Explore the taxability of Business Trusts (REIT/InvIT) in India, amended as per Budget 2023. Understand the structure, flows of income, taxation at different levels, and implications for sponsors, SPVs, business trusts, and investors.

A. Overview of Business Trusts (REITs / InvITs):

> Real Estate Investment Trust (REIT) is a tax-efficient vehicle that owns a portfolio of income-generating real estate assets. It is an entity that is created with the main purpose of channelising the funds that could be invested in operational functioning or ownership of the real estate to further generate income for the investors. InvITs stands for Infrastructure Investment Trusts.

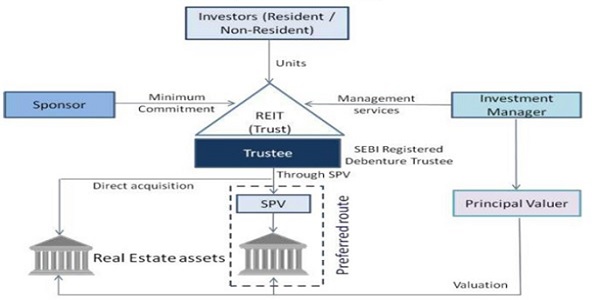

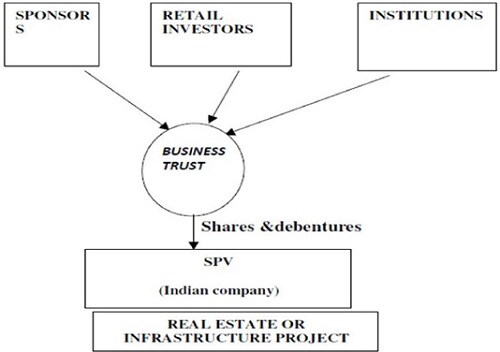

B. Structure of Business Trusts & SPVs:

> A REIT is created by a sponsor, who transfers ownership of assets to the trust in exchange for its units.

> Think of it like a mutual fund, where money is pooled from investors in return of which investor gets mutual fund units and then on behalf of investor mutual fund invest that in stocks and other securities. Now, instead of stocks and other securities, the funds will have investments in either SPVs (Special Purpose Vehicles) owning project; or directly in the real estate or infrastructure projects.

> The funds will earn income from the SPV/projects and the income will be distributed to the investors. The units of the trust will be listed on the stock exchange. Investors will be able to sell the units on the stock exchange also.

> REIT is designed for “completed” real estate project. Thus, those projects which can earn incomes post completion, can be considered for investment. InvITs is for infrastructure projects which are completed and also for those that are not yet completed.

> SPVs:

1) Features:

- Formed for a special purpose;

- powers are limited to what might be required to attain that purpose;

- Life ends when the purpose is attained;

- SPVs are also referred to as a “bankruptcy-remote entity” whose operations are limited to the acquisition and financing of specific assets.

2) Difference between Company and SPV:

a) Although both these entities are established as per Company Act and also follow the all the regulations in the Company Act, the difference lies in the purpose. The company, as distinguished from an SPV, may be called a general-purpose vehicle.

b) A company may do several things which are mentioned in the Memorandum of Association (MoA) or permitted by the Companies Act. An SPV may also do the same, but its scope of operation is limited and focused. The MoA is quite narrow in the case of an SPV. This is primarily to provide comfort to lenders who are concerned about their investment.

C. Parties in the structure:

1) Sponsor – The person who develops the projects and sets up the business trust. The sponsor can own the shares of the SPVs which will own / operate the real estate / infrastructure project. The sponsor will transfer the shares of the SPVs to Business trust and in turn he will get units of business trust. He can then sell the units of the business trust on the stock exchange.

2) Business trust – The sponsor may settle a Business Trust in which investors will invest funds.

3) SPV – Indian company which will be the owner of the project.

4) Financial Institutions – They may buy/subscribe units from the sponsor or the business trust.

5) Retail Investors – Resident and non-resident persons who will invest in the business trust.

D. Flows of Income at different level:

| In the hands of | Sources of Income | Application of Income |

| Sponsor |

|

|

| SPVs |

|

|

| Business Trusts |

|

|

| Investors |

|

E. Taxation of Income at different levels:

|

In the hands of |

Income | Tax |

| Sponsor | Conversion of Shares & Debentures of SPV into Units of Business Trust | It will not be considered as transfer as per Section 47(xvii) |

| Sale of Units of Business Trust to Institutions / Retails Investors over the stock market | Taxable under the head Capital Gain

Holding Period: Holding period is to be considered from date of purchase of shares Cost: Cost of the shares will be considered as cost of units |

|

| SPVs | Profits from Investment in Real Estate/Infrastructure Projects | Taxed as Business Income |

| Rental Income or | Taxed as HP Income | |

| Capital appreciations from Investment in Real Estate / Infrastructure Projects | Taxed as CG Income | |

| SPVs has to pay tax @ 25% + surcharge and cess or the concessional rate of 22% + surcharge and cess if opted for lower tax regime (Sec 115BAA). It may get Sec 80IA and other tax reliefs. | ||

| Business Trusts | Income from SPVs by way of: | |

| √ Dividend; | Exempt u/s 10(23FC) | |

| √ Interest; | Exempt u/s 10(23FC) | |

| √ Amortisation of Debt / Repayment of Loan | It is not taxable as the amount is not in nature of Income | |

| Rental Income from any real estate asset owned directly | Exempt u/s 10(23FCA) | |

| Capital Gain on Sale of Shares of SPVs or any real estate asset owned directly | Taxable at Applicable rates | |

| Miscellaneous Income like Bank Deposit Interest, Money Market Fund Income, etc. | Taxable at MMR | |

| Investors | Income from Business Trusts by way of: | |

| √ Rent; | Taxable at applicable rates | |

| √ Dividend; | If SPVs has opted for lower tax regime: Taxable at applicable rates

If SPVs has not opted for lower tax regime: Exempt u/s 10(23FD) |

|

| √ Interest; | For Residents: Taxable at applicable rate

For NRIs: Taxable @ 5% |

|

| √ Amortisation of Debt / Repayment of Loan;* | Upto FY 2022-23: Not taxable as the amount was not in nature of income

w.e.f. FY 2023-24: Taxable u/s 56(2)(xii) as IFOS |

|

| √ Any other Income; | Exempt u/s 10(23FD) | |

| Capital Gain on Sale of Units of Business Trust | Taxed as CG Income |

*As per Section 115UA(1), Notwithstanding anything contained in any other provisions of this Act, any income distributed by a business trust to its unit holders shall be deemed to be of the same nature and in the same proportion in the hands of the unit holder as it had been received by, or accrued to, the business trust.

Which means that Income taxable in the hands of Unit holder based on following:

1. Income needs to be distributed by the business trust;

2. Income distributed by the trust will be of same nature as it had been in the hand of business trust. For e.g. Rent received by business trust will be taxable in the hands of unit holder as Rent under House Property head, Interest received by business trust will be taxable in the hands of unit holder as Interest under Other Sources head.

So, due to passthrough status, cash received from loan repaid by SPV to Business Trust which is then distributed by BT to its unit holders is received by the unit holders as repayment of loan only. Under the income tax as far as taxation of these distributed amounts is concerned, repayment of loan will not be taxed as it is not in the nature of income in the hands of BT.

So, in order to plug the above loophole, the government has proposed to make certain amendments by which the profit element in repayment of loan will be taxed in the hands of the unit holder.

Accordingly, the following amendments are proposed in the Finance Bill, 2023:

1. Insertion of clause (xii) in sub-section (2) of section 56 of the Act to provide that income chargeable to income-tax under the head “income from other sources” shall also include any sum, received by a unit holder from a business trust, which-

a. is not in the nature of dividend, interest and rent income as referred to in section 10(23FC) and 10(23FCA) of the Act; and

b. is not chargeable to tax to BT at MMR under section 115UA(2) of the Act;

2. Insertion of a proviso to the above clause stating that in case the amount distributed to the unit holder is for redemption of units held by him, then the amount chargeable to tax in the hands of the unit holder will be reduced by the cost of acquisition of units redeemed.

3. Since, all the income referred in section 115UA, other than the ones referred to in section 10(23FC) and 10(23FCA), is exempted in the hands of unit holders under section 10(23FD), it is proposed to insert clause (3A) in section 115UA to state that the provisions of sub – sections (1), (2) and (3) of this section, shall not apply in respect of any sum, as referred to in clause (xii) of sub-section (2) of section 56 of the Act, received by a unit holder from a business trust.

4. Adding clause (xii) of section 56(2) in the definition of income under section 2(24).

Thus, the income which is distributed as repayment of loan will now be taxed in the hands of unit holder as income from other sources under section 56(2)(xii).

The above proposal saw considerable pushback from industry and therefore, the government has decided to soften the tax impact on unit holders of REITs and InvITs, as envisaged in the Finance Bill, 2023, last month.

It has been proposed that only a portion of distribution as repayment of debt i.e. a ‘specified sum’ will be taxable. The specified sum is arrived at after taking out the cost of acquisition from the distributed amount.

For e.g. If a REIT or InvIT had an issue price of Rs. 100 and in 2024, the amount distributed as repayment of debt was Rs. 30, there will be no tax on this in the year of distribution since it is lower than the issue price. If in future the trust’s cumulative distribution becomes Rs. 120, then Rs. 20 is taxed in the hands of the unitholder in the year of receipt. If in the subsequent year the amount increases to Rs. 150, then tax will be on Rs. 30, since tax has already been paid on Rs. 20 in the previous year.

F. Conditions for REIT:

> REIT shall invest in commercial real estate assets, either directly or through SPVs. In such SPVs, a REIT shall hold or proposes to hold controlling interest and not less than 50% of the equity share capital or interest.

> REITs must invest minimum 80% in properties that are capable of generating revenues, according to Sebi regulations. Only 10% of the total investment must be made in real estate under-construction properties.

> REITs can currently only invest in commercial real estate and office premises.

> They must distribute 90% of their income in form of dividends.

G. The Way Forward:

> The business trusts will need to review its model of their income distribution to unitholders as the Union Budget for 2023-24 has proposed to tax such distribution through repayment of debt. However, distribution of income as dividend by these trusts continues to be exempted from taxation to unitholders if SPV has not opted for lower tax regime.

> So, they can structure their pay out in such a way as to reduce the investor’s tax liability and thereby entice investors.

> One way is to distribute the amount in form of dividend if SPV has not chosen for lower tax regime that’ll be exempt in the hands of investors. In this case, the SPV would only be required to pay tax on the profit and could distribute the surplus funds to investors, eliminating the situation where the same income was subject to double taxation.

(Article was amended on 03rd April 2023)

THANKS YOU VERY MUCH FOR VERY WELL WRITTEN ARTICLE

Excellent Article and Well explained.

I have one Query. In Which sections in ITR ‘Amortisation of Debt / Repayment of Loan’ for the business trust can be filed, if repayment of debt is less than issue price. Does it means exempt from Tax

Not many will be able to understand this, but its well written. Thanks.