1. INTRODUCTION

Things have changed from local Kirana Shops to Online Grocery shopping, local readymade garments shops to online purchase of cloth. Everything is now online. The Indian e-commerce sector is the fastest growing in the world and is expected to grow to $200 billion by 2026. Govt of India has also adopted technology in its working style at every department. The main purpose of Govt. is to increase tax payer’s base and eventually collection of taxes which will result in development of economy as a whole.

In Budget 2020, Govt. has taken many steps for widening and deepening tax base. One step is insertion of section 194-O of Income-tax Act, 1961 requiring e-commerce operator to deduct TDS from payments made to e-Commerce participant. The same is applicable from 01/10/2020.

2. TERMS TO UNDERSTAND

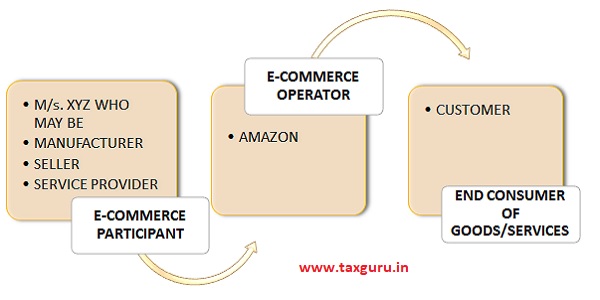

a) E-Commerce Operator- It means a person who owns, operates or manages digital or electronic facility or platform for electronic commerce. Eg: Amazon, Flip kart, Myntra, etc.

b) E-Commerce Participant-It means a person resident in India selling goods or providing services or both, including digital products through digital or electronic facility or platform for electronic commerce. Eg: Sellers, manufacturers and Service Providers who use e-commerce platform to sell may be M/s. XYZ.

For Eg: M/s. XYZ sells watches to customers through Amazon. Customer purchases watch and pay to Amazon. Amazon pays to M/s. XYZ after deducting its commission. Now after insertion of provision of deduction of TDS, Amazon will deduct TDS @ 1% and pay the balance amount of to M/s. XYZ.

In case if customer pays directly to M/s. XYZ then also Amazon has to deduct TDS on amount paid by customer. In this case Amazon has to deduct TDS and pay to the credit of Central Govt. and later on collect TDS deducted from M/s. XYZ.

3. CONCEPT OF PROVISION- This section applies if all the following conditions are fulfilled-

a) There is a sale of goods or provision of services

b) Such sale or provision is of an e-commerce participant

c) Such sale or provision is facilitated by an e-commerce participant

d) Such facilitation is through the digital or electronic facility or platform (by whatever name called) of e-commercial operator.

If aforesaid conditions are fulfilled, then

a) The e-commerce operator shall deduct income-tax @1% of the gross amount of such sales or services or both.

b) At the time of payment thereof to such e-commerce participant by any mode.

Note: Rates of TDS has been reduced by 25% from 14th May 20 to 31th March 21 due to COVID-19. Therefore TDS should be deducted @ 0.75% for said period.

4. SMALL SELLERS SELLING GOODS/SERVICES OF 5LAKHS BEING INDIVIDUAL/HUF EXCLUDED-No deduction shall be made if e-commerce participant is individual or HUF and the gross amount of sale during the previous year do not exceed Rs.5lakh. E-commerce participant should furnish his PAN or Aadhaar number to e-commerce operator. If the same is not given then section 206AA of the Act would become applicable and TDS shall be deducted @ 5%.

5. APPLICABILITY- The provision

1) Applies to both resident and non-resident e-commerce operator.

2) Applies only to resident e-commerce participant.

3) Applies even if purchaser of goods/recipient of services is a non-resident.

4) Shall not apply to amount received by e-commerce operator for hosting advertisements or providing any other services which are not connected with sales mentioned in this provision.

6. SOME FAQ’s

1) Whether TDS is deductible on “gross amount” of sales includes GST?-

No, TDS is required to be deducted excluding GST component.

2) Can e-commerce participant apply for certificate for deduction of tax at lower rate?-Yes

3) For determining threshold limit of 5lakh, should gross amount of total sales be considered or only gross amount of sales from e-commerce operator platform. For Eg: If total annual gross sale of goods of Mr. A, an e-commerce participant is Rs.15 lakhs out of which Rs. 4 lakhs is facilitated by an e-commerce operator. Then how threshold limit of Rs. 5lakhs will be computed?-

In this case, Rs.4lakh is to be reckoned for the purpose of deduction of TDS therefore e-commerce operator is not required to deduct TDS.

7. CLARIFICATION REQUIRED

1) What happens in a scenario where the sold goods are returned by the purchaser within a specified return period-Often the sellers offer a specified return period, say 15 days from date of sale?.

In such case it is possible that the e-commerce operator may have deducted TDS u/s 194O at the time of original sales. In this scenario, it is not clear how the amount of sales return will be adjusted in calculating TDS u/s 194O.

2) Whether TDS is deductible on amount of delivery charges, etc. Charged by e-commerce participants-E-commerce operator is required to deduct TDS @1& of gross amount of sales.

It may not be possible to argue that such delivery charges are merely reimbursement of delivery charges. Hence it appears that such gross amount would include delivery charge also.

3) Whether TDS is deductible on amount including commission/service fee of e-commerce operator?-There may be two views-

a) As per section 194-O, TDS is required to be deducted on gross amount of sales and where transaction is covered under this section, then TDS will not be deducted under any other provision. Therefore, it appears that TDS is required to be deducted including commission. But it seems to be illogical from the point of view that how Amazon can itself deduct TDS on its own income and then how it can be reflected in its Form 26AS.

b) Another view is that TDS u/s 194-O is to be deducted on amount paid to e-commerce participant after deduction of commission and on commission deducted TDS u/s 194H shall be levied.

The second option seems to be more logical as the Gross Amount includes three things or may be more-

i. Share of Amazon

ii. Share of M/s. XYZ (an e-commerce participant)

iii. Share of Logistics Company (i.e. delivery charges)

4) Whether taxi aggregator will be regarded as e-commerce operator and if yes then, whether services of taxi drivers can be regarded as supply of services over digital network?

5) How payment through payment gateways shall be seen under this section?

6) Whether online travel company/website be regarded as e-commerce operator and if yes then whether sale of tickets by airlines can be regarded as supply of services using electronic facility?

OUR COMMENTS

Sales through online facility include many things and clarification is required on each and every stage. The purpose of Govt. is to tax small-scale manufactures and service providers who sell their products or services through online platform like Amazon. Online business is increasing and huge transactions are incurred through online platform. Govt. may not identify small sellers who sell their products online but not file their income-tax returns. Thus Govt. has enlarged tax base by bringing e-commerce participants under the tax base.

******

Disclaimer: The above comments do not constitute professional advice. The Author can be reached at companyfinancialtree@gmail.com or visit website www.financialtreecompany.com . My name is CA Divya Agrawal and I am Practising Chartered Accountant, CEO and Founder of FINANCIAL TREE COMPANY (An online return filing and Tax Consultancy Company) where we have taken an initiative that allows person to Pay from Heart. We also upload educational videos in You tube and name of our channel is FINANCIAL TREE COMPANY. Our aim is to help people in improving their financial health by spreading knowledge and love. Stay Financially Fit and Healthy.

Dear Sir,

Hope you are taking good care of yourself in this pandemic. As regards your query-

E-Commerce Operator is required to deduct TDS and TCS as follows-

(a)TDS@ 1% u/s 194O of Income Tax Act on gross amount of sale and

(b) TCS @ 1% under GST on (Sales-Sales Return)

Therefor TDS and TCS both is deducted.

Hope your query is cleared. For any further queries kindly mail to companyfinancialtree@gmail.com or call 9111872247

Thanks and Regards

good Morning sir,

Here you are saying that e-commerce operator should deduct TDS @1% under income tax, then He is again deducting TCS @1%. basing on which value those TDS & TCS are deducted.

Please Calrify