Government jobs in India attract many due to their comprehensive compensation packages, which include the Dearness Allowance (DA) to offset inflation. Understanding how DA is calculated is crucial for PSU employees, as it directly impacts their monthly earnings. This article delves into the mechanics of DA calculation, examining how inflation indices and specific item categories influence the final allowance percentage. In this article we shall discuss about how the increase/ decrease in DA is calculated.

The DA (Dearness Allowance) is paid as a certain percentage of basis pay. For example if the Basic Salary of an employee is Rs 50,000 per month and DA rate is 30% then he will get DA of Rs 15,000 per month in addition to Basic salary and other applicable allowances (like House Rent Allowances etc).

This DA percentage keeps on changing (both increase and decrease) from time to time depending upon the level of inflation / deflation in the economy. In simple terms inflation means an increase in the price of goods and services and deflation means vice-versa.

While calculating this inflation / deflation, following 6 categories of items are considered.

| Sr No | Groups |

| I | Food & Beverages |

| II | Pan, Supari, Tobacco & Intoxicants |

| III | Clothing & Footwear |

| IV | Housing |

| V | Fuel & Light |

| VI | Miscellaneous |

The increase or decrease in prices of above categories are determined for each calendar month. Then a specified weightage (i.e no equal weightage) is assigned for each group based on expenditure pattern of people. Finally General Index is calculated as a weighted average of above groups.

For example for the month of February 2024, March 2024 and April 2024, indexes are determined for above groups and then General Index is determined by assigning applicable weightage for each group as below: (Source: Press Release No F.No. 5/1/2021-CPI dated 07th June 2024 is given as an attachment)

| Sr No | Groups | February,2024 | March,2024 | April,2024 |

| I | Food & Beverages | 142.20 | 142.20 | 143.40 |

| II | Pan, Supari, Tobacco & Intoxicants | 159.10 | 160.30 | 161.10 |

| III | Clothing & Footwear | 142.50 | 143.00 | 143.20 |

| IV | Housing | 128.40 | 128.40 | 128.40 |

| V | Fuel & Light | 161.80 | 154.10 | 152.80 |

| VI | Miscellaneous | 135.80 | 135.90 | 136.10 |

| General Index | 139.20 | 138.90 | 139.40 |

In case of PSU employees on account of pay revision the Labour Bureau has changed the base year of the Consumer Price Index for Industrial Workers from year 2001 to year 2016. However Consumer Price Index (CPI) continues to be published with base year of year 2001. In order to address this situation a link factor of 2.88 is multiplied to published Consumer Price Index (CPI) to arrive at Adjusted CPI. This Adjusted CPI (or multiplied CPI) is used for calculation DA by taking 2016 as the base year.

In other words the Consumer price Index to be considered for DA calculation for PSU employees is taken as below as against the published CPI.

| Month | CPI-IW index published | CPI-IW index considered for DA calculation | Remark |

| December,2023 | 138.80 | 399.74 | CPI-IW index * 2.88 |

| January,2024 | 138.90 | 400.03 | CPI-IW index * 2.88 |

| February,2024 | 139.20 | 400.90 | CPI-IW index * 2.88 |

| March,2024 | 138.90 | 400.03 | CPI-IW index * 2.88 |

| April,2024 | 139.40 | 401.47 | CPI-IW index * 2.88 |

The DA for any quarter (3 months period of Jan-Mar, Apr-June and so on) is calculated based on the 3 months CPI as was prevailing one month prior to the applicable quarter.

For example: DA for Q1 2024-25 (i.e for April 2024 to June 2024) is calculated based on CPI for Dec 2023, Jan 2024 and Feb 2024. Similarly DA for Q2 2024-25 (i.e July 2024 to Sep 2024) is calculated based on CPI for Mar 2024, Apr 2024 and May 2024.

The DA % for any quarter is calculated by applying following formula:

| Average adjusted CPI for last 3 months (one months prior to applicable quarter) | – | 277.33 | X | 100 |

| 277.33 | ||||

* This 277.33 in the above formula is the average CPI of Sep 2016 to Nov 2016 (i.e applicable months for DA of 1st Quarter of year 2017)

We can understand the above formula with the help of following examples.

Example 1: Published CPI of Dec 2023 to Feb 2024 is as below.

| Month | CPI-IW index |

| December,2023 | 138.80 |

| January,2024 | 138.90 |

| February,2024 | 139.20 |

What will be the DA (Dearness Allowance) for 2nd quarter of calendar year 2024 (i.e for period from April 2024 to June 2024).

Solution:

In this case adjusted CPI (i.e Multiplied CPI) for DA calculation would be 2.88 times of published CPI. The average CPI for last 3 months (one month prior to applicable quarter) is as below:

| Month | CPI-IW index | Adjusted CPI | Remark |

| December,2023 | 138.80 | 399.74 | CPI-IW index * 2.88 |

| January,2024 | 138.90 | 400.03 | CPI-IW index * 2.88 |

| February,2024 | 139.20 | 400.90 | CPI-IW index * 2.88 |

| Average adjusted CPI | 400.22 |

Hence DA applicable for 2nd quarter of calendar year 2024 (i.e for period from April 2024 to June 2024) will be [(400.22-277.33)/277.33]*100 = 44.31% ~ 44.30%

Example 2: Published CPI of Sep 2023 to Nov 2023 is as below.

| Month | CPI-IW index |

| Sep 2023 | 137.50 |

| Oct 2023 | 138.40 |

| Nov 2023 | 139.10 |

What will be the DA for 1st quarter of calendar year 2024 (i.e for period from Jan 2024 to March 2024).

Solution:

In this case adjusted CPI (i.e Multiplied CPI) for DA calculation would be 2.88 times of published CPI. The average CPI for last 3 months (one month prior to applicable quarter) is as below:

| Month | CPI-IW index | Adjusted CPI | Remark |

| Sep 2023 | 137.50 | 396.00 | CPI-IW index * 2.88 |

| Oct 2023 | 138.40 | 398.59 | CPI-IW index * 2.88 |

| Nov 2023 | 139.10 | 400.61 | CPI-IW index * 2.88 |

| Average adjusted CPI | 398.40 |

Hence DA applicable for 1st quarter of calendar year 2024 (i.e for period from Jan 2024 to March 2024) will be [(398.40-277.33)/277.33]*100 = 43.66% ~ 43.70%

Published CPI-IW index and adjusted CPI index since January 2021 to April 2024 is given below:

| YYYYMM | Published CPI-IW index | YYYYMM | Published CPI-IW index | |

| 202101 | 118.20 | 202301 | 132.80 | |

| 202102 | 119.00 | 202302 | 132.70 | |

| 202103 | 119.60 | 202303 | 133.30 | |

| 202104 | 120.10 | 202304 | 134.20 | |

| 202105 | 120.60 | 202305 | 134.70 | |

| 202106 | 121.70 | 202306 | 136.40 | |

| 202107 | 122.80 | 202307 | 139.70 | |

| 202108 | 123.00 | 202308 | 139.20 | |

| 202109 | 123.30 | 202309 | 137.50 | |

| 202110 | 124.90 | 202310 | 138.40 | |

| 202111 | 125.70 | 202311 | 139.10 | |

| 202112 | 125.40 | 202312 | 138.80 | |

| 202201 | 125.10 | 202401 | 138.90 | |

| 202202 | 125.00 | 202402 | 139.20 | |

| 202203 | 126.00 | 202403 | 138.90 | |

| 202204 | 127.70 | 202404 | 139.40 | |

| 202205 | 129.00 | |||

| 202206 | 129.20 | |||

| 202207 | 129.90 | |||

| 202208 | 130.20 | |||

| 202209 | 131.30 | |||

| 202210 | 132.50 | |||

| 202211 | 132.50 | |||

| 202212 | 132.30 |

The formula for determining DA (Dearness Allowance) is reproduced below:

| Average adjusted CPI for last 3 months (one months prior to applicable quarter) | – | 277.33 | X | 100 |

| 277.33 | ||||

You may check the applicable DA for any of the quarter at your own by applying the above formula.

Conclusion: The calculation of Dearness Allowance for PSU employees is a meticulous process that ensures salaries keep pace with inflation. By considering various categories of goods and applying a precise formula, the government maintains a fair adjustment in compensation. Understanding this process helps employees anticipate changes in their earnings and appreciate the intricate system designed to protect their purchasing power against inflation. Hope the users will find this article useful.

****

GOVERNMENT OF INDIA

MINISTRY OF LABOUR & EMPLOYMENT

LABOUR BUREAU

Shram Bureau Bhawan, Block No. 2,

Institutional Area, Sector 38 (West),

Chandigarh – 160036

Dated: 7th June, 2024

F.No. 5/1/2021-CPI

Press Release

Consumer Price Index for Industrial Workers (2016=100) – February, March & April, 2024

1. The Labour Bureau, an attached office of the M/o Labour & Employment, has been compiling Consumer Price Index for Industrial Workers every month on the basis of retail prices collected from 317 markets spread over 88 industrially important centres in the country. The indices for the months of February, 2024, March, 2024 and April, 2024 are being released in this press release.

2. The All-India CPI-IW for February, 2024 increased by 0.3 point and stood at 139.2 (one hundred thirty nine point two). The All-India CPI-IW for March, 2024 decreased by 0.3 point and stood at 138.9 (one hundred thirty eight point nine). The All-India CPI-IW for April, 2024 increased by 0.5 point and stood at 139.4 (one hundred thirty nine point four).

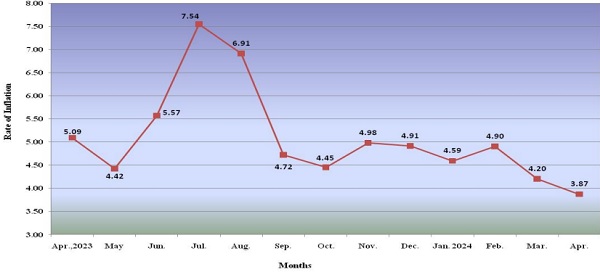

3. Year-on-year inflation for the month of February, 2024 stood at 4.90% as compared to 6.16% in February, 2023. Year-on-year inflation for the month of March, 2024 stood at 4.20% as compared to 5.79% in March, 2023. Year-on-year inflation for the month of April, 2024 stood at 3.87% as compared to 5.09% in April, 2023.

Y-o-Y Inflation based on CPI-IW (General)

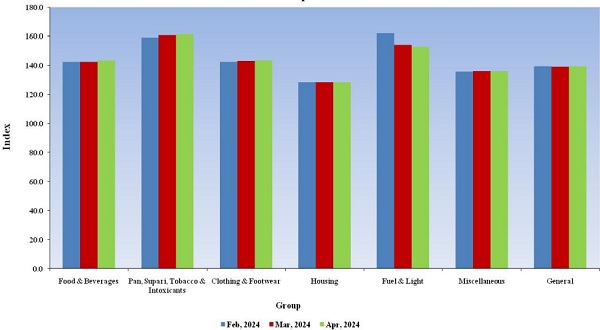

4. All-India Group-wise CPI-IW for February, 2024, March, 2024 and April, 2024:

| Sr. No. | Groups | February,2024 | March,2024 | April,2024 |

| I | Food & Beverages | 142.2 | 142.2 | 143.4 |

| II | Pan, Supari, Tobacco & Intoxicants | 159.1 | 160.3 | 161.1 |

| III | Clothing & Footwear | 142.5 | 143.0 | 143.2 |

| IV | Housing | 128.4 | 128.4 | 128.4 |

| V | Fuel & Light | 161.8 | 154.1 | 152.8 |

| VI | Miscellaneous | 135.8 | 135.9 | 136.1 |

| General Index | 139.2 | 138.9 | 139.4 |

CPI-IW: Groups Indices

*****

Ministry of Labour and Employment has published CPI-IW for May 2024 via notification No F.No. 5/1/2021-CPI – dated 10.07.2024 and CPI-IW for May 2024 stood at 139.90 as against 139.40 in April 2024.

Based on published CPI-IW for May 2024 DA (Dearness Allowance) calculation for 3rd quarter of calendar year 2024 (i.e for period from July 2024 to Sep 2024) is as below:

Published CPI of Mar 2024 to May 2024 is as below.

Month CPI-IW index

March 2024 138.90

April 2024 139.40

May 2024 139.90

What will be the DA for 3rd quarter of calendar year 2024 (i.e for period from July 2024 to Sep 2024).

Solution:

In this case adjusted CPI (i.e Multiplied CPI) for DA calculation would be 2.88 times of published CPI. The average CPI for last 3 months (one month prior to applicable quarter) is as below:

Month CPI-IW index Adjusted CPI Remark

March 2024 138.90 400.03 CPI-IW index * 2.88

April 2024 139.40 401.47 CPI-IW index * 2.88

May 2024 139.90 402.91 CPI-IW index * 2.88

Average adjusted CPI 401.47

Hence DA applicable for 3rd quarter of calendar year 2024 (i.e for period from July 2024 to Sep 2024) will be [(401.47-277.33)/277.33]*100 = 44.76% ~ 44.80%

So DA for 3rd quarter of calendar year 2024 (i.e for period from July 2024 to Sep 2024) would be 44.80% as against 44.30% in 2nd quarter of calendar year 2024.