As per CBDTs Notification 36/2019, dated 12th Apr 2019 the format of TDS statement in Form No. 24Q, Annexure – II has been revised. The notification shall come into force w.e.f. 12th May 2019.

The revised Form 24Q, Annexure – II has brought certain changes with regard to the reporting of transactions while filing the TDS statements. It is therefore advised that due diligence may be exercised to ensure accurate TDS statement filing so as to avoid possible defaults / mismatch in TDS certificate (Form 16 – Part B) which shall be available for download from TRACES.

A. Important Information regarding revised Form No. 24Q Annexure-II.

Applicability of The Notification –

As per “CBDTs Notification 36/2019”, dated 12th April, 2019 the format of TDS Statement in Form No. 24Q, Annexure-II has been revised. The Notification shall come into force w.e.f. 12th May’2019.

The Form 16 and 24Q have been amended to make them more elaborative and informative. The same has been done to bring the Forms in parity with latest changes made in ITR Forms such as disclosure of deductions and exemptions. This will ensure that Form 16 shall be in conformity with the IT return forms making it easy for the taxpayers to file their Income tax returns.

B. Changes/ New requirements in Form No. 24Q Annexure-ll

Revised Form 24Q seeks more details on salary paid or credited during the year. Also furnishing of Lender’s PAN is mandatory in the cases where housing loan is taken from a person other than a Bank/ Financial Institution/ Employer. New format requires the tax deductors to furnish following additional information-

1. Detailed break-up for exempt Income u/s 10–

a. Travel concession or assistance u/s 10(5)

b. Death-cum-retirement gratuity u/s 10(10)

c. Commuted value of Pension u/s 10(10A)

d. Cash equivalent of leave salary encashment u/s 10(10AA)

e. House rent allowance under u/s 10(13A)

f. PAN of landlord, if exemption is claimed u/s 10(13A)

g. Amount of any other exemption u/s10

2. Section-wise disclosure of deductions u/ Chapter VI-A (viz. Sec 80C, 80CCC, 80CCD (1), 80CCD (1B), 80CCD (2), 80D, 80E, 80G, 80TTA etc.)

3. Deductible limits will be applicable as per deductions under Chapter VI-A.

4. Rebate under section 87A (If Applicable)

5. Standard deduction u/s 16(ia) as introduced by Finance Act, 2018.

C. Column wise changes in Form No. 24Q Annexure-ll

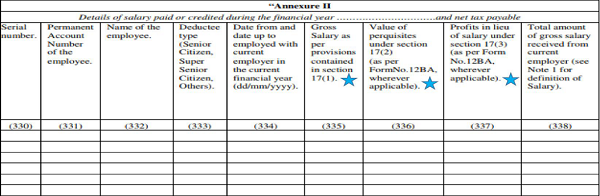

As per Notification 36/2019, in Form No. 24Q, for “Annexure II”, the following “Annexure” shall be substituted, namely:–

Note:

◊ New Columns introduced for reporting the following information:

- Gross Salary as per provisions contained in section 17(1). (Column No. 335)

- Value of perquisites under section 17(2). (Column No. 336)

- Profits in lieu of salary under section 17(3) (Column No. 337)

- For further details, CBDTs Circular No. 01/2019 dated 01/01/2019 may be referred.

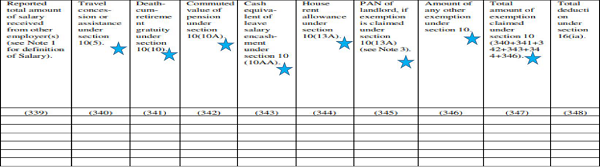

Note: Columns introduced for reporting Incomes claimed as exempt u/s 10 :

- Travel concession or assistance under section 10(5). (Column No. 340)

- Death-cum-retirement gratuity under section 10(10) (Column No. 341)

- Commuted value of pension under section 10(10A) (Column No. 342)

- Cash equivalent of leave salary encashment under section 10 (10AA) (Column No. 343)

- House rent allowance under section 10(13A) (Column No. 344)

- PAN of landlord, if exemption is claimed u/s 10(13A) (Column No. 345)

- Amount of any other exemption under section 10. (Column No. 346)

- Total amount of exemption claimed under section 10 (340+341+3 42+343+34 4+346). (Column No. 347)

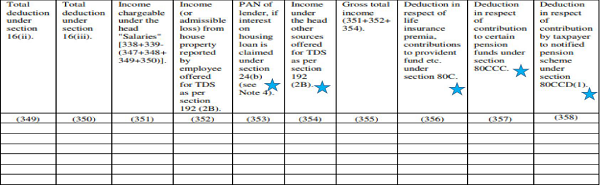

Note: Columns introduced for reporting:

- PAN of lender, if interest on housing loan is claimed under section 24(b). ( Column No. 353)

- Income under the head other sources offered for TDS as per section 192(2B). ( Column No. 354)

◊ Columns introduced for reporting Deductions under Chapter VI-A :

- Deduction in respect of life insurance premium, contributions to provident fund etc. (section 80C) ( Column No. 356)

- Deduction in respect of contribution to certain pension funds (section 80CCC) ( Column No. 357)

- Deduction in respect of contribution by taxpayer to notified pension scheme [section 80CCD(1) ( Column No. 358)

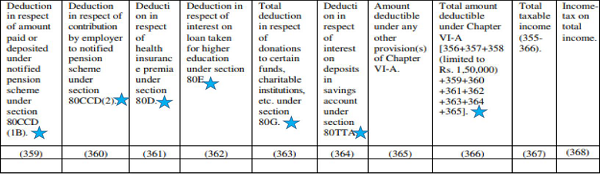

Note: Columns introduced for reporting Deductions under Chapter VI-A : (Contd.)

- Deduction in respect of amount paid/deposited under notified pension scheme [section 80CCD(1B) ( Column No. 359)

- Deduction in respect of contribution by employer to notified pension scheme [section 80CCCD(2) ( Column No. 360)

- Deduction in respect of health insurance premium (section 80D) ( Column No. 361)

- Deduction in respect of interest on loan taken for higher education (section 80E) ( Column No. 362)

- Total deduction in respect of donations to certain funds, charitable institutions, etc. (section 80G) ( Column No. 363)

- Deduction in respect of interest on deposits in savings account (section 80TTA) ( Column No. 364)

- Total amount deductible under Chapter VI‐A (a+b+c+d+e+f+g+h+i+j) ( Column No. 366)

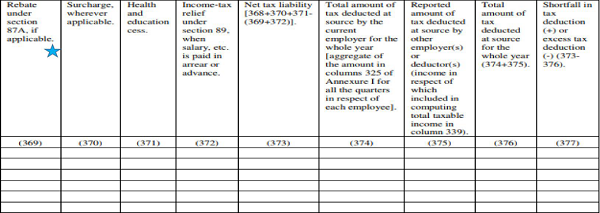

Note: Column introduced for reporting Rebate under section 87A, (if applicable) (Column no .369)

Notes:

1. Salary includes wages, annuity, pension, gratuity (other than exempted under section 10(10)), fees, commission, bonus, repayment of amount deposited under the Additional Emoluments (Compulsory Deposit) Act, 1974 (8 of 1974), perquisites, profits in lieu of or in addition to any salary or wages including payments made at or in connection with termination of employment, advance of salary, any payment received in respect of any period of leave not availed (other than exempted under section 10 (10AA)), any annual accretion to the balance of the account in a recognised provident fund chargeable to tax in accordance with rule 6 of Part A of the Fourth Schedule of the Income-tax Act, 1961, any sums deemed to be income received by the employee in accordance with sub‐rule (4) of rule 11 of Part A of the Fourth Schedule of the Income-tax Act, 1961, any contribution made by the Central Government to the account of the employee under a pension scheme referred to in section 80CCD or any other sums chargeable to income-tax under the head ‘Salaries’.

2. Where an employer deducts from the emoluments paid to an employee or pays on his behalf any contributions of that employee to any approved superannuation fund, all such deductions or payments should be included in the statement.

3. Permanent Account Number of landlord shall be mandatorily furnished where the aggregate rent paid during the previous year exceeds one lakh rupees.

4. Permanent Account Number of lender shall be mandatorily furnished where the housing loan, on which interest is paid, is taken from a person other than a Financial Institution or the Employer.”

Return preparation utility ver 5.1 – Income (including loss from house property) under any head other than income under the head “salaries” offered for TDS [section 192 (2B)] –

[352] while repreparing annexure 11 negative loan amount not taking , pls help on this

Which columns show the interest on housing loan amount in 24Q Annexure II which can be clime under section 24b

How to report Negative Salary Income(overall negative) in form 24Q?

Sir,

I have been served with a defective Form 16 and have returned the form 16 for correction But employer says that there is no provision in the Form 24Q for claims under Section 80EEA,Will the portal be updated with 80EEA soon?PLEASE OFFER HELP

In Annexure II of RPU, put the amount of 80EEA in column 91, 92 & then 20. i.e. amount deductible under any other provision(s) of chapter VI_A.

column 91 is for gross amount, column 92 for qualifying amount and column 20 is for deductible amount.

BANK INTT. KIS Column ME BHAREN

in which column of annexure II, deduction for 80TTB

how can fill section 80u in etds return (24Q4) for the F/Y 2020-21

T_FV_6135 Total Deductible amount under Chapter VI-A should be less than Total Gross amount under Chapter VI-A how to rectify the problem

how can fill section 80u in etds return (24Q4) for the F/Y 2019-20.

One of the employee transferred to another office in last March. Whether his details are entered in Annexure II of Q4 or not.?

If Yes how we will show his deductions?

Thanks in advance

T_FV_6135 Total Deductible amount under Chapter VI-A should be less than Total Gross amount under Chapter VI-A

IN WHICH COLOUM WE ADD SECURITY DEPOSIT AMOUNT IN 24Q TDS RETURN ANNEXXUR 2

How to fill physically handipped allowance in annexure II 4th quarter

Which column show the interest on housing loan amount in 24Q Annexure ii

Which can be claim under section 24(b)

T_FV_6135 Total Deductible amount under Chapter VI-A should be less than Total Gross amount under Chapter VI-A

One of the employee transfereed to another office in last september. Whether his details are entered in Annexure II of Q4 or not.?

If Yes how we will show his deductions?

Thanks in advance

TDS 24Q ANNUXURE II PART B U/S 80U HOW TO FILE ON WHICH COLUMNE TO BE FILL THE DETAILS

T_FV_6046 Invalid Section details mentioned for deduction under Chapter VI-A. For allowed values of deduction details under Chapter VI-A, refer the latest Form 24Q (Q4) TDS statement data structure avaialble at TIN website.

plz solve it

Should amounts specified in Annexure 1 (like amount paid/ credited) for every quarter be matched with Annexure 2 of 24Q ?

Sir, this is regarding the filling up of newly amended 24Q form (4thQ), where I can fill up the amount claimed for housing loan interest (self occupied home loan interest component), under 24b, I am unable to find any suitable column for fill up this amount; can any one help and guide me please?

19^C4 – Salary Correction^Travel concession or assistance [section 10(5)]^NA^1^T_FV_6100^No value to be provided under this field.

This type of error is showing what to do

How to make corrections in salary details.

Downloaded conso file, Not allowing us to alter salary details

while validate revise 24Q where the rebate u/s. 80DDB and 80U to report? its showing invalid

. Please revert

I got T-FV-6021 Invalid Section Chapter VI-A Total Amount can any one help me out

T_FV_6046 Invalid Section details mentioned for deduction under Chapter VI-A. For allowed values of deduction details under Chapter VI-A, refer the latest Form 24Q (Q4) TDS statement data structure avaialble at TIN website.

T_FV_6046 Invalid Section details mentioned for deduction under Chapter VI-A. For allowed values of deduction details under Chapter VI-A, refer the latest Form 24Q (Q4) TDS statement data structure avaialble at TIN website.

Sir

We have already filed 24Q on 7th may 2019. Do we need to file revised return in rpu 2.

reply pls

Sir

We have already filed 24Q on 7th may 2019. Do we need to file revised return in rpu 2.7

Pls reply

Sir,

Which amount should be reflect in column”Aggregate amt. of deduction U/s 80C(17)”?

What is the last date for filing of TDS return -Salary(24Q)- for FY 2018-2019-Q4 as per notification dated 12th April 2019.

Thanks

Which column show the interest on housing loan amount in 24Q Annexure ii

Which can be claim under section 24(b)

Form 24Q already filed & download Form 16 ( Part A )

Do we need to file revised return ?

We have already filed 24Q on 10.05.2019 i.e. before the revised 24Q became effective. Do we need to file revised 24q.

I generated 24Q on 11-05-2019 (Saturday) and going to file on 13-05-2019 (Monday) with NSDL for FY 2018-19. I need to make any changes ?

1. Does this post apply to tax payer or TDS deductor?

2.Does it apply to FY 2018-19 or FY 2019-20?

Kindly pardon me for my ignorance.

Thanks alot for most reliable TAXGURU

where is the provision to show the Claim on Interest on Housing Loan in this new format of Form24Q

from where I get this revised format of 24Q Anx II

WE FILE 24Q DATED 03-05-19 AND RETURN PROCESSED DATED 08-05-2019 WITH OLD FORMAT ANY CHANGES FOR US REGARDING THIS NEW AMENDMENT.