legislative power.”

The writ petitions challenging the validity of Rule 89(5) on the ground that it is ultra vires Section 54(3)(ii) were dismissed. The divergence between the views of the Gujarat High Court on the one hand, and the Madras High Court on the other, forms the subject matter of this batch of appeals.

♦ Final Verdict by The Apex Court – Union of India & Others vs. VKC Footsteps India Pvt Ltd:

Ruling of Hon’ble Gujarat High Court was challenged by the Union of India before the Supreme Court. To a sheer surprise, Hon’ble Supreme Court dismissed the ruling of the Hon’ble Gujarat High Court and affirmed the ruling of the Hon’ble Madras High Court.

Hon’ble Supreme Court held that “if the legislature had any intention of giving the credit of tax paid on input goods and input services, the legislature would not have restricted the scope of refund in inverted duty structure to only inputs”.

Despite giving an unfavorable decision, Hon’ble Supreme Court acknowledged the anomaly in the formula covered under rule 89(5) of the Central Goods and Services Rules, 2017 and accordingly directed the GST council to take required corrective action.

Acting on the same, the 47th GST Council Meeting recommended to amend the formula of refund prescribed under rule 89(5). It was recommended to take into account the unutilized ITC of inputs and input services for payment of output tax on inverted rated supplies in the same proportion in which ITC has been availed on inputs and input services.

The claim of the applicant for the refund is revealed in clause (ii) of the proviso to Section 54(3) of the CGST Act. As per the applicant, the tax rate on specific inputs is more compared to the tax filed on the output (bottled LPG). The applicant as a result is not able to completely use the ITC on its inputs.

Only on the ITC accumulated on the account of the “rate of tax on inputs being more than the rate of tax on output supplies” Clause (ii) of the proviso to sub-section (3) of Section 54 of the CGST Act is applicable.

The council argued that the refund shall be admissible under Clause (ii) to proviso Sub-section (3) of Section 54 of the CGST Act. No refund shall be admissible since the tax rate on the bulk LPG and bottled LPG was identical.

The court rendered that the related authority to process the application of the applicants for the refund including with the applicable interest as per the law as expeditiously as possible and in any event within 6 weeks from the date.

REFERENCES

https://taxinformation.cbic.gov.in/content-page/explore-act

https://tutorial.gst.gov.in/userguide/refund/index.htm#t=Refund_of_ITC_accumulated_due_to_inverted_tax_structure_(RFD-01A).htm

https://gstcouncil.gov.in

https://icmai.in/TaxationPortal/upload/IDT/Article_GST/101.pdf

https://www.taxmann.com