Consideration in relation to the supply of goods or services includes

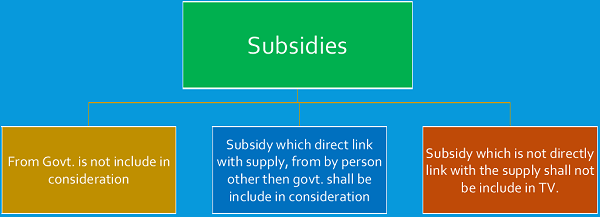

(a) any payment made or to be made, whether in money or otherwise, in respect of, in response to, or for the inducement of, the supply of goods or services, whether by the recipient or by any other person but shall not include any subsidy given by the Central Government or a State Government;

(b) the monetary value of any act or forbearance, whether or not voluntary, in respect of, in response to, or for the inducement of, the supply of goods or services, whether by the recipient or by any other person but shall not include any subsidy given by the Central Government or a State Government:

PROVIDED that a deposit, given in respect of the supply of goods or services or both shall not be considered as payment made for such supply unless the supplier applies the deposit as consideration for the said supply;

INCLUSIVE VS. EXHAUSTIVE DEFINITION

The Supreme court in west Bengal state warehousing corporation Vs. Indrapuri studio Pvt. Ltd. has examined the meaning of inclusive and exhaustive definition as appearing in various statues. The word “include” when used, enlarge the meaning of expression defined so as to comprehend not only such things as they signify according to their natural import but also those things which the clause declared that they shall includes.

MEANING OF CONSIDERATION- SEC 2(D) OF INDIAN CONTRACT ACT,1872

The definition of ‘consideration’ as given in section 2 (d) of the Indian Contract Act, 1872 as follows-

- “When, at the desire of the promisor, the promise or any other person has done or abstained from doing, or does or abstains from doing, or promises to do or to abstain from doing, something, such act or abstinence or promise is called a consideration for the promise”

MEANING OF PHRASE USED IN DEFINITION

- The phrase “in respect of, in response to, or for the inducement of” means there must be a direct link between the supply and the consideration.

- Inducement means to gives something to a person so that he will do something else in return.

A restaurateur offered ‘free’ meals to drivers of buses carrying passengers as an inducement to bring potential customers to his business premise. Since the meals were not given to drivers of empty buses, there is a direct link between the act of bringing passengers to the food outlet and the provision of the free meals. The consideration here is the free meals provided.

THE “NEXUS” BETWEEN SUPPLY AND

CONSIDERATION

Sydney High Court define the meaning of Supply In case of QUANTAS AIRWAYS LIMITED VS COMMISSIONER OF TAXATION

- The tribunal held that there has been a supply of right, obligation and services under the contract between QUANTAS and the passengers, for which the unused fares were consideration as defined, and that the assessment were not shown to be excessive.

- On the appeal by Qantas, the Full Court of the Federal Court held that “that the relevant supply in the present case is the contemplated flight ,not reservation…and the contemplated flight failed to occur”, that the tribunal had “artificially split the transaction, and in consequence that there had been no taxable supply where the flight was not taken; “it is plain that what each customer pays for is carriage by air. This is the essence, and sole purpose, of the transaction The actual travel was the relevant supply, and if did not occur there was no taxable supply.”

CONTRACTUAL RECIPROCITY

- Supply of goods and/ or services such as sale, transfer, barter, exchange, license, rental, lease or disposal made or agreed to be made for a consideration by a person’ involves an element of contractual relationship wherein the person doing an activity does so at the desire of the person for whom the activity is done in exchange for a consideration

Example: An artist performing on a street does an activity without consideration even though passersby may drop some coins in his bowl kept after feeling either rejoiced or merely out of compassion. They are, however, under no obligation to pay any amount for listening to him nor have they engaged him for his services. On the other hand if the same person is called to perform on payment of an amount of money then the performance becomes an activity for a consideration.

CONSIDERATION FROM ANY OTHER PERSON

Example: Mr. A contracts with Mr. B to provide hampers worth Rs. 10,000 to its business clients. The consideration for the supply of the hampers is paid by Mr. A as stipulated in the contract.

- When Mr. A has a binding contract with Mr. B to supply hampers to the clients, there is a taxable supply made by Mr. B to Mr. A since there is a direct link between the supply made and the consideration given.

TYPES OF CONSIDERATION

Consideration can be in monetary or non-monetary form or partly in monetary form and partly in non-monetary form.

- (a) Monetary consideration includes payment by cash, cheque or credit card, bank transfer and deduction from bank account.

- (b) Non-monetary consideration essentially means compensation in kind such as the following:

- Supply of goods and services

- Refraining or forbearing to do an act

- Tolerating an act or a situation

- Doing or agreeing to do an act

SUBSIDIES

SECURITY DEPOSIT-PROVISO

PROVIDED that a deposit, given in respect of the supply of goods or services or both shall not be considered as payment made for such supply unless the supplier applies the deposit as consideration for the said supply;

There is an ambiguity in law;

1. Whether deposit applied for a contract where the contract has been completed (supply has been made) or security deposit forfeited for non performance or breach of contract where contract has not completed(supply did not take place).

2. The law is not clear about the security deposit forfeited for non performance or breach of contract.

- If the “supply” occurred at the time of execution of agreement, and consideration occurred at the time application of deposit.What will be the taxable period.. There is lack of temporal coincidence between “supply” and “consideration.

RELEVANT CASE LAW ON FORFEITED DEPOSIT

Sydney High Court In FC of Tv RELIANCE CARPET CO PTY LTD 2008 ATC 20-028 the Full Federal Court held that the forfeiture of a security deposit is consideration for supply. Accordingly, there is Taxable supply on which to impose GST.

“In the circumstances it may fairly be said that upon execution of the contract the applicant made a supply in that, in terms of s 9-10(2)(g) of [the Act], it ‘entered into an obligation’ to do the things it was bound to do under the contract.”

Relevant Section;

- “9-10(2)Without limiting subsection (1), supply includes any of these;

(g) an entry into, or release from, an obligation: (i) to do things; or (ii) to refrain from an act; or (iii) to tolerate an act or situation.

- “99-5 Giving a deposit as security does not constitute consideration

(1)A deposit held as security for the performance of an obligation is not treated as *consideration for a supply, unless the deposit:

(a) is forfeited because of a failure to perform the obligation; or (b) is applied as all or part of the consideration for a supply.

- “99-10 Attributing the GST relating to deposits that are forfeited etc.

(1)The GST payable by you on a *taxable supply for which the *consideration is a deposit that was held as security for the performance of an obligation is attributable to the tax period during which the deposit:

(a) is forfeited because of a failure to perform the obligation; or

(b) is applied as all or part of the consideration fora supply.

SOMETHING MORE THEN EXISTING OBLIGATION/LEGAL DUTY

- A police officer cannot collect reward for capture and arrest of an outlaw. A police officer cannot contract independent security service while he is on duty at his regular job.

- Protection of people is sovereign duty of police office.

GRANTS/ CHARITABLE ACTIVITY

- If grants are given freely in which the grantor does not receive any benefit in return, then they are not consideration for any supply and are therefore outside the scope of GST. However, if the grantor receives a benefit in return, then the grant is treated as a consideration for the supply.

- For Example, if a grant is given to a researcher and in return, the grantor receives a research finding exclusively for his own benefit, then the person receiving the grant must account for GST on the research services on a tax inclusive basis.

Q 4. Will giving away essential commodities by a charitable institution be taxable activity?

In order to be a supply which is taxable under GST, the transaction should be in the course or furtherance of business. As there is no quid pro quo involved in supply for charitable activities, it is not a supply under GST.

FINES AND PENALTY CHARGES

- If a payment is a fine or a penalty, then it is not a consideration. For example, a fine that is imposed on illegal parking is not a consideration.

- However, if the fine or penalty is actually an additional consideration for a supply in fulfillment of the terms and conditions of the agreement or arrangement, it is a consideration for the supply and is subject to GST.

Example: A fine or a penalty charge for late return of a DVD compact disc is a consideration for a supply of hire as the customer has extended the use of the DVD compact disc for a longer period.

DEEMED SUPPLY ACTIVITIES TO BE TREATED AS SUPPLY EVEN IF MADE WITHOUT CONSIDERATION-SCHEDULE I

1. Permanent transfer or disposal of business assets where input tax credit has been availed on such assets.

2. Supply of goods or services or both between related persons or between distinct persons as specified in section 25, when made in the course or furtherance of business:

Provided that gifts not exceeding fifty thousand rupees in value in a financial year by an employer to an employee shall not be treated as supply of goods or services or both.

3. Supply of goods—

(a) by a principal to his agent where the agent undertakes to supply such goods on behalf of the principal; or

(b) by an agent to his principal where the agent undertakes to receive such goods on behalf of the principal.

4. Import of services by a taxable person from a related person or from any of his other establishments outside India, in the course or furtherance of business.

Nice Article.

Please confirm whether GST will be applicable on cash incentive paid to consultants/advisors for providing good services?