NEW PROCEDURE AND FAQs TO FILE AN APPEAL BEFORE CIT (A)

As you are aware, Income Tax Scrutiny cases related to A.Y-2016-17 has been over on 31st December. Some assessees are happy with the decision given by Assessing officer and some are not happy or not satisfied by their decision. To deal with such situation, Income Tax Law provide another opportunity to assessee that, if they are not satisfied by the decision given by Assessing Officer related to their Income Tax Liability they can approach higher authority known as CIT (A) to represent their case again and if eligible, then get relief from CIT (A).

Some of the Common FAQ are illustrated below:

1. Whether all orders passed by Assessing Officer are appealable before CIT (A)?

No, not all orders are appealable but only those Orders specified under Section 246A can be appealed upon by filing Form 35 online.

2. Time Period within which Appeal can be filed before CIT (A).

The assessee has to file Appeal within 30 days from the date of Receipt of Order.

3. Whether Appeal can be filed after 30 Days?

Income Tax Law has provided a period of 30 days for filing Appeal before CIT (A). However, in exceptional cases where assessee has reasonable cause, due to which he is not able to file appeal within prescribed time, then CIT (A) has power to condone the delay.

4. What is the maximum fees payable at time of Filing Appeal before CIT (A).

Maximum fee payable at time of filing Appeal is Rs.1000/- Only.

Process to File Form -35 online

1. Login in your Account using User credentials.

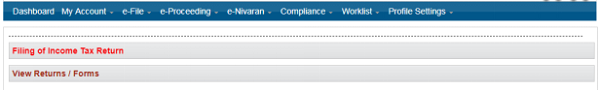

2. Go to E-File Link and Choose Income Tax Forms

3. Choose Form No- 35 –Appeal to Commissioner Appeals

4. Now start Filing Form No 35 Online. You will get some details Pre-filed and fill remaining editable details properly.

4. Now start Filing Form No 35 Online. You will get some details Pre-filed and fill remaining editable details properly.

5. Now provide details of the order to be appealed against.

6. Provide details related to Filed ITR, selected for Scrutiny and against which Appeal is to be filed.

6. Provide details related to Filed ITR, selected for Scrutiny and against which Appeal is to be filed.

7. Now Provide details related to Statements of facts, Grounds of Appeal and Additional Evidence related information which is not made available at time of Assessment. This is very crucial part of Appeal. Adequate attention needs to be paid while preparing Facts and Grounds of Appeal.These are the points on which, your case will proceed further. Each matter on which there is controversy/ matter of disputes between assessee and Assessing Officer needs to be explained properly. All facts should be adequately drawn because in case of appeal before ITAT also these Grounds of Appeal play a very crucial role.

8. Now provide details, whether appeal is filed within time limit or there is any delay in filing Appeal. As explained earlier, appeal is to be filed within 30 days from the date of receipt of order however; CIT (A) has power to condone the delay in filing appeal within prescribed time period. In case of delay, please provide the reasons of delay. The reason should be genuine.

9. Now provide details related to Appeal Fees paid and address on which further communication can be done and save the appeal.

10. After above process, submit the Form 35 and you will get the Acknowledgement number of this Submission.

Disclaimer: The whole appeal process depends upon the facts and circumstances of the case which vary with respect to each assessee. Before filing such appeal application, professional’s advice is strictly advisable, so as to draw Grounds of appeal in the most suitable manner.

This article is for the purpose of information and shall not be treated as solicitation in any manner and for any other purpose whatsoever. It shall not be uses as legal opinion and not to be used for rendering any professional advice. This article is written on the basis of author’s person experience gained during the Appeal Proceedings. Adequate attention has been given to avoid any clerical/arithmetical error, however; if it still persist kindly intimate us to avoid such error for the benefits of others readers.

The Author can be reached at mail –shivsharma786@gmail.com and Mobile/Whatsapp – 9911303737

(CA Shiv Kumar Sharma)

Sir,

I. I purchased a flat in Delhi and sold the same after 33 years. (1984/2017).Purchased price Rs.163000 and sold for Rs.75 lakhs. CG Rs.71 lakhs approx resulting to Tax of Approx. 16 lakhs. I disagreed to the demand. NO REPLY FROM AO. This was in May 2019.

ii. Same year in AY 2018 purchased another flat for Rs. 79 Lakhs approx.

I filed the return AO did not take into account my return under CG. B.10(1)(a)(h). I did not follow as my CA advised I will get refund and it takes more than expected time.

Now for AY 2023/24 my refund, I am advised this will be adjusted against demand under 245.

Now, can I file an appeal with CIT(A).

I would be grateful for your advice.

Thanks and regards.

Sir,

under 280 challan which head (300 or 400) we should pay the 20% disputed amount. (self assessment or regular assessment)

CAN WEALTH TAX APPEAL ALSO BE FILED IN FORM 35

what is the position if charitable trust does not get registered

Sir thanks for info. Sir what if we lose on apeal and u don’t have enough money to pay the order issued. It is in case of indiviual tax payer.

Thanks Sharma Ji.