INTRODUCTION

The increasing participation of multinational groups in economic activities in the country has given rise to new and complex issues emerging from transactions entered into between two or more enterprises belonging to the same multinational group. The profits derived by such enterprises carrying on business in India can be controlled by the multinational group, by manipulating the prices charged and paid in such intra-group transactions, there-by, leading to erosion of tax revenues.

TRANSFER PRICING IN INDIA

To curb the tax erosion scenarios in India, the Government has come up with various measures from time to time. Such measures include introduction of General Anti-Avoidance Rule (“GAAR”) and Specific Anti-Avoidance Rule (“SAAR”). One of such SAAR introduced by the Government is Transfer pricing provisions.

With a view to provide a statutory framework which can lead to computation of reasonable, fair and equitable profits and tax in India, in the case of such multinational enterprises, provisions were introduced in the Income Tax Act (hereinafter referred as “the act”) in the year 2001. These provisions relate computation of income from international transactions having regard to the arms-length price, meaning of associated enterprise, meaning of international transaction, determination of arm’s length price, keeping and maintaining of information and documents by persons entering into international transactions, furnishing of a report from an accountant by persons entering into such transactions.

The concept of revolves around the concept of “international transactions” or “specified domestic transactions” and “associated enterprises”. In this digital economy, it would be not wrong to say that geographical boundaries can put a hold on anyone from doing their business across the globe. Todays business exposure can be extended to any individuals, partnership firms, HUF’s or corporate entities anywhere in the world. Once, a person is clear with what constitute international or specified domestic transactions, it becomes pertinent to understand who are termed as ASSOCAITED ENTERPRISES. Income tax act has very well listed out the guidelines to define the relationship between two entities to determine if they should be treated as associated enterprises or not. Here is a small effort to understand and analyse the same so that all the professionals can easily apply these provisions while preparing transfer pricing reports.

ASSOCIATED ENTERPRISES – SECTION 92A OF THE ACT

SECTION 92A OF THE ACT IS ENUMERATED BELOW FOR EASE OF REFERENCE:

“Meaning of associated enterprise.

92A. (1) For the purposes of this section and sections 92, 92B, 92C, 92D, 92E and 92F, “associated enterprise”, in relation to another enterprise, means an enterprise—

(a) which participates, directly or indirectly, or through one or more intermediaries, in the management or control or capital of the other enterprise; or

(b) in respect of which one or more persons who participate, directly or indirectly, or through one or more intermediaries, in its management or control or capital, are the same persons who participate, directly or indirectly, or through one or more intermediaries, in the management or control or capital of the other enterprise.

(2) For the purposes of sub-section (1), two enterprises shall be deemed to be associated enterprises if, at any time during the previous year—

(a) one enterprise holds, directly or indirectly, shares carrying not less than twenty-six per cent of the voting power in the other enterprise; or

(b) any person or enterprise holds, directly or indirectly, shares carrying not less than twenty-six per cent of the voting power in each of such enterprises; or

(c) a loan advanced by one enterprise to the other enterprise constitutes not less than fifty-one per cent of the book value of the total assets of the other enterprise; or

(d) one enterprise guarantees not less than ten per cent of the total borrowings of the other enterprise; or

(e) more than half of the board of directors or members of the governing board, or one or more executive directors or executive members of the governing board of one enterprise, are appointed by the other enterprise; or

(f) more than half of the directors or members of the governing board, or one or more of the executive directors or members of the governing board, of each of the two enterprises are appointed by the same person or persons; or

(g) the manufacture or processing of goods or articles or business carried out by one enterprise is wholly dependent on the use of know-how, patents, copyrights, trade-marks, licences, franchises or any other business or commercial rights of similar nature, or any data, documentation, drawing or specification relating to any patent, invention, model, design, secret formula or process, of which the other enterprise is the owner or in respect of which the other enterprise has exclusive rights; or

(h) ninety per cent or more of the raw materials and consumables required for the manufacture or processing of goods or articles carried out by one enterprise, are supplied by the other enterprise, or by persons specified by the other enterprise, and the prices and other conditions relating to the supply are influenced by such other enterprise; or

(i) the goods or articles manufactured or processed by one enterprise, are sold to the other enterprise or to persons specified by the other enterprise, and the prices and other conditions relating thereto are influenced by such other enterprise; or

(j) where one enterprise is controlled by an individual, the other enterprise is also controlled by such individual or his relative or jointly by such individual and relative of such individual; or

(k) where one enterprise is controlled by a Hindu undivided family, the other enterprise is controlled by a member of such Hindu undivided family or by a relative of a member of such Hindu undivided family or jointly by such member and his relative; or

(l) where one enterprise is a firm, association of persons or body of individuals, the other enterprise holds not less than ten per cent interest in such firm, association of persons or body of individuals; or

(m) there exists between the two enterprises, any relationship of mutual interest, as may be prescribed.”

Ambiguity in the above section

Section 92A (1) of the act provides that two enterprises shall be treated as Associated enterprises only when one of the enterprises participates in “management, control or capital” of the other enterprise.

Section 92A (2) of the act starts with the term- “For the purposes of sub-section (1), two enterprises shall be deemed to be associated enterprises, if…”. Then the sub-section gives various criterion on which two enterprises shall be deemed to be associated enterprises.

From the reading of section 92A (1) of the act it can be said that this section is complete in itself which means that section 92A (2) is merely illustrative and elaborates the meaning of 92A (1) of the act. However, attention is drawn to section 92A (2) which starts as follows: “For the purposes of sub-section (1)”. Thus, it can be said that Section 92A (2) defines the ambit of Section 92A (1) and sub-section (2) is not exhaustive and not merely illustrative.

There were lot of ambiguities with respect to the same and hence the Government came up with clarification w.r.t the above in the Finance Bill 2002 as enumerated below:

“The existing provisions contained in section 92A of the Income-tax Act to provide as to when two enterprises shall be deemed to be associated enterprises. It is proposed to amend subsection (2) of the said section to clarify that the mere fact of participation by one enterprise in the management or control or capital of the other enterprise, or the participation of one or more persons in the management or control or capital of both the enterprises shall not make them associated enterprises, unless the criteria specified in sub-section (2) are fulfilled.”

Due to ambiguity, the same is a matter of litigation for course of time. Some of the judicial pronouncements that throw insight on the above subject matter have been studied and analysed. Summary of the same is provided below1:

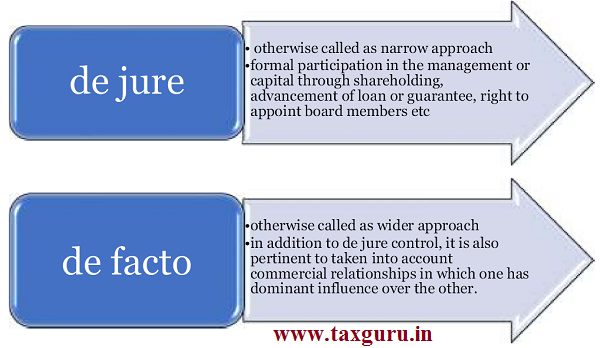

Here it is very important to understand the meaning of “de jure” and “de facto”.

Here it is very important to understand the meaning of “de jure” and “de facto”.

Thus, if any one or more of the clauses of 92A (2) is not satisfied, any amount of de fac

to or de jure control will not make units associated enterprises within the meaning of Section 92A of the Income Tax Act and transfer pricing provisions shall not be attracted.

IN-DEPTH ANALYSIS OF SECTION 92A (1)

Two enterprises are said to be Associated enterprises in terms of Section 92A(1), if:

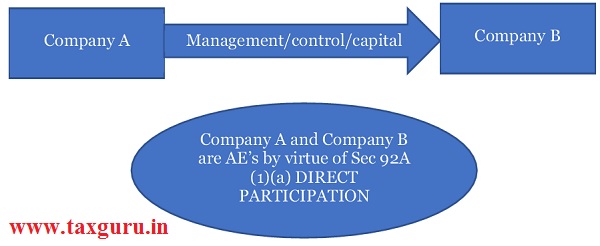

Section 92A(1)(a) – “…………….. which participates, directly or indirectly, or through one or more intermediaries, in the management or control or capital of the other enterprise…” – LINEAR STRUCTURE

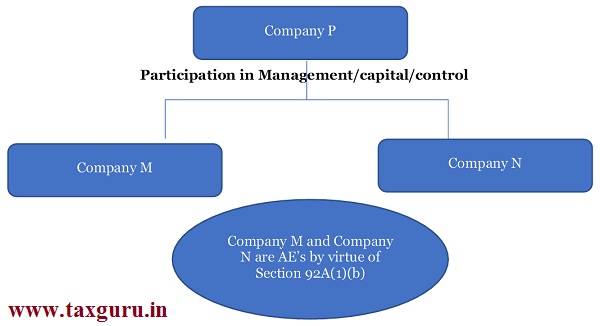

Section 92A(1)(b) – “……………. in respect of which one or more persons who participate, directly or indirectly, or through one or more intermediaries, in its management or control or capital, are the same persons who participate, directly or indirectly, or through one or more intermediaries, in the management or control or capital of the other enterprise…….. ” –

LATERAL STRUCTURE

Participation in Management/capital/control

Here if,

- If same persons of company P participate directly in company M and indirectly in Company N or

- If persons of Company P participate directly in both Company M and Company N or If persons of Company P participate indirectly in both Company M and Company N or

- If persons of Company P participate in both Company M and Company N through their intermediaries

In all these scenarios, Company M and Company N are said to be Associated Enterprises by virtue of Section 92A(1)(b)

IN-DEPTH ANALYSIS OF SECTION 92A (2) – DEEMING SECTION

Section 92A (2) provides illustrative situations where in two enterprises can deemed to be considered as associated enterprises. Clause (a) to ( m) of section 92A (2) can be divided into 3 distinct segments as below2:

| Clause (a) to (d) | Clause ( e) and (f) | Clause (g) to (l) |

| This segment represents participation in capital, whether equity or loan, and includes cases involving shareholding with 26% voting power, or advancement of loans or guarantees beyond a certain threshold. | This segment represents participation in management, and refers to power of appointment of board of directors | This segment refers to situations where one enterprise has de facto control over the other enterprise, i.e., “control” other than through participation in capital or management, which may be on account of commercial relationships or personal relationships. For example, supply of 90% of the raw materials required for manufacture by one enterprise being “wholly dependent” on intellectual property held by the other etc |

Major key points brought by Revised Guidance Note on Transfer Pricing and amendment in the act by the Finance Act, 2002:

1. For every previous year, deemed associated enterprise will have to be identified afresh.

2. If at any time during the previous year any of the conditions in clauses (a) to (m) are satisfied, the enterprises will be deemed to be associated enterprises.

3. If conditions in section 92A (2) for treating enterprises as AEs are fulfilled at any time during the previous year, enterprise would be AE for the entire period and ALP has to be determined for the entire period.

4. In clauses (c) to (m) of section 92A(2),the words ‘directly’ or ‘indirectly’ have not been used which indicates the intention of legislature that not envisaged and hence direct relationship between two enterprises are relevant to determine whether they are associate enterprises or not.

Clause by clause analysis of Section 92A (2)

Two enterprises shall be deemed to be associated enterprises, if at any point during the previous year, if any of the following conditions are satisfied:

92A (2) (a): one enterprise holds, directly or indirectly, shares carrying not less than twenty-six per cent of the voting power in the other enterprise:-

Key points:

- Investment in shares shall not be less than 26% if the voting power.

- Holding can be direct or indirect

- Investee enterprise should be a company, investor enterprises could be any person

- Investment in shares should carry voting rights (eg: investment in preference share does not provide any voting rights)

Example:

- XYZ ltd of India holds 31% of voting power in ABC Inc, USA. Both these companies are AEs in terms of Sec 92A(2)(a)

- ABC plc, UK holds 27% of voting power in PQR Ltd, India. Both companies are AEs.

92A (2) (b): Any person or enterprise holds, directly or indirectly, shares carrying not less than twenty-six per cent of the voting power in each of such enterprises-:-

Key Points:

- Both the investee enterprises have to be companies.

- One person or enterprise simultaneously holds shares carrying 26% or more voting power in each of them.

- Both the enterprises need not hold any shares in each other if they have common 26% or more voting right holders.

- Shareholding may be direct or indirect.

Example:

- ABC Inc of USA holds 30% of voting power in ABC India Ltd and 34% of voting power in ABC Plc of UK.

ABC India Ltd. and ABC Plc. are AEs by virtue of section 92A(2)(b).

ABC Inc of USA and ABC India Ltd. are AEs as per section 92A(2)(a).

ABC Inc and ABC Plc. are AEs as per section 92A(2)(a).

- ABC Inc of USA holds 30% of voting power in ABC India Ltd., 34% of voting power in ABC Plc of UK and 32% of voting power in ABC Co. of Netherlands.

ABC India Ltd., ABC Plc and ABC Co. are AEs by virtue of section 92A(2)(b)

92A (2) (c): A loan advanced by one enterprise to the other enterprise constitutes not less than fifty-one per cent of the book value of the total assets of the other enterprise-:

Key Points:

- Loan must have been provided by one enterprise to another

- The loan provided should be more than 51% of book value of total assets of the other enterprises and not market value

Example:

- XYZ Limited, a recently incorporated entity, has obtained a loan of Rs 5 crores from PQR Ltd for setting up the manufacturing facility. The book value of total assets of XYZ Limited is Rs 9 crores.

The loan advanced constitutes 55.55% of the total book value of assets of XYZ Ltd and hence XYZ Ltd and PQR Ltd are considered as AEs

92A (2) (d): One enterprise guarantees not less than ten per cent of the total borrowings of the other enterprise-:

Key points:

- Guarantee should exceed 10% of the borrowings Example:

- ABC Limited, provided guarantee towards the loan taken by XYZ ltd to the extent of Rs 11crores. Total borrowings of XYZ ltd is Rs 100 crores, hence ABC Ltd and XYZ ltd are considered to be AEs

92A (2) (e): More than half of the board of directors or members of the governing board, or one or more executive directors or executive members of the governing board of one enterprise, are appointed by the other enterprise-:

Key points:

- If any of the following two conditions are satisfied, both enterprises are associated enterprises:

- One enterprise appoints more than 50% of directors or members of the Board/Governing body of the other.

- One enterprise appoints one or more executive directors/executive members of the board/governing body of the other

- If one enterprise appoints even one person as executive director/ executive member in

the Board/Governing body of the other, both enterprises are associated enterprises. - The term “governing board” would be understood in the same sense as ‘board of directors’ – i.e. a body or council that has the authority to manage the affairs of enterprise other than company. The entities in question could be artificial non-corporate bodies.

- It is the enterprise which appoints directors/executive director(s)/member(s) in the other enterprise here. One of the directors of one enterprise does not make these appointments in the other.

Example:

- If enterprise A appoints 5 directors on the Board of Enterprise B Ltd. The Board strength of enterprise B Ltd. is 9 directors. Then Enterprise A and Enterprise B Ltd. are associated enterprises.

But if enterprise A only has the power to appoint 50% or more directors in B Ltd. but does not actually exercise that power, then enterprises A and B Ltd. are not associated enterprises.

92A (2) (f): More than half of the directors or members of the governing board, or one or more of the executive directors or executive members of the governing board of each of the two enterprises are appointed by the same person or persons:-

Key Points:

- This clause is applicable where the same person has

- appointed more than one-half of the board of directors or members of the governing board; or

- appointed one or more executive directors or executive members of the governing board of two or more enterprises

- Mere right to appoint board of directors or executive directors would not make both entities as associated enterprise.

Example:

- If A ltd appoints seven out of twelve members of board of Directors of B ltd and six out of ten members of board of Directors of C ltd, then by virtue of clause f B ltd and C ltd are associated enterprises.

- If executive director of B ltd and six out of ten members of board of directors are appointed by A ltd, then also by virtue of clause f B ltd and C ltd are associated

92A (2) (g): The manufacture or processing of goods or articles or business carried out by one enterprise is wholly dependent on the use of knowhow, patents, copyrights, trade-marks, licences, franchises or any other business or commercial rights of similar nature, or any data, documentation, drawing or specification relating to any patent, invention, model, design, secret formula or process, of which the other enterprise is the owner or in respect of which the other enterprise has exclusive rights

Key Points:

- Two enterprises are deemed to be associated, if one is wholly dependent on the other for the use of know-how, patents, copyrights etc. for the manufacture or processing of goods or articles or business carried on by such enterprise.

- Such know-how, patents, copyrights etc. must be either owned by the other enterprise or the exclusive rights thereto must vest with the other enterprise

Examples:

- If an Indian enterprise is wholly dependent on the licence granted by a non-resident enterprise for manufacture or processing of goods or articles or business carried out by the Indian enterprise both enterprises shall be deemed to be associated enterprises.

- The clause will equally be applicable in case where the overseas entity is wholly dependent on the license / brand owned by the Indian entity

92A (2) (h): Ninety per cent or more of the raw materials and consumables required for the manufacture or processing of goods or articles carried out by one enterprise, are supplied by the other enterprise or by persons specified by the other enterprise, and the prices and other conditions relating to the supply are influenced by such other enterprise.

Key Points:

- Applicable mainly to manufacturing or processing of goods, hence the said criteria should be applied exclusively to raw materials and consumables used for manufacturing or processing only.

- 90% or more of the raw materials and consumables required for manufacturing or processing of goods or articles are supplied by

- The other enterprises or

- Persons specified by the other enterprise and the prices and other conditions relating to supply are influenced by the other enterprise

92A (2) (i): The goods or articles manufactured or processed by one enterprise, are sold to the other enterprise or to persons specified by the other enterprise, and the prices and other conditions relating thereto are influenced by such other enterprise

Key Points:

- Though similar to the conditions specified in clause (h) except that there are no 90% criteria in clause (i)

- This clause covers only sale of goods manufactured and processed and not sale of traded goods

Example:

- Where the goods or articles manufactured and processed by one enterprise, (say, enterprise A) are sold

- to another enterprise (say, enterprise B)

or

- sold to another enterprise (say, enterprise C) specified by enterprise B, and the prices and other conditions relating thereto are influenced by enterprise B, then enterprises A and B shall be associated enterprises

92A (2) (j): Where one enterprise is controlled by an individual, the other enterprise is also controlled by such individual or his relative or jointly by such individual and relative of such individual

Key Points:

- This clause deals with a situation where one enterprise is controlled by an individual and the other enterprise is also controlled by –

(i) such individuals; or

(ii) his relative; or

(iii) jointly by such individual and his relative then both the enterprises shall be deemed as associated enterprises

92A (2) (k): Where one enterprise is controlled by a Hindu undivided family, the other enterprise is controlled by a member of such Hindu undivided family, or by a relative of a member of such Hindu undivided family, or jointly by such member and his relative.

Key Points:

- This clause envisages control of the two enterprises by the same Hindu undivided family and includes control by –

(i) a member of the Hindu undivided family, or

(ii) by a relative of a member of such Hindu undivided family, or

(iii) jointly by such member and his relatives.

92A (2) (l): Where one enterprise is a firm, association of persons or body of individuals, the other enterprise holds not less than ten per cent interest in such firm, association of persons or body of individuals

Key Points:

- This clause seeks to cover non-corporate bodies like partnership firms, association of persons and body of individuals.

- In case of partnership firm or association of persons or body of individuals, the other enterprise must hold not less than 10% interest in such firm, association of persons or body of individuals to be regarded as an associated enterprise

92A (2) (m): There exists between the two enterprises, any relationship of mutual interest, as may be prescribed

Key Points:

- This is a residuary clause. No such mutual interest of relationship has been prescribed yet by CBDT

Conclusion:

Based on the above, one needs to give a thorough analysis to the relevant clause to determine if associated enterprise relation exists between two entities or not. It being a very vast subject one would need an expertise knowledge to arrive at any kind of conclusion/judgement. In a scenario of plethora of litigations, it is a huge responsibility on the shoulders of professionals to utilise their knowledge to the best and arrive at the intentions imbedded in the Government.

Note:-

1 Hon’ble ITAT in case of Page Industries Limited Vs DCIT [(2016) 159 ITD 680 (Bang)] Hon’ble Ahmedabad ITAT in case of Assistant Commissioner of Income Tax v. Veer Gems [ITA No. 1514/Ahd/2012]

Hon’ble Chennai bench of the ITAT in case of Hospira Healthcare India Pvt. Ltd. v. DCIT [Order dated 28.02.2017]

Hon’ble Gujarat High Court in Pr. CIT v. Veer Gems [TAX APPEAL NO. 338 of 2017; order dated 20.06.2017]

2 Hon’ble Chennai ITAT in case of Orchid Pharma Ltd vs DCIT (2016)….