On verification of Form No. 26AS, if there is any inconsistency between the TDS details as provided by the deductor and TDS details available with the Government records (i.e. mismatch) then the deductee should intimate the same to the deductor.

Page Contents

- Mismatch in tax credit status of a deductee is because of :

- Deductee to claim the correct credit of TDS

- Deductee to correctly mention the details of TDS in the return of income

- Who is deductee?

- Deductee should furnish his permanent account number (PAN) to deductor?

- Deductee to furnish the certificate of lower deduction or Form No. 15G/15H well in advance?

- Deductee to obtain and preserve Valid TDS certificate issued by the deductor?

- Online Facilities for Taxpayers on TRACES

- Deductee to cross check the tax credit by viewing From 26AS

Mismatch in tax credit status of a deductee is because of :

- Non-quoting of PAN or quoting of incorrect PAN of the deductee by the Tax deductor in his quarterly TDS statement submitted to the Income Tax Department.

- Non-filing of statement by the deductor, Taxpayer may check status of filing of TDS statement by the Deductor through online on “TDS/TCS” credit at traces (www.tdscpc.gov.in).

Mismatch results in :

Tax demand from Income Tax Department/reduction in the amount of refund due to the taxpayer.

Avoid mismatch by :

Viewing “TDS/TCS credit” and your Tax Credit Statement “(26AS)” online(TRACES) to ensure that the statement has been filed by the deductor and asking the deductor to file “Correction Statement” quoting the correct PAN.

Deductee to claim the correct credit of TDS

The deductee is entitled to claim the credit of tax deducted by the deductor. The deductee should claim the correct amount of TDS as deducted by the deductor.

Deductee to correctly mention the details of TDS in the return of income

To claim the credit of TDS, the deductee has to mention the details of TDS in his return of income. Deductee should take due care to quote the correct TDS certificate number and TDS details while filing the return of income. If any incorrect detail is provided by the deductee, then tax credit discrepancy will arise at the time of processing the return of income and same can cause problem in processing the return of income.

Who is deductee?

As per the scheme of the Income-tax Act, in case of certain prescribed payments (e.g. interest, commission, brokerage, rent, etc.), the person making the prescribed payments is required to deduct tax at source from such payments. In such a situation, the person making these payments has to pay the net amount after deducting the tax at prescribed rates. He is known as deductor and the person receiving the payment after deduction of tax is called the deductee.

Deductee should furnish his permanent account number (PAN) to deductor?

Every deductee should obtain a valid PAN (if not obtained) and should furnish the correct PAN to the deductor. If incorrect PAN is provided, then the tax deducted may be credited to incorrect account.

Non furnish of PAN or furnishing incorrect PAN to the deductor would also result in TDS at higher of the following rates:

a. the rate prescribed in the Act; or

b. at the rate in force, i.e., the rate mentioned in the Finance Act; or

c. at the rate of 20%

Failure to apply for PAN or quote correct PAN by the deductee to the deductor may result in levy of penalty of ten thousand rupees. Before furnishing the PAN ensure that it is in active state. The deductee can check the “Know Your PAN” by visiting Income Tax Website: http//www.incometaxindiaefiling.gov.in. If PAN is in inactive (deleted/deactivated) state, the taxpayer is required to contact the jurisdictional Assessing Officer to change it to active state.

Deductee to furnish the certificate of lower deduction or Form No. 15G/15H well in advance?

If any deductee has obtained lower deduction certificate from the Assessing Officer or wants to furnish Form No. 15G/15H for non-deduction of tax in prescribed case, then he should furnish the certificate/form to the deductor well in advance.

No certificate for deduction at lower/rate or nil deduction of income tax shall however be granted unless the application contains the PAN of the applicant.

Deductee to obtain and preserve Valid TDS certificate issued by the deductor?

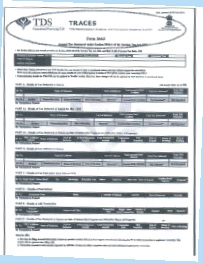

Valid TDS certificate is the TDS certificate downloaded from TRACES (http://www.tdscpc.gov.in) bearing a 7 digit unique

certificate number and TRACES watermark.

Every deductee shall preserve the TDS certificate issued by the deductor. TDS certificate in respect of TDS on payments other than salary is issued on quarterly basis and in respect of TDS on salary on annual basis. If the TDS certificate is lost, the deductee can request for duplicate TDS certificate. IMAGE OF FORM 16 GENERATED BY TDS-CPC (AS PER ANNEXURE 01). The deductee can verify the TDS certificate Online on the TRACES website www.tdscpc.gov.in. The deductee needs to login and go to “View TDS/TCS Credit” screen and click on “Varify TDS Certificate” to verify the TDS certificate (Form 16/16A) after filling the required details.

Online Facilities for Taxpayers on TRACES

• View and download

– Annual Tax Credit Statements in Form 26AS

– TDS Certificate in case of TDS on Sale of Immovable Property: Form 16B (Issued by Buyer)

• Verification of TDS certificate (Form 16/16A)

• Aggregate TDS Compliance report for corporates/banks-provides details of TDS demands of all TANs belonging to one PAN.

Note : Tax Payers can access TRACES website from outside India also by using the URL: www.nriservices.tdscpc.gov.in

Deductee to cross check the tax credit by viewing From 26AS

The deductee can cross check the TDS credit, as reflected in TDS certificate available in his account by viewing the tax credit status online from Form No. 26AS, which is an Annual Tax Statement containing the details of tax deducted/collected by various deductors. Income tax refund details, high value transactions and transactions pertaining to TDS on sale on immovable property during the financial year. Every deductee should check the tax credit available in his account (i.e. in Form 26AS). This enables him to cross check the TDS details provided to him by the deductor with the TDS details available with the Government. IMAGE OF FORM 26AS GENERATED BY TDS-CPC (AS PER ANNEXURE 02).

Disclaimer: The contents of this article are for information purposes only and does not constitute advice or a legal opinion and are personal views of the author. It is based upon relevant law and/or facts available at that point of time and prepared with due accuracy & reliability. Readers are requested to check and refer to relevant provisions of statute, latest judicial pronouncements, circulars, clarifications etc before acting on the basis of the above write up. The possibility of other views on the subject matter cannot be ruled out. By the use of the said information, you agree that Author / TaxGuru is not responsible or liable in any manner for the authenticity, accuracy, completeness, errors or any kind of omissions in this piece of information for any action taken thereof. This is not any kind of advertisement or solicitation of work by a professional.

(Republished with Amendments by Team Taxguru)

Valuable post about TDS obligations.you cover so many great points about it.its very intresting and very helpful for me and others.

The subject of TDS has been thoroughly muddled by all concerned,As a result the tax payer has become an unpaid inspector himself, whereas each ITO has an insprctor to assist, The basic problem is with the dirtied system itself thanks to the deducor, govt of India and the CBDT. They all seem to be working with amalicious heart at each other, The suffere is the honest tax payer who does not get his refund because he has e-filed his ITR with a few miniscule errors. The ITO sees “red”,The CBDT feigns helplessness as it is in the ITO’s office. The deductor is sitting pretty to get a “qualified warning from CBDT” for taking any action.. The Govt India is BLIND like the proverbial Daroga who will take action only if case is made out in writing. Finally the Ombudsman is no better than a Head Post Office!The taxation system of our nation is a big mess which can never do anything good!

सर नमस्कार। मैं आपकी साईट का निरन्तर पाठक हूं कृपया मार्गदर्शन दें कि हमें मार्च 16 का वेतन अप्रेल 16 में मिला है ये किस वर्ष में लिया जाए पहले मार्च का वेतन 31 मार्च को मिलता था जिसे उसी वर्ष में जोड़ा जाता था इ

The deductee is once again made the guinea pig by the fat CBDT. In the ITR form once the tan number is input then name of the company should get filled automatically. To expect the tax payer to fill the name of deductor accurately is causing head ache for the poor tax payer. Why cant CBDT FILL THE NAME AUTOMATICALLY AS FOR THE BANK NAME AND IFSC CODE LINK IN THE ITR FORM ? My ITO IN CHENNAI is sleeping on my refund for ay 2015 -2016 due to a small mismatch!

Secondly ITOS should work to time limits. MY ITO HAS TAKEN 18 MONTHS AND YET THE PROBLEM FROM CBDT END IS UNSOLVED. I AM PLANNING TO GO TO THE VIGILANCE AND OMBUDSMAN IN A FEW DAYS.

CBDT is bogged down in making finer rules which are DEDUCTEE UNFRIENDLY ENTIRELY. THROUGH YOUR COLUMNS I WANG THE FM JATLEY AND CHAIRMAN CBDDT TO SOLVR MY CASE QUICKLY IN CHENNAI. I HAVE LOST all confidence which I had once with that behemoth called AAYAKAR BHAVAN, MAHATMA GANDHI ROAD, CHENNAI.Do they know how to solve simple problems? Every one knows that they are all babus with no brains. We have to suffer as deductees while deductor is friendly with the IT departments.