A. FAQs on Refund on account of Supplier of Deemed Export

Q.1 When refund application by Supplier of Deemed Exports can be filed?

Ans: If the supplier of deemed exports has not collected tax from the recipient of deemed exports and paid the tax amount to the government, then the supplier of deemed exports would be eligible to claim the refund of tax amount paid by him, by providing the declaration that the recipient shall not claim any refund with respect of the said supplies and recipient has not availed any input tax credit on such supplies.

Q.2 What are the relied upon documents which I have to upload with refund application of supplier of deemed export?

Ans: You have to upload documents as are required to be filed along with Form RFD-01, as notified under CGST Rules or Circulars issued in the matter and other such documents the refund sanctioning authority may require.

Statement 5B shall be uploaded mandatorily with the details of documents for which refund is to be claimed. Taxpayers have an option to upload 10 documents with the refund application, of size up to 5MB each. Therefore, any supporting document can be uploaded by the taxpayer, if required.

Q.3 To whom should I file my application with?

Ans: The taxpayer shall file the refund application in Form RFD-01 on GST portal. Taxpayer shall choose ground of refund as “Supplier of Deemed Exports” for claiming refund. After filing, refund application shall be assigned to Refund Processing Officer and refund applicant can track the status of refund application.

Q.4 Can I file for multiple tax periods from two different financial years in one refund application?

Ans: Yes, you can file for multiple tax periods from two different financial years in one refund application.

For Example:

- You can file separate refund applications in Form GST RFD-01 for the month of Mar 2019, April 2020 and May 2020.

- You can club all three months in a single refund application in Form GST RFD-01 for Mar 2019 to May 2020.

Q.5 Can I file nil refund for multiple tax period in one refund application?

Ans: Yes, you can file for nil refund for multiple tax period in one refund application.

E.g. If taxpayer doesn’t want to claim refund of Apr 2018, May 2018 and June 2018 as he doesn’t have any documents for this period, then taxpayer can choose the period from Apr 2018 to June 2018 and file a nil refund application for that period. After filing no refund application, taxpayer won’t be able to file refund application for that period in future.

Q.6 Can nil period of refund be combined with the period in which there is refund in one application?

Ans: Yes, nil period of refund can be combined with the period in which there is refund in one application.

Let us suppose you want to file tax refund from Apr-Sep month, where you want to file nil refund for May-Jun month. There are two ways in which you can file your refund application.

a. You can select Tax Period as Apr-Apr and file normal refund application. You can then select May-Jun and file Nil refund application. And, select Jul-Sep and file normal refund application.

b. You can select Tax Period as Apr-Sep and file normal refund application.

Q.7 Can I save the application for refund?

Ans: Application for refund can be saved at any stage of completion for a maximum time period of 15 days from the date of creation of refund application. If the same is not filed within 15 days, the saved draft will be purged from the GST database.

Note: To view your saved application, navigate to Services > Refunds > My Saved/Filed Applications option.

8. Whether I would be able to file refund application without uploading statement of statements?

Ans: No. Statement 5B for details of documents is mandatory for filing refund application.

The statement uploaded by taxpayer would be validated with the data already declared by the taxpayer while filing return GSTR-1. Only after this data is validated, the taxpayer would be able to file the refund application.

Q.9 From where can I download the utility to upload the statement?

Ans: Offline utility can be downloaded from the refund application page itself.

Navigate to Services > Refunds > Application for Refund > Select the refund type as “Supplier of Deemed Exports” > Download Offline Utility link.

Q.10 What is the purpose of Download Offline Utility to upload the statement?

Ans: Download Offline Utility (Statement 5B) is provided to enter and upload details of documents for which refund is being claimed.

Q.11 Details of which documents are to be entered in the Statement 5B available as Download Offline utility?

Ans: Download Offline Utility is provided to enter and upload document details in Statement 5B. Under the column Document Type applicant has to select as Invoice/Debit Note/Credit Note and details of these are to be provided in the Statement 5B. Multiple Debit note or Credit note issued against invoices can also be entered in this statement.

Q.12 What is the significance of VALIDATE STATEMENT button?

Ans: Validate Statement button is used to validate document data provided by the taxpayer. The details of documents would be validated from the details provided by taxpayer while filing GSTR-1.

Q.13 Can I update/ edit data after clicking the VALIDATE STATEMENT button?

Ans: Yes, you can update/ edit data even after you have validated the uploaded statement. If you want to update/delete the statement, then you would have to first delete the whole statement by clicking the DELETE STATEMENT button and upload a new statement of documents again if needed.

Q.14 What is the purpose of Download Unique Documents?

Ans: To download the documents that have been uploaded successfully on the GST Portal, you can click on the hyperlink “Download Unique Documents”.

Q.15 What is the purpose of Download Invalid Documents?

Ans: To download the documents that have not been uploaded successfully along with error details on the GST Portal, you can click on the hyperlink “Download Invalid Documents”.

Q.16 I am getting a message “validated with error” while uploading statement on the GST Portal. What do I do?

Ans: In case any statement is validated with error, click the Download Invalid Document link. Open the invalid document excel sheet. Error details are displayed. You can only rectify the error details in the JSON file and upload on the GST Portal again by clicking the CLICK HERE TO UPLOAD button.

Q.17 I have uploaded statement which has been validated on the GST Portal. I need to upload a new statement of documents again. What do I do?

Ans: If you don’t have any error and statement has been validated, and then you want to update/delete the statement, then you would have to first delete the whole statement by clicking the DELETE STATEMENT button and upload a new statement of documents again if needed.

Q.18 I am getting error that “Future date is not allowed for document Document” while uploading statement on the GST Portal using the offline utility even if I am providing correct document dates. Why?

Ans: For offline utilities, there is no server date available and hence the utility will have to depend on local system date for validation. In case your system has incorrect date, such issues can come.

Q.19 Can I preview the refund application before filing?

Ans: Yes, you can preview the refund application in PDF format to check for any inconsistency or discrepancy before filing on the GST Portal.

Q.20 How can I track the status of application for refund?

Ans: To track your filed application, navigate to Services > Refunds > Track Application Status option.

Q.21 What is ARN?

Ans: Once the refund application is filed, Application Reference Number (ARN) receipt would be generated and ARN would be sent to your registered e-mail address and mobile number.

Q.22 Where can I download my filed refund application?

Ans: Navigate to Services > User Services > My Applications link to download your filled/filed refund application.

Q.23 What happens when refund application is filed?

Ans:

- GST Portal generates an ARN and displays it in a confirmation message, indicating that the refund application has been successfully filed.

- GST Portal sends the ARN to registered e-mail ID and mobile number of the registered taxpayer.

Q.24 Whether there is any ledger entry on filing refund application?

Ans: As the taxpayer is claiming refund of the tax amount paid, there is no ledger entry in Electronic Credit Ledger.

Q.25 When / how will the refund Form RFD-01 be processed?

Ans: Once the ARN is generated on filing of refund application in Form RFD-01, the refund application along with the documents attached while filing the form would be assigned to Refund Processing Officer for processing the refund. Tax payer can track the status of refund application using track status functionality.

The application will be processed and refund will be disbursed by the Jurisdictional Authority after scrutiny.

B. Manual on Refund by Supplier of Deemed Export

How can I file application for refund as a supplier of deemed export?

To file the application for refund as a supplier of deemed export on the GST Portal, perform following steps:

1. Access the https://www.gst.gov.in/ URL. The GST Home page is displayed.

2. Click the Services > Refunds > Application for Refund command.

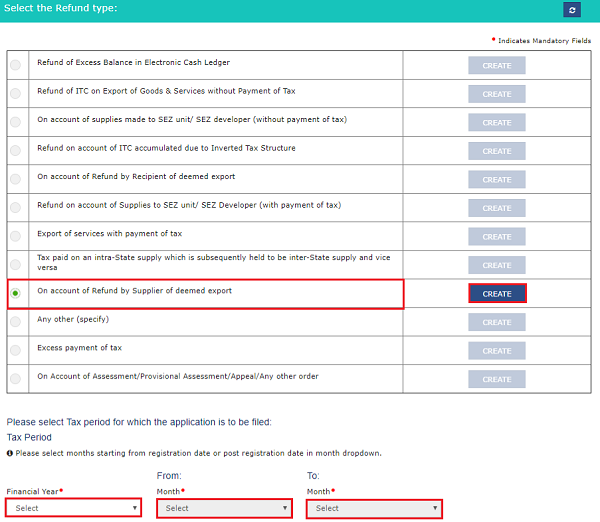

3. The Select the refund type page is displayed. Select the On account of Refund by Supplier of deemed export option.

4. Select the Financial Year for which application has to be filed from the drop-down list.

5. Select the Tax Period for which application has to be filed from the drop-down list.

6. Click the CREATE button.

7 (a). Select Yes if you want to file a nil refund. Or else, select No.

In case of Yes:

8. Select the Declaration checkbox.

9. In the Name of Authorized Signatory drop-down list, select the name of authorized signatory.

10. Click the FILE WITH DSC or FILE WITH EVC button.

In Case of DSC:

a. Click the PROCEED button.

b. Select the certificate and click the SIGN button.

In Case of EVC:

a. Enter the OTP sent to email and mobile number of the Authorized Signatory registered at the GST Portal and click the VERIFY button.

7 (b). In case of No:

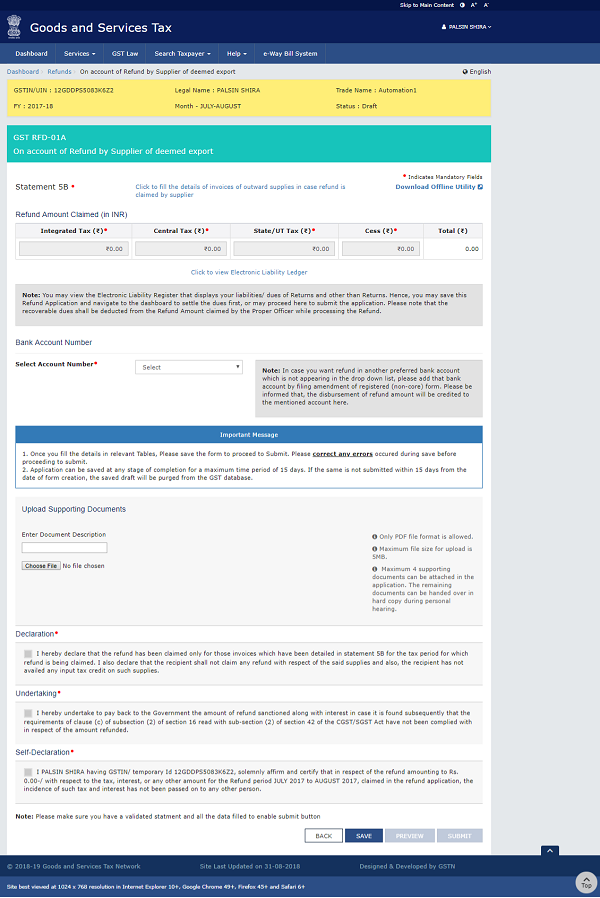

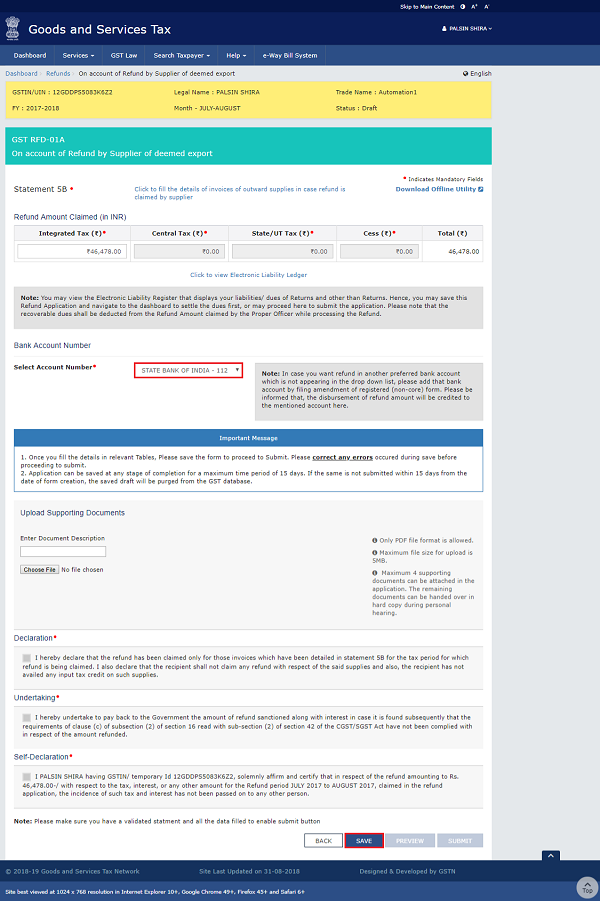

8. TheOn account of Refund by Supplier of deemed export page is displayed.

First you need to download the offline utility, upload details of invoices of outward supplies in case refund is claimed by supplier and then file refund as a supplier of deemed export.

Click the hyperlink below to know more about them.

Download Offline Utility – To download offline utility for statement 5B and enter details for invoices for which refund has to be claimed

Upload details of invoices of outward supplies in case refund is claimed by supplier – To upload the details of invoices of outward supplies in case refund is claimed by supplier

Refund by Supplier of Deemed Export – To enter details for refund as a supplier of deemed export on the GST Portal

Download Offline Utility

9. Click the Download Offline Utility link.

10. Click the PROCEED button.

11. The zip file is downloaded. Right click on the zip file and select Extract All to unzip the downloaded file.

12. Statement 5B template would be downloaded. Open the excel sheet.

13. Once the template is downloaded, you need to enter the invoice details for which refund has to be claimed. Enter the GSTIN and “From Return Period” and “To Return Period” in mmyyyy format for which refund has to be claimed.

14. Enter the Sr. No., details of invoices of outward supplies in case refund is claimed by supplier and details of tax paid.

15. Click the Validate & Calculate button.

16. The total number of records in the sheet is displayed. Click the OK button.

In case of Error:

17.1. Error is displayed in the Error column. Rectify the error.

17.2. Click the Validate & Calculate button.

17.3. Notice that the Error column is blank now after rectification.

18. Click the Create File To Upload button.

19. Browse the location where you want to save the file. Enter the name of the file and click the SAVE button.

20. A success message is displayed that file is created and you can now proceed to upload the file on the GST Portal. Click the OK button.

Upload details of invoices of outward supplies in case refund is claimed by supplier

21. Click the link Click to fill the details of invoices of outward supplies in case refund is claimed by supplier.

22. Click the CLICK HERE TO UPLOAD button.

23. Browse the location where you saved the JSON file. Select the file and click the Open button.

24.1. A success message is displayed that Statement has been uploaded successfully. You can click the Download Unique Invoices link to view the invoices that has been uploaded successfully.

24.2. Unique invoices that has been uploaded successfully are displayed.

25. Select the Declaration checkbox.

26. Click the PROCEED button.

27. Click the VALIDATE STATEMENT button.

28.1. In case any statement is validated with error, click the Download Invalid Invoice link.

28.2 Invalid invoice excel sheet is downloaded on your machine. Open the invalid invoice excel sheet. Error details are displayed.

28.3 (a). If your statement has been uploaded/validated with error, rectify the error in the JSON file and upload these invoices on the GST Portal again, as per process described above.

Note: You need to upload only the error invoices again by clicking the CLICK HERE TO UPLOAD button.

28.3 (b). If you don’t have any error and statement has been validated, and then you want to update/delete the statement, then you would have to first delete the whole statement and upload a new statement of invoices again if needed.

29. Once the statement is validated, you will get a confirmation message on screen that the statement has been submitted successfully for validation. Click the BACK button.

Refund by Supplier of Deemed Export

30. In the Table Refund Amount Claimed, the amount of refund will get auto populated based on the statement uploaded. The amount for refund to be claimed auto-populated from statement is downward editable.

Note: You can click the hyperlink Click to view Electronic Liability Ledger to view details of Electronic Liability Ledger that displays your liabilities/ dues of Returns and other than Returns. Click the GO BACK TO REFUND FORM to return to the refund application page.

31. Select the Bank Account Number from the drop-down list.

32. Under section upload Supporting Documents, you can upload supporting documents (if any).

33. Click the SAVE button.

Note: To view your saved application, navigate to Services > Refunds > My Saved/Filed Application command.

Application can be saved at any stage of completion for a maximum time period of 15 days from the date of creation of refund application. If the same is not filed within 15 days, the saved draft will be purged from the GST database.

34. Click the PREVIEW button to download the form in PDF format.

35. Form is downloaded in the PDF format.

36. Select the Declaration and Undertaking checkbox.

37. Click the SUBMIT button.

38. A confirmation message is displayed that “Statement submitted successfully.” Click the PROCEED button.

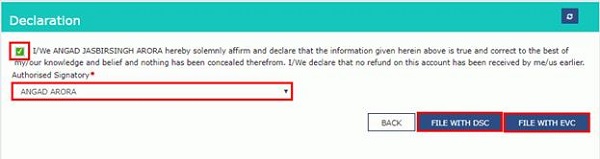

39. Select the Declaration checkbox.

40. In the Name of Authorized Signatory drop-down list, select the name of authorized signatory.

41. Click the FILE WITH DSC or FILE WITH EVC button.

In Case of DSC:

a. Click the PROCEED button.

b. Select the certificate and click the SIGN button.

In Case of EVC:

a. Enter the OTP sent to email and mobile number of the Authorized Signatory registered at the GST Portal and click the VERIFY button.

42. The success message is displayed and status is changed to Submitted.Application Reference Number (ARN) receipt is downloaded and ARN is sent on your e-mail address and mobile phone number. Click the PDF to open the receipt.

Notes:

- The system generates an ARN and displays it in a confirmation message, indicating that the refund application has been successfully filed.

- GST Portal sends the ARN to registered e-mail ID and mobile number of the registered taxpayer.

- Filed applications (ARNs) can be downloaded as PDF documents using the My Applications option under Services.

- Filed applications can be tracked using the Track Application Status option under Refunds.

- Once the ARN is generated on filing of form RFD-01A, refund application shall be assigned to refund processing officer for processing. The application will be processed and refund status shall be updated.

- The disbursement is made once the concerned Tax Official processes the refund application.

43. ARN receipt is displayed.

Thank you very much, It was very useful for us.