Reserve Bank of India

RBI/DoR/2023-24/105

DoR.FIN.REC.40/01.02.000/2023-24 Dated: September 21, 2023

Master Direction – Reserve Bank of India (Prudential Regulations on Basel III Capital Framework, Exposure Norms, Significant Investments, Classification, Valuation and Operation of Investment Portfolio Norms and Resource Raising Norms for All India Financial Institutions) Directions, 2023

In exercise of the powers conferred by Section 45L of the Reserve Bank of India Act, 1934, the Reserve Bank of India (hereinafter called the Reserve Bank) being satisfied that it is necessary and expedient in the public interest and in the interest of financial sector policy so to do, hereby, issues the Directions hereinafter specified.

Chapter I – Preliminary

1. Short Title and Commencement

(a) These Directions shall be called the Reserve Bank of India (Prudential Regulations on Basel III Capital Framework, Exposure Norms, Significant Investments, Classification, Valuation and Operation of Investment Portfolio Norms and Resource Raising Norms for All India Financial Institutions) Directions, 2023.

(b) These Directions shall be applicable latest w.e.f. April 1, 2024.

2. Applicability

These Directions shall be applicable to the All India Financial Institutions (AIFIs) regulated by the Reserve Bank, viz. the Export-Import Bank of India (EXIM Bank), the National Bank for Agriculture and Rural Development (NABARD), the National Bank for Financing Infrastructure and Development (NaBFID), the National Housing Bank (NHB) and the Small Industries Development Bank of India (SIDBI).

3. Definitions

3.1 In these Directions, unless the context states otherwise, the terms herein shall bear the meanings assigned to them below:

(a) “available for sale” means the category of investment portfolio of AIFIs which includes investment that do not fall within the HTM (Held To Maturity) or HFT (Held For Trading) category.

(b) “basis risk” means the risk that emanates from the changes in interest rate of different assets, liabilities and off-balance sheet items in different magnitudes;

(c) “capital funds” means the total regulatory capital of an AIFI, fulfilling the criteria defined in the prescribed capital regulations as per Chapter II of these Directions, as per the last audited balance sheet;

(d) “central counterparty” (CCP) means a system provider, who by way of novation interposes between system participants in the transactions admitted for settlement, thereby becoming the buyer to every seller and the seller to every buyer, for the purpose of effecting settlement of their transactions

(e) “clearing member” means a member of, or a direct participant in, a CCP that is entitled to enter into a transaction with the CCP, regardless of whether it enters into trades with a CCP for its own hedging, investment or speculative purposes or whether it also enters into trades as a financial intermediary between the CCP and other market participants1;

(f) “client” means a party to a transaction with a CCP through either a clearing member acting as a financial intermediary, or a clearing member guaranteeing the performance of the client to the CCP;

(g) “control” shall have the same meaning as assigned to it under clause (27) of Section 2 of the Companies Act, 2013 as amended from time to time;

(h) “corporate bonds / debentures” for the purpose of these Directions mean debt securities which create or acknowledge indebtedness, including (i) debentures (ii) bonds (iii) commercial papers (iv) certificate of deposits and such other securities of a company, a multilateral financial institution (MFI) or a body corporate constituted by or under a Central Act or a State Act, whether constituting a charge on the assets of the company or body corporate or not, and includes convertible instruments and instruments of a perpetual nature, but does not include debt securities issued by Central Government or a State Government, or such other persons as may be specified by the Reserve Bank, security receipts and securitized debt instruments.

(i) “counterparty credit risk” (CCR)2 means the risk that the counterparty to a transaction could default before the final settlement of the transaction’s cash flows. An economic loss would occur if the transactions or portfolio of transactions with the counterparty has a positive economic value at the time of default.

(j) “credit enhancement” means a contractual arrangement in which an entity provides some degree of added protection to other parties to a transaction so as to mitigate the credit risk of their acquired exposures

(k) “credit risk” means the potential that an AIFI’s borrower or counterparty may fail to meet its obligations in accordance with agreed terms and also includes the possibility of losses associated with diminution in the credit quality of borrowers or counterparties.;

(l) “credit valuation adjustment” means an adjustment to the mid-market valuation of the portfolio of trades with a counterparty. This adjustment reflects the market value of the credit risk due to any failure to perform on contractual agreements with a counterparty. This adjustment may reflect the market value of the credit risk of the counterparty or the market value of the credit risk of both the AIFI and the counterparty;

(b) “cross-product netting” means the inclusion of transactions of different product categories within the same netting set;

(m) “current exposure3 under the Current Exposure Method” means the larger of zero, or the market value of a transaction or portfolio of transactions within a netting set with a counterparty that would be lost upon the default of the counterparty, assuming no recovery on the value of those transactions in bankruptcy;

(n) ”current or valid credit rating” means a credit rating granted by a credit rating agency in India, registered with SEBI and fulfilling the following conditions:

(i) The credit rating letter shall not be more than one month old on the date of opening of the issue;

(ii) The rating rationale shall not be more than one year old on the date of opening of the issue;

(iii) The credit rating letter and the rating rationale shall preferably be part of the offer document.

(iv) In the case of secondary market acquisition, the credit rating of the issue shall be in force and confirmed from the monthly bulletin published by the respective rating agency.

(p) “default funds”4 shall mean clearing member’s funded or unfunded contributions towards, or underwriting of, a CCP’s mutualised loss sharing arrangements;

(q) “deferred tax assets” shall have the same meaning as assigned under the extant Accounting Standards;

(r) “derivative” shall have the same meaning as assigned to it in Section 45U(a) of the Reserve Bank of India Act, 1934;

(s) “duration (Macaulay duration)”5 measures the price volatility of fixed income securities often used in the comparison of the interest rate risk between securities with different coupons and different maturities.

(t) “exchange” means “Recognized stock exchange” and shall have the same meaning as defined in Section 2 (f) of Securities Contracts (Regulation) Act, 1956.

(u) “financial services company” means a company engaged in the ‘business of financial services as defined in the Reserve Bank of India (Financial Services provided by Banks) Directions, 2016 dated May 26, 2016 as amended from time to time;

(v) “forward contract”6 means an agreement between two parties to buy or sell an agreed amount of a financial instrument or currency at an agreed price, for delivery on an agreed future date.

(w) “general market risk” means risk of losses in on-and off-balance sheet positions arising from movements in market prices;

(x) “Government security” shall have the same meaning as assigned to it in Section 2(f) of the Government Securities Act, 2006.

(y) “hedging” means taking action to eliminate or reduce exposure to any type of risk;

(z) “hedging set” means a group of risk positions from the transactions within a single netting set for which only their balance is relevant for determining the exposure amount or Exposure at Default (EAD) under the CCR standardised method;

(aa) “Held for Trading” means the category of investment portfolio maintained by AIFIs with the intention to trade in securities by taking advantage of short-term price/interest rate movements;

(ab) “Held to Maturity” means the category of investment portfolio maintained by AIFIs with an intention to hold securities upto maturity;

(ac) “horizontal disallowance” means a disallowance of offsets to required capital used for assessing market risk for regulatory capital. In order to calculate the capital required for interest rate risk of a trading book, offsetting of long and short positions is permitted. However, interest rate risk of instruments at different horizontal points of the yield curve are not perfectly correlated. Hence, this method requires that a portion of these offsets be disallowed;

(ad) “implicit support” means the protection arising when a lender provides support to a securitisation in excess of its predetermined contractual obligation;

(ae) “infrastructure projects/infrastructure lending” means any credit facility in whatever form extended by the AIFIs to any infrastructure facility that is a project in any of the sectors incorporated in the latest updated Harmonized Master List of Infrastructure Sub-sectors published by the Government of India;

(af) “initial margin” means a clearing member’s or client’s funded collateral posted to the CCP to mitigate the potential future exposure of the CCP to the clearing member arising from the possible future change in the value of their transactions. Initial margin shall not include contributions to a CCP for mutualised loss sharing arrangements7.

(ag) “interest rate risk” means risk that the financial value of assets or liabilities (or inflows/outflows) will be altered because of fluctuations in interest rates.

(ah) “Large Exposure” means the sum of all exposure value of an AIFI measured in terms of Section 22 of Chapter III of these Directions, to a counterparty and / or a group of connected counterparties, if it is equal to or above 10 per cent of the AIFI’s eligible capital base;

(ai) “listed security” is a security, which is listed on an exchange;

(aj) “long position” refers to a position where gains arise from a rise in the value of the underlying;

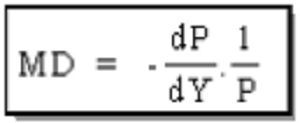

(ak) “modified duration” or volatility of an interest bearing security is its Macaulay duration divided by one plus security’s yield to maturity (YTM) per period. It represents the percentage change in a securities’ price for a 100 basis points change in yield8.

where:

MD = Modified duration

P = Gross price (i.e., clean price plus accrued interest).

dP = Corresponding small change in price.

dY = Small change in yield compounded with the frequency of the coupon payment;

(al) “mortgage-backed security” shall have the same meaning as assigned under Master Direction Reserve Bank of India (Securitisation of Standard Assets) Directions, 2021 as amended from time to time;

(am) “netting set” means a group of transactions with a single counterparty that are subject to a legally enforceable bilateral netting arrangement and for which netting is recognised for regulatory capital purposes. Each transaction that is not subject to a legally enforceable bilateral netting arrangement which is recognised for regulatory capital purposes should be interpreted as its own netting set for the purpose of these Directions;

(an) “net interest margin” means the net interest income divided by average interest earning assets;

(ao) “net worth” shall have the same meaning as assigned to it under clause (57) of Section 2 of Companies Act, 2013 as amended from time to time;

(ap) “non-financial services company” means a company not engaged in any of the activities being conducted by a financial services company;

(aq) “nostro accounts” means foreign currency settlement accounts that an AIFI maintains with its overseas correspondent banks. These accounts are assets of the domestic AIFI;

(ar) “offsetting transaction” means the transaction leg between the clearing member and the CCP when the clearing member acts on behalf of a client (e.g. when a clearing member clears or novates a client’s trade);

(as) “one-sided credit valuation adjustment” is a credit valuation adjustment that reflects the market value of the credit risk of the counterparty to the AIFI but does not reflect the market value of the credit risk of the AIFI to the counterparty;

(at) “open position” means the net difference between the amounts payable and amounts receivable in a particular instrument or commodity. It results from the existence of a net long or net short position in the particular instrument or commodity;

(au) “option” means a contract which grants the buyer the right, but not the obligation, to buy (call option) or sell (put option) an asset, commodity, currency or financial instrument at a specified rate (exercise price) on or before an agreed date (expiry or settlement date).

(av) “outstanding Exposure at Default (EAD)” for a given OTC derivative counterparty is defined as the greater of zero and the difference between the sum of EADs across all netting sets with the counterparty and the credit valuation adjustment (CVA) for that counterparty which has already been recognised by the AIFI as an incurred write-down (i.e., a CVA loss);

(aw) “qualifying central counterparty” (QCCP) means an entity that is licensed to operate as a CCP (including a license granted by way of confirming an exemption), and is permitted by the appropriate regulator / overseer to operate as such with respect to the products offered. This is subject to the provision that the CCP is based and prudentially supervised in a jurisdiction where the relevant regulator/overseer has established, and publicly indicated that it applies to the CCP on an ongoing basis, domestic rules and regulations that are consistent with the CPSS-IOSCO Principles for Financial Market Infrastructures;

(ax) “quoted security” is a security for which market prices are available at stock exchanges / reporting platforms / trading platforms authorized by the Reserve Bank / Securities and Exchange Board of India (SEBI).

(ay) “rated security” means a security which is subjected to a detailed credit rating exercise by a SEBI-registered credit rating agency and shall carry current or valid credit rating.

(az) “reconstitution” means the reverse process of stripping, where the individual STRIPS i.e., both coupon STRIPS and Principal STRIPS are reassembled to get back the original security, as defined in circular on Government Securities – Separate Trading of Registered Interest and Principal of Securities (STRIPS) issued vide IDMD.1762/2009-10 dated October 16, 2009, as amended from time to time.

(ba) “repo” and “reverse repo” shall have the same meaning as defined in Section 45U of the Reserve Bank of India Act, 1934. For the purpose of these Directions, the word ‘repo’ is used to mean both ‘repo’ and ‘reverse repo’ with the appropriate meaning applied contextually.

(bb) “securities” shall have the same meaning as defined in Section 2(h) of Securities Contracts (Regulation) Act, 1956.

(bc) “securities financing transactions” (SFTs) means transactions such as repurchase agreements, reverse repurchase agreements, security lending and borrowing, collateralised borrowing and lending (CBLO) and margin lending transactions, where the value of the transactions depends on market valuations and the transactions are often subject to margin agreements;

(bd) “securitisation” shall have the same meaning as assigned under Master Direction DOR.STR.REC.53/21.04.177/2021-22 dated September 24, 2021 – Reserve Bank of India (Securitisation of Standard Assets) Directions, 2021;

(be) “securitisation exposures” shall have the same meaning as assigned under Master Direction DOR.STR.REC.53/21.04.177/2021-22 dated September 24, 2021 – Reserve Bank of India (Securitisation of Standard Assets) Directions, 2021;

(bf) “securitized debt instrument” means securities of the nature referred to in Section 2(h)(ie) of the Securities Contracts (Regulation) Act, 1956.

(bg) “Security Receipts” shall have the same meaning as defined in Section 2(1)(zg) of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002.

(bh) “significant influence” shall have the same meaning as assigned under the extant Accounting Standards;

(bi) “specific market risk” refers to the risk associated with a specific security, issuer or company, as opposed to the risk associated with a market or market sector (general market risk);

(bj) “stripping” means the process of separating the cash flows associated with a regular Government Security i.e., each outstanding semi-annual coupon payment and the final principal payment into separate securities, as defined in circular on Government Securities – Separate Trading of Registered Interest and Principal of Securities (STRIPS) issued vide IDMD.1762/2009-10 dated October 16, 2009, as amended from time to time.

(bk) “subsidiary” shall have the same meaning as assigned under the extant Accounting Standards;

(bl) “trade exposures” include the current9 and potential future exposure of a clearing member or a client to a CCP arising from OTC derivatives, exchange traded derivatives transactions or SFTs, and initial margin;

(bm) “unrated securities” means securities, which do not have a current or valid credit rating by a SEBI-registered credit rating agency;

(bn) “value at risk” (VAR) means a method for calculating and controlling exposure to market risk. VAR is a single number (amount) which estimates the maximum expected loss of a portfolio over a given time horizon (the holding period) and at a given confidence level;

(bo) “variation margin” means a clearing member’s or client’s funded collateral posted on a daily or intraday basis to a CCP based upon price movements of their transactions;

(bp) “vertical disallowance” means a reversal of the offsets of a general market risk charge of a long position by a short position in two or more securities in the same time band in the yield curve where the securities have differing credit risks under the method followed for determining regulatory capital necessary to cushion market risk.

(bq) “when, as and if issued” (commonly known as ‘when-issued’ (WI)) security means a security as referred to in When Issued Transactions (Reserve Bank) Directions, 2018 issued vide FMRD.DIRD.03/14.03.007/2018-19 dated July 24, 2018, as amended from time to time.

Notes:-

1 For the purpose of these guidelines, where a CCP has a link to a second CCP, that second CCP is to be treated as a clearing member of the first CCP. Whether the second CCP’s collateral contribution to the first CCP is treated as initial margin or a default fund contribution will depend upon the legal arrangement between the CCPs. In such cases, if any, the Reserve Bank should be consulted for determining the treatment of this initial margin and default fund contributions.

2 Unlike a firm’s exposure to credit risk through a loan, where the exposure to credit risk is unilateral and only the lending AIFI faces the risk of loss, CCR creates a bilateral risk of loss: the market value of the transaction can be positive or negative to either counterparty to the transaction. The market value is uncertain and can vary over time with the movement of underlying market factors.

3 Current exposure is often also called Replacement Cost

4 also known as clearing deposits or guarantee fund contributions (or any other names). The description given by a CCP to its mutualised loss sharing arrangements is not determinative of their status as a default fund, rather, the substance of such arrangements will govern their status.

5 Duration is calculated the weighted average of the present value of all the cash flows associated with a fixed income security. It is expressed in years. The duration of a fixed income security is always shorter than its term to maturity, except in the case of zero coupon securities where they are the same.

6 In contrast to a futures contract, a forward contract is not transferable or exchange tradable, its terms are not standardized and no margin is exchanged. The buyer of the forward contract is said to be long the contract and the seller is said to be short the contract;

7 In cases where a CCP uses initial margin to mutualise losses among the clearing members, it shall be treated as a default fund exposure;

8 It is generally accurate for only small changes in the yield.

9 For the purpose of this definition, the current exposure of a clearing member includes the variation margin due to the clearing member but not yet received.

Read Full text of RBI’s Master Direction on Basel III and Investment Norms – 2023