1. Introduction: E-Invoice is a standard format of the invoice recommended by the GSTN for the GST registered suppliers. There is a myth or misconception that e-invoicing means the generation of invoices from a central portal of the tax department (GSTN Portal).

1.1 E invoice does not mean the generation of invoices from a central portal of the tax department. It’s a standard format of the invoice. The taxpayer would continue to use their existing accounting system / ERP or excel based tool for generating the invoice.

1.2 Existing software would adopt the new e-invoice standard wherein they would re-align their data access and retrieval in the standard format.

2. Why it is important to understand e-invoicing: The understanding of e-invoicing is important for the registered person even if he is otherwise not liable to generate e-invoice.

2.1 As per Rule 48(4) of CGST Rules 2017, the invoice shall be prepared by such class of registered persons as may be notified by the Government, by including such particulars contained in FORM GST INV-01 after obtaining an Invoice Reference Number by uploading information contained therein on the Common GST Portal.

2.2 Further, Rule 48 (5) prescribes – Every invoice issued by a person to whom sub-rule (4) applies in any manner other than the manner specified in the said sub-rule shall not be treated as an invoice

2.3 The Government vides notification no. 13 /2020 CT- dated 21 March 2020 exercised the power conferred by rule 48(4) and notified registered person, whose aggregate turnover in a financial year exceeds rupees 100 crores (amended as 500 crores vide notification no. 61/2020 dated 30.07.2020) as a class of registered person who shall prepare the invoice and other prescribed documents, in terms of rule 48(4) in respect of supply of goods and /or services to a registered person.

2.4 The invoice issued by the notified supplier without being registered at the IRP portal will be considered as an invalid invoice and Input Tax Credit is not available to the recipient on an invalid invoice.

3. Verification of E-Invoice by the Recipient :- An e-invoice portal has been developed by the government which provides facility / an App to the recipient or any third person to check the correctness/validity of e-invoice issued to them. Anyone can verify the authenticity or the correctness of e-invoice by uploading the signed JSON file or Signed QR Code into the e-invoice system. The option ‘Verify Signed Invoice’ under the Search option can be selected and the signed JSON file can be uploaded and verified. Similarly, the QR Code Verify app may be downloaded and used to verify the QR Code printed on the Invoice.

4. Applicability of E-Invoicing: E-invoice under GST is applicable for taxpayers whose aggregate turnover during the financial year 2019-20 exceeds Rupees five hundred crores (Rs. 500 crores). These taxpayers are required to upload the Invoice details on the Government Invoice Registration Portal (IRP) w.e.f. 01st October 2020.

4.1 Aggregate turnover has been defined under section 2(6) of the CGST Act, 2017 and reference has to be placed accordingly for calculating aggregate turnover. The taxpayer needs to upload invoices in IRP, in case the aggregate of all GSTINs based on the same PAN is more than Rs 500 crores

4.2 The taxpayer can come to know his eligibility for IRN generation by selecting the ‘e-invoice status of Tax Payer’ under the Search option. On entry of the GSTIN, the system will indicate whether this GSTIN is enabled/notified for the IRN generation.

4.3 It has been clarified by NIC vide release dated 7th September 2020 that the taxpayers have been enabled to self-register with Invoice Reference Portal (IRP ) for the e-invoice system if they have crossed the aggregate turnover of the business with INR 500.00 Crores during any of the previous 3 financial years of GST regime.

4.4 The taxpayer having an annual aggregate turnover of less than INR 500 crores cannot opt for e-invoicing voluntarily.

5. Exemptions from E-invoicing: There is certain relaxation given by Government to various businesses from e-invoicing as shown below:

5.1 Notification No. No.13/2020 – Central Tax, dated the 21st March 2020 has been issued under rule 48(4) in supersession of the Notification No. 70/2019–Central Tax which gives exemption from the implementation of e-invoicing to the following persons:

(a) An Insurer, Banking Company, or Financial Institution including NBFC.

(b) Goods Transport Agency (GTA).

(c ) Passenger Transport Service.

(d) Admission to the exhibition of Cinematograph Films in Multiplex Screens ie. PVR.

(e) The aforesaid notification has been further amended vide Notification No. 61/2020–Central Tax Dated: 30th July 2020. Wherein an SEZ UNIT (SEZ DEVELOPER is not exempted) has also been exempted from the implementation of e-invoicing

5.2 It is very important to note that Exemption is QUA BUSINESS and NOT QUA TAXPAYER. In other words, a taxpayer engaged in multiple lines of business within the same GSTIN needs to ascertain the activities which are not covered within the aforesaid exemptions. For Example, if a GTA is engaged in warehousing services and his aggregate turnover is more than Rs 500 crores, he is not exempted for issuing e-invoice.

6.0 Applicability on Documents :

| Rule | Type of Document | Applicability |

| 46 | Tax Invoice – B2B & B2G

[Not applicable to self-invoice issued on the RCM basis.] |

Yes |

| Exports Invoice | Yes | |

| SEZ developer Invoice

[SEZ unit is exempted vide NN 61/2020] |

Yes | |

| 53 | Revised tax invoice | Yes |

| Debit Note | Yes | |

| Credit Note | Yes | |

| 46(A) | Invoice-cum-Bill of Supply | No |

| 49 | Bill of Supply | No |

| 50 | Receipt Voucher | No |

| 51 | Refund Voucher | No |

| 52 | Payment Voucher | No |

| 54(1) | ISD Invoice | No |

| 54(1A) | Invoice/Debit/Credit Note for transferring ISD Credit | No |

7. Who Can generate E-Invoice: E-invoice can be generated only by the suppliers. The recipients and transporters cannot generate E-Invoice. The recipient liable to pay tax under RCM also cannot generate E-Invoice. It is the supplier, supplying the goods and /or services under RCM who is liable to generate E-Invoice.

7.1 Taxpayer having an annual aggregate turnover of more than INR 500 crores and have B2C supplies as well, cannot issue e-invoice for B2C. The access to the taxpayer will be blocked if continuous requests with B2C transactions are fired.

7.2 Taxpayers issuing both taxable as well as exempt supply under single invoice would be troublesome and would be required to issue e-invoice only in respect of taxable supplies.

7.3 Taxpayer having an annual aggregate turnover of less than INR 500 crores cannot opt for e-invoicing voluntarily.

8. E-Invoice Mechanism: The taxpayer would continue to use their existing accounting system / ERP or excel based tool for generating the invoice. Existing software would adopt the new e-invoice standard wherein they would re-align their data access and retrieval in the standard format (schema) that is published on the GST portal and have the mandatory parameters. The optional parameters can be according to the business need of the supplier.

It is relevant to know that the accuracy and smooth perpetration of e-invoice are largely depended on the accountant or the person entering details in the ERP system. The organization should make sure the person keying invoice in ERP is trained and understood the contents (As per the Scheme provided for the purpose) to be entered in the ERP system.

9. Steps in the generation of E-Invoice E-invoicing mechanism is the process wherein details of the invoices have to be sent for registration on the Invoice Reference Portal (IRP) in a standard format for which e-schemahas been notified, in return of which supplier gets an Invoice Reference Number (IRN), a digitally signed invoice by IRP and a QR Code in JSON

9.1. The supplier will upload the JSON of the invoice into the IRP ( Invoice Reference Portal).

9.1.1. JSON (JavaScript Object Notation ) format is a standard data interchange format. It is primarily used for transmitting data between a web application and a server. A JSON file is a file that stores simple data structures and objects in JSON Format.

9.2 The JSON may be uploaded directly on the IRP or through GSPs or third party provided Apps. The IRP will generate the Hash.

9.2.1 The hash function is a type of mathematical function, which, when applied to a digital file (a record), assigns it a specific value called a hash.

9.3 The hash generated by IRP will become the IRN (Invoice Reference Number) of the e-invoice. This shall be unique to each invoice and hence be the unique identifier for each invoice for the entire financial year in the entire GST system for a taxpayer.

9.4 The IRP will check the IRN from the central registry of the GST system to ensure its uniqueness. On receipt of confirmation from Central Registry, IRP will authenticate and add its signature on the Invoice data as well as a QR code to the JSON. After that Invoice Reference Number (IRN) will be generated by the IRP.

9.5 IRP will return the digitally signed JSON with IRN back to the seller along with a QR code.

9.6 IRP will share the signed e-invoice data along within IRN (same as that has been returned to the supplier) to the GST system as well as to E-Way Bill System.

9.7 It is very significant to note that GSTR 1, GSTR 2A, and GSTR 6A will get auto-populated along-with the facility to directly generate E-waybill thereby reducing duplication work. Table 4A, 4B, 4C, 6A, 6B, 6C, 9B, and 12 of GSTR 1 will be auto-populated i.e. B2B, exports, Registered DN, Registered CN, and HSN.

9.8 Invoice in GSTR 1, GSTR 2A, and GSTR 6A will be auto-populated on a T+1 basis as data will be pulled in GSTN from IRP every night and once stabilized it will be reflected in a real-time basis.

10. Modes of generating E-Invoice For the implementation of e-invoicing as per the methodology, the following are the channels through which the same can be adopted:

10.1 Offline Facility – Bulk Upload Tool : In this, the taxpayer prepare and upload the file containing the multiple IRN requests, and the e-invoicing system will process each one of them and return the IRN for all as applicable

10.2 Direct API integration This is a direct method of taxpayer system requesting for IRN and e-invoicing system will return the IRN

10.3 API Integration through GSP In this case, the taxpayer system will route the request for IRN through GSP, and the e-invoicing system will return IRN. ERP shortlisted by GSTN to work as GSP and E-Commerce Operator has been enabled to register and test the APIs on the sandbox system. The taxpayer can appoint more than 1 GSPs also for availing e-invoicing services i.e. more than 1 GSPs can be registered

10.3.1 In the case of e-commerce transactions, the e-Commerce Operator can request for the IRN/e-invoice on behalf of the supplier. In this case, the e-Commerce Operator should have been registered on the GST portal as an e-Commerce Operator and use e-cCom GSTIN accordingly.

11. E-Invoice Schema: The schema simply means format. E invoice schema is the standard format for electronic invoices. It is termed as GST-INV-1.

11.1 The GST council approved the standard of e-invoice in its 37 meetings held on 20 Sep 2019 and the same along with schema has been published on the GST portal. The same e-invoice schema will be used by all kinds of businesses and no separate format is required for different kinds of users i.e. Traders, Medical Shops, Professionals and Contractors, etc.

11.2 The schema has mandatory and non-mandatory fields Mandatory field has to be filled by all the taxpayers. The non-mandatory field is optional for the business to choose from. Specific sectors of business may choose to use those non-mandatory fields which are needed by them or their eco-system.

11.3 Mandatory and optional fields as per e-schema issued by the Government vide Notification No, 60/2020–CT dated 30-7-2020 should be given in the desired format.

12. Invoice Reference Number (IRN): IRN( Invoice Reference Number) is a number allotted by the Government to tag and identify valid e-invoice generated through Invoice Reference Portal (IRP).

12.1 Once the supplier uploads the JSON of the invoice into the IRP (Invoice Reference Portal), The IRP will generate the hash. The hash generated by IRP will become the IRN (Invoice Reference Number) of the e-invoice. This shall be unique to each invoice and hence be the unique identity for each invoice for the entire financial year in the entire GST system for a taxpayer.

12.2 Features of IRN

(a) It is a unique 64 characters hash based on 4 parameters which are supplier GSTIN + Fin. Year + Doc Type + Doc Number

(b) IRN is different from Invoice Number

(c ) IRN needs to be generated before the issuance of the invoice or before the movement of the goods.

(d) IRN generated remains on the IRP portal for 1 or 2 days

(e) IRN generated by the IRP portal is stored in the GST Invoice Registry under GST Systems

13. Validations: The taxpayer has to upload the complete invoice details, prepared manually, or through an internal ERP/accounting system, as per the format only after due validations of the data.

13.1 GSTIN Validation: Recipient GSTIN should be registered and active. The business needs to ensure enter valid GSTIN of the recipient in their system. In case of transaction of direct export, the recipient GSTIN has to be URP, and state code has to be 96, PIN code should be 999999, POS should be 96.

13.2 HSN /SAC Code should be validated as per GST Master Codes

13.3 Financial year will be derived based on the document date. Unique series of the invoice should be maintained throughout the financial year.

13.4 Calculation: The passed value should be between the minimum and maximum values as explained here. The minimum value is considered as the rupee part of the calculated value minus one rupee and the maximum value is taken as the rounded up to next rupee value of the calculated value plus one rupee.

13.4.1 In the case of Credit Note and Debit Note, the tax rate can be passed with any value.

13.4.2. Passed IGST Value of Item will not be validated even actual tax rate is passed in case of EXPWOP ( Export without payment ) and SEZWOP,( SEZ without payment ) if the passed value of IGST for that is ZERO.

14. IRN Validations: Duplicate IRN requests are not considered. That is, if the IRN is already generated on a particular type of document and document number of the supplier for the financial year, then one more IRN cannot be generated on the same combination.

14.1 Maximum number of items in each invoice should not exceed more than 1000 items and a minimum of 1 item should be available. However, taxpayers who are required to report more than 1000 line items may contact NIC.

14.2 Document number should not be starting with 0, / and -. If so, then the request is rejected

14.3 Reverse Charges” can be set as “Y” in case of B2B invoices only and tax is being paid in a reverse manner as per rule. Even in the case of Reverse Charged invoices, the Supplier has to generate the IRN

14.4 In case of any error invalidation, the error code, and its details can be referred from https://einv-apisandbox.nic.in/api-error-codes-list.html.

15. E-Invoice – Amendment: All the amendments to the e-invoice will be done on the GST portal only. JSON sent for the generation of e-invoice cannot be amended. IRN cannot be amended.

16. E-Invoice Cancellation: The e-invoice mechanism enables invoices to be cancelled. This will have to be reported to IRP within 24 hours. Data on IRP will be kept there only for 24 hours. Any cancellation after 24hrs could not be possible on IRP; however one can manually cancel the same on the GST portal before filing the returns.

16.1 Further, E-invoice cannot be partially cancelled. It cannot be cancelled if a valid e-waybill exists for that IRN as goods are in movement. Edited (amended) invoice cannot be cancelled (even within 24 hours) and will be kept for audit trail. IRN cannot be generated again on the same invoice number. IRN cannot be re-generated for the cancelled invoice Fresh invoice needs to be raised for generating IRN.

17. E-Invoice Printing The taxpayer can continue to print his paper invoice as he is doing today including logo and other information.

17.1 Company LOGO: Software company has to provide a place holder for company LOGO in the billing/accounting software so that it can be printed on the supplier’s invoice using his printer. The company’s LOGO will not be part of the JSON file to be uploaded on the IRP. The place holder is not provided in the e-invoice schema for the company logo.

17.2 Signature on e-invoice: The e-invoice will be digitally signed by the IRP after it has been validated. The signed e-invoice along with QR code will be shared with the creator of the document as well as the recipient. The taxpayer can sign on e-invoice if so wish.

18. QR Code: QR (Quick Response ) Code will be part of the JSON file returned by IRP. It is Mandatory to print the QR code on the Invoice. It can be printed anywhere on the invoice. The size of the printed signed QR code can be 2 X 2 inches. However, it depends on the size of the space available on the invoice. But it should be readable from the QR code scanners. Printing of the QR Code on separate papers is not allowed. The taxpayer can print more than 1 QR code on the invoice – proper annotation is required

18.1 Contents of QR Code: GSTIN of supplier • GSTIN of Recipient • Invoice number as given by Supplier • Date of a generation of invoice • Invoice value (taxable value and gross tax) • Number of line items. • HSN Code of the main item (the line item having the highest taxable value) • Unique Invoice Reference Number (hash).

19. E-Invoice & E Way Bill: On the production environment, E-Invoice System and E Way Bill System are seamlessly integrated. The Credentials of E Way Bill System work on E-Invoice System.

19.1 IRP will share the signed e-invoice data along within IRN (same as that has been returned to the supplier) to the GST system as well as to E-Way Bill System.

19.2 E Way Bill can be generated as part of the generation of IRN itself or by using the IRN as a reference or by calling E Way Bill APIs separately.

19.3 Only Part A of the E Way Bill can be generated . Further operations on E Way Bills can be performed on the E Way Bill System. E Waybill system will create Part A of e way bill using this data to which only vehicle number will have to be attached in Part –B of the e waybill. However, for the transportation of goods, carrying an e-way will during transit of goods will continue to be mandatory,

19.4 It is very interesting to note that even the E-waybill system is directly integrated with the e-invoicing system and therefore, it is totally upon the choice of the taxpayer if they want to generate E-way Bill at the time of generation of e-invoice only to avoid duplication work. However, it is significant to note that E-Waybill will not be generated if the Supplier or Recipient GSTIN is blocked due to non-filing of Returns

19.5 E-waybill can also be generated from the same JSON file sent for registration at IRP. However, the challenge would be in the issuance of e-waybill in case of delivery in installments.

19.6 Ideally, IRN has to be generated before the e-waybill. The cancellation of EWB is integrated with E-Invoice to enable the cancellation of E-Invoice

19.7 In the case of export transactions for goods, if an e-way bill is required along with IRN, then the ‘Ship-To’ address should be of the place/port in India from where the goods are being exported. Otherwise, the E-way bill can be generated later based on IRN, bypassing the ‘Ship-To’ address as the place/port address of India from where the goods are being exported. The said functionality has been improved and released on 7th September 2020 i.e. ‘Generate EWB by IRN’ has been improved to enable the generation of EWB in case of export by passing the address of the port from where it is getting exported later.

19.8 E-way Bill is not generated for document types of Debit Note and Credit Note and Services.

19.9 PIN code of Recipient GSTIN is mandatory if Ship-To details are not entered

19.10 In case incomplete information has been passed for the generation of E Way Bill, then IRN will be generated and returned but not E Way Bill number. However subsequently, based on IRN, E Way Bill can be generated.

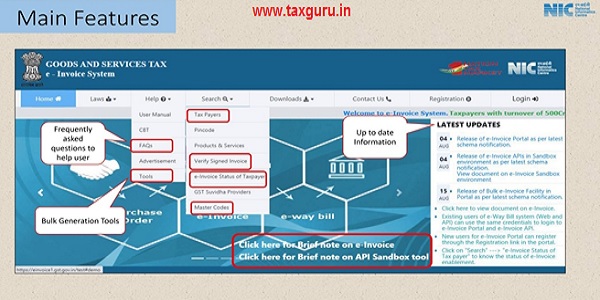

20. E-Invoice Portal The taxpayer can see the features like rules, notifications, help, manuals, Audio-Video materials, FAQs, etc. on the e-invoice portal https://einvoice1.gst.gov.in

20.1 There is a facility to login to the e-invoice system. If the taxpayer has registered in the e-way bill portal (https://ewaybillgst.gov.in), he can use the login credentials (username and password) of the e-way bill system to login to the e-invoice portal. If he is not registered in the e-way bill portal, then can register in the e-invoice portal at option Registration. The system enables him automatically for both the e-way bill and e-invoice systems.

20.2 The taxpayer can come to know his eligibility for generation IRN by going to the e-invoice portal and selecting the ‘e-invoice status of Tax Payer’ under the Search option. On entry of the GSTIN, the system will indicate whether this GSTIN is enabled/notified for the IRN generation.

20.3 One can upload the IRN generated and signed the invoice file and get it verified on the portal for the authenticity of the IRN. For this option, select ‘Verify Signed Invoice’ under the Search option.

20.4 E-Invoice API has two sets of credentials – Client ID, Client Secret (For GSPs) and User ID, Password (For Taxpayers with GSTIN). If the taxpayer is enabled to access the API directly, then they will get Client ID, Client Secret that can be used PAN India for all sister concerned GSTINs with the same PAN.

FREQUENTLY ASKED QUESTIONS:- FAQ released by NIC are as follows:-

Q.1 Is e-invoicing applicable for supplies by notified persons to Government Departments / PSUs? Or e-invoice is applicable for B2G transactions?

Ans. Government Departments / PSUs might have registered as regular GSTIN or TDS GSTIN. If the transaction is with TDS authority/ registration, then e-invoicing is necessary.

Q.2 In the e-invoice schema, the amount under ‘other charges (item level)’ is not part of taxable value. However, some charges to be shown in the invoice are leviable to GST. How to mention them?

Ans. Such other charges (taxable) may be added as one more line item. For example, freight charges, insurance charges will have separate line entries.

Q.3 In the current schema, there is no provision to report details of supplies not covered under GST, e.g. a hotel wants to give a single invoice for a B2B supply where the supply includes food and beverages (leviable to GST) and Alcoholic beverages (outside GST).

Ans. Ideally, for items outside the GST levy, a separate invoice may be given. Some businesses are following this.

Q.4 While returning IRN, the IRP is also giving an IRN No, Acknowledgement No., and Date. Whether this also needs to be printed while issuing the invoice?

Ans. Printing of IRN No, Acknowledgement No, and Date, given by IRP, are optional and can be recorded in the ERP system for reference purposes.

Q.5 In case of a breakdown of internet connectivity in certain areas, will there be any relaxation for the requirement to obtain IRN?

Ans. The mechanism to provide relaxation in such contingent situations will be notified by the government soon.

Q.6 TCS of Income Tax is not part of the E-invoice schema. Is it not required to be displayed in e-invoice? if so, how to pass these details.?

Ans. Clarification on this will be provided by the Government soon.

Q.7 Who has to generate Reverse Charge Mechanism (RCM) invoices?

Ans. RCM related invoices have to be generated by the supplier, not by the recipient

- In case of B2B RCM invoices, if the supplier is notified to generate the IRN, he will do so with the RCM flag in it, otherwise not required.

- In case of B2C RCM invoices or self invoices, then IRN need not have to be generated

Q.8 Whether B2C invoices can be reported to IRP for the generation of IRN?

Ans. Reporting B2C invoices by notified persons is not allowed currently. Printing of dynamic code on B2C invoices is not be confused with B2B reporting.

Q.9 How to generate the QR code of B2C invoices as per the notification?

Ans. There is a separate notification issued by the government for QR code generation for B2C invoices. The purpose of this is to enable digital payment by consumers. That’s is a separate process, not rated to e-invoicing.

Q.10 On the e-invoice portal, IRN generation is failing because of minor variations in the calculation. What should be done?

Ans. Calculation validations have been improved recently with a tolerance limit for each one. Now, all types of transactions will be passed through.

Q.11 What is the time limit for the generation of IRN

Ans. Previously, 24 hours time limit had been provided for the generation of IRN after the preparation of the invoice by the taxpayers.

Now, that validation has been removed based on the demand of taxpayers. IRN should be generated before issuing the invoice to the other party or movement of goods.

Q.12 The taxpayers, who have crossed with aggregate Turnover of Rs 500 Crores, have not been enabled. What should they do?

Ans. The list of taxpayers, who have been crossed with an aggregate turnover of Rs. 500 Crores have been identified based on the turnover declared in GSTR3B for previous years.

The separate option is being provided on the portal for self-declaration by the taxpayers, who have crossed with an aggregate turnover of Rs. 500 Crores, to register and get enabled for the e-invoicing system. It will be enabled in a couple of days.

Q.13 Can the taxpayer is allowed to generate IRN after EWB generation.

Ans. Ideally, the First E-invoice/IRN has to be generated and then e-way bill.

On the same line, if IRN has to be cancelled, the first e-way bill has to cancel and then IRN

Q.14 How to generate the e-way bill through API, when I don’t have the distance between the source and destination PINs?

Ans. E-Way Bill system has a distance between all the postal PINs of India. If you send the distance as ZERO, then the system considers it has requested for auto-calculated PIN-PIN distance and uses that generate the e-way bill.

The Author can be approached at caanitabhadra@gmail.com

Very nice.Article gives the basic information theorically.Thank you.

Thanks for your humble comment

HELLO ,

I HAVE ONE QUERY

whether e invoicing is applicable on tax free goods sold to B2B.

Dear Sir / Madam,

On LD Invoice (Late Delivery Charges debited to party via issuing a invoice ) E – invoice is applicable ?? (My compamy turnover crossed 500 Crore)

Yes, Applicable. #caniteshambaliya

Is e invoicing is applicable to academic institutions established under an act of parliament and their primary work is to impart education and not to do business.

whether the grant paid by govt to such institutions on account of OH31, OH 35 and OH 36 should be counted to calculate gross turnover though it do not have any relation to the services being rendered by such institutions.

Hello, many businesses send material to the transporter, who after getting sufficient load, on a subsequent date, designates a vehicle for the actual transportation.

In such a case, while generating an e-invoice, the vehicle number is not known, though the transporter may be known.

If data in json format is submitted for generating e-invoice, with relevant details as required in the e-way bill block, system generates the e-invoice, but gives error under e-way bill column, stating that vehicle number is not given and hence, a connected e-way bill number is not generated.

User has a choice in the same e-invoice portal to enter the part B details and generate a connected e-way bill. However, all this time, the transporter used to do this as they only know the date when the actual transportation shall happen and the vehicle number in which it will happen.

Is there a way, where after generating the e-invoice, a person delivers the goods to the transporter, who (transporter) can generate an e-way bill later based on the IRN or the Acknowledgement number?

Is E-invoice applicable for Retail Industries (Departmental Stores / Super Market)

hi, my client has crossed 100 cr turnover in FY 20-21. while it was less in all previous financial years. Is einvoicing applicable ?

A petroleum retail outlet (petrol pump) supplies both non-gst goods (petrol, diesel, cng) and gst goods/services (oil, accessories, services).

If their turnover exceeds Rs. 100 Cr:

a. Will they be required to issue any e-invoice for the non-gst b2b supply?

b. Will they be required to issue e-invoice for b2b supply of goods/services covered under gst? Typically, they supply goods/services on credit also during the month and generate credit invoices at the end of the month.

Tax Free / Nil Rated goods supplier’s Tern Over are more than 100 Crore. Please tell me for e-invoicing is liable or not.

my company nature of business Services and payment mode paytm this period invoice automatic generating so after e invoice period how to invoice generate reply sir or madam

One of our customer is asking us to undertake that our Aggregate Turnover (as per Section 2(6) of Central Goods and Services Tax Act, 2017) for FY 2019-20 does not exceed the prescribed threshold (as on the date of this declaration) for generation a Unique Invoice Registration Number (IRN) and QR code as per the provisions of CGST Act, 2017 and rules thereunder (“GST Law”). Our turnover is in between Rs.100 cr to Rs.500 crores and we are going to generate e-invoice from 1st Jan`21. Is it mandatory under CGST Act to declare as such??

In our existing system, invoices were issued in Tally as Tax Invoice. Now after e-invoicing, will that invoice (Tally generated) be considered as Tax Invoice or e-invoice will be tax invoice. If later is the case, then what should be the title of the existing invoices?

How to generate GST E invoicing for annual turnover is less than 500cr?

If one is dealing in multiple business of petrol pump, GTA and in other taxable services and turnover is above 300 crore in which GTA plus petrol pump services turnover is above 250 cr. Whether E invoicing is applicable or not? If yes, then how GTA B2B bills will be prepared?

How will E-invoicing work in case of a Motor car dealer sellling cars,if hereby the customer is registered person (B2B) who thereby himself is taking the delivery from the showroom. Will E-invoice need to be issued ? What will the effect taken/adopted?

Is proforma invoice to be considered as tax invoice under the new provisions

Is it mandatory that the e-invoice is to be given to the transporter with our own generated invoice and Eway bill . regards vinod akolkar dewas

whether E-Invoices can be reflected in GSTR-1 Return automatically every day or every month?GSTR-1 returns upload electronically or generate template every month.

Thanks and Regards,

Murali Krishna Bonthu

Relaxation has been given to Financial Institutions including NBFC for E-Invoicing.

It is clarified by the Authorities in one of the FAQs that exemption for issuing e-invoicing will be on Entity based.

In my view, HFC is not required to issue e-invoice for both the core & non-core services.

Dear All,

I have one query

Whether E invoicing is applicable to Housing Finance Co.(HFC’s) or not??

If not then whether all the services ( i.e. whether core or non core) provided by HFC’s r exempted or not.