The Foreign Exchange Management Act, 1999 (FEMA) is an act of the Parliament of India to consolidate and amend the laws relating to foreign exchange with the objective of facilitating external trade & payments and promoting the orderly development and maintenance of foreign exchange market in India.

Section 15 of Foreign Exchange Management Act (FEMA), 1999 empowers Reserve Bank of India to compound any contravention made under Section 13 of FEMA, 1999 except the contraventions under section 3(a).

Compounding refers to the process of admitting voluntarily the breach of any of the provisions of FEMA, 1999 or the rules/regulations/notifications/orders/directions or the circulars issued under the said Act. The person contravening the provisions admits the lapse and requests compounding to regularise mistake. This saves the legal proceedings and makes the process simple and fast. The offence is to be compounded within 180 days from the date of receipt of application by the officers of Reserve Bank of India as may be authorised in this respect.

Power to Compound by RBI

Any contravention of the provisions of FEMA, 1999 shall be compounded by following officers under the direction, control and supervision of the Governor of the RBI.

| Sum Involved in Contravention | Compounding Authority |

| Amount upto Rs 10 Lakh | Assistant General Manager of RBI |

| Amount more than Rs 10 Lakh but less

than Rs 40 Lakh |

Deputy General Manager of RBI |

| Amount RS 40 Lakh and more but less

than Rs 100 Lakh |

General Manager of RBI |

| Amount Rs 100 Lakh and more | Chief General Manager of RBI |

No contravention shall be compounded unless the amount involved in such contravention is quantifiable.

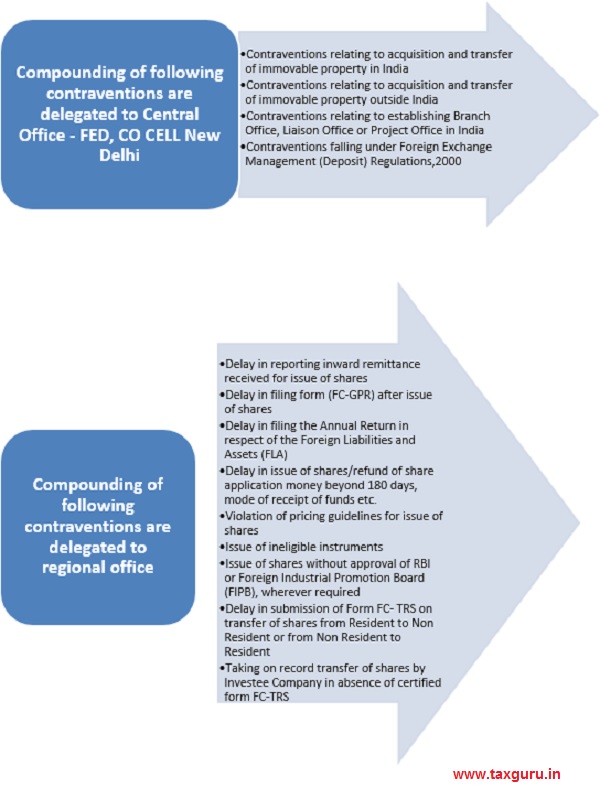

Delegation of Power to Regional and Central Office

In order to ease off the operational issues and customer service, RBI has segregated compounding powers to Regional and Central level.

Kochi and Panaji Regional offices can compound the contraventions for an amount less than Rs 100 Lakh. For contraventions of amount RS 100 Lakh and above in Panaji and Kochi, compounding shall be handled at Mumbai RO and Thiruvananthapuram RO respectively.

Apart from the contraventions specified in particular, application for all other contraventions has to be submitted to Foreign Exchange Department, RBI, Mumbai.

Application for Compounding

Any person who contravenes any provisions/ rules/ regulations/ notifications/ directions or orders issues under FEMA, 1999 except contraventions under section 3(a) can apply for compounding along with the prescribed fees of RS 5000 by way of demand draft drawn in favour of “Reserve Bank of India”. Application can be made once the applicant is made aware of the contraventions by the Reserve Bank or the statutory authority. Application can also be made suo moto on becoming aware of the error.

Application must be made in the prescribed format containing the contact details i.e. the name of the applicant or his authorised official or representative of the applicant, telephone or mobile number along with the email ID. Apart from the application in prescribed format, following documents must also be furnished:

> Details as per Annex II relating to Foreign Direct Investment, External Commercial Borrowings, Overseas Direct Investment and Branch Office/ Liaison Office

> Copy of Memorandum of Association

> Latest Audited Balance Sheet along with an undertaking as per Annex III that they are not under any enquiry/ investigation/ adjudication by any agency like Directorate of Enforcement, CBI etc. as on the date of application. Also, the applicant should inform the compounding Authority / RBI if any such proceedings are initiated after filing the application but on or before the date of issuance of the compounding order

If the application for compounding is not filed in the prescribed format or the mandatory details, documents or declarations are missing or the application is filed without the demand draft towards the application fees, it will not be processed and will be returned to the applicant. Once the application is completed in all aspects within the given time then date of such submission will be considered as the date of receipt of application and shall be processed accordingly.

Serious contraventions i.e. contraventions involving money laundering, terror financing or anything affecting sovereignty and integrity of the nation or the cases where applicant fails to pay the sum for which compounding order was passed within the specified time period shall be directly referred to Directorate of Enforcement for further investigation and necessary actions would be taken accordingly.

If the applicant again commits some contravention within the period of 3 years which is similar to the contravention for which a compounding order has already been passed, it shall not be compounded again and provisions of FEMA, 1999 shall prevail. Any contravention after the expiry of the period of 3 years shall be considered for compounding.

Procedure of Compounding

Once the application is received, the RBI shall examine the same basis the documents and submissions made. Also, the Compounding Authority can ask for further information or records supporting the compounding procedure. Basis the above, contravention is quantified.

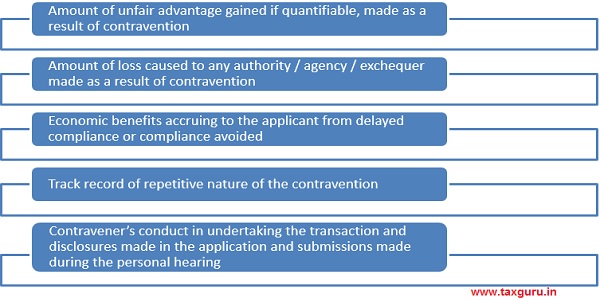

Factors which are considered for passing the compounding order and deciding the quantum of the sum of payment for the contravention are:

Computation Matrix

| S.No | Type of Contravention | Details | Existing Formula |

| 1 | Reporting Contraventions | Fixed Amount: Rs 10,000 (applied once for each contravention in a compounding application) + Variable Amount as under : Upto Rs. 10 Lakh : Rs1000 per year Above Rs 10 Lakh & below 40 Lakh: Rs 2500 per year Above Rs. 40 Lakh & below 100 Lakh: Rs 7000 per year Rs. 1-10 Crore: Rs 50,000 per year Rs. 10-100 Crore: Rs 100,000 per year Above Rs. 100 Crore: Rs 200,000 per year |

|

| A.FEMA 20 | Para 9(1)(A), 9(1)(B), part B of FC(GPR),FCTRS(Reg 10) and taking on record FCTRS (Reg 4) | ||

| B. FEMA 3 | Non Submission of ECB statements | ||

| C. FEMA 120 | Non reporting/Delay in reporting of Acquisition/Set up of Subsidiaries/Changes in Shareholding pattern | ||

| D. Any other reporting contraventions | |||

| E. Reporting contraventions by LO/BO/PO | As above, subject to ceiling of Rs 2 Lakhs. In case of Project Office, the amount imposed shall be calculated on 10% of total project cost | ||

| 2 | AAC/APR/FLAR/Share Certificate Delays | In case of non-submission /delayed submission of APR/share certificates (FEMA 120) or AAC (FEMA 22) or FCGPR (B) or FLA Returns -FEMA 20/FEMA20(R)/FEMA 120/FEMA 395 | Rs 10,000 per AAC/APR/FCGPR (B)/FLA Return delayed. Delayed receipt of share certificate – Rs 10,000/- per year , the total amount being subject to ceiling of 300% of the amount invested |

| 3 | A. Allotments/Refunds | Para 8 of FEMA 20/2000-RB (non-allotment of shares or allotment/refund after the stipulated 180 days | Rs 30,000/- + given percentage 1st year – 0.30% 1-2 years – 0.35% 2-3 years – 0.40% 3-4 years – 0.45% 4-5 years – 0.50% >5 years – 0.75% (For Project Offices the amount of contravention shall be deemed to be 10% of the cost of project.) |

| B. LO/BO/PO | Other than reporting contraventions | ||

| 4 | All other Contraventions | Includes all contravention of FEMA20(R)/2017/NDIR, 2019/ FEMA 395/2019, except contraventions pertaining to FLA returns and corporate guarantees | Rs 50,000/- + given percentage 1st year – 0.50% 1-2 years – 0.55% 2-3 years – 0.60% 3-4 years – 0.65% 4-5 years – 0.70% >5 years – 0.75% |

| 5 | Issue of Corporate Guarantees | Issuance without UIN/ without permission wherever required/ open ended guarantees or any other contravention related to issue of Corporate Guarantees | Rs 500,000/- + given percentage 1st year – 0.050% 1-2 years – 0.055% 2-3 years – 0.060% 3-4 years – 0.065% 4-5 years – 0.070% >5 years – 0.075%. In case the contravention includes issue of guarantees for raising loans which are invested back into India, the amount imposed may be trebled. |

The contraventions of FEMA 20 existing and continuing as on November 7, 2017 (i.e. the starting date of contravention prior to November 7, 2017) will be compounded as per 1(A) above.

Compounding Order

Compounding order shall be passed in the following format:

| S. No | Name of the Applicant | Details of the Contravention (Provisions of the Act compounded) | Date of Compounding Order | Amount imposed for compounding of Contravention |

The amount mentioned in the order for the contravention has to be paid by way of the demand draft in the favour of the Reserve Bank of India within 15 days from the date of order passed. Once the order is passed, the contravener cannot seek to withdraw the order or request review of the order passed. On the realisation of sum compounded, a certificate is issued by the RBI stating the compliance by the applicant of the orders passed. If the contravener fails to pay the amount compounded, it shall be deemed as if he never made an application for compounding of the contravention and will be referred to Directorate of Enforcement for necessary action.

*****

About the Author

Author is Ruchika Bhagat, FCA helping foreign companies in setting up and closure of business in India and complying with various tax laws applicable to foreign companies while establishing a business in India. Neeraj Bhagat & Co. Chartered Accountants, is a well-established Chartered Accountancy firm founded in the year 1997 with its head office at New Delhi.

Author is Ruchika Bhagat, FCA helping foreign companies in setting up and closure of business in India and complying with various tax laws applicable to foreign companies while establishing a business in India. Neeraj Bhagat & Co. Chartered Accountants, is a well-established Chartered Accountancy firm founded in the year 1997 with its head office at New Delhi.

It was an informative article. Thank you for that. I have a doubt.

In FEMA, if one person inadvertently sent USD 1,00,000/- under LRS where the LRS limit for that years was USD 75,000/-, (FY 14-15) can the department say entire USD 1 lac is violation? My logic is there is violation only to the extent of USD 25,000/-. Is there any decided cases on this aspect?