The introduction of Goods and Services Tax (GST) is a significant reform in the field of indirect taxes in our country. Multiple taxes levied and collected by the Centre and the States will be replaced by one tax called the Goods and Services Tax (GST). GST is a multi-stage value added tax levied on the consumption of goods or services or both.

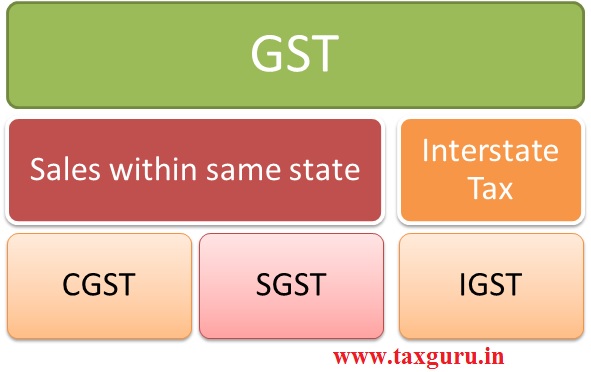

A “Dual GST” model has been adopted in view of the federal structure of our country. Centre and States will simultaneously levy GST on every supply of goods or services or both which, takes place within a State or Union Territory. Thus, there shall be two components of GST:

(i) Central tax (CGST)

(Levied & collected under the authority of CGST Act, 2017 passed by the Parliament)

(ii) State tax (SGST)

(Levied & collected under the authority of SGST Act, 2017 passed by respective State)

Why the third tax in the name of IGST?

Before discussing the IGST Model and its features, it is important to understand how inter-State trade or commerce is being regulated in the present indirect tax system. It is significant to note that presently the Central Sales Tax Act, 1956 regulates the inter-State trade or commerce (hereinafter referred to as “CST”), the authority for which is constitutionally derived from Article 269 of the Constitution. Further, as per article 286 of the Constitution of India, no State can levy sales tax on any sales or purchase of goods that takes place outside the State or in the course of the import of the goods into, or export of the goods out of the territory of India. Only the Parliament can levy tax on such a transaction. The Central Sales Tax Act was enacted in 1956 to formulate principles for determining when a sale or purchase of goods takes place in the course of inter-State trade or commerce. The Act also provides for the levy and collection of taxes on sales of goods in the course of inter-State trade.

The IGST model remove all these deficiencies.

IGST is a mechanism to monitor the inter-State trade of goods and services and ensure that the SGST component accrues to the consumer State. It would maintain the integrity of ITC chain in inter-State supplies. The IGST rate would broadly be equal to CGST rate plus SGST rate. IGST would be levied by the Central Government on all inter-State transactions of taxable goods or services.

IGST Rate=CGST Rate + SGST Rate (more or less)

As per the GST definition, the liability to pay taxes arise at the time and place of supply. And both time and place of supply depend upon whether the supply is intra-state or inter-state. Hence, to guide the taxation under GST, the law lays down provisions regarding the nature of supply, place of supply of goods, place of supply of services, time of supply and value of supply. So, to understand each of these, it’s first important to know what is place of supply.

Understanding Place of Supply in GST

GST is all set to float its wings across India, and it is a high time that we start adapting to its rules and provisions. Under GST, special attention is given to the reporting structure of all transactions, irrespective of the fact that it is of goods or for services. There are three types of taxes under GST, CGST, SGST and IGST. All these taxes are leviable whenever there is a movement of goods or services.

It is very important to understand the term ‘place of supply’ for determining the right tax to be charged on the invoice

The concept of place of supply crucial under GST as all the provisions of GST revolves around it. Place of supply of goods under GST defines whether the transaction will be counted as intra-state or inter-state, and accordingly levy of SGST, CGST & IGST will be determined.

GST is a destination based tax, i.e., the goods/services will be taxed at the place where they are consumed and not at the origin. So, the state where they are consumed will have the right to collect GST.

To determine the actual nature of the movement of goods and services, it is imperative to understand the “place of supply” of such goods or services. It plays a pivotal role in identifying whether CGST & SGST or IGST will be levied on any transaction.

Place of supply of goods and services have been given separate provisions.

The location of the supplier and the place of supply together define the nature of the transaction. The registered place of business of the supplier is the location of the supplier, and the registered place of the recipient is the place of supply.

Place of Supply is nothing but the place of delivery of goods or consumption of service. In other words, it is the registered location of recipient of a good or service

Movement of goods and services can be of 2 types:

- Within the State i.e. Intra-State

- Between Two States i.e. Inter-State

Intra-State movement attracts CGST and SGST whereas Inter-State movement attracts IGST.

In order to determine the levy of taxes based on Place of Supply, following two things are considered:

Location of Supplier: It is the registered place of business of the supplier

Place of Supply: It is the registered place of business of the recipient

Place of supply

A. Supply of Goods

B. Supply of Services

Place of Supply of Goods

Usually, in case of goods, the place of supply is where the goods are delivered.

So, the place of supply of goods is the place where the ownership of goods changes.

Section 10 of the IGST Act lays down the provisions to determine the place of supply of goods in domestic transactions.

Accordingly, following are the rules to determine the place of supply of goods other than imports or exports:

10. Place of supply of goods, other than supply of goods imported into, or exported from India

(1) The place of supply of goods, other than supply of goods imported into, or exported from India, shall be as under, ––

(a) where the supply involves movement of goods, whether by the supplier or the recipient or by any other person, the place of supply of such goods shall be the location of the goods at the time at which the movement of goods terminates for delivery to the recipient;

(b) where the goods are delivered by the supplier to a recipient or any other person on the direction of a third person, whether acting as an agent or otherwise, before or during movement of goods, either by way of transfer of documents of title to the goods or otherwise, it shall be deemed that the said third person has received the goods and the place of supply of such goods shall be the principal place of business of such person;

(c) where the supply does not involve movement of goods, whether by the supplier or the recipient, the place of supply shall be the location of such goods at the time of the delivery to the recipient;

(d) where the goods are assembled, or installed at site, the place of supply shall be the place of such installation or assembly;

(e) where the goods are supplied on board a conveyance, including a vessel, an aircraft, a train or a motor vehicle, the place of supply shall be the location at which such goods are taken on board.

(2) Where the place of supply of goods cannot be determined, the place of supply shall be determined in such manner as may be prescribed.

10.1 Introduction

Place of supply is important to determine the kind of tax that is to be charged.

> When the location of supplier and the place of supply are in two different States, then it will be an inter- State supply and IGST would be chargeable.

> And when they are in the same State, then it will be an intra-State supply and CGST/ SGST would be chargeable.

‘Place of supply’ is not a phrase of common understanding, it is a legal term and as in the cases of all legal terms, their common understanding must not be applied but the meaning assigned to them in the law must be followed.

Place of supply, similar to time of supply, is that which the legislature has appointed. Place of supply determines the State or Union Territory to which the SGST portion of the revenue accrues.

The importance of place of supply (POS) is underlined due to following questions as under:

> Whether one has to charge IGST or CGST+SGST/UTGST?

> Whether the recipient of goods or services would be able to claim ITC?

> Whether there is any liability on services received from outside India (import of services)?

> Whether the supply is export of services and zero rated?

GST is understood as a ‘destination-based consumption tax’ but there is no provision that declares this fact. This missing declaration is more than adequately supplied by the principle being embodied in the provisions of ‘place of supply’. It is here that we find that the destination principle of GST is fully captured. The law makers have declared, in each case of supply, its destination of supply.

10.2 Analysis

(a) Place of Supply – Supplies within India

Place of supply of goods, where the supplier and the recipient are both located within India, will be determined in accordance with section 10 of the IGST Act.

The phrase ‘location of supplier of goods’ has not been defined in the IGST Act and this is deliberate due to the reason that location of the supplier of goods can be easily tracked. Whereas location of supplier of services has been defined under section 2(15) of the IGST Act.

Two important phrases are very relevant, namely:

1. Location of supplier – the word ‘location’ in this phrase refers to the site or premises (geographical point) where the supplier is situated with the goods in his control ready to be supplied or in other words, it is the physical point where the goods are situated under the control of the person wherever incorporated or registered, ready to be supplied.

However, in case where goods are sent by the Principal to a job worker and the goods are subsequently supplied by the Principal from such job worker’s place directly to the premises of the Principal’s customer, a view can be taken that the ‘location of supplier’ would be the location of the Principal from where the goods were originally sent.

Though this view is really not in harmony with the provisions of the law, which require that the Principal declares the location of the job worker as his additional place of business in order to effect supplies directly from the job worker’s location (and an additional place of business ought to be within the same State for which the registration has been obtained).

Therefore, in the alternate view, the Principal would be required to obtain a separate registration in the State in which the job worker is located, in order to effect taxable supplies from the job worker’s premises;

2. Place of supply of goods – this is a legal phrase which the section decides to be the site or premises (geographical point) as its ‘place of supply’.

Place of supply in each case as:

1) Where the supply involves a movement of goods, the place of supply shall be determined by the location of the goods at the time of final delivery.

Supply involves movement

The place of supply will be the place where the goods are located at the time at which the movement terminates for delivery to the recipient.

- The location of the goods is a question of fact to be ascertained by observing the journey that the goods supplied make from their origin from supplier and terminating with recipient.

- This movement, however, can be by the supplier or by the recipient after having disclosed the destination of their movement or journey.

- Movement ‘terminates for delivery’ requires a brief understanding about the manner of concluding delivery from Contract of the recipient regarding the mode and time of delivery. The supplier is always duty-bound to deliver in exactly the same way ‘manner and timing’ which the recipient dictates as per terms of contract.

In fact, the supplier continues to be obligated until delivery is completed in the way it is stated by the recipient.

In other words, delivery is not complete if there is any deviation in either the manner or the timing by the recipient as per terms of contract. When the delivery is to the satisfaction of the recipient (as per contract) , then the supplier is released from his obligation.

There are situations when a supply involves movement of goods. Hence, the place of supply of goods in such cases is the location where goods have been delivered to the recipient. Furthermore, the supplier or the recipient or any other person can undertake such a supply.

For Example:-

Say for instance, Kabir Khan from Mumbai sells refrigerators to M/s Sharma Traders from Ahmedabad. Since such a supply involves movement of goods from Mumbai to Ahmedabad, therefore the place of supply would be Ahmedabad. Additionally, on such a supply, IGST would be charged. This is because the location of the supplier (Maharashtra) is separate from the place of supply (Gujarat).

For Example:-

A manufacturer in Kolkata, West Bengal, has an order from a customer in Surat, Gujarat. The manufacturer directs his branch in Mumbai, Maharashtra to ship the goods to Surat. In this case, place of supply shall be Surat, Gujarat and thus entails an inter-state movement of goods and will attract levy of IGST.

2) Where the supply involves a movement of goods, on the direction of a third party, whether as an agent or otherwise, the place of supply shall be the principle place of business of such third party, irrespective of the place of delivery of goods.

(b) Where goods are delivered by the supplier to the recipient but at the instruction of a third person (Known as Bill to ship to model)

Goods Delivered On Behalf Of Third Party

The place of supply will be the principal place of business of such third person (who is giving instruction/placing order ) and not of the actual recipient.

♦ Two limbs of supply involved –

> by supplier to third person and

> by third person to recipient.

This provision deals only with the first limb of supply, that is, supply by supplier to third person.

Section 2(93) refers to recipient as the ‘payer of the consideration’,

But in this provision, recipient is the one who actually collects the goods.

The question that arises is – the locus or authority of the third person to issue instructions to the supplier regarding its delivery.

And the third person is the one who enjoys privity of contract with the supplier to be able to direct him to deliver the goods.

This is a case of constructive delivery to the third person, therefore, the third person turn out to be the recipient in this case.

Now, the place of supply will dependent on the principal place of business of such third person (i.e., the person providing instructions to the supplier where the delivery should take place).

There are scenarios when a supplier delivers goods to a recipient or any other person on the direction of a third party. Furthermore, the supplier delivers such goods either as an agent or otherwise before or during movement of goods. Also, the supplier supplies the goods either by way of transfer of documents of title to the goods or otherwise. In such situations, the supply is deemed to be received by the third person. And the place of supply of such goods is the principal place of business of such person.

For Example:-

Let’s say Akram Khan has a registered place of business at Pune. He places an order to Vipul Ltd. in New Delhi, for delivering a parcel to Aditya Kumar who is at Nasik. Since, goods are delivered by Akram Khan to Aditya Kumar via a third party (Vipul Ltd), the place of supply is Pune. That is the registered place of business of Akram Khan. Furthermore, IGST would be charged on such a supply since the location of supplier (New Delhi) and place of supply (Maharashtra) are different.

For Example:-

A dealer in Mumbai, Maharashtra sells products to a customer in Delhi. Delhi-based customer directs the Mumbai seller to send the materials to Kolkata-based customer. Although the place of delivery is Kolkata, since Delhi-based seller had directed such movement, then the place of supply shall be the principle place of business, i.e. Delhi and thus, charge IGST on such movement.

3) Where the supply does not involve any movement of goods, then place of supply shall be the location of such goods at the time of final delivery.

Supply does not involve movement of goods

The place of supply will be the location of the goods at the time of its delivery to the recipient.

- It is a case where the supply contemplates that the goods ought not to move and when their delivery to the recipient will stand complete.

This provision comes into operation only when its applicability is established based on the facts involved in the supply, that is, they do not involve movement

At times the supplier or the recipient makes a supply that does not involve any movement of goods. In such situations, the place of supply is the location of goods at the time of delivery to the recipient.

For example:-

A generator that is bolted to the concrete floor in the basement of a building purchased by the tenant and being left behind at the time of terminating the tenancy, the supply of the generator by the tenant to the landlord for an agreed price is a case of ‘supply that does not involve movement of the goods’.

In such cases, the place of supply will be where the generator stands bolted to the concrete floor and without requiring any movement. The landlord (recipient) confirms satisfactory completion of delivery.

For Example :-

A case where the job worker develops a mould for the production of goods for the principal and retains the mould in his place itself for production of goods. The mould developed by the job worker is sold to the principal but the same is retained by the job worker without causing the movement of mould from job worker premises to principal premises. In this case, the place of supply would be job worker premises.

Over-the-counter sales are also confused with supply NOT involving movement.

Whether the movement is over long distances or short distance from one end of the counter-top to other end of the counter, since the enjoyment of the goods supplies is on ‘as is where is’, this is also a supply that involve movement.

Such sales will come within 10(1)(a) and be subject to CGST-SGST unless they are effected under 10(1)(b) .

4) Where the supply includes installation of goods at site, then place of supply shall be the place of such installation.

Installation or Assembly of Goods at a Site

The place of supply will be the location of such installation or assembly.

- It is important to note that assembly or installation as referred to in this clause is not a ‘works contract’, which has been classified by law as a supply of services (in Paragraph 6(a) of Schedule II to the CGST Act, 2017)

The concept of works contract would arise only in respect of services, for which the place of supply is determined under section 12 and section 13 of the IGST Act, 2017.

The supply addressed in this provision refers to only a supply of goods, being a composite supply of goods along with some services, or a mixed supply treated as a supply of goods in terms of sections 2(30), 2(74) and 8 of the CGST Act.

In other words, supply from the place of their origin to the site ‘for’ assembly or installation is subsumed within this provision and merged with the supply to the recipient by virtue of such assembly or installation.

- This provision appoints the place of supply based on the final act of assembly or installation.

Where the goods are assembled or installed at site, the place of supply shall be the place of such installation or assembly.

For Example:-

Chandra Shekhar from Jamshedpur orders a machine to be installed in his factory at Jamshedpur. The supplier, from Kolkata, sources the parts from various states across the country. Finally, he successfully installs the machine at Chandra Shekhar’s factory at Jamshedpur. In this case, since the machine parts were installed at Jamshedpur, the place of supply would be Jamshedpur. Such a supply attracts IGST since the location of the supplier (West Bengal) and the place of supply (Jharkhand) are different.

For example,

A supplier located in Kolkata supplies machinery to the recipient in Delhi. The machinery is installed in the factory of the recipient in Kanpur. In this case, the place of supply of machinery will be Kanpur.

5) Where the goods are being supplied on board a vehicle, vessel, aircraft, or a train, i.e. on board a conveyance, then place of supply shall be the first location at which the goods are boarded.

Goods Supplied On Board A Conveyance

The place of supply will be the location at which the goods are taken on-board.

- Such transactions also cover two supplies –

- first being the supply of goods ‘to’ the operator of the conveyance, and

- second being the supply of such goods as goods or as services, ‘by’ the operator to the passenger (or any other person), during the journey ‘in’ the conveyance.

The place of supply covered under this clause is in respect of the second limb, and particularly for the supply of goods by the operator of the conveyance during its journey to the passengers.

The supply of goods being food or beverages on board a conveyance would be outside the scope of this clause, given that such supply is treated as a composite supply of services in terms of Paragraph 6(b) of Schedule II to the CGST Act, 2017.

Notification No. 13/ 2018-Central Tax (Rate), dated 26-July- 2018 states that supply of food in train/ platform would be taxable @5% pari materia with restaurant services. However clarity is awaited with respect to the place of supply of such services supplied by IRCTC is to be considered as restaurant services [10(4)] or goods supplied on board [10(1) (e)]. However, supply of goods like sale of gift items etc. would be covered under this clause.

- The term ‘conveyance’ includes vessel, aircraft, train or motor vehicle as defined under section 2(34) of the CGST Act.

Next, there are cases when a supplier supplies goods on board a conveyance. Such a conveyance includes a vessel, an aircraft, a train or a motor vehicle. Hence the place of supply in such cases is the location at which the goods are taken on board.

For Example:-

Howrah – New Delhi Rajdhani Express supplies food during the journey from Kolkata to New Delhi. The train takes food on board at Mugalsarai in Uttar Pradesh. In this case, since the goods are taken on board in Mugalsarai, the place of supply would be Mugalsarai (Uttar Pradesh).

Now, there are also cases where the place of supply of goods cannot be determined. In such situations, the place of supply shall be determined in such manner as may be prescribed

For Example:-

Howrah to New Delhi Rajdhani starts its journey from Howrah, West Bengal and passes through many states before ending its journey in New Delhi. The food served on board the train shall be considered as supply of goods. Thus, place of supply shall be Howrah since it is the first location of the goods.

6) Any other cases not covered above will be determined further as per recommendations from the GST council

Residuary provision:

Where none of the foregoing provisions are applicable to determine the place of supply in case of a supply of goods, the Central Government may prescribe rules regarding the manner of its determination.

For Residuary provision, it must be demonstrated that the supply is one which cannot be covered by any of the clauses (a) to (e) of section 10(1).The above rules are defined for goods. The place of supply of services is separate and specific in nature.

1. Summarise/ Tabulate the provisions for determination of place of supply of goods in GST other than import and export:

The provisions of section 10 of CGST Act will be applicable in such cases which are tabulated as under:-

| Sl. No. | Nature of Supply of Goods | Place of Supply |

| 1. | Where the supply involves the movement of goods, whether by the supplier or the recipient or by any other person | Location of the goods at the time at which, the movement of goods terminates for delivery to the recipient |

| 2. | Where the goods are delivered to the recipient, or any person on the direction of the third person by way of transfer of title or otherwise, it shall be deemed that the third person has received the goods | The principal place of business of such person |

| 3. | Where there is no movement of goods either by supplier or recipient | Location of such goods at the time of delivery to the recipient |

| 4. | Where goods are assembled or installed at site | The place where the goods are assembled or installed |

| 5. | Where the goods are supplied on-board a conveyance like a vessel, aircraft, train or motor vehicle | The place where such goods are taken on board the conveyance |

| 6. | Where the place of supply of goods cannot be determined in terms of

sub-sections (2), (3), (4) and (5) |

It shall be determined in such manner as may be prescribed |

Points for Consideration:-

Consider a case of delivery ex-factory.

A question may arise in such a case as to whether the supply involves movement of goods.

However, considering that clause (a) specifies that the movement may be by the supplier or the recipient or any other person, it can be inferred that even a supply with an ex-factory delivery would be considered to be a supply involving movement of goods.

The law does not provide the meaning of the phrase “terminates for delivery”.

Delivery may be physical, constructive, implied or in any other form. A plain reading of this clause suggests that the delivery is completed ex-factory, and accordingly, ex-factory supplies would always be intra-State supplies (unless the supplier or recipient is an SEZ).

Section 2(2) which defines “address of delivery” as the address of the recipient of goods or services or both indicated on the tax invoice issued by a registered person for delivery of such goods or services or both;

Section 2(3) defines “address on record” as the address of the recipient as available in the records of the supplier;

Section 2(93) defines “recipient” of supply of goods or services or both; and

Section 2(96) defines “removal” in relation to goods, suggest that in case of ex-factory sale or counter-sale, the delivery of goods done by the supplier or taken by the recipient would terminate at the registered place or address on record mentioned in the tax invoice.

As such, it can be inferred that if the delivery of goods is taken ex-factory or on counter sale by the recipient such supply would be chargeable to tax based on the address mentioned in the tax invoice.

An alternative view is possible –

It may be noted that the delivery for the purpose of the contract law and delivery indicated by this clause may be different.

- For the purpose of the GST law, a supply is effected on removal of goods for delivery.

- For the purpose of contract law, the supply may be understood (in terms of an agreement) to be completed only on acceptance of such goods by the recipient.

The risks and rewards pertaining to the goods being supplied may pass at the factory gate, the movement for delivery of such goods may stand terminated only at the premises of the recipient, considering that the movement is undertaken by the recipient for delivery at his own premises.

‘Where the movement terminates for delivery to the recipient’ should be read very strictly and only refers to the destination at which the movement finally stops.

Over the Counter Sales

Over-the-counter sales are also confused with supply NOT involving movement.

Whether the movement is over long distances or short distance from one end of the counter-top to other end of the counter, since the enjoyment of the goods supplies is on ‘as is where is’, this is also a supply that involve movement.

Such sales will come within 10(1)(a) and be subject to CGST-SGST unless they are effected under 10(1)(b) .