Section 197 of Income Tax Act, 1961 contains the provisions for Lower Deduction Certificate. Generally, where the actual income tax liability on the income of the assessee is less than the TDS which has been deducted by the payer as per Chapter-XVII, then it may cause a major problem of working capital management for the assessee. The solution is, file an application for LDC i.e. Lower Deduction Certificate with Income Tax Authorities.

Before understanding the proceeding, I would like to lay down the payments/incomes on which TDS will be deducted as per Chapter XVII covered under section 197,

- Section 192- Payment of Salary

- Section 193- Payment of Interest on securities

- Section 194- Payment of Dividends

- Section 194A- Payment of interest on other than securities

- Section 194C- Payment to contractors and sub-contractors

- Section 194D- Payment of insurance commission

- Section 194G- Payment of commission on the sale of lottery

- Section 194H- Payment of commission or brokerage

- Section 194I- Payment of Rent

- Section 194J- Payment of Fees for Technical services

- Section 194K- Payment of income in respect of units

- Section 194LA- Payment of compensation on acquisition of immovable property

- Section 194LBB- Payment of income in respect of units of investment fund

- Section 194LBC- Payment of income in respect of investment in securitization trust

- Section 194M- Payment of commission by individual and HUF pursuance of a contract (other than covered under section 194C, 194H and 194J)

- Section 194O- Payment by e-commerce operator to e-commerce participant

- Section 195- Payment to non-resident or foreign companies

No application can be filed under section 197 for the purpose of payment other than above mentioned.

LDC facilitates the payment of certain sum on deduction of TDS at a lower rate. It ultimately saves the assessee from the repercussions of the higher TDS deduction which cause an imbalance in the working capital requirement of the assessee. Assessee will get the higher disbursement from their customer as TDS amount will be on a lower side.

Below is the most common situation where LDC is beneficial for the assessee,

1. Receipt of the payment for the sale of property in India by a non-resident seller from the Indian buyer: This is the most common situation we come across as professional chartered accountant where a non-resident sells his property in India to the Indian buyer and that Indian buyer disburse the sale consideration after deducting TDS at the rate of 20% on the whole value regardless the gain that seller has actually earned from the property.

2. Receipt of the payment by a company who does not have PE in India from the customer who is liable to deduct TDS under section 195: Generally, the Indian counterpart, while making payment to the Foreign company who does not have PE in India deduct TDS at the rate of 40% treating them as PE in India. By filing an application under section 197, such company may mitigate the higher TDS and may get a certificate for deduction of TDS at the rate as per DTAA provisions.

3. Where a assessee’s NP ratio is low or assessee is in loss: In this case the TDS is deducted by the payer at full rate as per Chapter XVII regardless the actual taxability of the payee. Where the assessee is in loss or earning at relatively low NP ratio, the actual Taxability of the assessee is quite low or nil (in case of loss). By applying for LDC, such assessee may lower their TDS amount and ultimately may mitigate the working capital crisis.

There are other cases also where assessee can get LDC from Income Tax Department and mitigate their TDS amount.

The process of filing the application for LDC: Rule 28 of Income Tax Rules governs the procedure of filing application. The application shall be filed in Form 13 on TRACES portal by logging in as ‘Taxpayer’.

Below are the steps for the whole process,

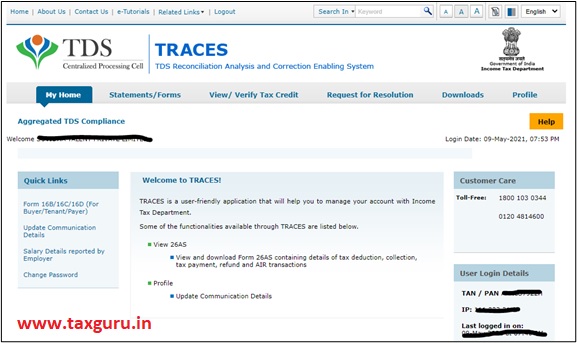

Step-1: Logging in TRACES portal.

After login in, below screen will appear,

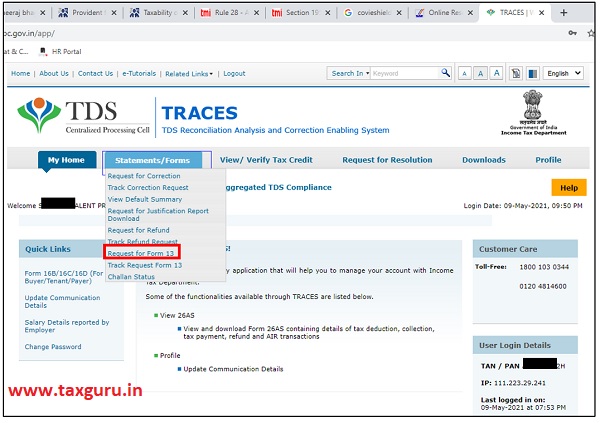

Step-2: From ‘Statements/Forms’ menu select ‘Request for Form 13’

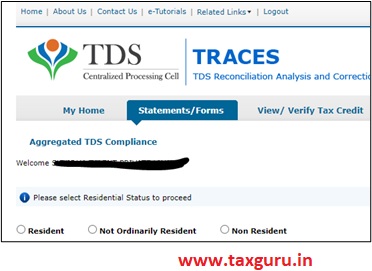

By clicking this option, below screen will appear,

Select the option as appearing on the screen. If we are applying for a non-resident person or a foreign company, then select ‘Non Resident’ or ‘Not Ordinarily Resident’ as the case may be and if we are applying for a resident assessee, then select ‘Resident’.

Step-3: Select ‘Request Type’ as ‘Original’ and then select Financial Year for which we are applying for LDC. Then click on ‘Proceed’.

Step-4: After step-3, a detailed Form 13 will appear on the screen and below mentioned details shall be filled,

- Status: Whether it’s a company, LLP, Partnership firm or individual

- Residential Status: Whether resident or non-resident

- PAN: PAN of the assessee

- Email Id: Email id should be a valid one. Any communication or query raised by the department would be notified on this mail id only

- Mobile No.: A message after filing the application and further communication from the department would be notified on this mobile no. as well

- State: State can be selected as per the convenient of the assessee

- District: Select from the drop down menu. Jurisdictional A.O will be assigned on the basis of State & District given by taxpayer in Original application of Form-13

- Detail of existing Income Tax liability: A table need to be filled up for any liability which is unpaid for the financial year for which application is being filed

- Estimated total income of the previous year for which application is filed: A projected gross receipt shall be entered here. Note that the LDC will be issued by the department upto this amount only. Therefore, this amount shall be entered carefully

- Total tax payable including interest for the above mentioned income: Tax liability which will be computed on the basis of above mentioned projected income shall be entered here. The tax rate at which assessee apply will be calculated on the basis of this tax liability and projected receipts as mentioned above.

- Details of income claimed to be exempt: If any income has been claimed to be exempt and included in the projected receipts as reported above, shall be entered here.

- Details of payment of advance-tax and tax already deducted/collected: A table need to be filled up by entering the amount which has already been paid as Advance Tax or deducted as TDS. These details may be taken from Form 26AS.

- Thereafter some declaration shall be checked by clicking against the respective options. After all this click on ‘Save & Proceed’ button.

Step-5: Next, below screen will appear,

Select the ‘Annexure-I’ and click on ‘Proceed’ button.

Step-6: After step-5, below table will appear which needs to be filled up,

In this table we need to fill the details of the deductor like TAN, section under which TDS to be deducted, nature of payment (which will be selected from the drop down menu), Estimated amount and tax rate at which the assessee wishes to apply.

At last, supporting documents shall be attached by clicking on the respective links as below,

Document shall be attached by clicking on ‘Browse’ button as provided against each document description. A template shall also be filled up by clicking on ‘Template’ button.

After uploading all the documents, click on ‘Preview & Submit’ button and a preview will be appeared on screen where you can cross check all the details and download the preview as well. After that you can submit the Form by using DSC or mobile OTP.

After submission of Form 13, the Jurisdiction will be assigned automatically within 2 or 3 days. The assessing officer may raise further query which can be replied online on the link which will be there when you check the status of your application.

Below are the documents to be attached along with the Form 13,

- Projected balance sheet and computation for the financial year for which application is filed. In case of individual, only projected computation is required.

- Audited balance sheet and computation for any one of the four previous year. Not required in case of individual who is not carrying any business or profession

- Copy of exemption certificate, if any exemption is claimed

- Copy of assessment order for the last four years, if any

- Copy of ITR acknowledgment for last four years

- Any other documents e.g. Property papers, copy of agreements etc.

The certificate once issued by the authority can be downloaded from the link which will be available when you check the status of the application.

******

Author is Amit Jindal, ACA working as Manager Taxation in Neeraj Bhagat & Co. Chartered Accountants, a Chartered Accountancy firm helping foreign companies in setting up business in India and complying with various tax laws applicable to foreign companies while establishing their business in India.

I have obtained Lower TDS Certificate for Payments made by A limited, now A Ltd is merged in B Ltd.

What is the status of my Lower Rate TDS Certificate!

Partywise certificate can be downloaded

In case of tds on sale of property by NRI. Buyer has made advance payment without deducting tds. E.g. total sale value 50 lakh , advance payment is 4 lakh. For how much amount we can apply for lower deduction certificate, 50 lakh or 46 lakh?

For applying for LDC, we have to do computation of capital gains first, after that rate of LDC can be decided.

Dear Sir

Can we download lower TDS/TCS Certificate partywise, as at present they are issuing certificate not partywise .

There will be a single certificate issued by the department containing all the Parties. A unique number will be given to each party in the certificate.