Documents Required for GST Registration of a Small Proprietorship Firm:

-Mobile Number

-E-Mail ID

–PAN Card

-Aadhar Card

-Passport size Photo (Up to 100 KB Size )

-Bank Passbook or Bank Statement First page

-Electricity Bill (latest) of the person on whose name Registration is seeking.

Step by step approach for for GST Registration of a Small Proprietorship Firm:

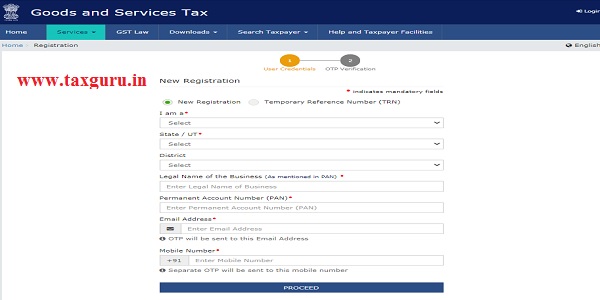

Step 1 – TRN Generation

Click here: https://reg.gst.gov.in/registration/and then fill the basic details as shown here

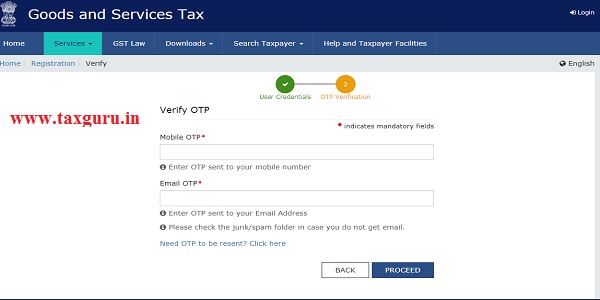

Then click on proceed to get OTPs on your Mobile no. and E-Mail ID which is to be used for OTP Verification as shown below

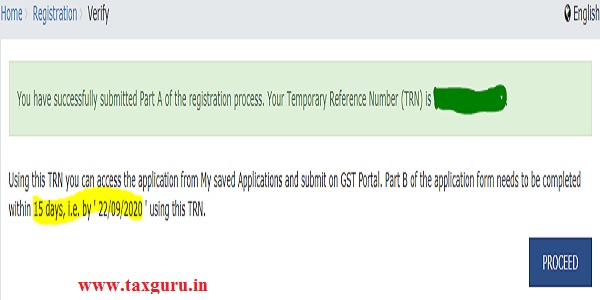

after that TRN will be sent to your Mobile No. and E-Mail ID.

Step 2: Open the Registration Application

What we did in the first step is just for opening the Registration application and we can save the application draft and can come out of the application but each time when you want to open your draft application you should provide the OTP which will be coming to your contact details.

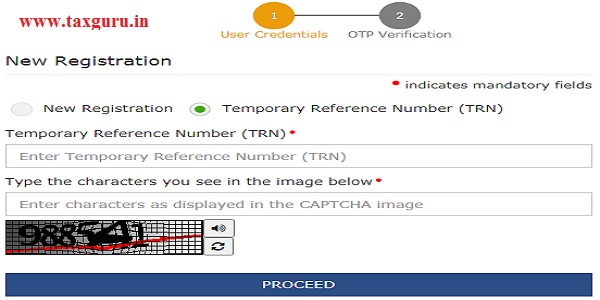

So now open the application by clicking on the link provided in 1st step and select TRN Option as shown below and enter the TRN and Captcha code and click on proceed and after that provide the OTP to open the application.

Step 3: Fill up the Application

Then the application will be showing like a draft and click on Action symbol to open the application

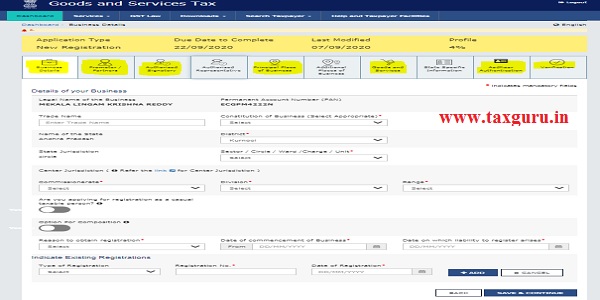

Then application opened looks like this

Here you can find 10 Tabs in which Highlighted are Compulsory and here FYI to go to 2nd and later tabs you should fill and save the first Tab.

Now,

- 1st Tab – Business Details: Provide Trade name and Tax Jurisdiction ( You can find the same from the link provided there itself).

- 2nd Tab – Proprietor Details: Provide the Proprietor personal and Identity information and Residential Address and attach Photo of Proprietor and click on save and continue to go to the next tab

- 3rd Tab – Authorised Signatory: Here nothing you need to fill and you just click on the option provided at the end of 2nd tab Stating ALSO AUTHORISED SIGNATORY. Which means declaring Proprietor as Authorised signatory which is common in all proprietorship firms. Then the details of the 2nd tab will be copied to 3rd Tab and click on save and continue to go to the next Tab

- 5th Tab – Principle place of Business: Provide the Business address and Attach Electricity bill as an address proof and ownership proof and attach the copy of EB AND select the nature of activity at the address provided above. Click Save & Continue.

- 7th Tab – Goods and Services: Select the HNS Code of the Goods or SAC Code of the Services suitable to your business AND Click Save & Continue.

- 9th Tab – Aadhar Authentication: New Tab introduced recently. It’s advisable to choose Yes to the question Would you like to opt for Aadhaar authentication of Promoters/ Partners, Authorized Signatories? to get the Registration approved at the earliest.

- 10th Tab – Verification: Click on verification box provided there and Select the authorised signatory and enter the Place and Click on submit with EVC and Enter the EVC Code which ll be coming to your mobile number and email id and submit it finally

Aadhar Authentication :

Once the application is submitted you should the Aadhar authentication and then only your application is considered as submitted.

How to do?

Once the application is submitted you will get a link for Aadhar Authentication. Click on the link and it will ask for the Aadhar number of the Proprietor. Please provide the Aadhar number and click on proceed to generate Aadhar OTP and provide the OTP and click on submit.

Here please note that the OTP will come to the Aadhar linked mobile number of the proprietor and not to the Mobile number which is provided in the Registration application.

ARN Number :

Once the Aadhar Authentication is done you will receive the ARN Number which means your application reached the Tax authorities for verification.

When I will get the GST Certificate :

After getting ARN within 1 working day you will get if all the details provided are correct as per my experience.

Provide Bank account Details :

Once the application is approved you will receive the login credentials to your email id and then use these Credentials to create new Credentials. It is mandatory to change the Old Credentials.

Now login to your GST Account using your new Login Details.

In the next slide the system will ask for providimg the Bank account details.

Provide the bank account details and submit it using EVC.

Once the bank account details are provided then you can download the GST Certificate immediatly which is available at Downloads.

Hi, mine is a MSME startup , registered with MSME,, I want to register GST, what are the charges,,

Is telephone number mandatory for business?

I have GST Registration for my Proprietorship Firm based in Mumbai, Maharashtra. I wish to start a new Proprietorship Firm in different state. Do I need to apply for Fresh GST Registration or the old one is needed to be modified ?

Please advise.

Hello,

Really Good information, I need some clarification on selecting the HSN code for a busineess of distribution os FMGC products as it involves different HSN items like food items, soaps, cleaning products , request you to kindly on the above.

Thank you so much.

HI!

This is sreenivas, a practicing CA from Tirupati , Iam very happy to see ur article today and proud of U. could u pl send ur contact no?

Mine is 83330 24179

All the best