CA Archit Nevatia

Brief- The article covers Introduction, Residential Status, Tax Rates, Head-wise Taxation & Deduction available under the Act. Hope you will find it useful in this Return Filing Season.

Brief- The article covers Introduction, Residential Status, Tax Rates, Head-wise Taxation & Deduction available under the Act. Hope you will find it useful in this Return Filing Season.

Introduction

Charge of Income Tax

- Income tax is charged in assessment year at rates specified by the Finance Act applicable on 1st April of the relevant assessment year.

- It is charged on the total income of every person for the previous year.

- Gross Total Income (G.T.I):- The aggregate income under the 5 heads of income (viz. Salary, House Property, Business or Profession, Capital Gains & Other Sources) is termed as “Gross Total Income”.

- Total Income (T.I):- Total Income of assessee is gross total income as reduced by the amount permissible as deduction under sections 80C to 80U. Also called “Taxable Income”

Types of Residential Status

The different types of residential status are:-

- Resident(R)

- Not Ordinarily Resident (NOR)

- Non-Resident (NR)

RATES OF INCOME TAX (Assessment Year 2015-16)

- In case of every Individual (Men/Women) below the Age of 60 Years.

| S.No | INCOME | TAX RATE |

| 1 | Up to 250000 | NIL |

| 2 | 250000-500000 | 10% |

| 3 | 500000-1000000 | 20% |

| 4 | Above 1000000 | 30% |

2. In case of resident senior citizen i.e. age above 60 years but below 80 years

| S.No | INCOME | TAX RATE |

| 1 | Up to 300000 | NIL |

| 2 | 300000-500000 | 10% |

| 3 | 500000-1000000 | 20% |

| 4 | Above 1000000 | 30% |

Note: In case of residents individual if their total income is not more than Rs.500,000 than U/s 87A there is Tax Credit Relief of 10% of Taxable Income or upto maximum of Rs.2000.

Income From Salary

Meaning

Salary includes [section17 (1)] :-

- Wages

- Any annuity on pension

- Any gratuity

- Any fees, commission, bonus, perquisite on profits in lieu of or in addition to any salary on wages

- Any advance of salary

- Any earned leave

- Employers contribution (taxable) towards recognized provident fund.

BASIS OF CHARGE

Income is taxable under head “Salaries”, only if there exists Employer – Employee Relationship between the payer and the payee. The following incomes shall be chargeable to income-tax under the head “Salaries”:-

- Salary Due

- Advance Salary [u/s 17(1)(v)]

- Arrears of Salary

Note:

- Salary is chargeable on due basis or receipt basis, whichever is earlier.

- Advance salary and Arrears of salary are chargeable to tax on receipt basis only.

Allowances

Allowance is generally defined as a fixed quantity of money or other substance given regularly in addition to salary for the purpose of meeting some particular requirement connected with the services rendered by the employee or as compensation for unusual conditions of that service.

- Dearness Allowance – It is always Taxable.

- City Compensatory Allowance – It is always Taxable.

- House Rent Allowance

Exemption In Respect Of House Rent allowance is regulated by rule 2A. The least of the three given below is Exempt from Tax.

| 1 | An Amount Equal to 50 % of Salary. Where Residential House in situated at Bombay, Calcutta, Delhi or Madras and An Amount Equal to 40 % of Salary where Residential House is situated at any Other Place. |

| 2 | House Rent Allowance Received by The Employee in Respect of The Period during which Rental Accommodation is Occupied by the Employee during the Previous Year. |

| 3 | The Excess of Rent Paid over 10 % of Salary. |

4. Special allowances prescribed as exempt under section 10(14) – In the cases given below the amount of exemption under section 10(14) is :–

i. The amount of the allowance ; or

ii. The amount utilized for the specific purpose for which allowance is given.

Whichever is lower.

For e.g.

- Travelling Allowance

- Conveyance Allowance

- Daily Allowance

5. When exemption does not depend upon expenditure –

- the amount of allowance ; or

- the amount specified in rule 2BB,

Whichever is lower.

Others:

| Name of allowance | Exemption as specified in rule 2BB |

| Children education allowance | The amount exempt is limited to Rs. 100 per month per child up to a maximum of two children. |

| Hostel expenditure allowance | It is exempt from tax to the extent of Rs. 300 per month per child up to a maximum of two children. |

| Transport allowance | It is exempt up to Rs. 800 per month (Rs. 1,600 per month in the case of an employee who is blind or orthopedically handicapped) |

TERMINAL BENEFITS

1. Gratuity [Sec.10(10)] – Gratuity is a retirement benefit. It is generally payable at the time of cessation of employment and on the basis of duration of service. Tax treatment of gratuity is given below:

2. PENSION [SEC. 17(1)(ii)] – Pension is chargeable to tax as follows :-

3. Annuity [Sec. 17(1)(ii)] – An annuity payable by a present employer is taxable as salary even if it is paid voluntarily without any contractual obligation of the employer. An annuity received from an ex-employer is taxed as profit in lieu of salary.

3. Annuity [Sec. 17(1)(ii)] – An annuity payable by a present employer is taxable as salary even if it is paid voluntarily without any contractual obligation of the employer. An annuity received from an ex-employer is taxed as profit in lieu of salary.

4. Retrenchment compensation [Sec. 10(10B)] – Compensation received by a workman at the time of retrenchment is exempt from tax to the extent of the lower of the following:

a. an amount calculated in accordance with the provisions of sec. 25F(b) of the Industrial Disputes Act, 1947; or

b. such amount as notified by the Government (i.e., Rs, 5, 00, 000); or

c. the amount received.

5. Compensation received at the time of Voluntary Retirement [sec.10 (10C)] – Compensation received at the time of voluntary retirement is exempt from tax, subject to certain conditions. Maximum amount of exemption is Rs. 500000.

Provident Fund

Provident Fund Scheme is a welfare scheme for the benefit of employees. The employee contributes certain sum to this fund every month and the employer also contributes certain sum to the provident fund in employees A/c. the employers contribution to the extent of 12% is not chargeable to tax.

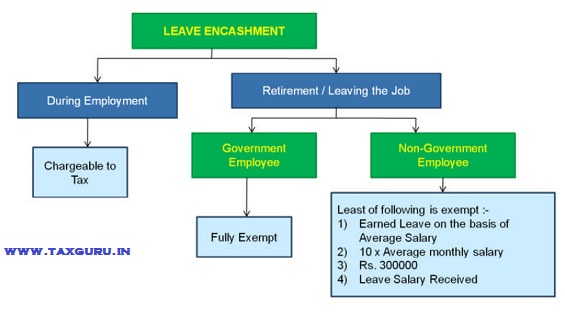

LEAVE SALARY

Encashment of leave by surrendering leave standing to one’s credit is known as “leave salary”.

Deductions Admissible in Computing Income under head ‘SALARIES’

Deductions Admissible in Computing Income under head ‘SALARIES’

1. Employment Tax / Professional Tax [Sec.16(iii)]: Any sum paid by assessee on account of a tax on employment within the meaning of Article 276(2). Under the said article employment tax cannot exceed Rs. 2500 p.a.

Relief in respect of Advance or Arrears of Salary u/s 89

When an assessee is in receipt of a sum in the nature of salary, being paid in arrears or in advance, due to which his total income is assessed at a rate higher than that at which it would otherwise have been assessed, Relief is granted on an application made by the assessee to the assessing officer.

Income From House Property

Basis of Charge

- The basis of charge of income under the head ‘income from house property’ is the Annual Value of the property.

- Income from house property is charged to tax on Notional Basis, as generally tax is not on receipt of income but on the inherent potential of the house property to generate income.

Conditions to be Satisfied

1. The property must consist of buildings or lands appurtenant to such buildings.

2. The assessee must be the owner of such house property.

3. The property should not be used by the owner thereof for the purpose of any business or profession carried on by him, the profits of which are chargeable to tax.

- In case of Self-occupied House Property Net Annual Value is always Zero.

- Since NAV is zero, the municipal taxes paid by the owner of the house are not deductible.

Deduction Admissible u/s 24

i. Statutory deduction :- 30% of Annual Value (i.e.30% of NAV)

ii. Interest payable on capital borrowed for acquisition, construction, repair, renewal or reconstruction of house property :- Actual amount of interest for the year on accrual basis plus 1/5th of the interest, if any, pertaining to the pre-acquisition or pre-construction period.

Deduction for Interest on Capital Borrowed in case of SOP

Maximum limit of deduction in respect of interest on capital borrowed in case of a Self-occupied property whose annual value is assessed at NIL, is Rs. 1,50,000

| CASE | MAXIMUM DEDUCTION |

| Interest on capital borrowed on or after 1-4-1999 for acquisition or construction of house | 1,50,000 |

| In any other case | 30,000 |

Income From Other Sources

General [Section 56(1)]

Income of every kind, which is not to be excluded from the total income and not chargeable to tax under any other head, shall be chargeable under the head “Income from Other Sources”.

Specific Income [Section 56(2)]

- Dividends.

- Lottery winnings etc

- Income by way of interest on securities if not chargeable as Profits and Gains of Business or Profession

- Interest on bank deposits and loans

- Cash Gifts exceeding Rs. 50,000,

Cash Gifts

Except,

- From Relatives

- On the Marriage Occasion

- By will or heritance

- In contemplation of death of payer

- From local authority

- From Charitable Trust regtd u/s12AA

- From trust, Foundation etc u/s 10(23c)

Deductions Under Chapter VI-A

Introduction

- Deductions to be made [Section 80A] :

The total income of an assessee is to be computed after making deductions permissible u/s 80C to 80U. However, the aggregate amount of deductions cannot exceed the Gross Total Income.

- No deduction from certain (following) Incomes :

- Long term Capital Gains referred u/s 112, and Short Term Capital gains referred u/s 111A.

- Winnings from lotteries, races, etc. as referred to in section 115BB.

Deduction for Payment of Life Insurance Premia, etc., [Section 80C]

Deduction under this section is allowed as follows –

- Deduction is available only in respect of ‘specified sums’ actually paid or deposited during the previous year (sum not actually paid and outstanding is not allowed)

- Specified sums must have been paid/deposited by an Individual or HUF; and

- The total amount of deduction under this section is subject to a maximum limit of Rs.1,50,000

Investment Options under Section 80C

- PPF

- NSC’s

- LIP Payment

- Children’s Tuition Fee Payment

- Principal Repayments on Loan for purchase of house property

- ULIPS, ELSS; etc.

- 5-year Deposit of Post Office

- Notified Pension fund, Bonds of NABARD, Deposit Scheme, Mutual Fund or UTI .,etc;

Contribution to Certain Pension Funds [Section 80CCC]

– Amount paid or deposited by individual in the previous year –

- out of his income chargeable to tax

- to effect or keep in force a contract for any annuity plan of LIC or any other insurer

- for receiving pension from the fund referred to in section 10(23AAB).

– Quantum of Deduction: Deduction shall be allowed to the extent of lower of the following –

- Amount so paid or deposited; or

- 1,00,000

Contribution to Pension Account [Sec. 80CCD]

Deduction to the Extent: –

| Maximum 10% of Salary (In case of employment) |

| Maximum 10% of Gross Total Income (In case of Self-employment) |

| Rs.100,000/- |

Aggregate Limit u/s 80C, 80CCC & 80CCD

The aggregate amount of deductions under section 80C, section 80CCC and section 80CCD shall not, in any case, exceed Rs.1,50,000.

Deduction In Respect Of Health Insurance Premia [Sec. 80D]

- Deduction is available upto Rs. 20,000/- for Senior Citizens

- 15,000 in other cases for insurance of self, spouse and dependent children.

- Additionally 20,000/- if parents are senior citizens and 15,000/- in other cases

- So Total limit summing to Rs.40,000/- and within it Rs.5,000 limit of preventive health Check-up

Maintenance of A Dependant Being Person With Disability [Section 80DD]

Deduction is available in respect of –

- expenditure incurred for medical / treatment / nursing / training/ rehabilitation, or

- Amount paid under scheme LIC / UTI other insurer approved by CBDT for maintenance, of a “dependant”, being a person with disability.

Deduction shall be allowed to the extent of –

- 50,000 (Rs. 1,00,000 in case of dependant suffering with severe disability), irrespective of expenditure incurred or sum paid.

Medical Expenditure on self or Dependent Relative, etc. [Sec. 80DDB]

Deduction is available in respect of sum actually paid during previous year for medical treatment of prescribed disease or ailment for the following –

- In case of individual: himself or his spouse, children, parents, brothers and sisters,

- In case of HUF: its member(s),

- Dependant mainly on such individual or HUF for his support and maintenance.

Deduction shall be available to the extent of lower of the following –

- sum actually paid; or

- 40,000 (Rs. 60,000 in case of a senior citizen).

Deduction in respect of Interest on Loan taken for Higher Education [Sec.80E]

- Deduction is available in respect of sum paid by way of interest on loan taken –

- for his higher education, or

- for the higher education of his relative.

- 100% of the amount of interest on such loan Deduction will be admissible.

Deduction in respect of Donations [Section 80G]

- Deductions are eligible for deduction upto either 100% or 50% with or without restriction.

- There is specified list for each of the four categories.

- If donation is given in the form of cash for amount over Rs. 10,000 then deduction is not available.

Deductions in respect of House Rent [Sec.80GG]

- Rent actually paid for any furnished or unfurnished residential accommodation occupied by the Individual, who is not in receipt of any House Rent Allowance (HRA).

- Should not have Self-Occupied property.

- The deduction shall be allowed to the extent of least of the following –

- 2,000 per month;

- 25% of adjusted total income;

- Rent paid less 10% of adjusted Total Income.

Deduction on Savings Bank Account [Sec.80TTA]

- Deduction of Rs. 10,000 in respect of Interest on deposits in Savings account is available.

- No time deposits or fixed deposits are eligible for deduction

- Savings account can be with a Bank, co-operative society or post office.

Deduction in respect of person with Disability [Section 80U]

- Individual who suffers from a physical disability (including blindness) or mental retardation is eligible for deductions of Rs.50,000

- In case of severe disability, Rs.100,000 is allowable.

- Certificate from Govt. Doctor is necessary.

Respected Sir,

I want to thank you for the article it is awesome & very much informative as it has covered all the aspects of Income & their respective deductions available to us according to I.T Act 1961.

Thanks once again.

SIR i am not getting transport allowance from my employer, shall i get transport allowance exemption of Rs1600/- pm

Why the rate of tax of salaried persons and business persons are same. Salaried persons are paying tax on all amount received by them and pay tax on every transaction they made thereafter. Even if they made FD in bank again TDS is deducted on interest. Whereas a business person is showing amount as INCOME after meeting out all expenses in other words his profit is his income. even his personal expanses are also met out before declaring an amount as income. Earlier salaried person were having cushion of standard deduction but it was withdrawn.???????????

KasiviswanathanRam Says:

09/02/2015 At 5:10 PM

Really Very informative Article which explains the basic details of Income Tax Act applicable on INCOME Under Head : Salary / Pension / House Property / Other Sources and is to be aware of by all Assessee, Step By Step explanation is very much appreciable.

– See more at: https://taxguru.in/income-tax/income-tax-provisions-individual-salaried-ay-201516.html#comment-1851301

Shrirang Kapadia Says:

08/27/2015 At 8:30 PM

Very helpful article for freshers nd also for students. Even students can complete their revision from this article before their exam.

Thanking you

– See more at: https://taxguru.in/income-tax/income-tax-provisions-individual-salaried-ay-201516.html#comment-1851301

Vaidyanathan Says:

08/27/2015 At 11:41 AM

An excellent article covering all main points.

– See more at: https://taxguru.in/income-tax/income-tax-provisions-individual-salaried-ay-201516.html#comment-1851301

S.Satya Manoj Says:

08/27/2015 At 10:34 AM

Nice article, covered all the sections with the main points in each section.

– See more at: https://taxguru.in/income-tax/income-tax-provisions-individual-salaried-ay-201516.html#comment-1851301

Thank you all for such appreciation and good words.

These will motivate me to share more articles like these.

Taxation does not retire with retirement of an employee, it is always applicable till the time he earns Income. After retirement employee receives income in the form of pension and other benefits like Gratuity etc. In this article we have explained the taxability of pension received by a retired individual.

SS Prasad Says:

08/27/2015 At 11:09 AM

Sir

I am employed at state agricultural University in U. P. I shall be getting pension. Please clarify commuted & noncommuted pension. What exemption on income tax I shall be getting on pension.

Thanking you

ss prasad

– See more at: https://taxguru.in/income-tax/income-tax-provisions-individual-salaried-ay-201516.html#comment-1851299

Thanks SS Prasad for sparing time to read my article.Pension is broadly covered in above article. Then also for additional guidance I providing you a short brief on it. Hope it is useful to you.

In taxation, pension is classified in 2 types:

Commuted Pension which is lump sum payment received at the time of retirement

Uncommuted pension which is monthly pension received by employee after retirement.

Taxability on these 2 types of pension is discussed below:

Commuted Pension:-

Commuted Pension received by Government employees is not taxable.

Non government employees, who receive Gratuity along with Commuted Pension, get a tax exemption of up to 1/3rd of the total amount so commuted.

Non government employees who do not receive Gratuity, exemption amount from tax is 1/2 of the total Commuted Pension received.

Uncommuted Pension:-

Monthly pension received by an employee is taxable.

Uncommuted Pension received from UNO by an employee or his family is not taxable.

Family pension received by the family of armed force employee after his death is exempted from tax.

Family pension received after the death of the employee is taxable as ‘Income from Other Sources’. 1/3rd of the pension amount or Rs. 15,000/-, whichever is lower, is exempt from tax.

RONALD Says:

08/27/2015 At 12:23 PM

50,000 additional deduction under 80 CCD (1b) for NPS is not covered.

– See more at: https://taxguru.in/income-tax/income-tax-provisions-individual-salaried-ay-201516.html#comment-1851298

Thanks Ronald for sparing time to read my article. Your suggestion is valuable to me. I will keep that in mind for next time.

Jyothi Says:

08/27/2015 At 1:55 PM

I have queries:

1. if an individual has any taxable income, then the tax is to be paid before 31st of march as advance tax ? or it can be paid at time of filing of return (31.07. ) without any penalty ?

2. interest is paid for the loan taken for the purchase of land, can it be deducted ?

– See more at: https://taxguru.in/income-tax/income-tax-provisions-individual-salaried-ay-201516.html#comment-1851297

Your second query is not clear. Please describe in detail.

Jyothi Says:

08/27/2015 At 1:55 PM

I have queries:

1. if an individual has any taxable income, then the tax is to be paid before 31st of march as advance tax ? or it can be paid at time of filing of return (31.07. ) without any penalty ?

2. interest is paid for the loan taken for the purchase of land, can it be deducted ?

– See more at: https://taxguru.in/income-tax/income-tax-provisions-individual-salaried-ay-201516.html#comment-1851295

First of all thanks jyoti for sparing time to read my article.

Secondly your queries,I will try to answer to the best of my knowledge and Exprience.

1)Tax can be paid with penalty before due date which in this case 31/07 but interest has to be paid along with it under Section 234.

and even u can pay tax after 31/07 without penaly in most cases IT department does not demand for it.

Ya but if tax paid is after 1 year after FY for which return is to submitted. Then it attracts Penalty of Rs 5000.

Sanjeev Says:

08/27/2015 At 9:42 PM

Contribution of employer under section 80 ccd2 not covered

– See more at: https://taxguru.in/income-tax/income-tax-provisions-individual-salaried-ay-201516.html#comment-1851294

Will be kept in mind for future reference. your suggestions are valuable to me.

CMA D. Bandyopadhyay Says:

08/28/2015 At 10:52 AM

Exemption limit for Transport Allowance u/s 10(14) has been increased to Rs. 1,600 p.m. w.e.f. 01.04.2015 (Rs. 3,200 p.m. for blind or other specified employees w.e.f. 01.04.2015) irrespective of actual amount incurred.

– See more at: https://taxguru.in/income-tax/income-tax-provisions-individual-salaried-ay-201516.html#comment-1851292

Will be considered in future. Thanks for valuable suggestion. I would incorporate it next time.

Vivek Ram Says:

08/31/2015 At 8:27 AM

I am preparing for competitive exam. Along with I am also giving tutions/coaching and earning around Rs 4.5 laks. Which ITR form I need to fill.

– See more at: https://taxguru.in/income-tax/income-tax-provisions-individual-salaried-ay-201516.html#comment-1851290

Vivek you can File ITR 1 only Income from other sources showing Tution Income Head in it.

BIKASH KUMAR Says:

09/01/2015 At 7:59 PM

I AM SUBMITTED ITR FOR AY-15-16 AND MY IN HAND SALARY IS 3.00LAC PER ANNUM, BUT THERE IS NOT DONE ANY DEDUCTION SO KINDLY SUGGEST ME HOW CAN I FILL ITR FOR COMING YEAR

– See more at: https://taxguru.in/income-tax/income-tax-provisions-individual-salaried-ay-201516.html#sthash.2lDYayE2.dpuf

For the same i can suggest u can make investments in many fields mentioned in Section 80C, i.e. Insurance, NSC, Tax Free Bonds. Or under 80 D medical insurance premium or 80G Donation. As mentioned in my article.

great article

Really Very informative Article which explains the basic details of Income Tax Act applicable on INCOME Under Head : Salary / Pension / House Property / Other Sources and is to be aware of by all Assessee, Step By Step explanation is very much appreciable.

I AM SUBMITTED ITR FOR AY-15-16 AND MY IN HAND SALARY IS 3.00LAC PER ANNUM, BUT THERE IS NOT DONE ANY DEDUCTION SO KINDLY SUGGEST ME HOW CAN I FILL ITR FOR COMING YEAR

I am preparing for competitive exam. Along with I am also giving tutions/coaching and earning around Rs 4.5 laks. Which ITR form I need to fill.

Exemption limit for Transport Allowance u/s 10(14) has been increased to Rs. 1,600 p.m. w.e.f. 01.04.2015 (Rs. 3,200 p.m. for blind or other specified employees w.e.f. 01.04.2015) irrespective of actual amount incurred.

Contribution of employer under section 80 ccd2 not covered

Very helpful article for freshers nd also for students. Even students can complete their revision from this article before their exam.

Thanking you

I have queries:

1. if an individual has any taxable income, then the tax is to be paid before 31st of march as advance tax ? or it can be paid at time of filing of return (31.07. ) without any penalty ?

2. interest is paid for the loan taken for the purchase of land, can it be deducted ?

50,000 additional deduction under 80 CCD (1b) for NPS is not covered.

An excellent article covering all main points.

Sir

I am employed at state agricultural University in U. P. I shall be getting pension. Please clarify commuted & noncommuted pension. What exemption on income tax I shall be getting on pension.

Thanking you

ss prasad

Nice article, covered all the sections with the main points in each section.