The composition scheme provides for a very simple way of filing returns by the composition dealers. The taxpayer who has opted for composition scheme under GST Act has to file a single quarterly return as Form GSTR 4 for the income earned and tax paid during the preceding Financial Year. Unlike other tax payers who need to furnish a large no of returns under GST mechanism , the dealer under composition levy is required to submit only one quarterly return i.e. Form GSTR 4.

Due dates for filing GSTR 4

| Period | Due Date |

| April-June 2018 | 18th July 2018 |

| July-September 2018 | 18th Oct 2018 |

| October-December 2018 | 18th Jan 2019 |

| January-March 2019 | 18th April 2019 |

Eligibility to file GSTR 4

The taxpayer who has opted for Composition levy has to file GSTR 4.

The basic format of GSTR 4 as prescribed under rule 62

Details to be mentioned in GSTR 4 Return under GST Composition Scheme

Details to be mentioned in GSTR 4 Return under GST Composition Scheme

Broadly there are 13 different sections of the GSTR4 which are required to be filled up by the Composition Dealer. However while explaining below we have mentioned each minute detail separately against the serial numbers of the GSTR 4 format.

1. The Goods and Service Tax registration number (GSTIN)

2. When the GSTIN number will be entered in the GSTR 4, the system will auto populate the name of the taxable person who is filing the return. These are the two mandatory details to be entered into the form for filing the return.

3. Since the composition levy is turnover based, hence the next important part of the inclusion of the information is the details of the aggregate turnover of the composition dealer.

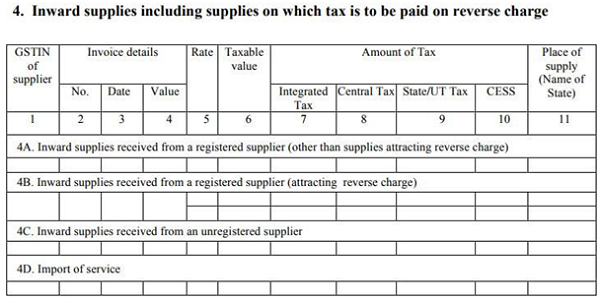

4. The details of the inward supplies from the registered supplier whether interstate or intra state on which reverse charge is not applicable.

5. The details of the inward supplies from the registered supplier whether interstate or instar state on which reverse charge is applicable.

6. The above detail(point no 5) is required to be incorporated for the purposes of calculating the amount of tax payable and most important to note that this figure of tax payable will become part of the cost of the inwards supplies.

7. The details of the inward supplies made from the unregistered supplier.

8. The details of the import of services on which tax is to be paid due to applicability of reverse charge.

9. Correction Tables are available in case any wrong information has been updated w.r.t. point no 4-8. Hence the required corrections can be done in the serial no 5 of the return.

10. Details of the credit and debit notes on account of inward supplies

– from the registered suppliers

– supplies on which reverse charge is applicable

– supplies from unregistered suppliers

11. The next part of the return format includes the details of the tax to be paid on the value of the outwards supplies by the Composition Dealer. It basically contains the following details-

– Value of net turnover of the composition dealer.

– Rate of Tax applicable on the outward supply

12. If any amendment is required to be made in the details already furnished by the tax payer then such amendments can be made in the column given at serial no 7 of the GSTR 4.

13. Serial no 8 of the GSTR4 subdivided into various categories such as 8 A, 8 B and further small sections as (i) & (ii) etc deal with eth advance payments paid for reverse charge supplies in the tax period.

14. Serial no 9 of the GSTR 4 requires the details of TDS credit to be mentioned. It also includes the following details-

– amount of TDS deducted by the supplier while making payments to the composition dealer

– GSTIN of the deductor

– Gross invoice value

15. Details regarding total amount of tax bifurcated below has to be mentioned as specified below in the column 10 of the GSTR 4.

16. Serial no 11 relates to the disclosure of the details of the Interest,Late Fees payable and paid in regards to GST paid.

17. The serial no 12 of GSTR 4 relates to the mentioning of information of refund claimed from electronic cash ledger

17. The serial no 12 of GSTR 4 relates to the mentioning of information of refund claimed from electronic cash ledger

18. Debit entries in cash ledger for tax/ interest payment is the last entry at serial no 13 of the GSTR4 form.

Revision in the GSTR 4

One of the most important factor has to keep in mind while filing GSTR 4 i.e. it has to be filed accurately because once filed inaccurately on the portal of the GSTIN, it cannot be rectified unless and until the next return is filed by the assesse.

In other words it can be said that the return filed in the previous quarter can only be rectified at the time of filing of return of the subsequent quarter.

For instance- if the assesse has filed incorrect particulars in the return of the quarter Jan- Mar 2018 then the rectification will be done while filing the return for the quarter April-June 2018.

Consequences for Not Filing of GSTR 4

Initially a penalty of Rs. 200 per day was levied if the GSTR 4 was not filed which has been reduced to Rs. 50 per day of default via notification no 73/2017 Central Tax. Additionally the late fees for NIL return in GSTR 4 is Rs. 20 per day of delay. It is to be noted that maximum penalty to be imposed is Rs. 5000/-. One has to keep in mind that if the GSTR 4 is not filed for a given quarter , then the tax payer cannot file the next quarter’s return either.

Can you give Events/transaction that are in it

Debit entries in cash ledger for tax/ interest payment is the last entry at serial no 13 of the GSTR4 form.

Mention some Examples