The Reserve Bank of India (RBI) issued a circular no. RBI/2023-24/90, on December 19, 2023, addressing concerns related to investments in Alternative Investment Funds (AIFs) by regulated entities (REs).

REs invests into AIF as a part of their regular investment. An AIF is a privately pooled investment vehicle, which collects funds from investors, for investing it in accordance with a defined investment policy for the benefit of its investors.

However, Central Bank is seeking to put a stop to transactions that entail substitution of direct loan exposure of lenders to borrowers with indirect exposure through investments in units of AIFs.

Accordingly, the following has been advised by RBI:

1. RE shall not make investment into schemes of AIF which has made downstream investment either directly or indirectly in a debtor company. Here Debtor Company means a company where RE has currently or previously had a loan or investment in the preceding 12 months.

2. If in an AIF scheme, RE is already an investor and the AIF make a downstream investment in such debtor company then the RE shall liquidate its investment within a period of 30 days from the date of such downstream investment.

3. In case as on date, if the AIF has already made a downstream investment in such debtor company then RE shall liquidate its investment within a period of 30 days from the date of the issuance of the aforesaid circular.

4. In case Res not able to liquidate within the above-mentioned timeline they shall make 100% provision on such investments.

5. The Central Bank prescribed full deduction from lenders capital funds if they have investments in the subordinated units of any AIF scheme with a ‘priority distribution model’.

The above is effective with immediate effect

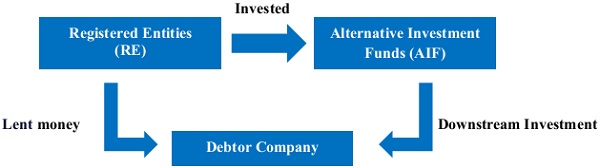

For better clarity below is an illustration citing the reason for tightening the norms for lenders investing in AIFs.

A debtor company due to repay a loan or instalment (but is not having liquidity to pay) can give a list of mutual funds/fund houses, which have invested either in their equity or debts through AIFs, to the lender.

The lender invests in the AIF with an understanding that the money will in turn be invested partly or fully in its debtor company.

The debtor company uses the funds received from AIF (mostly as debt) and repays the lender on due date. This company gets additional finance or fresh funds from the lender after clearing old dues.

Thus, the RBI’s circular, signifies a proactive approach in addressing potential risks associated with AIF investments by regulated entities. The guidelines aim to prevent ever greening practices and ensure transparency in financial operations.

*****

Disclaimer: This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement