With the implementation of Goods and Service Tax Act on 1st July, 2017, there had been huge cry amongst the trade and industry relating to filing of the GST returns. In general, the businesses are required to file normally three returns in a month and additionally one annual return, summing up to the total of 37 returns under GST. Due to the huge compliance involved in the same, there had been various representation by the trade to reduce the compliance involved in filing the GST returns.

When it comes to return filing one question always hinders into the minds of the taxpayer that in case of no transactions, is it mandatory to file the NIL GST return?

An answer to the above-mentioned question is in affirmative i.e. yes taxpayers are required to file NIL return in case of Goods and Service Tax. Even in case of no transaction, the taxpayer is required to file GST returns.

Procedure For Filing Nil GSTR-1 Return –

Different category of taxpayers are required to file different types of GST returns. Under the below-mentioned steps, as an illustration, we are providing the procedure for filing NIL GSTR-1 return.

In order to file NIL GSTR-1 return under GST, one needs to follow the undermentioned steps –

1. Visit site https://www.gst.gov.in/;

2. Provide appropriate username and password;

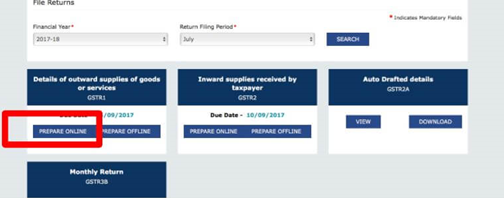

3. Navigate path Services > Returns Dashboard;

4. Month and year for filing the return needs to be selected from the drop down list;

5. Select ‘prepare online’;

6. Mention the details of Aggregate Turnover for the given Financial Year and Aggregate Turnover of the given period;

7. Select ‘B2C (Others)’ under ‘GSTR-1 Other details’ and provide the details;

8. Under the next screen select the POS i.e. Place of Supply from the drop down list;

9. Click on the back button;

10. Click on Generate GSTR – 1 Summary;

11. Tick the check box and select ‘Preview’;

12. Click on Submit button;

13. Return can be filed either using DSC or using EVC.

Penalty For Non-Filing Of Nil Return –

Provisions relating to penalty / late fee are contained under section 47 of the Central Goods and Service Tax Act, 2017. Penalty / late fee for non-filing of GST return as per section 47 is as under –

The taxpayer in default is required to pay a late fee of INR 100 for every day during which such failure continues. However, the maximum amount of penalty / late fee cannot exceed INR 5,000.

As per notification no. 4/2018 – Central Tax dated 23rd January, 2018, penalty / late fee payable has been reduced in case of monthly / quarterly return in FORM GSTR – 1 to INR 50 per day (INR 25 CGST and INR 25 SGST) and the maximum amount of penalty cannot exceed INR 5,000. Further, in the said notification it had been clarified that in case of no outward supplies in any month / quarter i.e. NIL return, the late fee payable would be INR 20 per day (INR 10 CGST and INR 10 SGST) up to a maximum of INR 5,000.

Similarly, as per notification no. 5/2018 – Central Tax dated 23rd January, 2018, penalty / late fee payable has been reduced in case of return in FORM GSTR – 5 to INR 50 per day (INR 25 CGST and INR 25 SGST). Further, in the said notification it had been clarified that in case the total amount of central tax payable in return is NIL, i.e. in case of NIL return, the late fee payable would be INR 20 per day (INR 10 CGST and INR 10 SGST).

In the same line, as per notification no. 6/2018 – Central Tax dated 23rd January, 2018, penalty / late fee payable has been reduced in case of return in FORM GSTR – 5A to INR 50 per day (INR 25 CGST and INR 25 SGST). Further, in the said notification it had been clarified that in case the total amount of integrated tax payable in return is NIL, i.e. in case of NIL return, the late fee payable would be INR 20 per day (INR 10 CGST and INR 10 SGST).

Proposed Nil Return Filing Through SMS –

The Goods and Service Tax council has approved the SMS system which will enable the registered taxpayer to file NIL return through SMS. Businesses, who are NIL filers, where there is no supply or purchase in a quarter, can file their quarterly return through SMS.

It must be noted that above system of filing the NIL return through SMS is currently not in force and is likely to be implemented from 1st January, 2019.

I have not filed my nil return from march to novwill i have to pay how much of each month 2020.how much i have to my office was closed no staff was coming due to covid19 is thre is any rebate. Penelty come 34,000. How wave off.

I registered my company and go GST on Jan 2019 and still, I am filing GST NIL Returns will it create any problems in the future.

Suppose if my penalty amount exceeds INR 5000 shall I need to pay only INR 5000 as per the wording of the provision or I need to pay more than that?

Is there any restriction on number of months i can file NIL return ?

WHEN IT SAYS THE EFFECTIVE DATE IS ONLY FROM 5TH MARCH TO FILE NIL RETURN HOW CAN WE FILE NIL RETURN FOR THE MONTH OF FEBRUARY 2018