The section 201(1) of Income Tax Act, 1961 talks about when assesse is not treated as assesse in default. That is, when he had complied certain conditions and furnished the Form 26A. Let’s see what this form is and how it is furnished.

Legal Aspects –

- Analysis of Section 201(1) read with its proviso and Section 40(a)(ia) of the Income Tax Act, 1961 –

Section 201(1) of Income Tax Act states that any person liable to deduct TDS on the income distributed, makes default in the deduction and/or payment of TDS, shall be treated “assesse in default” and penalty U/s 221 of Income Tax Act shall be payable by such assesse. However, the assesse would not be deemed to be an assesse in default if –

- He has furnished his return of income under section 139 of the Act;

- has considered such sum for computing income in such return of income;

- has paid the tax due on the income declared by him in such return of income;

- and the person has furnished a form as prescribed in Rule 31ACB of Income Tax Rules to this effect from an accountant, i.e., chartered accountant.

In case of non-deduction or non-payment of tax deducted at source (TDS) from certain payments made to residents, the entire amount of expenditure on which tax was deductible is disallowed under section 40(a)(ia) for the purposes of computing income under the head “Profits and gains of business or profession” the disallowance shall be restricted to 30% of the amount of expenditure on which TDS is not deducted.

However, when the assesse furnishes Form 26A as prescribed under proviso of section 201(1), he would not be considered as assesse in default. The expenditure would be disallowed that year, and will be allowed in the year when Form 26A is furnished.

- Analysis of Rule 31ACB of Income Tax Rules – Form for furnishing certificate of accountant under the first proviso to sub-section (1) of section 201

This rule provides that the certificate so furnished should be in prescribed Form 26A. Furthermore, the Central Board of Direct Taxes (CBDT) has issued Notification No. 11/2016 for prescribing the procedure for electronic filing of Form 26A for short/non deduction of tax at source.

Procedural Aspects –

- Procedure at TRACES of Deductor –

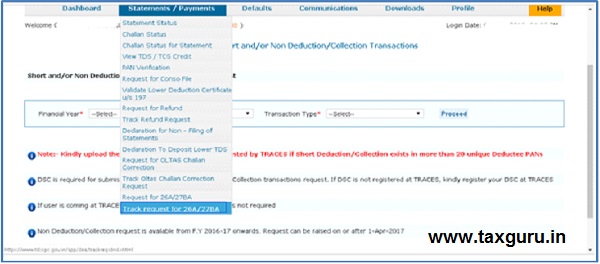

1. The deductor has to go to the TRACES portal and submit a request for Form 26A. Further, deductor needs to enter the details of non-deduction transaction.

–

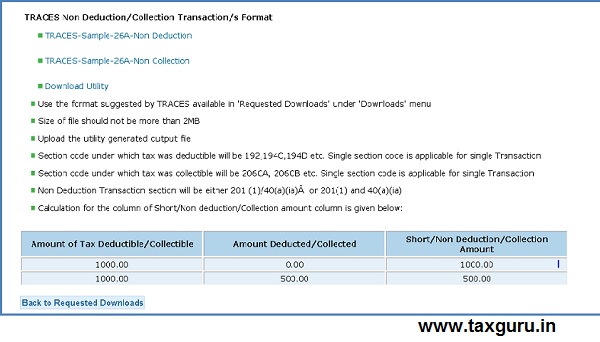

2. For Submitting the details of the transaction shall be uploaded in a .nzip file format.

- Procedure for generating .nzip file

The format shall be generated after downloding a utility as follows –

1. Go to Downloads > Requested Downloads.

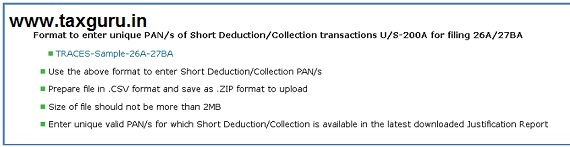

2. Enter the captcha and scroll down unless you see TRACES Sample – 26A – 27BA. Traces provides a sample format of .csv (excel file) to be feeded into the utility.

3. Click on download utilty to download the utility and also download TRACES – Sample – 26A – Non Deduction to download the .csv file.

4. The .csv file will be in following format. Enter the details and save the file in the same format.

5. Open the utility and enter the details and also attach the .csv

6. Click on proceed. It will display the common error. Click on OK and an .nzip file will be generated.

7. After generating this .nzip file, upload it on the TRACES.

- Procedure for uploading file to TRACES

1. Click on Track Request for 26A/ 27BA. Click on upload file and upload the .nzip file. DSC of authorized person of the deductor will be required to upload.

2. Status will be changed as Submitted. Once the status is changed to sent to efiling, deductor can proceed further from e – filing

- Procedure at e-filing portal of Deductor –

1. Go on e-filing Portal. Login as deductor.

2. Select e-file > Submit and View Form 26A / 27BA.

3. Click on assign CA and enter the membership number of the CA who is certifying Annexure A of form 26A.

4. CA will be assigned. This request of Form 26A will be displayed in e-filing portal of the CA.

- Procedure at E-filing portal of CA –

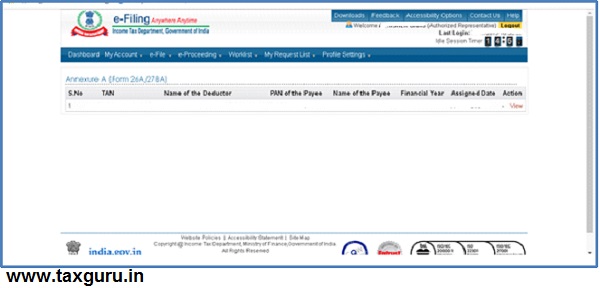

1. The CA has to login into e-filing. Go on Worklist> For your Action> Annexure A of form 26A/27BA.

2. A dialog box will appear. CA will find the name of Deductor and Payee in whose respect the Form 26A is furnished.

3. Click on submit and follow the steps as displayed for submission of Annexure A.

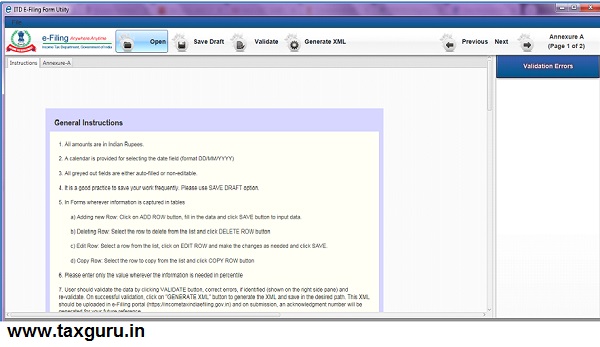

4. At first, download the utility for generating xml to be uploaded.

5. Open the utility and fill the information as required.

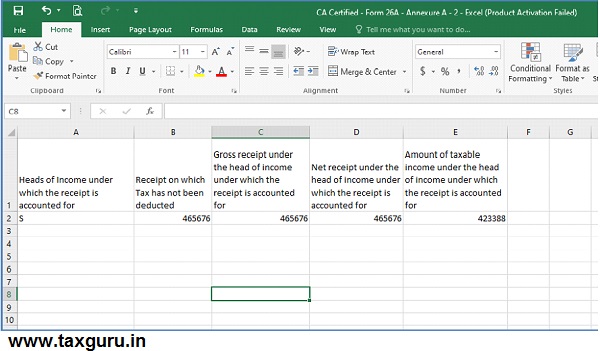

6. CA needs to import two .csv files for entering the details of no deduction.

7. This format of .csv can be downloaded from the steps displayed in efiling portal of CA.

8. The two files to be imported will be as follows. Data has to be filed by CA in few columns.

–

9. Import the files, feed the information and generate the xml.

10. Upload this xml and check the status. The status should be Accepted for successful submission of Annexure A.

- Procedure at TRACES portal of Deductor –

1. Login into TRACES portal of deductor.

2. Click on Track request of Form 26A/27BA.

3. Check the status. The status can be as following –

4. After successful processing, a demand of interest may arise.

5. Here, the work of Deductor ends. Department may or may not throw a demand regarding to interest on delayed payment, which deductor will pay.

Although we know what is assesse in default, but we are not aware about the Form 26A. There are many instances The Income Tax Department has given this tremendous option to help the assesse in reducing the unnecessary penalties which otherwise would have been charged. The process may look complicated, but is not and help an assesse to save his hard-earned income which he would pay in a demand which was not even needed.

IS THE ASSESSEE REQUIRED TO FILE HIS/HER ITR ON OR BEFORE DUEDATE FOR FURNISHING FORM 26A

What if the short deduction was before 2016. how to correct. because short deduction utility from traces not accepting year before 2016.

It should be

Provided that any person, including the principal officer of a company, who fails to deduct the whole or any part of the tax in accordance with the provisions of this Chapter on the sum paid to a payee or on the sum credited to the account of a payee shall not be deemed to be an assessee in default in respect of such tax if such payee—

(i) has furnished his return of income under section 139;

(ii) has taken into account such sum for computing income in such return of income; and

(iii) has paid the tax due on the income declared by him in such return of income,

and the person furnishes a certificate to this effect from an accountant in such form as may be prescribed:

Please refer first paragraph of the article. It appears that the conditions mentioned for immunity from being a defaulter are incorrect. Who has to file ITR, declare income/pay tax and to get a certificate from CA are vague. I believe that it is not “HE” (Payer assessee) but the payee who should file ITR and pay tax and it is the payer to get the certificate of CA.

Please correct me if I am wrong.