1. Introduction

1.1 Background

The GST Council has approved introduction of ‘E-invoicing’ or ‘electronic invoicing’ in a phased manner for reporting of business to business (B2B) invoices to GST System, starting from 1st January 2020 on voluntary basis.

Since there was no standard for e-invoice existing in the country, standard for the same has been finalized after consultation with trade/industry bodies as well as ICAI after keeping the draft in public place. Having a standard is a must to ensure complete inter-operability of e-invoices across the entire GST eco-system so that e-invoices generated by one software can be read by any other software, thereby eliminating the need of fresh data entry– which is a norm and standard expectation today. The machine readability and uniform interpretation is the key objective. This is also important for reporting the details to GST System as part of Return. Apart from the GST System, adoption of a standard will also ensure that an e-invoice shared by a seller with his buyer or bank or agent or any other player in the whole business eco-system can be read by machines and obviate and hence eliminate data entry errors.

The GST Council approved the standard of e-invoice in its 37th meeting held on 20th Sept 2019 and the same along with schema has been published on GST portal. Standards are generally abstruse and thus an explanation document is required to present the same in common man’s language. Also, there are lot of myth or misconception about e-Invoice. The present document is an attempt to explain the concept of e-invoice, how it operates and basics of standards.

E-invoicing in India will be a big move, due to the volume of business transactions undertaken every day, as well as the plethora of different, non-standardized formats used in invoice generation. The main objective is to enable interoperability across the entire GST eco-system i.e. an e-invoice generated by one software should be capable of being read by any other software. Basically, through machine readability, an invoice can be uniformly interpreted.

In addition to the above, this new system of e-invoicing aims to make invoice reporting an integral part of a business process and remove the tedious task of invoice-compilation at the end of a return period. Claiming fictitious Input Tax Credit (ITC) by raising fake invoices is also one of the biggest challenges currently faced by tax authorities.

The e-invoice system will help to curb the actions of unscrupulous taxpayers and reduce the number of fraud cases as the tax authorities will have access to data in real-time.

The basic aim behind adoption of e-invoice system by tax departments is ability to pre-populate the return and to reduce the reconciliation problems.

1.2 Purpose and Intended Audience

This document aims to explain the operational procedure on how to use offline tool to generate the bulk e-invoice generation. It is expected that the document will also be useful for the taxpayers, tax consultants and the software companies to adopt the designed standard.

This document aims to explain the operational procedure on how to use offline tool to generate the bulk e-invoices.

This document is intended for registered taxpayers under GST, who are the main stakeholders of e-invoice system under GST.

1.3 Scope

The scope of this document covers:

- What is E-invoice

- Using Invoice Bulk Upload tool

1.4 URL or Web site address

IRP (Invoice Registrartion Portal)

2. What is E-invoice?

E-Invoicing is a process in which all the invoices created by accounting software will be authenticated electronically by GSTN for further use (like return preparation, E-way bill creation).

There are lots of myths or misconception about e-invoice. E-Invoice does not mean generation /creation of invoice from central portal or tax department because practically it is not possible it will create unnecessary restrictions on trade and industry and different industry have different business requirement, which cannot be met out by software.

E-Invoice is a submission of already generated Invoices from accounting software to GST Portal and we all are aware that there are hundreds of accounting & billing software, which generate invoices, but they all use their own formats to store information electronically and data in such different-different formats cannot understand by the GST System, hence it was not possible to submit the data from accounting software (Like ERP/Tally/SAP) to GST System.

So, need was felt to issue a standard format (Schema) in which data will be shared with other systems, although from user prospective it’s same as earlier, there would not any change in print or electronically creation of invoice. Only standard schema needs to be implemented by all the accounting and billing software so that it can generate JSON of each invoice in such format which can be uploaded on GST Portal for further authentication and approval.

2.1 Benefits on E-Invoicing System

The major benefits of e-Way Bill system are as follows:

- Standardization: One time reporting on B2B invoice data in the form it is generated to reduce reporting in multiple formats (one for GSTR-1 and the other for e-way bill).

- Automation: Auto-generation of Sales and Purchase Registers (ANX-1 and ANX-2). To generate Sales and purchase register (ANX-1 and ANX-2) from this data to keep the Return (RET-1 etc.) ready for filing under New Return. e-Way bill can also be generated using e-Invoice data

- Seamless Reconciliation: Reconciliation and data verification between suppliers and recipient will be seamless and thus provide better control over input tax credit computation and claim.

- Lesser Compliance: Reduction in overall compliance burden. Substantial reduction in input credit verification issues as same data will get reported to tax department as well to buyer in his inward supply (purchase) register.

- Elimination of fake invoices: Reduction of tax evasion, System level matching of input credit and output tax.

- Information Availability: Near real-time availability of information to all the relevant participants in the supply chain.

- On receipt of info thru GST System as buyer can do reconciliation with his Purchase Order and accept/reject in time under New Return

- Environment friendly – The need of the paper form of the multiple copies of way bill is Hence, the tons of paper are saved per day.

- Officials saved of monotonous work collecting and matching the manual work with the returns of the taxpayers.

2.2 Objective

E-invoicing in India will be a big move, due to the volume of business transactions undertaken every day, as well as the plethora of different, non-standardised formats used in invoice generation. The main objective is to enable interoperability across the entire GST eco-system i.e. an e-invoice generated by one software should be capable of being read by any other software. Basically, through machine readability, an invoice can be uniformly interpreted.

In addition to the above, this new system of e-invoicing aims to make invoice reporting an integral part of a business process and remove the tedious task of invoice-compilation at the end of a return period. Claiming fictitious Input Tax Credit (ITC) by raising fake invoices is also one of the biggest challenges currently faced by tax authorities. The e-invoice system will help to curb the actions of unscrupulous taxpayers and reduce the number of fraud cases as the tax authorities will have access to data in real-time.

2.3 Stakeholders

The objective behind introducing e-invoice is to effectively address the expectations and concerns of the stakeholders by leveraging the use of ITC( Input Tax Credit).

The following are two key stakeholders of the e-invoice system:

- Suppliers – Generate the e-invoice and reject/accept the e-Way Bills generated by other party against his/her name, if it does not belong to him/her.

- Recipients – Accept or reject the e-invoice generated by other party against his/her name, if it does not belong to him/her.

3. Offline Method of e-Invoice Generation

The e-invoice system being implemented by tax departments across the globe consists of two important parts namely,

a) Generation of invoice in a standard format so that invoice generated on one system can be read by another system.

b) Reporting of e-invoice to a central system.

The e-invoice system provides a provision of offline method to generate the multiple Invoice reference number in one-go by the tax payers.

In this process, the taxpayer opens the E-Invoice System and downloads the formats provided under ‘Bulk Generation Tools’. This tool can be downloaded by the tax payer from ‘Help-> Tools-> Bulk Generation Tools’ option provided in E-Invoice portal as shown below.

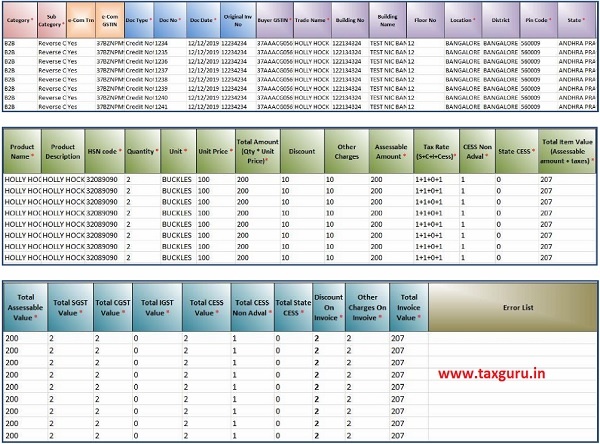

The taxpayer can download the excel file formats from Bulk Generation Tools as shown below under ‘JSON Preparation Tools’ option. Bulk Generation Tool allows the user to enter the requests in excel file offline, validate and convert the same into JSON file for bulk upload in the system.

After entering the required data in the downloaded formats provided in ‘Bulk Generation Tools’ module, the tax payer ,logs in to the E-Invoice system and uploads the file containing the multiple requests for IRN . The system then generates the IRN for all these requests one-by-one and shows the result in table. Otherwise it shows error details. The table details can be cut and pasted into user’s system for further use and action.

3.1 Bulk IRN Generation

Generation of IRN is the responsibility of the taxpayer who will be required to report the same to Invoice Registration Portal (IRP) for authentication, which in turn will generate a unique reference number (IRN) and digital sign the e-invoice and also generate a QR code and will return the invoice to the seller.

Step by Step Process to Generate Invoice reference number

For generating a Bulk Invoice reference numbers, user needs to have the EINV bulk convertor or the excel file, which helps the user to convert the multiple invoices excel file into a single JSON file.

This tool can be downloaded by the user from Help-> Tools-> Bulk Generation Tools option provided in E-Invoice portal as shown in Figure 2 above.

This tool will allow you to enter the requests in excel file and allow to validate and convert into JSON file. Sample for preparing Bulk IRN request file for generation of JSON file is given below for user reference.

Generating the EWB from bulk file

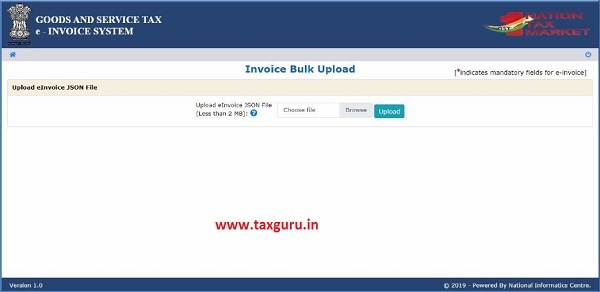

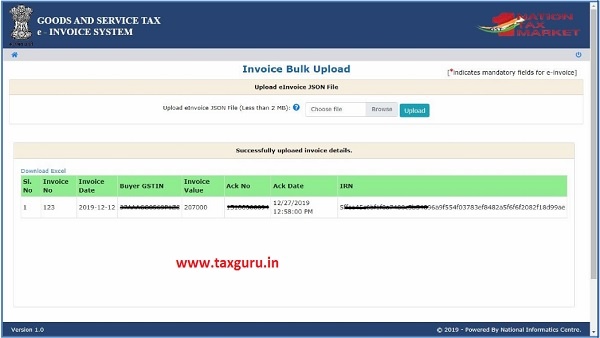

Step 1: Login: To generate a Bulk Invoice reference numbers, user needs to select the sub option ‘Bulk Upload’ option under ‘e-invoice. On clicking this option, the following screen will be displayed.

Step 2: On click of ‘Choose file’ button, the system will request to select the JSON file

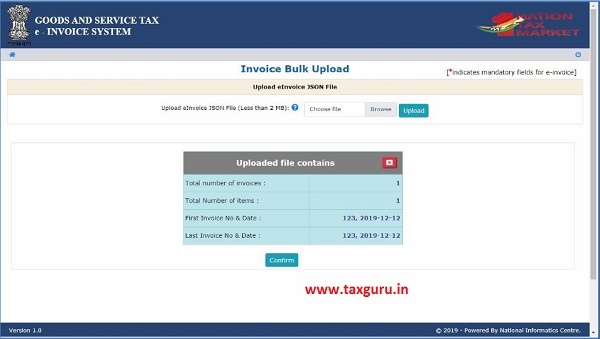

User has to upload the IRN request file (maximum allowed file size for upload is 2 MB along with the hash, if generated) to the e-invoice system. After IRN request file is uploaded the following screen will be displayed.

Step 3: Generation of IRN: Next on click of ‘Confirm button the system generates the e-invoices and shows the 64 character length Invoice reference number for each request. If it is not possible it will show the appropriate error for each request.

The user can export the e-invoices in excel file by clicking on ‘Export to Excel”.

The hash computed by e-invoice system will become the IRN (Invoice Reference Number of 64 character length) of the e-invoice. This shall be unique to each invoice and hence be the unique identity for each invoice for the entire financial year in the entire GST System for a taxpayer.

System will also update the invoice details to E-Waybill system. E-Way bill system will create Part-A of e-way bill using this data to which only vehicle number will have to be attached in Part-B of the e-way bill.

Tips for easy and quick generation of Invoice Reference Number

The JSON must conform to the e-invoice schema (standards) that is published and

have the mandatory parameters. The optional parameters can be according to the

business need of the supplier.

4. Summary

- E-invoices will not be generated by the GST Portal.

- E-Invoice schema issued by GST System will be used by the all kind of businesses. The Schema has mandatory and non-mandatory fields, mandatory fields has to be filled by all the Non-mandatory field is for the business to choose.

- E-Invoice will be authenticated with the digital signature of the IRP.

- Each E-Invoice will be uploaded for registration on IRP within time line (will be notified by the Government) without registration of the e-invoice the same will not be valid (required changed will be made in the law).

- E-Invoice cannot be partially cancelled it has to be fully cancelled.

- E-Invoice mechanism has an option to cancel the invoice within 24 hours of registration of IRP. Any cancellation after 24 hours could not be possible through IRN, taxpayer have to manually cancel the same on GST Portal before filing the return.

List of Abbreviations

| Abbreviation | Full Form |

| IRP | Invoice Registration Portal |

| IRN | Invoice Reference Number |

| GSTIN | Goods and Services Tax Identification No |

| B2B | Business To Business |

| ITC | Input Tax Credit |

| EWB | e-Way Bill |

| GSP | Goods and Services Tax Suvidha Provider |

| GST | Goods and Services Tax |

| QR Code | Quick Response Code |

| NIC | National Informatics Centre |

Bulk E-Invoice Generation tool is not working in macbook. can we get a different tool to create json file for macbook? please help.

i am facing same issue in my mac as ACTIVE X does not work on excel in MacOs.

have you found any tool for e-invoicing for mac users? if yes please contact.

manual invoice the e-invoice Genret pls link send sir