Manual on Form GSTR-2A – View of Inward Supplies Return

How can I view the Inward Supplies details in Form GSTR-2A?

Note:

1. Form GSTR-2A will be generated in below scenarios,

- When the supplier uploads the B2B transaction details in Form GSTR-1& 5/ &

- ISD details will be auto-populated on submission of Form GSTR-6 by the counterparty / &

- TDS & TCS details will be auto-populated on filing of Form GSTR-7 & 8 respectively by the counter party.

2. Form GSTR-2A is a Read only view form and you cannot take any action in Form GSTR-2A.

3. Form GSTR-2A will be generated in the following manner:

- After filing/submission of Form GSTR-1 by suppliers or when counterparty adds Invoices / Credit notes / Debit Notes etc. or make Amendments in Form GSTR-1/5.

- Form GSTR-6 is submitted for distribution of credit in the form of ISD credit invoice or ISD credit notes.

- Form GSTR-7 & 8 filed by the counterparty for TDS & TCS credit respectively.

Note: Details of TDS and TCS returns will be available as and when Form GSTR-7 & 8 will be made operational.

To view the Inward Supplies details in Form GSTR-2A, perform the following steps:

1. Access the www.gst.gov.in URL. The GST Home page is displayed.

2. Login to the GST Portal with valid credentials.

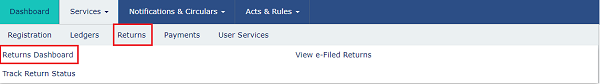

3. Click the Services > Returns > Returns Dashboard command.

Page Contents

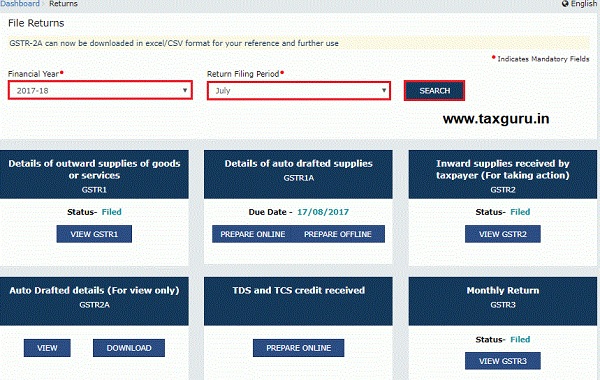

4. The File Returns page is displayed. Select the Financial Year & Return Filing Period (Month) for which you want to view Form GSTR-2A from the drop-down list.

5. Click the SEARCH tile.

6. The File Returns page is displayed.

7. Download GSTR-2A

8. View GSTR-2A

7. Download GSTR-2A

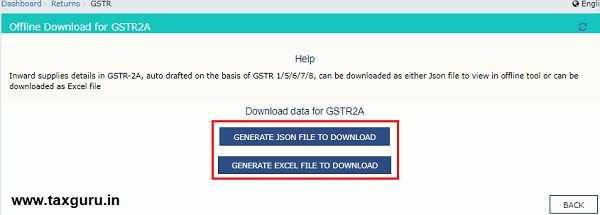

7.1. If number of invoices is more than 500, then you need to download the invoices in Form GSTR-2A. Click the DOWNLOAD button to download the file.

7.2. Click the GENERATE JSON FILE TO DOWNLOAD button to generate data in the JSON format.

Click the GENERATE EXCEL FILE TO DOWNLOAD button to generate data in the excel format.

It may take upto 20 minutes for the file to be generated. Once the file is generated, the link will appear to download. Download the file.

8. View GSTR-2A

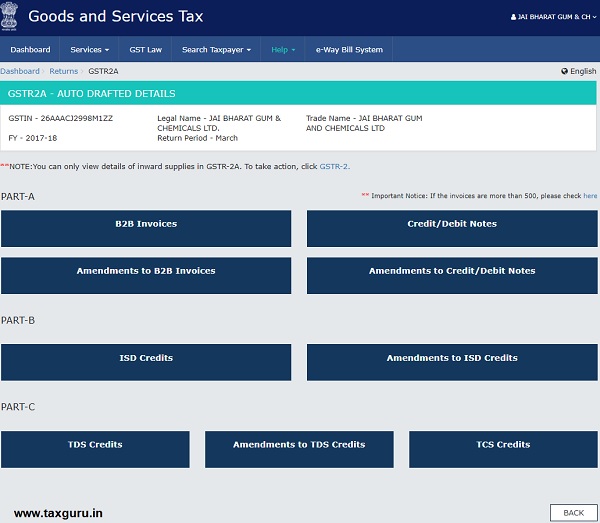

8.1. In the Form GSTR-2A tile, click the VIEW tile.

8.2. The Form GSTR-2A – AUTO DRAFTED DETAILS page is displayed.

Click the tile names to know more details:

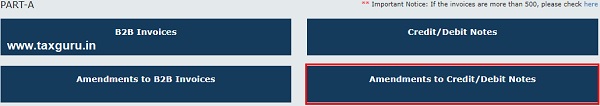

PART- A

B2B Invoices

B2B invoices displays all the invoices added by the supplier through their Form GSTR-1 and/ or Form GSTR 5. The B2B section of PART-A of Form GSTR-2A is auto-populated on uploading or saving of invoices by the supplier in their respective returns – Form GSTR-1 and Form GSTR-5.

1. Click the B2B Invoices tile. The B2B Invoices – Supplier Details page is displayed.

2. Click the GSTIN hyperlink to view the invoices uploaded by the supplier.

3. Click the Invoice No. hyperlink to view the invoice details.

Note: In case of supply attracts reverse charge, then Supply attract Reverse Charge column will be displayed as Y.

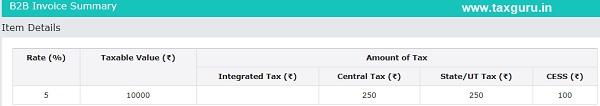

The item details are displayed.

Amendments to B2B Invoices

Amended B2B invoices section covers the invoices which are amended by the supplier in their returns of Form GSTR-1/5 respectively.

1. Click the Amendments to B2B Invoices tile. The Amend B2B Invoices – Supplier Details page is displayed.

2. Click the GSTIN hyperlink to view the amended invoices uploaded by the supplier.

3. Click the Invoice Number hyperlink to view the invoice details.

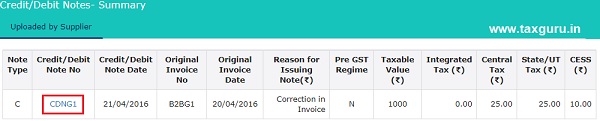

Credit/Debit Notes

This section covers the Credit/Debit notes added by the supplier in their respective returns (Form GSTR-1/5).

1. Click the Credit/Debit Notes tile. The Credit/Debit Notes – Supplier Details page is displayed.

2. Click the GSTIN hyperlink to view the credit or debit notes uploaded by the supplier.

3. Click the Credit/Debit Note No hyperlink to view the details.

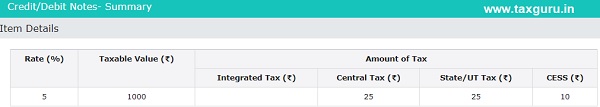

The item details are displayed.

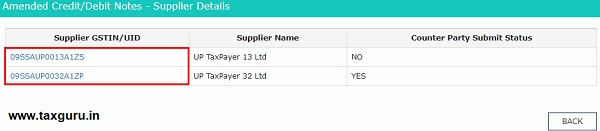

Amendments to Credit/Debit Notes

Amendments to Credit/Debit Notes section covers the amendments of Debit / credit notes done by the supplier in their respective returns (Form GSTR-1/5).

1. Click the Amendments to Credit/Debit Notes tile. The Amend Credit/Debit Notes – Supplier Details page is displayed.

2. Click the GSTIN hyperlink to view the credit or debit notes uploaded by the supplier.

3. Click the Invoice No. hyperlink to view the details.

The item details are displayed.

PART-B

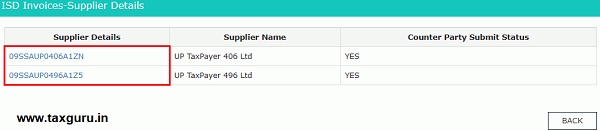

ISD Credits

1. Click the ISD Credits tile. The ISD Credit Received page is displayed.

PART B of Form GSTR-2A will be auto-populated on submission of Form GSTR-6.

2. Click the GSTIN hyperlink to invoices uploaded by the supplier.

The details are displayed.

Amendments to ISD Credits

Amendments to ISD Credits section covers the amendments of ISD credits done by the supplier in their respective returns (Form GSTR-1/5).

1. Click the Amendments to ISD Credits tile.

The Amended ISD Invoices-Supplier Details page is displayed.

2. Click the GSTIN hyperlink to invoices uploaded by the supplier.

The details are displayed. You can click the ISDCNA tab to view the ISD credit note details.

PART-C

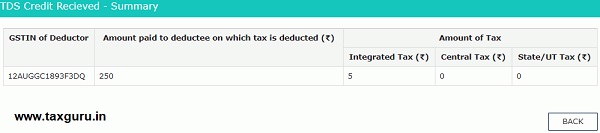

TDS Credits

Note: Details of TDS and TCS returns will be available as and when Form GSTR-7 & 8 will be made operational.

1. Click the TDS Credits tile.

The TDS Credit Received – Summary page is displayed.

PART C of Form GSTR-2A is auto-populated on filing of Form GSTR-7 by TDS Deductor.

Amendments to TDS Credits

Amendments to TDS Credits section covers the amendments of ISD credits done by the supplier in their respective returns (Form GSTR-1/5).

1. Click the Amendments to TDS Credits tile.

The Amendments to TDS Credit Received – Summary page is displayed.

TCS Credits

Note: Details of TDS and TCS returns will be available as and when Form GSTR-7 & 8 will be made operational.

1. Click the TCS Credits tile. The TCS Credit Received page is displayed.

PART D of Form GSTR-2A will be auto-populated on filing of Form GSTR-8 by TCS Collector.

Disclaimer: The contents of this article are for information purposes only and does not constitute an advice or a legal opinion and are personal views of the author. It is based upon relevant law and/or facts available at that point of time and prepared with due accuracy & reliability. Readers are requested to check and refer relevant provisions of statute, latest judicial pronouncements, circulars, clarifications etc before acting on the basis of the above write up. The possibility of other views on the subject matter cannot be ruled out. By the use of the said information, you agree that Author / TaxGuru is not responsible or liable in any manner for the authenticity, accuracy, completeness, errors or any kind of omissions in this piece of information for any action taken thereof. This is not any kind of advertisement or solicitation of work by a professional.

Source- GST.gov.in