The Finance Act of 2023 brought about a pivotal amendment to Section 43B(h) of the Income Tax Act, 1961. This amendment holds significant implications, specifically for Wholesale and Retail Traders, altering the dynamics of delayed payments and benefits under the Micro, Small, and Medium Enterprises Development Act, 2006 (MSMED Act).

As you are aware provision of section 43B(h) of the Income tax Act, 1961 (the “Act”) has been amended vide Finance Act, 2023 wherein case of delay in payment to Micro or Small Enterprises beyond the time limit (15 days or 45 days as the case may be) specified in Section 15 of the Micro, Small and Medium Enterprises Development Act, 2006 (the “MSMED Act, 2006”) has been covered.

According to amendment delayed payment beyond the time limit will be disallowed for the previous year in which the liability has been incurred and deduction of said payment will be allowed only in the previous year in which the actual payment is made i.e. benefit of up to the due date of filing of the Income tax Return will not be available in this case.

Before 02 July 2021, retail and wholesale traders were not included in MSME definition, vide Office Memorandum No. 5/2(2)/2021-E/P&G/Policy dated 02 July 2021 following NIC code were included in the list of eligible for Udyam Registration:

| Sr. No. | NIC Code | Description of Activity |

| 1 | 45 | Wholesale and retail trade and repair of motor vehicle and motorcycles |

| 2 | 46 | Wholesale trade except of motor vehicles and motor cycles |

| 3 | 47 | Retail Trade Except of Motor Vehicles and motor cycles |

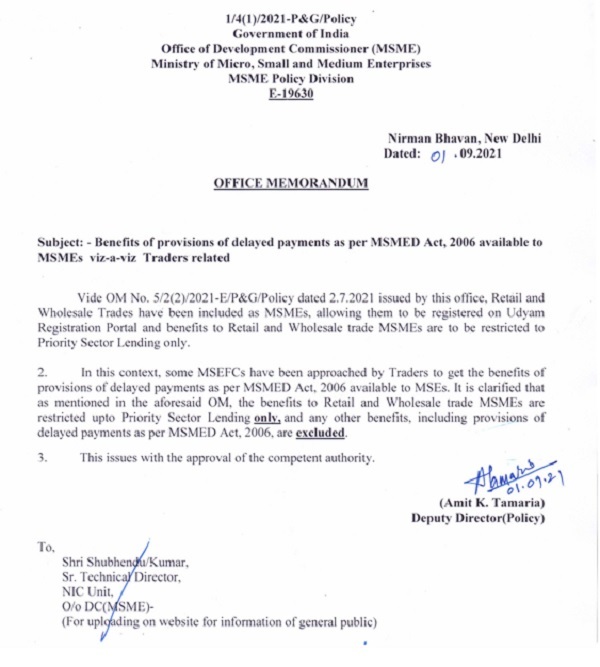

Vide above Office Memorandum it is further clarified that benefits to Retail and Wholesale trade MSMEs are to be restricted to Priority Sector Landing only. That means other benefits, including provision of delayed payments as per MSMED Act, 2006 are excluded.

The above clarification was issued vide Office Memorandum (OM) No. 1/4(1)/2021-P&G/Policy, Dated: 01.09.2021.

In view of the combined reading of the amendment in section 43B of the Act and Office Memo issued by MSME (Policy Division) of Govt. of India following preposition can be drawn:

> Purchases from and Payment to Micro or Small Enterprises other than Retail and Wholesale Trader will be governed by Section 43B(h);

> Purchases from and Payment to Retail and Wholesale Traders will not be governed by Section 43B(h), accordingly there will not be any disallowance on account of delay in making payment beyond 15 days or 45 days;

> Category selected while applying for MSME will play an important role while categorising the suppliers into Retail and Wholesale Trader etc.

> Before drawing conclusion please verify the above facts.

Conclusion: The nuanced changes in Section 43B(h) of the Income Tax Act, 1961, ushered in by the Finance Act, 2023, have distinct implications for the Wholesale and Retail Trade sectors. Understanding the categorization under MSME, coupled with the precise timelines for payment, becomes paramount. As businesses navigate these amendments, thorough verification against the presented facts is essential for accurate compliance and strategic decision-making.

We are mainly into export of goods. We buy from manufacturer who are Micro and small . Is 43B h still applicable for us.

Hi Manish,

As your purchases are from Manufacturer (Micro or small), you are liable to make the payment to them within the stipulated time of 15 days or 45 days from the date of acceptance of goods.

Regards,

SIR WHETHER 43B IS IMPLICATED ON WHOLESALE AND RETAIL TRADERS

As per Office Memo dated 01.09.2021, Wholesaler and Retail Trader will not be able to take the benefit of delayed payment. That means if their customers are not paying within a time period of 15/45 days they will not be able to make a reference to the council for timely payment along with Interest.

I am a businessman having turnover under 50 CR. I purchase my raw materials (cloth) from Surat and have it job worked here in Ahmedabad. Will I be considered under the head trader or manufacturer ? Most of our accountants and peers are still confused.

If transaction with Job worker is of P2P nature i.e. at the time of sending RM to Jobworker you prepare Sales Invoice and at the time of return of FG, you receive the same through Purchase Invoice. In that case you are a Trader from MSMED Act perspective.

If you are accounting Job work charges as Manufacturing expenses in your books of account and there are no sale or purchase invoice while sending/receiving goods from Job Worker, you will be regarded as Manufacturer.

Just ensure to report/incorporate the same in your Udyam Aadhar and GST Registration Certificate.

I am a businessman from Ahmedabad . I purchase my raw materials(cloth) from Surat and have jobwork done here in Ahmedabad. Will I be considered as a trader or manufacturer ? Most of our accountants and officials has different take on it.

Is this section applicable only to Udyam registered organisations or all organisations falling under the definition of MSME?

Please clarify.

Thanks

Hon’ble Delhi High Court in the case of RAMKY INFRASTRUCTURE PRIVATE LIMITED vs MICRO AND SMALL ENTERPRISES FACILITATION COUNCIL & ANR (W.P.(C) 5004/2017 & CM No. 21615/2017):

Facts of the case:

• GCIL, the Company, executed the work as per contract over the period up to 2010 for RIL, another Company. RIL did not pay the balance contract amount;

• On 04 July 2015 the Commissioner of Industries, Govt of NCT of Delhi issued Entrepreneurs Memorandum Part-II Acknowledgement indicating GCIL‘s registration as a Service Enterprise for Civil Construction;

• GCIL in Aug 2015 made a reference to the Micro and Small Enterprises Facilitation Council for recovery of balance contract amount along with Interest under MSMED Act, 2006, however in the absence of replies from RIL, the Council referred the case to Delhi International Arbitration Centre (DIAC) for initiating arbitration proceedings and accordingly the matter came before Hon’ble Delhi Court for disposal;

Crux or arguments of the matter:

• GCIL had not filed the Memorandum as contemplated under Section 8(1) of the MSMED Act, 2006 up to the year 2010 and GCIL was registered on 04 July 2015. Therefore prior to the said date GCIL could not be considered as a “supplier” within the meaning of Section 2(n) of the MSMED Act;

• Since GCIL was not registered under MSEMD Act and not having “Udyam Aadhar”, proceedings cannot be carried out for recovery of amounts along with Interest under MSMED Act;

Court Ruling:

• Definition of the term “supplier” given in section 2(n) of the MSMED Act uses the expression “means” and “includes” to define a term, that means the definition is exhaustive one;

• Section 2(h) and 2(m) of MSMED Act defines “micro enterprise” and “small enterprises” respectively;

• Classification of above enterprise is given in Section 7 of the MSMED Act;

• A supplier is defined to mean a micro or small enterprise, which has filed a Memorandum with the authority and includes three other types of entities as indicated in the three clauses of Section 2(n) of the MSMED Act. Accordingly, there will be four categories of micro or small enterprise:

enterprises that have filed the Memorandum under Section 8(1) of the MSMED Act;

National Small Industries Corporation;

Small Industries Development Corporation of a State or a Union territory;

a company, co-operative society, trust or a body engaged in selling goods produced by micro or small enterprises or rendering services provided by such enterprises.

• GCIL will fall in the fourth category as it is a Company and the services provided by GCIL are clearly services rendered by a micro/small enterprise and, therefore, GCIL – being engaged in supply of services rendered by a micro/small enterprise even at the time of execution of contract in the year 2010.

Conclusion:

A Company, co-operative society, trust even if it has not filed memorandum under MSMED Act, 2006 i.e. not applied for Udyam Aadhar or applied lateron can take the benefit of the above ruling and will be categorized as micro or small enterprise for the purpose of MSMED Act.

Further, proprietory or unregistered partnership firm will not be termed as body for the above definition and accordingly will not be eligible to take the benefit of above clause.

Thank you sir