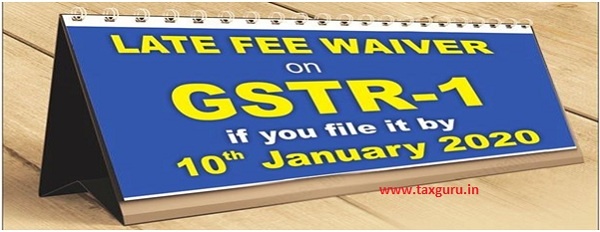

Dear Readers, in my last article, I have tried to focus on an in-depth analysis of Notification No. 74/2019 – Central Tax & Notification No. 75/2019 – Central Tax issued by the GST Department. In today’s article, we are discussing FAQ’s and consequences of not Filing of pending GSTR-1 before 10th January 2020. Now, GST Department is trying to create a massive awareness of this one-time late fee waiver scheme provided to GSTR-1 Defaulters. Department is sending SMS to GSTR-1 defaulters to avail of this opportunity.

Q 1. I am regularly filing my GSTR-3B before the due date, whether it is mandatory for me to file GSTR-1?

Ans: Yes, it is mandatory for all GST Registered persons to file GSTR-1 along with GSTR-3B because GSTR-3B is just a summarized return in which, we have to show self calculated Sales, GST Liability and GST Inputs, however, in GSTR-1, we have to show detailed B2B Invoices Details and other required details in elaborated form like Debit/ Credit Note Detail, Invoices, and HSN Code wise detail.

Q 2. I am a Composition dealer, whether GSTR-1 filing is applicable to me?

Ans: No, GSTR-1 Return is not required to be filed by Composition dealers. All regular Scheme dealers are mandatory to file GSTR-1.

Q 3. If due to some unavoidable circumstances, I am not able to file GSTR-1 before 10th January 2020. Will I am eligible to file the same after due date.

Ans: Yes, you have the option to file the same after cutoff date (10th January 2020) but you have to pay GSTR-1 late Filing fee after due date.

Q 4. Whether there are any consequences if I do not file the GSTR-1 return?

Ans: Yes. Non-filing of GSTR-1 return attracts many Consequences:

♦ Your GST Registration may be canceled

♦ Your Bank Account may be freezed

♦ E-Way Bill generation facility will be blocked

♦ Assessing Officer has the power to make Best Judgment Assessment which may be harsh to GST Registered Dealers.

♦ Face issues while dealing with Registered Persons – because if your credit is not reflected in Counterparty GSTR-2A, they may stop working with you.

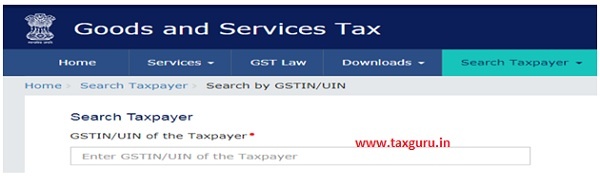

Q 5. I am a young entrepreneur and I have newly started business. Whether there is an option where I can check GST Return related compliance track of dealer with whom I am going to start working.

Ans: For creating transparency, GST Department has given a link on GST Portal, where you can easily track GST Compliance record of Counter Dealer by just using his GST Number.

Q 6. I am running a transport business and dealing in B2B Transactions. In our case, the service recipient is required to pay GST under reverse charge. Whether, it is mandatory for me to file GSTR-1 containing details of these B2B Transactions?

Ans: Yes, in this case, you have to report all B2B transaction covered under reverse charge.

Disclaimer: This article is for the purpose of information and shall not be treated as a solicitation in any manner and for any other purpose whatsoever. It shall not be used as a legal opinion and not be used for rendering any professional advice.

The Author “CA. Shiv Kumar Sharma” can be reached at mail –shivsharma786@gmail.com

After cancellation gst number can i subbmit the GSTR!