What is Slump Sale:

♦ A slump sale for income tax purposes would be one where an undertaking is sold without considering the individual values of the assets or liabilities contained within the undertaking.

♦ It may be important to note here that finding out individual values may be of relevance only for the purpose of determining stamp duty or any other similar taxes.

Section 2(42C)

Slump sale means the transfer of one or more undertaking, by any means, for a lump sum consideration without values being assigned to the individual assets and liabilities in such sales.

Explanation 1.—Forthe purposes of this clause, “undertaking” shall have the meaning assigned to it in Section 2 of the Explanation 1 to clause (19AA).

Explanation 2.—For the removal of doubts, it is hereby declared that the determination of the value of an asset or liability for the sole purpose of payment of stamp duty, registration fees or other similar taxes or fees shall not be regarded as assignment of values to individual assets or liabilities.

Explanation 3.—For the purposes of this clause, transfer shall have the meaning assigned to it in the section 2(47).

Meaning of Undertaking

For the purposes of this clause, “undertaking” shall include any part of an undertaking, or a unit or division of an undertaking or a business activity taken as a whole, but does not include individual assets or liabilities or any combination thereof not constituting a business activity.

Section 50B:

(1) Any profits or gains arising from the slump sale effected in the previous year shall be chargeable to income-tax as capital gains arising from the transfer of long-term capital assets and shall be deemed to be the income of the previous year in which the transfer took place.

Provided that any profits or gains arising from the transfer under the slump sale of any capital asset being one or more undertakings owned and held by an assessee for not more than thirty-six months immediately preceding the date of its transfer shall be deemed to be the capital gains arising from the transfer of short-term capital assets.

Crux of Sub-section (1):

- If Undertaking or divison held for more than 36 months = LTCG

- If Undertaking or divison held for less than or equal to 36 months = STCG

(2) In relation to capital assets being an undertaking or division transferred by way of such slump sale,—

(i) The “net worth” of the undertaking or the division, as the case may be, shall be deemed to be the cost of acquisition and the cost of improvement for the purposes of sections 48 and 49 and no regard shall be given to the provisions contained in the second proviso to section 48;

(ii) Fair market value of the capital assets as on the date of transfer, calculated in the prescribed manner, shall be deemed to be the full value of the consideration received or accruing as a result of the transfer of such capital asset.

Crux of Sub-section (2):

(1) Net worth will deemed to be the cost of acquisition and cost of improvement & no indexation benefit shall be available.

(2) FMV as per Rule 11UAE shall be deemed as full value of consideration.

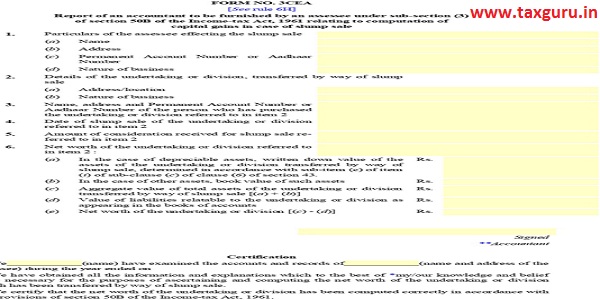

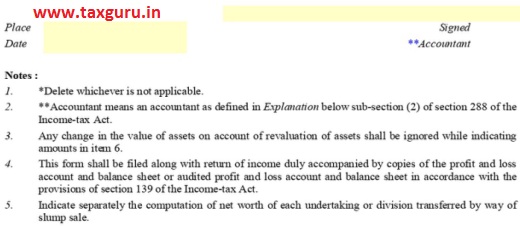

(3) Every assessee, in the case of slump sale, shall furnish in the prescribed form3637[a report of an accountant as defined in the Explanation below sub-section (2) of section 288 before the specified date referred to in section 44AB] indicating the computation of the net worth of the undertaking or division, as the case may be, and certifying that the net worth of the undertaking or division, as the case may be, has been correctly arrived at in accordance with the provisions of this section.

Rule 6H:

The report of an accountant which is required to be furnished by every assessee along with the return of income, in case of slump sale, under sub-section (3) of section 50B shall be in Form No. 3CEA.

Crux of Sub-section (3):

Assessee shall furnish FORM 3CEA certified by the CA that net worth has been calculated correctly.

Explanation 1:

For the purposes of this section, “net worth” shall be the aggregate value of total assets of the undertaking or division as reduced by the value of liabilities of such undertaking or division as appearing in its books of account.

Provided that any change in the value of assets on account of revaluation of assets shall be ignored for the purposes of computing the net worth.

Crux of Explanation 1:

Net worth = Books Value of all the Assets (Excluding Revaluation of assets) – Book value of all the liabilities

Explanation 2:

For computing the net worth, the aggregate value of total assets shall be,—

(a) In the case of depreciable assets, the written down value of the block of assets determined in accordance with the provisions contained in sub-item (C) of item (i) of sub-clause (c) of clause (6) of section 43;

(aa) In the case of capital asset being goodwill of a business or profession, which has not been acquired by the assessee by purchase from a previous owner, nil;

(b) In the case of capital assets in respect of which the whole of the expenditure has been allowed or is allowable as a deduction under section 35AD, nil;and

(c) In the case of other assets, the book value of such assets.

Crux of Explanation 2:

- Depreciable Asset = WDV of Assets (Actual cost of assets in that block – Depreciation on assets if asset was the only asset in the relevant block)

- Self-generated Goodwill = Nil

- Assets of which full amount is claimed as expenditure = Nil

- Other assets = Books Value of assets

__

Rule 11UAE: Computation of Fair Market Value of Capital Assets for the purposes of section 50B of the Income-tax Act.

Introduction

CBDT vide Notification No.68/2021 dated 24/05/2021 notified Rule 11UAE of the Income Tax Rules, 1962 to compute the Fair Market Value (FMV) of Capital Assets for the purposes of section 50B of the Income-tax Act, 1961 for the purpose of computing the capital gains in case of an exchange of assets in a slump sale.

(1) For the purpose of clause (ii) of sub-section (2) of section 50B, the fair market value of the capital assets shall be the FMV1 determined under sub-rule (2) or FMV2 determined under sub-rule (3), whichever is higher.

Crux of Sub-rule (1)

FMV for capital assets = FMV1 or FMV2 whichever is higher.

(2) The FMV1 shall be the fair market value of the capital assets transferred by way of slump sale determined in accordance with the formula –

A+B+C+D – L, where

A= Book value of all the assets (other than jewellery, artistic work, shares, securities and immovable property) as appearing in the books of accounts of the undertaking or the division transferred by way of slump sale as reduced by the following amount which relate to such undertaking or the division, —

(i) any amount of income-tax paid, if any, less the amount of income-tax refund claimed, if any; and

(ii) any amount shown as asset including the unamortised amount of deferred expenditure which does not represent the value of any asset;

B = The price which the jewellery and artistic work would fetch if sold in the open market on the basis of the valuation report obtained from a registered valuer;

C = fair market value of shares and securities as determined in the manner provided in sub-rule (1) of rule 11UA;

D = the value adopted or assessed or assessable by any authority of the Government for the purpose of payment of stamp duty in respect of the immovable property (Stamp Duty Value);

L= book value of liabilities as appearing in the books of accounts of the undertaking or the division transferred by way of slump sale, but not including the following amounts which relates to such undertaking or division, namely:

(i) The paid-up capital in respect of equity shares;

(ii) the amount set apart for payment of dividends on preference shares and equity shares where such dividends have not been declared before the date of transfer at a general body meeting of the company;

(iii) reserves and surplus, by whatever name called, even if the resulting figure is negative, other than those set apart towards depreciation;

(iv) any amount representing provision for taxation, other than amount of income-tax paid, if any, less the amount of income-tax claimed as refund, if any, to the extent of the excess over the tax payable with reference to the book profits in accordance with the law applicable thereto;

(v) any amount representing provisions made for meeting liabilities, other than ascertained liabilities;

(vi) any amount representing contingent liabilities other than arrears of dividends payable in respect of cumulative preference shares.

(3) FMV2 shall be the fair market value of the consideration received or accruing as a result of transfer by way of slump sale determined in accordance with the formula-

E+F+G+H, where

E = Value of the monetary consideration received or accruing as a result of the transfer;

F = Fair market value of non-monetary consideration received or accruing as a result of the transfer represented by property referred to in sub-rule (1) of rule 11UA determined in the manner provided in sub-rule (1) of rule 11UA for the property covered in that sub-rule;

G = The price which the non-monetary consideration received or accruing as a result of the transfer represented by property, other than immovable property, which is not referred to in sub-rule (1) of rule 11UA would fetch if sold in the open market on the basis of the valuation report obtained from a registered valuer, in respect of property;

H = The value adopted or assessed or assessable by any authority of the Government for the purpose of payment of stamp duty in respect of the immovable property in case the non-monetary consideration received or accruing as a result of the transfer is represented by the immovable property.

(4) The fair market value of the capital assets under sub-rule (2) and sub-rule (3) shall be determined on the date of slump sale and for this purpose valuation date referred to in rule 11UA shall also mean the date of slump sale.

SIR I AM CA RAJENDRA JOSHI PUNE ONE MY CLINT RECIEVED SLUM SALE AMOUNT RS 6.65 CR AND NETWORTH IS 2 CR FOR A Y 23-24 THE BALANCE AMOUNT IS FULLY TAXABLE PLZ CLERIFY