Esha Agrawal

♣ What is the need to introduce GST composition scheme.

Composition scheme under the law is for small businesses. This is to bring relief to small businesses so that they need not be burdened with the compliance provisions under the law. Thus, an option has been provided where they can opt to pay a fixed percentage of turnover as fees in lieu of tax and be relieved from the detailed compliance of the provisions of law.

♣ Who can opt for Composition Scheme

A taxpayer whose turnover is upto Rs 1.5 crore can opt for Composition Scheme. In case of North-Eastern states and Himachal Pradesh, the limit is now Rs 75 lakh.

Turnover of all businesses registered with the same PAN should be taken into consideration to calculate turnover.

♣ Who cannot opt for Composition Scheme

√ Taxpayer supplying exempt supplies

√ Supplier of services other than restaurant related services

√ Manufacturer of ice cream, pan masala, or tobacco

√ Casual taxable person or a non-resident taxable person

√ Businesses which supply goods through an e-commerce operator

♣ Can Composition Dealers avail Input Tax Credit

No, a Composition Dealer is not allowed to avail input tax credit of GST on purchases.

♣ I have many branches. Will composition scheme apply to each of them separately

If Composition Scheme is opted for all businesses that are associated with this PAN

♣ Benefits Under GST Composition Scheme

√ Less Compliance

√ Reduced tax liability

√ High Liquidity

♣ Limitations of GST Composition Scheme

√ No Credit of Input Tax

√ No Inter-state business

√ Pay tax from own pocket

♣ Can I opt-in for composition scheme anytime during the year

√ Before the beginning of every financial year, a registered taxpayer is required to provide a declaration on the GST Portal. This cannot be done anytime during the year.

♣ Eligibility For GST Composition Scheme

Getting registered under composition scheme is optional and voluntary. Any business which has a turnover up to Rs 1.5 Crore can opt for this scheme but on any given day, if turnover crosses the above-mentioned limit, then he becomes ineligible and has to take registration under the regular scheme. There are certain conditions that need to be fulfilled before opting for composition levy.

They are as follows:

√ Any assessee who only deals in supply of goods can opt for this scheme that means this provision is not applicable for service providers. However, restaurant service providers are excluded.

√ There should not be any interstate supply of goods that means businesses having only intra state supply of goods are eligible.

√ Any dealer who is supplying goods through electronic commerce operator will be barred from being registered under composition scheme. For example: If M/s ABC sells its products through Flipkart or Amazon (Electronic Commerce Operator), then M/s. ABC cannot opt for composition scheme.

√ Composition scheme is levied for all business verticals with the same PAN. A taxable person will not have the option to select composition scheme for one, opt to pay taxes for other. For example, A taxable person has the following Business verticals separately registered – Sale of footwear, the sale of mobiles, Franchisee of McDonald’s. Here the composition scheme will be available to all 3 business verticals.

√ Dealers are not allowed to collect composition tax from the recipient of supplies, and neither are they allowed to take Input Tax Credit.

√ If the person is not eligible under composition scheme, tax liability shall be TAX + Interest and penalty which shall be equal to the amount of tax.

√ Dealers who collect Tax at source u/s 56.

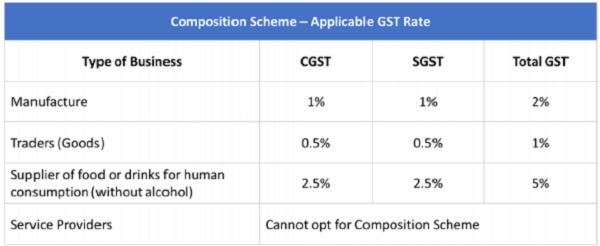

♣ GST rates for a composition dealer

♣ What are the returns to be filed by a composition dealer

A dealer is required to file a quarterly return GSTR-4 by 18th of the month after the end of the quarter. Also, an annual return GSTR-9A has to be filed by 31st December of next financial year.

Also, note that a dealer registered under composition scheme is not required to maintain detailed records.

Thanks for Reading !!!!

In case you are confused about GST as business owner, feel free to consult me at eshaag6@gmail.com

KEEP ON SMILING!!!!!!!!

The indispensable first step to getting the thing you want out of life is this decide what you want- Ben Stein

(The author can be reached at agrawalesha6@gmail.com)

can a composition dealer sell exempted goods???

By mistake I have opted composition scheme, for first 2 generated tax invoice containing gst without knowing that I have to issue bill of supply till I have not filed any gst return. I have registered under gst law as on 01.06.2018.

As per composition rules, if violated composition rules have to intimate within seven days but it is nearly 2 months. So if I apply for transfer from composition to regular what are the consequences

I am registered under composition levy. Is it compulsory to give gstn no. To suppliers. Of goods

Turnover is still 1 crore. 1.5 crore is the decision of GST council. It will be effective after amendment in Section 10 of CGST/SGST Act. However good effort.

Good article. Very informative.

Manufactures tax also .5% and .5% right?

Tax rates applicable for the manufacturers and traders have been revised now.

if composition dealer purchases goods from unregistered dealer, then reverse charge will apply and which rate apply?

Good Informative FAQ

Thanks

Please refer the notification the turnover limit is 1 crore and not 1.5 crore