CA Umashankar Tiwari

Types of Mutual Fund Schemes

1. Equity

(a) Index Fund

(b) Large Cap Fund

(c) Small Cap Fund

(d) Mid Cap Fund

(e) Arbitrage Fund

(f) Sector Specific Fund

(g) Diversified Fund

(h) Open Ended Fund

(i) Close Ended Fund

(j) ELSS (Equity Linked Savings Schemes)

(k) Growth Fund

(l) Value Fund

(m) Dividend Yield Fund or Equity Income Fund

2. Debt

(a) Debt Fund

(b) Money Market Fund

(c) Liquid Fund

(d) Interval Fund

(e) Fixed Maturity Plans ( FMPs)

(f) Gilt Fund

(g) Monthly Income Plan (MIP)

3. Balance

(a) Balanced Equity Fund

(b) Balanced Debt Fund

4. Exchange Traded Fund (ETF)

(a) Index ETF

(b) Stock ETF

(c) Commodity ETF

5. FundOf Funds

- Open Ended Fund –

Open for subscription at all time. Exit allowed at all time.

Ex:-Reliance Growth Fund

- Close Ended Fund –

Open for subscription for a limited period. Exit possible only through Stock Exchange.

Ex:-Tata Infrastructure Sector Fund.

- Diversified Fund –

Invests across sector, across caps.

Ex:-HDFC TOP 200

- Sector Specific Fund–

Minimum 65% invested in companies of a particular sector only.

Ex:-SBI Magnum IT Sector Fund.

- Index Fund –

Replica of any index. Index can be brond based index (i.e.- Nifty, Sensex) or a sector specific index (i.e.- BSE pharma index). Fund is invested in the constituent securities of any index, in their respective weightage in the index.

Ex:-SBI Magnum Index fund.

- Large Cap Fund –

They primarily invest in large cap companies. i.e., Companies having very High Market Capitalization.

Ex:-Reliance vision fund.

- Mid Cap Fund –

They primarily invest in mid cap stocks.

Ex:-Sundaram select mid cap fund

- Small Cap Fund –

They primarily invest in small cap stocks.

Ex:- Birla Small Cap

- Arbitrage Fund –

They adopt the arbitrage techniques using derivatives on nifty . They adopt the strategies like “ Long Spot – Short Future” and vice versa to generate returns. Since underlying of nifty is equity, arbitrage funds are considered to be equity fund for taxation purposes.

Ex.:-UTI Spread Fund.

- Equity linked Savings Schemes – (ELSS)

They invest at least 90% of their corpus in equities. There is lock in period of three years for investors. Investment eligible for section 80 C deduction.

Ex:-Birla Sunlife Tax Plan

- Growth Fund –

They invest primarily in emerging sectors. High risk high return.

Ex:-Reliance Growth fund.

- Value Fund –

They invest primarily in undervalued stocks

Ex:- Fidelity Value fund.

- Dividend Yield or Equity Income Fund-

They invest primarily in good dividend paying companies.

Ex:- UTI Dividend Yield Fund.

- Debt Fund –

They invest in bonds having term to maturity of over 365 days. Interest rate risk is higher.

- Money Market Funds-

They invest in bonds having term to maturity between 92 days to 365 days. Interest rate risk is intermediate. Also called “Interval Fund”

- Liquid Fund-

They invest in bonds having term to maturity upto 91 days only. Negligible Interest rate risk.

- Fixed Maturity Plans (FMPs)-

The maturity amount is not fixed. They invest in bonds having similar duration as that of the FMP. They can’t assure guaranteed returns but can give indicative yields based on yield to maturity (YTM) of the invested bonds.

- Gilt Fund-

They invest in only government bonds.

- Monthly Income Plan (MIP)-

MIP doesn’t guarantee any monthly income. They invest primarily in debt instruments with very little proportion invested in equities. They generally declare dividend on monthly basis depending on surplus position of the fund.

- Balance Fund-

It’s a combination of debt and equity. If equity is more then 65% of the fund, then will be categorized as equity fund for income tax purpose.

- Exchange Traded Fund (ETF)-

ETFs have features of both equity and MF. They are traded like any other stocks on stock exchanges. Demat A/c and trading A/c with a broker is required for buying/selling of ETF units. Units are created based on some underlying which can be an index , a set of stocks or a commodity like gold.

- Fund Of Funds (FOF)-

These are special category of mutual funds which invests only in other mutual fund schemes. They can’t invest directly in equity or debt.

TAXATIONPROVISIONS

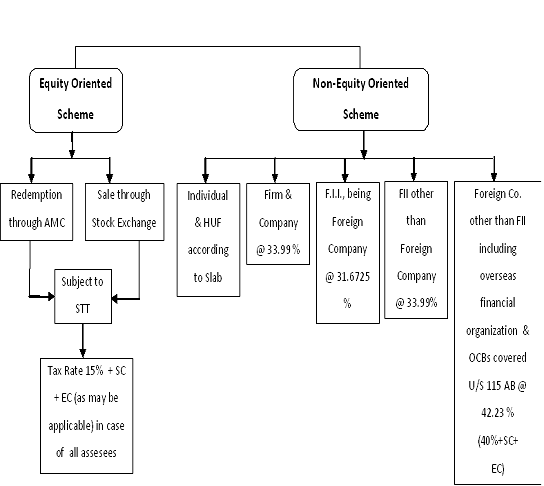

It’s important to note that under the Income Tax Act, 1961, there is mention of only one type of mutual fund. i.e. “Equity Oriented Fund”. It implies that from Income Tax angle mutual fund schemes can be categorized into-

(a) Equity oriented fund (Scheme)

(b) Non Equity oriented fund (Scheme)

“Equity Oriented Fund” is defined in explanation (b) OF CHAPTER XII-E, of Income Tax Act,1961.

“Equity Oriented Fund” is defined to mean:

- Such funds where the investible funds are invested by way of equity shares in domestic companies to the extent of more then 65% of the total proceeds of such fund; and

- Which has been setup under a scheme of mutual fund specified under section 10 (23D).

The percentage of equity shares holdings of such fund is required to be computed with reference to the annual average of the monthly averages of opening and closing figures.

TAX IMPLICATION ON INVESTORS

Investor can earn by investing in Mutual Funds in the one or more of the following ways :

- Dividend

- Short Term Capital Gains

- Long Term Capital Gains

DIVIDEND INCOME:-

- Any dividend received by investors of all kinds of schemes, is tax free in the hands of investors in accordance with provisions of Section 10(35)(a).

- However, AMC deducts DDT in case of Non Equity oriented Schemes [S115R(2)]

TABLE OF DDT RATES

| Income distributed to | Effective tax rate (%) (Money Market Mutual Fund or a Liquid Fund) | Effective tax rate (%) |

(others)i.e, Debt Fund, Fund of Funds etc.Individuals and Hindu Undivided Families (‘HUFs’)28.325

(tax rate of 25% plus surcharges @ 10% thereon plus additional surcharge by way of education cess @ 3% on the income tax plus surcharge)14.1625

(tax rate of 12.5% plus surcharges @ 10% thereon plus additional surcharge by way of education cess @ 3% on the income tax plus surcharge)Persons other than individuals and HUFs28.325

(tax rate of 25% plus surcharges @ 10% thereon plus additional surcharge by way of education cess @ 3% on the income tax plus surcharge)22.66

(tax rate of 20% plus surcharges @ 10% thereon plus additional surcharge by way of education cess @ 3% on the income tax plus surcharge)

CAPITAL GAINS

- If holdings period ? 12 months, then Short Term Capital Asset, Otherwise Long Term Capital Asset (Section 2(42A) in respect of all MF schemes.

Taxationof Short Term Capital Gain From MF Units

- In case of individual/ HUFs being residents , where the Total Income, excluding Short Term Capital Gains, is below the maximum amount not chargeable to tax, then the difference between the current maximum amount not chargeable to tax, and total income excluding Short Term Capital Gains, shall be adjusted from capital gains. Therefore, only balance STCG will be liable to income tax at the rate of 15%.

- In respect of short term capital gains arising to non resident individual unit holders, the Mutual Fund is required to deduct tax at source @15% +SC+EC, in case of Equity Funds and @ 33.99% (30% +SC+EC) in case of non equity schemes.

- No tax needs to be withheld from capital gains arising to a FII (section 196D)

- In respect of STCG arising to Foreign Companies (Other than FIIs and Overseas Financial Organisation but including OCBs), the fund is required to deduct tax at source @42.23% (40%+SC+EC)

LONG TERM CAPITAL GAINS

LTCG From Equity Schemes

- Equity Oriented Scheme – NIL [S.10(38)]

- However, companies are required to include such long term capital gains in computing the Book Profit and MAT liability under S.115JB

LTCG from Non Equity Oriented Schemes

i) Without Indexation -10%

ii) With Indexation – 20%

- Further in case of Individuals/HUF, being residents, where the Total Income excluding LTCG is below the maximum amount not chargeable to tax, then the difference between the maximum amount not chargeable to tax and Total Income excluding LTCG, shall be adjusted from LTCG. Therefore, only the balance LTCG will be liable to be taxed @10% or 20% .

- As per the provisions of Section 115AB of the Act, LTCG on transfer of units arising to specified overseas financial organizations, being companies, on transfer of units purchased by them in foreign currency shall be liable to tax @10.5575% (i.e. 10% +2.5%SC+EC). No indexation benefit is available to S.115AB entities.

- If section 115AB entity is other than company, tax shall be chargeable at the effective tax rate of 11.33% (10%+SC10%+EC).

- LTCG arising to FII (being company) shall be taxed @10.5575% (10%Tax +2.5%SC+3%EC)

- LTCG arising to FII (non company)-11.33%

TDS PROVISIONS ON LONG TERM CAPITAL GAINS

- Ø TDS rate is 22.66% (20% +10%SC+EC), in case of Non Resident Individual Unit holders.

- ØIn case of FIIs and OCBs , TDS is mandatory.

DIVIDEND STRIPPING [S. 94(7)]

As per the provisions of section 94(7) of the Act, loss arising on transfer of units, which are acquired within a period of three months prior to the record date (date fixed by the fund for the purpose of entitlement of the unit holders to receive the income from units) and sold within a period of nine months after the record date, shall not be allowed to the extent of income distributed by the fund in respect of such units.

BONUS STRIPPING [S. 94(8)]

As per the provisions of S.94(8) of the Act, where any units (“original units”) are acquired within a period of three months prior to the record date (date fixed by the fund for the purpose of entitlement of the unitholder to receive bonus units) and any bonus units are allotted (free of cost) based on the holding of the original units, the loss, if any, on sale of the original units within a period of nine months after the record date, shall be ignored in the computation of the unitholders taxable income. Such loss will however be deemed to be the cost of acquisition of the bonus units.

TAX TREATMENT OF CAPITAL GAINS FROM SYSTEMATIC INVESTMENT PLANS (SIP)

Nature of capital gains arising to unitholder who has invested by way of SIP will depend upon the period of holding of units. There may be two situations-

i) Where SIP is closed and some / all units are redeemed ;

ii) Where SIP is not closed but some / all existing units are redeemed.

At the time of redemption it is impossible to understand as to which units are being redeemed. In this condition, for computing the capital gain chargeable to tax, the cost of acquisition and period of holding of units shall be determined on the basis of FIFO method.

TAX TREATMENT OF CAPITAL GAINS FROM SYSTEMATIC TRANSFER PLANS (STP)

STP denotes transfer of a certain amount on a certain date (i.e. weekly, monthly or quarterly) from one scheme of a MF to another scheme of the same MF. Generally transfer is from debt scheme to equity scheme of the same fund house, though it could be vice versa or from one equity scheme to another or one debt scheme to another. The complexity arises, when it is transfer from equity scheme to debt scheme or vice versa. Let’s understand the same through an example.

| i) | Initial investment in Debt Scheme | Rs. 1,00,000/- (NAV Rs10) |

| ii) | Mode of STP from Debt scheme to Equity Scheme | Rs. 2,000/-P.M. |

| iii) | NAV of debt scheme on the date of transfer to equity Scheme | Rs. 10.30 |

| iv) | NAV of equity scheme on the date of transfer to equity scheme | Rs. 25.00 |

| v) | NAV of equity scheme on the date of redemption | Rs. 30.00 |

Thetaxability of Capital Gains from STP would depend upon :-

i) Holding period in debt fund;

ii) Holding period in equity fund;

iii) Difference between NAV of debt fund, between the date of investment and date of transfer to equity fund; and

iv) Difference between NAV of equity fund between the date of transfer from debt fund and redemption from equity fund

SHORT – TERM CAPITAL ASSET if,

- T2 – T1 ? 12 months, STCG = 10.30 – 10.00=Rs0.30 per unit

- T3 – T2 ? 12 months, STCG = 30.00 – 25.00=Rs5.00 per unit

LONG – TERM CAPITAL ASSET if,

- *T2 – T1 > 12 months, LTCG = 10.30 – 10.00

- T3 – T2 > 12 months, LTCG = 30.00 – 25.00

*Indexation benefits may be availed.

# FIFO method has to be applied.

SYSTEMATIC WITHDRAWAL PLANS (SWP)

SWP operates in two ways :-

i) A specified amount is given back to the investors at regular intervals by redeeming required no. of units. ; or

ii) The capital appreciation amount is given back to the investors by redeeming required no. of units.

In both the conditions the investor is paid back by redeeming a certain no. of units. The redemption may result into STCG/LTCG depending upon the holding period.

#FIFO method has to be applied.

IMPORTANT

i) Arbitrage funds are treated as equity fund.

ii) Fund of Funds (FOF) is treated as Non-Equity Fund.

iii) ETF will be treated as equity or non equity fund depending upon the underlying. If the underlying security is domestic equity it will be equity fund, otherwise non equity.

STT PROVISIONS

The Rates of STT are as under:-

| i) | Delivery based sale of equity fund on Stock Exchange | 0.125% of value |

| ii) | Delivery based purchase of equity fund on Stock Exchange | 0.125% of value |

| iii) | Non-delivery based trading of equity fund on Stock Exchange | 0.025% |

| iv) | Sale of units of equity fund back to Mutual Fund | 0.25% |

Author :

CA Umashankar Tiwari, FCA, LL.B., DISA (ICAI),AFP, B.Com(Hons)

Email :ca@ustassociates.com

Above Post was First Published on 5th June 2010

In respect of Non-Resident Individual, how will Long Term Capital Gains be calculated in case of sell/redemption of Units of UTI ULIPscheme? Whether Indexation will be available or whether it will be taxed under section 112(i)(c) at a special rate of 10% without indexation?

lic ulic long term gain , uti ulip long term and

reilance shot term gain ,uti ulip shotr term exempt or taxable as per income ta act 1961.

Any exemption for investing LTCG arising from sale of Debt MF Units ( MIP Funds) to save tax?

what is the tax rate on gains of such units?

RELIANCE GROWTH FUND – GROWTH PLAN GROWTH OPTION does this gets an exemption under section10 (23d) or not. Can you please confirm this. Rgds Rakesh

Hi,

I need taxation clarification, suppose I am investing 2,00,000 today in equity based MF and after 3 years I got 5,00,000. gain of 3,00,000.

What would be tax implication Income taxes.

Dear Sir,

Is there any MF Product for saving Long Term Capital Gains tax. (e.g. If one sells a residential unit and instead of buying another residential unit in the same fy OR buying a bond, if the person is thinking of investing the funds in any MF product/plan what would you suggest? Thanks. Kind regards. SKJ

my client mutual fund matured in this year… can it is taxable under the head of income from other sources or capital gain.. or exempt…

I have redeemed some units of Mutual funds which i have hold for more than 12 months and received amount during the year 2014-2015. What are the norms for income tax calculation.

Thanks

I am 64 years of age. I had joined the above UTI – Unit linked Insurance Plan (Unit scheme 1971)-10 year plan on 25-01-1999 with an annual contribution of Rs.7, 500/- for a period of 10 years. Every Year for 7 years after taking a sum of Rs.510/- towards insurance the balance of Rs.6990/- was invested into the scheme and units were allotted at the applicable NAV.. No insurance amount was taken for the remaining 3 years and full money was invested. Further they have allotted only BONUS UNITS every year and have not declared any dividends. The scheme is a debt oriented scheme with Not less than 60% of the funds in debt instruments and Not more than 40% of the funds in equities and equity related instruments.

Now the above scheme has matured on 25-01-2009, but I am still staying invested with the scheme. Now I want to know as to how the Capital Gains are to be calculated when I redeem the Units. Particularly I want to know the taxability of Bonus Units on redemption as I cannot apply indexation for the same, as it is allotted free of cost.

Further if my total income is within the non taxable limit even after adding the above capital Gains, can I refrain from paying any tax? Or do I have to shell out Capital Gains Tax separately irrespective of my tax status. So far no one has answered my query including the UTI Fund house.

ARUNACHALAM.V

05-04-2015

I had one query regarding Mutual Funds Taxation.

I had transfered my existing Mutual Funds from one Bank Account to another Bank Account. Its showing Mutual Funds at Transaction Price of Transfer date whereas its just a Transfer. Is this counted as Sales Transaction and will capital gain will arise on it?

Pls guide me for the solution.

Beautiful article. Very informative

Dear sir very useful information keep it up

Dear Tiwari sir, the information given on the subject is easy to understand. I have seen this type of material first time keep it up Regards Rahimullah Ansari

I think this is the first in its kind write-up available on this subject. Thanks a tone.

Regards

Thank you, Tiwariji.

Easy to understand, very lucidly explained.

My query is same as mentioned by Avdhut V Vaidya on June 27, 2010 at 8:26 pm.

what about loss due to sale of Non Equity (Debt)MF with Dividend and Indexation due to fall of NAV ? Do we get benefit of Short/Long term loss ? if yes , if index cost is to subtracted or original cost of buying in case of Long Term Loss?

Can we get clarification ?

Sudhir Goyal

Appreciate your efforts for providing such details. Surcharge on Dividend distribution tax for Debt (Non-liquid) schemes have been reduced to 7.5%, effective DDT on Debt schemes is 13.8406% (12.50% + 7.5% + 3%) for individual and HUFs and 22.145% for corporate.

STCG on equity has been raised to 15% for FY 2010-11

Regards,

Rahul Agrawal

will GOLD Exchange traded mutual fund come under equity mutual fund or debt oriented?

Thanks Sir,

But i have a quary regarding the tax implication if i sell Equity Oriented Units of 1 MF (holding Period is less than 1 Year)and buy the Units of another MF’s equity oriented Scheme on same day with the amount relised from earlier sale.

Gr8 Work…..

Though every time whther short term or long term capital gain tax is specified but what about loss due to sale of MF due to fall of NAV ? Do we get benifit of Short/Long term loss ? if yes , if index cost is to sbstracted or original cost of buying ?

Can we ger clarification ?

Avdhut Vaidya

Wonderful and thanks a lot for the effort and the knowledge sharing. Just right for professionals as well as common man.

Just one more area to cover if possible of Div. reinvestment schemes.

Thanks once again.

Dear readers,

Thanks a lot for positive feedback. My book on the subject is under process. Hope u’ll get it soon.

It is indeed one of the most comprehensive and very well written article on the subject where a lot of confusions remain in the mind of investors. The contents are very easy to understand even for a naive investor and one need not refer any thing else on the subject. Such type of articles are really welcome. Very much informative and enlightening article. Kudos to the author.

very enlightening article and it clears many doubts for the investor

sir,

the picture shown about the money market is tremendously outstanding.

One kind request you to sir pls send this file on my email id so as to save the same.

itsmepjet@gmail.com

Thanking you once again sir.

Really very nice and informative ready reckoner on taxation of mutual fund units, covering almost all aspects. Congratulations.

UMASHANKAR-JI JUST SPLENDID!SUCH EFFORTS TO EDUCATE THE COMMON PEOPLE WHO USUALLY DO NOT HAVE AN CLEAR PICTURE ON MONEY MARKET IS REALLY TREMENDOUSLY USEFUL.

I BEG TO SUGGEST YOU TO WRITE A HAND BOOK ON SUCH A SUBJECT-THOSE CAN EASILY BE GRABBED BY A SMALL INVESTOR.

HATS OFF AGAIN TO YOU,

Ashis Majumder,Karimganj, Assam

Beautifully done.

Very detailed Information given in clear form

Very very informative …..and very nicely elaborated…Thanks for sharing.

Really Great

Thanks a lot

Excellent….Superb

Thanx…