Every GST registered person as well as professionals filing GST returns for them are confused these days about which scheme to opt, QRMP scheme or Monthly 3B system. Like in Income Tax, Govt has introduced New Tax Slab Regime with lower tax rates & you have option to choose between old & new tax slab regime. In GST also, now Taxpayer with Turnover upto 5 crore have option to choose for GST return filing system Monthly or Quarterly. In this article, we have covered various doubts in the relation to QRMP scheme.

1. QRMP scheme applicable on whom?

As per Notification 84/2020 Central Tax dated 10.11.2020, Turnover in preceding Financial Year upto Rs.5Cr have the following mentioned options.

2. What is the new QRMP Scheme?

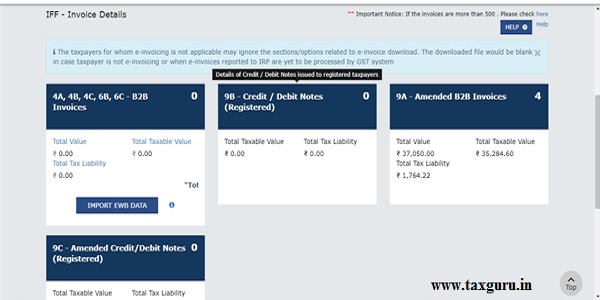

QRMP as the name suggests means Quarterly Return Monthly payment scheme where a registered taxpayer has to file GSTR 1 as well as GSTR 3B ON QUARTERLY BASIS and TO DEPOSIT TAX MONTHLY BASIS (PMT 06) along with option of furnishing of Invoices to Registered Taxpayer on Monthly basis(IFF) is available.

3. QRMP Scheme V/S Old Scheme for Small Taxpayers

Under Old Scheme of Quarterly filing of GSTR 1 and Monthly GSTR 3B there was a big anomaly or let say biggest problem that small taxpayers having turnover upto Rs.1.50 crore who have opted Quarterly filing scheme for GSTR 1 and who made sales to Registered taxpayer were not able to get credit for such sales made to them as they were not being reflected in GSTR 2A and 2B of the said taxpayers on monthly basis and thus they were going out of the business because of this reason that the people buying goods or services from such persons where not able to get GST input in GSTR 3B due to introduction Rule 36(4).

Under New Scheme QRMP Now GSTR 1 and GSTR 3B have to be filed on quarterly basis only but there is option for furnishing Invoices on monthly basis along with option to amend such invoices on monthly basis, is not mandatory. Also taxpayers have to pay GST on monthly basis under Challan PMT 06 on basis of self assessment basis or a minimum of 35% of total tax liability in order to avoid interest liability as per the provision of act. AlsoTurnover Limit has been increased to Rs.5 Crore.

4. Whether to opt QRMP Scheme or not?

If you are eligible to opt the scheme then following pros strongly recommend you should opt the scheme:-

1. IFF i.e. Invoice furnishing scheme (Optional) available on monthly basis where in Input can be claimed on invoices by your registered parties under GSTR3B as they will be reflecting under GSTR 2A and GSTR2B. Due date is 13th of next month.

2. PMT 06 Payment of only 35% of total tax liabilities of previous period as computed automated or on basis of self assessment and that too by 25th of next month then no interest liabilities as per act. This has resulted in reduced burden on taxpayers following under this scheme.

OPTIONS

1ST OPTION: 35% CHALLAN

2ND OPTION: SELF ASSESSMENT CHALLAN

3. Furnishing GSTR 3B and GSTR 1 actually on Quarterly basis.

4. Reduced compliances for Small and medium taxpayers i.e. upto Rs.5Cr.

5. Whether Exporters should opt for QRMPs?

As exporters get Refund of IGST Paid on export of goods by filing GSTR 3B as well as GSTR 1, they should not opt for this scheme, as it will delay the refund process.

6. Whether this scheme can be opted out any time and can we change the option in next quarter?

Taxpayer can opt in/opt out of this scheme after every quarter as per the following timelines.

For FY 2020-2021

For FY 2021-2022

7. How to opt in/opt out of QRMPs?

Taxpayer need to login to GST Portal & follow the steps as below-

1. Go to Services Menu

2. Select Returns

3. Select option: Opt in for Quarterly Return

4. Choose Financial Year

What are the consequences of delayed payment in QRMPs?

Interest payment under two options available in QRMP scheme is as follows-

Conclusion

Introduction of this QRMP scheme should be a welcome scheme by the industry as it will reduce compliances and time consumption for preparation and filing of GST returns.

****

Article Contributed by: Rahul Gupta | B.Com(H), FCA| carahulvgupta@gmail.com.

Author can be reached at carahulvgupta@gmail.com for any queries, issues &recommendations relating to article.

Disclaimer: The contents of this article are for information purposes only and does notconstitute an advice or a legal opinion and are personal views of the author. It is based uponrelevant law and/or facts available at that point of time and prepared with due accuracy &reliability. Readers are requested to check and refer relevant provisions of statute, latest judicialpronouncements, circulars, clarifications etc before acting on the basis of the above write up. The possibility of other views on the subject matter cannot be ruled out. By the use of the saidinformation, you agree that Author / TaxGuru is not responsible or liable in any manner for theauthenticity, accuracy, completeness, errors or any kind of omissions in this piece ofinformation for any action taken thereof. This is not any kind of advertisement or solicitation ofwork by a professional.