Everyone is aware that Form 15G and form 15H are used for avoiding the TDS deduction while computing the interest earned during the financial year. In this article we are discussing important points to remember while submitting the Form 15G and Form 15H to the deductor. We have also included frequently asked questions and answers on Form 15G and Form 15H. Reader can download the latest Form 15G and Form 15H in Excel, Word and PDF format from the links given at the bottom of the article.

Page Contents

A. Form 15H

Form 15H :- Declaration under sub-section (1C) of section 197A of the Income-tax Act, 1961, to be made by an individual who is of the age of sixty-five years or more (Sixty Years from 1st July, 2012) claiming certain receipts without deduction of tax.

- Form 15H can be submitted only by Individual above the age of 65 years. (Age limit reduced to 60 Years from from 1st July, 2012)

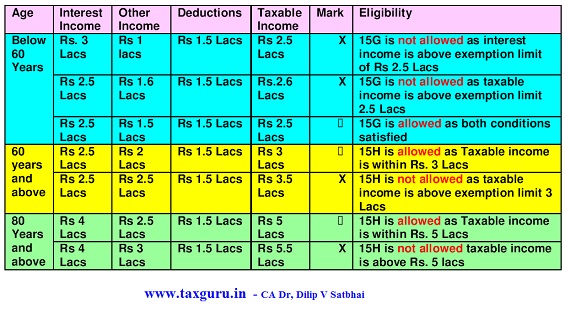

- Tax calculated on total income should be NiL. The assessee can submit 15H, even if the interest income exceed basic exemption limit, provided the tax paid on total income for the relevant previous year is NIL.

- This form should be submitted to all the deductors to whom you advanced a loan. For example you have deposit in three SBI bank branches Rs.100000 each. You must submit the Form 15H to each branch.

- Submit this form before the first payment of your interest. It is not mandatory but it will avoid the TDS deduction. In case of the delay, the bank may deduct the TDS and issue TDS certificate at the end of year.

- You need to submit form 15H to banks if interest from one branch of a bank exceeds 10000/- in a year (Rs 50,000 from A.y 2019-20)

- You need to submit for 15H If interest on loan ,advance, debentures , bonds or say Interest income other then interest on bank exceeds 5000/-.

B. Form 15G

Form 15G:- Declaration under sub-sections (1) and (1A) of section 197A of the Income-tax Act, 1961, to be made by an individual or a person (not being a company or a firm) claiming certain receipts without deduction of tax of tax.

- Form 15G can be submitted by Individual below the age of 65 years (Age limit reduced to 60 Years from from 1st July, 2012)) and Hindu Undivided family.

- Bank F.D. Interest income should not exceed basic exemption limit (i.e Rs 2,50,000). Otherwise the bank will deduct TDS though you have submitted 15G.

- The above points are applicable to the Form 15G as well, except that the Form 15H is only for the senior citizen.

- Form 15G should be submitted before the first payment of interest on fixed deposit.

C. Difference between form 15G and 15H:-

- Form 15G can be submitted by individual below the Age of 60Years while form 15H can be submitted by senior citizens i.e. individual’s above the age of 65 years. (60 Years from 1st July 2012).

- Form 15G can be submitted by Hindu undivided families but form 15H can be submitted only by Individual above the age of 65 years. ( 60 Years from 1st July 2012).

- 15G CAN NOT BE filed by any person whose income from interest on securities/interest other than “interest on securities”/units/amounts referred to in clause (a) of sub-section (2) of section 80CCA exceeds maximum amount not chargeable to tax.

In nutshell we can say that anybody whose tax on estimated income is not NIL and having income from interest on securities/interest other than “interest on securities”/units/amounts referred to in clause (a) of sub-section (2) of section 80CCA exceeds maximum amount not chargeable to tax cannot file DECLARATION u/s 15G . This is clear from the Declaration in Part-I for the form.

Declaration/Verification (Form 15H)

*I/We……………………………………………………… do hereby declare that to the best of *my/our knowledge and belief what is stated above is correct, complete and is truly stated. *I/We declare that the incomes referred to in this form are not includible in the total income of any other person under sections 60 to 64 of the Income-tax Act, 1961. *I/We further declare that the tax *on my/our estimated total income including *income/incomes referred to in column 16 *and aggregate amount of *income/incomes referred to in column 18 computed in accordance with the provisions of the Income-tax Act, 1961, for the previous year ending on ………………………… relevant to the assessment year ………………………… will be nil. *I/We also declare that *my/our *income/incomes referred to in column 16 *and the aggregate amount of *income/incomes referred to in column 18 for the previous year ending on ………………………… relevant to the assessment year ………………………… will not exceed the maximum amount which is not chargeable to income-tax.

However, if you are eligible and also fulfill the condition, the payer can not deduct the tax even if it is above 10,000.

Senior Citizens who are eligible to file Declaration in Form 15H has no such conditions. They can submit form 15H even if there total Income from interest on securities/interest other than “interest on securities”/units/amounts referred to in clause (a) of sub-section (2) of section 80CCA exceeds maximum amount not chargeable to tax if tax payable by them is NIL. This is clear from the Declaration in Part-I for the form.

Declaration/Verification (Form 15G)

*I/We………………………………………………. do hereby declare that to the best of *my/our knowledge and belief what is stated above is correct, complete and is truly stated. *I/We declare that the incomes referred to in this form are not includible in the total income of any other person under sections 60 to 64 of the Income-tax Act, 1961. *I/We further declare that the tax *on my/our estimated total income including *income/incomes referred to in column 16 *and aggregate amount of *income/incomes referred to in column 18 computed in accordance with the provisions of the Income-tax Act, 1961, for the previous year ending on……….. relevant to the assessment year………………… will be nil. *I/We also declare that *my/our *income/incomes referred to in column 16 *and the aggregate amount of *income/incomes referred to in column 18 for the previous year ending on ………………… relevant to the assessment year……………… will not exceed the maximum amount which is not charge‑able to income-tax.

D. Frequently Asked Question Answers On Form 15G And Form 15H

Question:- I am 70 years old. I invested a sum of Rs 6,00,000 in January 2014, in GOI 8 per cent savings bonds (taxable), via a leading private bank. The bonds issued were on a cumulative basis with a maturity period of six years. The total interest payable at the time of maturity is Rs 3,50,500. I have declared the income from the bonds on an accrual basis y-o-y, and have been filing tax returns since A/Y 2006/07. But the bank is not accepting Form 15H stating that the total interest payable on maturity is more than the threshold limit for senior citizens – Rs 3,00,000, and is insisting on my submitting Certificate u/s 197 from the IT office. What do I do?

Answer:- The bank should have deducted tax at source. It seems the bank has not provided for the accrued interest and is therefore not accepting Form 15H. You can prove that the tax on your total income of the previous year in which the interest is to be received shall be nil, even after including the cumulative interest the bank should not resort to tax deduction at source. You can submit Form 15H for deduction of tax at source for A.Y. 2019-20.

Question :- I am a senior citizen having income liable for tax deduction at source in respect of my deposits with State Bank of India. They asked me whether I would be filing declaration in Form 15G or 15H in the first week of March in respect of payments made during the year so that I am in a position to judge whether I have taxable income for the year or not and file declaration in Form 15H, if I have no taxable income. On the other hand, State Bank of India and, I understand, some other banks require form at the time of deposit itself. It may not be proper for the bank to act on such declaration made in one year for another year or for that matter act on a declaration which had become stale filed in earlier part of the year for payment towards the end of the year. What is the correct position of law?

Answer:- The doubt raised by the reader is a valid one. The law itself does not provide for any date on which the declaration is required to be filed as long as it relates to the income of the year and filed during the year. Since the deduction of tax at source has to be decided on the date of each credit or payment, deduction has to be made for each such credit or payment. Where an investor is not able to file the declaration in earlier part of the year in view of the uncertainty as to the prospect of his income crossing the exemption limit, he can probably inform the bank that deduction could be deferred till the end of the year. But then, the bank would like to have the declaration at the time of payment so that the declaration may have necessarily to be filed before the first quarterly payment, if the interest is payable quarterly. The difficulty for the investor in ascertaining the income in advance in such cases cannot be avoided. Tax may have to be deducted and refund applied in due course in such cases.

Question:- It is stated that 15H form is concessional for individuals aged 60 or more as this form, unlike 15G form, does not carry the restrictive declaration to the effect that the aggregate of eligible incomes will not exceed the maximum amount which is chargeable to income tax

- Can it be interpreted, that there is no ceiling on the aggregate incomes/ amounts liable for tax deduction for senior citizens of the age of 60 or more?

- It should be “not exceeding the maximum exemption limit” and not “not exceeding the minimum exemption limit”.

- Form No. 15H in circulation at present states that the particulars of the amounts are as per the in serial No.18. But there is no such schedule at all. The one and only schedule is about “investments”. In Form 15G carries this detail is given under serial no. 19.

As regards the first point, the limit for tax deduction for others is inapplicable for senior citizens, but the limit for statutory deduction under Sec. 80-C, for example, is applicable.

The second point made by him is correct.

As for the third point, the details of all the investments should be mentioned in the respective table under serial no. 18/19 as applicable for 15H and 15G respectively.

Question: What should I do if I am not liable to pay tax and TDS is not required to be deducted?

Answer:- To avail the benefit of deduction of tax at source at Nil/lower rate, you may submit any of the following documentation :

- Certificate from the Indian tax authorities : Certificate under section 197 of the Act issued by the Assessing Officer for nil / concessional rate of TDS can be submitted by any bondholder including companies and firms. The certificate should be submitted by the deductee to the deductor.

- Form 15G:If you are a resident person (other than a company, Co-operative society or a firm), you can submit Form 15G in duplicate to deductor. As per the provisions of section 197A of the Act, Form 15G can be submitted provided the tax on your estimated total income for the financial year computed in accordance with the provisions of the Act is NIL ) and the interest paid or payable to you does not exceed the maximum amount which is not chargeable to tax.

Click here to Download Form 15G in word format

- Form 15H:If you are a senior citizen, i.e. if you are of the age of 65 years and above (Sixty Years from 1st July, 2012) at any point of time during the financial year, you can submit Form 15H even if your income exceeds Rs.250,000 p.a. for the purposes of non-deduction of tax at source if your estimated total income for the financial year computed in accordance with the provisions of the Act is NIL.

- Entities exempt from tax as per CBDT Circular:Certain specified entities whose income is unconditionally exempt under section 10 of the Act and who are statutorily not required to file return of income as per section 139 of the Act, CBDT has vide Circular no.4/2002 dated July 16, 2002, granted blanket TDS exemption. Some examples of the specified entities are provident funds, gratuity funds, local authority, hospitals exempt under section 10(23C)(iiiac), educational institutions or university exempt under section 10(23C)(iiiab).

Exemption for insurance companies: Certain entities such as Life Insurance Corporation of India, General insurance Corporation of India along with its four subsidiaries or any other insurer are eligible to receive interest on securities without deduction of tax at source, if such securities are owned by them or it has full beneficial interest in the same.

Question:- I am an account holder in a nationalised bank and I filed Form 15H. The bank authorities refused to give acknowledgement for the same, though I have given it in duplicate. What is more is that they have deducted tax though I have no taxable income. What is the remedy for the amount already deducted and to avoid such deduction in future?

Answer:- Where tax has already been deducted and deposited by the bank, the only recourse for the assessee is to file a refund claim along with the return with the assessing officer and await the refund. It is possible for an assessee to seek remedy for deficiency of service in a consumer forum or to file a complaint with the Ombudsman asking for compensation for the trouble to which the reader has been put to. But then, the reader had failed to press for an acknowledgement. He should have complained about denial of acknowledgement at that stage to the concerned superior officers or should have sent it by registered post acknowledgement due for purposes of evidence for his case. In fact, it is not open to the bank official to refuse acceptance of any document sought to be served on the bank or refuse acknowledgement, where demanded.

Some reader has complained about the inordinate delay in getting TDS certificate to enable claim of refund in time. Such complaints received from time to time indicate the inordinate delay on the part of even banks and large corporate as regards this statutory duty to issue such certificates promptly. In the case of banks, this is again a matter on which complaint should be made to senior officers of banks in writing and on failure of response to the Ombudsman. A complaint to the TDS section of the Income-tax Department, which is expected to enforce law regarding issue of TDS certificate promptly, should be the most effective remedy, if only the TDS cell activates itself to enforce the law and the rules on those responsible for tax deduction at source for the benefit of the taxpayers.

DOWNLOAD FORM 15G AND FORM 15H APPLICABLE WEF 01.10.2015 -vide Notification No. 76/2015, Dated : September 29, 2015

Click here for Revised Format of Form 15G and Form 15H

Download Form 15G and Form 15H Applicable WEF A.Y. 2013-14 OR FY 2012-13 till 30.09.2015 -vide notification No. 11/2013 [F.NO.142/31/2012-SO(TPL)]/SO 410(E) Dated 19.02.2013

| Download Form 15G in word Format | Download Form 15G in Excel Format | Download Form 15G in PDF Format |

| Download Form 15H in word Format | Download Form 15H in Excel Format | Download Form 15H in PDF Format |

DOWNLOAD FORM 15G AND FORM 15H APPLICABLE UP TO A.Y. 2012-13

| Download Form 15G in word Format | Download Form 15G in Excel Format | Download Form 15G in PDF Format |

| Download Form 15H in word Format | Download Form 15H in Excel Format | Download Form 15H in PDF Format |

Please Note that from 1st July 2012 Age limit for senior citizen is reduced to 60 years from earlier 65 years. So from 1st July Form 15H can be filed by an individual who is of the age of sixty years or more claiming certain receipts without deduction of tax.

Also Read:

Form No.15G and 15H & related procedures

Who can submit Form 15G & 15H & care to be taken in submission

Submitting Form No. 15G & 15H -Points to Remember

TDS and form 15G/ 15H applicability

(Republished with Amendments)

In MARCH,2019 I will submit Form-15G & 15H to the bank to avoid TDS .In the ” Declaration / Verification ” which year to be mentioned in ” for the previous year ending on …. relevant to the Assessment year …. will be nil. I/we also,declare …

Sir,

I want to withdraw PF from my account and i have given details of the bank in which i want money to be transferred and amount is 4.5 Laks. but i have never filled up form 15 g before . EPFO site is asking for 15 G.

my age is 56 and for last 2 years i am job less and earning less than 2 lakhs by doing some odd jobs. my PAN details are there in EPFO. what should i do so that money that gets credited in my bank account by epfo without any deductions.

Can someone tell me the form 15G/15G submitted in the beginning of FY, will take care all FDs opened/renewed during that year OR one need to submit the form for every such subsequent FD?

My specific question was what is the last date for submitting form 15H for the year ending 31.3.19and assessment year 2019-20. The branch where I have the account gives vague replies. I am an 86 year old citizen and a specific reply will be appreciated. Thanks

Gahangu Odisha

I am 74 years pensioner getting Rs.32,000/-pm making an annual income of Rs.3,84,000/- into my bank. I invested Rs.1,50,000/- premium U/S 80C making taxable income now is Rs.2,34,000. But the bank has deducted TDS on my pension. Please guide me wheather I am eligible for 15H or is there any other form to be submitted to bank not to deduct TDS on my pension.

I am totally confused with govt orders and bank interpretations on 15 H.I sign 15 H in first week of April every year and show income under various FDs in same bank upto 200000//- Then bank wants me to give 15 H every time a new FD is made or renewed. Then they cut TDS on the maturity of the FD .What is wrong ? are we follwoing different Ministries in India?

I am talking about State bank of India.

I want to fill up 15 g and 15 h forms for me and my wife on line since we are out of station. If so please let me know the procedure.

Hallo Sir,

Thank you for the blog. I had a couple of questions and I wonder if you can perhaps help.

I had taxable income till FY 2014-15, so I did not furnish any 15G form for my FDs in SBI. Later in FY2015-16 and currently in FY2016-17 , I had (and have) no taxable income but I forgot to furnish 15G form for my FD. Even while filing tax for last year I did not claim this TDS on FD back. This SBI FD is due to mature in March 2017. How can I claim the deducted TDS ? I have downloaded the TDS deducted for the 2 years from SBI bank portal. Can I claim the tax deducted in both years together back now ?

Thanks in advance.

I am 61 years old and getting interest income Rs.259000/- during FY 2016-17. I have already submitted form no. 15H in April, 2016. My TDRs have also been renewed in July, 2016.

Please advise me whether I have to submit form no. 15H again after renewal in my CIF no. or form no. 15H already submitted in April, 2016 will do in renewed TDRs.

What is the rule of Income Tax department.

Kamini Gupta

I am SBI customer and the bank Manager has informed me 4 days Back that i will have to submit 15H From(I am a Senior Citizen) each and every time i open and/or renew Term Deposit 2. Actually i use NET BANKING for opening of Term Deposit and ensure that instructions are given while opening them that they are Renewed by default and do not like go to the Bank. 3. However, the new Ridiculous Rule of SBI means i will have to make physical trips to the Bank on every such occasion and in fact since i have a 7 days Term deposit (which gets renewed every days automatically) i will have to visit the Bank every 7 days just for submission of 15 H Form. 3. The ON LINE Facility of 15H submission does not work in case of SBI (in fact the menu shown in the Screen Shot above is not displayed ). 4 As a senior citizen i am unable to understand why should i visit the Bank every 7 Days. 4 Is there a way out ? also Note that the Menu of ON Line Submission of From 15 H Under NetBanking is not working and Bank is asking me visit the Bank every 7 days merely for sumbmission of 15 H Form (though the renewal is done by default under NETBANKING)

Reply

I (a Senior Citizen) have Rs 15 Lac FD each in 4 Different Banks (Total FD of Rs 60 Lac), and get Interest of Rs 1.5 Lac (approx ) each from each Bank per year (i.e. Rs 6 Lac in total )While filling in 15 H Form during this year the clerk tried to highlight that i should fill in the Estimated income from all sources meaning (other investments like FDs in banks etc. My problem is if fill in Rs 6 lac as the estimated income all the 4 banks will not accept 15 G Form and deduct 15,000 Rs TDS each (In all Rs 60,000) . Actually by investing Rs 1.5lac in NSS and Claiming Benefit under 80 G I become eligible to pay ITAX of Rs 10,000 apprax, which I pay regularly. Kindly appreciate that by listening to the Bank manager i will allow TDS deduction of Rs 15,000 from each bank (Total Rs 60,000 from 4 banks ) and then will have to claim Refund of Rs 50000 while filing returns which is little bit time consuming. Kindly advise what would be right action.

Yes he file it

i wnat to contact you and ask pls share your contact details mine would be 9958126715

Dear Sir,

Pl. guide me that in Proprietor firm, we had taken Unsecured Loan & in which the Interest amount is higher than 10K & the party has provided 15G. Shall we deduct the TDS of the said interest amount?

Pl. guide us in this matter.

Dear Sir/Madam,

I thought over the issue, and arrived at the following conclusion; and, I would request you for a confirmation if my revised thinking is correct; or, a clarification if it is not correct in your opinion.

I suspect field 17 of 15H relates only to such income that would require submission of 15H.

Here, Aggregate amount has probably no relevance to either:

(a) Total Income (after eligible deductions, and ignoring non-taxable income); or

(b) Gross Total Income (before eligible deductions).

I guess, Aggregate amount in field 17 refers to the total of income declared with other organizations under separate 15H for the same financial year.

And, field 16 refers to the Total Income as defined by the Act where eligible deductions, as well as, non-taxable income are given due effect to, before arriving at this amount, per the provisions of the Income Tax Act.

Consider the following example:

15H were earlier submitted to organizations A and B, where the Aggregate of amounts declared had been 295,000.

15H is now being submitted to organization C, where field 15 shows estimated income 25,000.

This 15H for organization C will show in field 17 Rs 295,000, which was the amount declared in 15H with other two organizations A and B.

Here is the catch. Amount in field 16 for organization C will not be 295,000 + 25,000 = 320,000.

Amount in field 16 for organization C will be 295,000 + 25,000 – 150,000 = 170,000 if the individual has made or is going to make 150,000 subscription to PPF out of his total taxable and non-taxable income for the year 2016-17. This is because Form 15H asks for Total Income in field 16 and this Total Income is a defined term in the Income Tax Act.

Now, it will be for the person responsible to deduct tax in each of these organizations as to what tax each should or should not deduct from interest payable by them individually.

Finally, there is a grey area with regard to the word “filed” used in field 17. It could mean to some, “filed” up to the date of submission of this 15H, in which case this submission may or may not reflect any form 15H that may be filed after this date. However, it would be best to leave such nitty- gritty of the Law for those to debate who may have something to gain from it.

Best Regards

Interpretation of field 17 and 18 in Form 15H pose a question.

Field 17 uses “Total Income” which is defined in the Act as income after eligible deductions.

Field 18 uses “Aggregate Income” which had not been traditionally defined in the Act, and one cannot go on the assumption that the department has used it loosely for “Gross Total Income” which is income before eligible deductions.

And, this one word eligible deductions can make huge difference. Consider: an individual who received tax free dividend of 75,000 from equity and made 150,000 subscription into his PPF account out of his total earnings, part of which was saved.

These two elements alone make the difference of 225,000 between Total Income and so-called Aggregate income. One who submitted the form 15H (300,000 in field 17 and 525,000 in field 18), leaves a question for the person who would be responsible for deduction of TDS from the income payable:

· If he considers field 17 amount 300,000 there would be no TDS

· If he considers field 18 amount 525,000 there would be TDS at 60+ age

· So, will he/she deduct TDS or not?

Your valuable input is requested.

Thank you

What service you are rendering by offering old FY 2013-14 15 G/H forms????

Just stop your website; that will be a service to the nation.

Sir meri FD SYNDICATE BANK me hai sir jab mene FD karayi thi tab mene 15G ka FORM Fill kiya tha lekin uske baad bhi meri amount me se tax cut gaya. or mene branch me baat ki to wo kaha rhe the ki apko 1st APRAI ko bhi 15G ka form fill krna jaruri hai lekin mujhe branch me phle aisa kuchh nhi bataya tha. wo kah rahe the ki ap FD karate ho usi date me 15G ka FORM fill krna padega or 1st Apr ko bhi form fill krna padega aisa jaruri hai. so please sir advise me.

I am Dr. shankar Prasad a retired senior citizen of 60 years have fixed deposits of around. 2.45 lacs in canaraw bank do I need to submit 15 h/g form to get some benefit? kindly reply?

sir after giving 15G we have to file the interest amount in IT returns.

Dear Sir,

I have policy worth 7L which earns interest and gets re-invested and I am an NRI and don’t have any income other than those savings. Do I have to fill in form 15?

Please advise.

Thanks

Vilas

As a Banker (Deductor)what information will be required to be filled in Part II of Form 15G while submitting Form 15 G to the department during first quarter of TDS return. In my opinion only interest accrued/due/paid till the date of submission of Form 15G is only required to be filled in Part II by the banker as against in Part I total interest income for the year has to be declared by the depositor.

dear sir ,

i was working with pharma company , after leaving for 3.5 yrs. trying to Reimbursement my PF , submitted all necessary documents regarding PF reimbursement, after so many phone calls & reminders . now Company says to fill the FORM 15G & 15H , with out this form PF will not Processed.

Now please you are requesyed to clear that Is it mandatory to fill FORM 15G & 15H.please clear .

regards ,

ASHUVENDU AWASTHI

AGE–36

Respected Sir,

I am filling form for my PF Withdraw. But i am little confused about assessment Year. Please Guide me.

Thanks a Lot!

hello sir,

I have applied for withdrawal PF after resigning,Now PF department asking for file F-15G,I dont know why they are asking this questions, i am already paid Income tax this year.Please advise me….is it necesssary to submit Form 15G?

Resp Sir

My name is Ch srinivsa Rao i am form Hyderabad i want some help from you please give me clarification about some doubts about submission of form 15h and form 15 g .

Know latest Employees Provident Fund organization has been introduced to deduction of TDS On payment of EPF Claims .

Is it mandatory of Pan Card for submission of Form H And Form G

Please guide me Sir

Thanking You

C Srinivsa Rao

8978135459

9059859706

plz sir

can you help me my question

befor april 14 i have no such salery as taxable so till date i didnot file any itr

but in 14-15 i go abrod and i got good salery and i sent a good amount in indiatomy faimily .i send approximatly 10 lakh in that year

so i want to know that how much i pay tax on that

thanks

what should be the assessment year for the financial year 2015-16 please Rply!

DEAR SIR

PL CLARIFY THE FOLLOWING:

I AM ( 55y) HAVING FIXED DEPOSITS WITH TWO FINANCE COMPANIES AND I WILL RECEIVE TOTAL INTEREST OF Rs 3,00,000/- ( having no other income)FOR THE YEAR 2015-16. I WOULD LIKE TO INVEST Rs 50,000/- in SEC 80C/80CC/80CCD ETC. WHETHER CAN I SUBMIT 15-G TO THOSE COMPANIES SINCE TOTAL TAX TO BE PAID BY ME IS NIL

Hi ,

I have some fixed deposits whose interest is more than 10000. What if i can’t submit 15g forms in the period Apr-JUN due to some reason ? And i submit the same in the month of OCt. Whether the tax will be deducted ? If yes , then how much tax will be deducted ?

My father, who died on 29 june 2014, have some Fixed deposits in bank jointly with my Mother, in the manner of “Either or Survivor” . The first holder of the fixed deposits is my father and my mother is in the 2nd one. Now I want to know:

1. how can we submit 15 H form

2. is there any way to avoid TDS deduction

3. is my mother is eligible to fill Form 15 H against those FD

My father, who died on 29 june 2015, have some Fixed deposits in bank jointly with my Mother, in the manner of “Either or Survivor” . The first holder of the fixed deposits is my father and my mother is in the 2nd one. Now I want to know:

1. how can we submit 15 H form

2. is there any way to avoid TDS deduction

3. is my mother is eligible to fill Form 15 H against those FD

Sir,

Can You send 15G and 15H Sample filld formats. Plz Sir.

Is we have to submit the 15G and 15H to the co-operative bank also, can an LLP give the Form 15G and 15H.

if 1st holder for Canara Bank Term Deposit expires prematurely in case of a long term FD held with either or survivor opertaion – 2nd holder is depositors housewife over 65 years of age and third holder is his son(salaried employee) can the housewife fill form 15G for non deduction of tax if her income is negligible? The bank refuses to make 2nd holder the automatic 1st holder just on basis of Death Certificate and wants deleration that there are no legal heirs before making 2nd holder the 1st holder on Term Deposit form. Please advise.

Sir,

In April,2015 I will submit Form-15G to the bank to avoid TDS .In the ” Declaration / Verification ” which year to be mentioned in ” for the previous year ending on …. relevant to the Assessment year …. will be nil. I/we also,declare …

previous year ending on …. assessment year …..will not exceed … incometax.”

Sudhir Saha

The form downloaded from this website is acceptable by all private Banks or company, as some time they insisting to the investor to use their form itself.

Secondly Bank can use TDS in Tax Saver Bank FD of Rs. 1.5 Lac for a period of 5 year if interest per year crossing Rs.10000 / per year ?

pls advise….

I want to know that during submission of form 15g/15h what no. of copies are required to submit in bank ?

sir 3 FD given bleow

1 30000

2 20000

3 50000

sir please clearify 15G form submiteed not submiteed

if interest of all FDs is 12000 then TDS will be 12000*10% or (12000-10000)*10% ??

my total taxable income is above the limit.

and interest accured from FDs are also above 10000.

is there any requirement to submit form 15G.??

I will be away from the town where my home bank branch is located to another town (in India only) for a period of 6 months or more. Can I submit my form 15H at the nearby branch of the bank at the new town OR I should submit / forward my form to the home bank branch only?

Sir,

I will be away from station from Jan.’15 ( within India only) and shall return only after 6 months to my home town. Can I submit form 15H to any nearby branch of the town to which I am going OR I should submit or mail the form to my home branch only?

I have a FD of 6 lacs & 2 lacs. I am indian resident, retired, age 62 and not earning. My overall (from all FDs) annual interest is 111250/- which does not exceed Taxable Limit, ie, 2.5 Lac for senior citizen as per rules. I have not applied for 15H form earlier (i am a bit of old school), should i submit it to my banks (2 of them) for saving TDS amounts. Am i fully eligible to submit this form? Please help. Urgent..

I am am a student having zero annual income .I want to open e fd in sbi through online. After opening efd how to submit form 15G so that i am not eligible of tac