Seeks to notify procedures, safeguards, conditions and limitations for grant of refund of CENVAT Credit under rule 5B of CENVAT Credit Rules, 2004

- Rent a Cab (where service provider has not opted for benefit of abatement)

- Manpower Supply Services

- Security Services

- Works Contract Services

Notification No. 12/2014–Central Excise (N.T.),

Dated : March 03, 2014

G.S.R. 139(E).- In exercise of the powers conferred by rule 5B of the CENVAT Credit Rules, 2004 (hereinafter referred to as the said rules), the Central Board of Excise and Customs hereby directs that the refund of CENVAT credit shall be allowed to a provider of services notified under sub-section (2) of section 68 of the Finance Act,1994, subject to the procedures, safeguards, conditions and limitations, as specified below, namely:-

1. Safeguards, conditions and limitations. –

(a) the refund shall be claimed of unutilised CENVAT credit taken on inputs and input services during the half year for which refund is claimed, for providing following output services namely:-

(i) renting of a motor vehicle designed to carry passengers on non abated value, to any person who is not engaged in a similar business;

(ii) supply of manpower for any purpose or security services; or

(iii) service portion in the execution of a works contract;

(hereinafter the above mentioned services will be termed as partial reverse charge services).

Explanation:- For the purpose of this notification,-

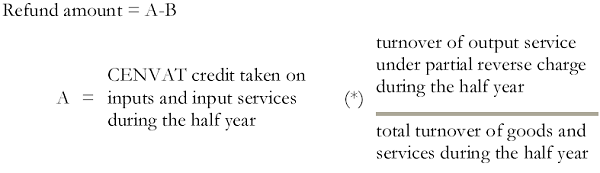

Unutilised CENVAT credit taken on inputs and input services during the half year for providing partial reverse charge services = (A) – (B)

Where,

| A | = | CENVAT credit taken on inputs and input services during the half year | (*) | turnover of output service under partial reverse charge during the half year

total turnover of goods and services during the half year |

| B = Service tax paid by the service provider for such partial reverse charge services during the half year; | ||||

(b) the refund of unutilised CENVAT credit shall not exceed an amount of service tax liability paid or payable by the recipient of service with respect to the partial reverse charge services provided during the period of half year for which refund is claimed;

(c) the amount claimed as refund shall be debited by the claimant from his CENVAT credit account at the time of making the claim;

(d) in case the amount of refund sanctioned is less than the amount of refund claimed, then the claimant may take back the credit of the difference between the amount claimed and the amount sanctioned;

(e) the claimant shall submit not more than one claim of refund under this notification for every half year;

(f) the refund claim shall be filed after filing of service tax return as prescribed under rule 7 of the Service Tax Rules for the period for which refund is claimed;

(g) no refund shall be admissible for the CENVAT credit taken on input or input services received prior to the 1st day of July,2012;

Explanation. – For the purposes of this notification, half year means a period of six consecutive months with the first half year beginning from the 1st day of April every year and second half year from the 1st day of October of every year.

2. Procedure for filing the refund claim. – (a) the provider of output service, shall submit an application in Form A annexed hereto, along with the documents and enclosures specified therein, to the jurisdictional Assistant Commissioner of Central Excise or Deputy Commissioner of Central Excise, as the case may be, before the expiry of one year from the due date of filing of return for the half year:

Provided that the last date of filing of application in Form A, for the period starting from the 1st day of July,2012 to the 30th day of September,2012, shall be the 30th day of June,2014;

(b) if more than one return is required to be filed for the half year, then the time limit of one year shall be calculated from the due date of filing of the return for the later period;

(c) the applicant shall file the refund claim along with copies of the return (s) filed for the half year for which the refund is claimed;

(d) the Assistant Commissioner or Deputy Commissioner to whom the application for refund is made may call for any document in case he has reason to believe that information provided in the refund claim is incorrect or insufficient and further enquiry needs to be caused before the sanction of refund claim;

(e) at the time of sanctioning the refund claim, the Assistant Commissioner or Deputy Commissioner shall satisfy himself or herself in respect of the correctness of the refund claim and that the refund claim is complete in every respect;

Annexure

FORM A

Application for refund of CENVAT Credit under rule 5B of the CENVAT Credit Rules, 2004 for the half year beginning from 1st of April/1st of October

To,

The Assistant Commissioner or Deputy Commissioner of Central Excise,

…………………………..…………………………………………………………

Sir,

I/We have provided taxable services where service recipient is also liable to pay service tax in terms of sub-section (2) of section 68 of the Finance Act, 1994. Accordingly the refund of CENVAT Credit in terms of Rule 5B of the CENVAT Credit Rules, 2004 (as per the details below) may be sanctioned.

(a) Particulars of output services provided and service tax liability of the service provider and the service recipient during the period of half year for which refund is claimed:-

| Sl.No | Description of service | Value of output services provided during the half year | Total Service tax liability during the half year | Service tax liability discharged by the provider of output service during the half year | Service tax liability of the receiver of such output service during the half-year [Column 3 –Column 4] |

| 1 | 2 | 3 | 4 | 5 | |

| 1 | renting of a motor vehicle designed to carry passengers on non abated value, to any person who is not engaged in a similar business | ||||

| 2 | supply of manpower for any purpose or security services | ||||

| 3 | service portion in the execution of a works contract | ||||

| Total | |||||

(b) Particulars of the amount eligible for refund at the end of the half year:-

| Period beginning from 1st April/1st October | Service tax liability of the receiver of such output service during the half-year (total of column 5 of above table) | Amount of unutilised CENVAT Credit taken on inputs or input services during the half year for providing services taxable under partial reverse charge [as calculated in para 1(a) of the notification]. | The eligible refund amount (minimum of column 2 and 3) |

| 1 | 2 | 3 | 4 |

(c), I/we have debited the CENVAT credit account by Rs. ………. for seeking refund.

2. Details of the Bank Account to which the refund amount to be credited: Refund sanctioned in my favour should be credited in my/ our bank account.

Details furnished below;

(i) Account Number :

(ii) Name of the Bank :

(iii) Branch (with address):

(iv) IFSC Code:

3. Declaration

(i) I/We certify that the aforesaid particulars are correct.

(ii) I/We certify that we satisfy all the conditions that are contained in rule 5B of the CENVAT Credit Rules, 2004 and in Notification No. 12/2014-CE (NT), dated 3rd March,2014.

(iii) I/We am/are the rightful claimant(s) of the refund of CENVAT Credit in terms of rule 5B, the same may be allowed in our favour.

(iv) I/we have been authorised as the person to file the refund claim on behalf of the assessee.

(v) I/We declare that we have not filed or will not file any other claim for refund under rule 5B of CENVAT Credit Rules, 2004, for the same half year to which this claim relates.

| Date | dd mm yyyy | Signature of the Claimant (proprietor/karta/partner/any other authorised person) |

……..………………. |

| Name of the Claimant Registration Number Address of the Claimant |

……….……………. ……….……………. ………….…………. |

4. Enclosures:

(i) Copy of the ST-3 returns for the half year.

5. Refund Order No.

| Date | d | d | m | m | y | y | y | y |

The refund claim filed by Shri/Messrs _______________________has been scrutinized with the relevant Central Excise/ Service Tax records. The said refund claim has been examined with respect to relevant enclosures and has/has not been found in order. A refund of Rs. ____________________________ (Rupees ____________________) is sanctioned/The refund claim filed is rejected.

Assistant Commissioner or Deputy Commissioner of Central Excise

Forwarded to-

(i) The Chief Accounts officer, Central Excise, for information and necessary action.

(ii) The Commissioner of Central Excise.

Assistant Commissioner or Deputy Commissioner of Central Excise

________________________________________________________________________

(i) Passed for payment of Rs. ______________ (Rupees ____________) The amount is adjustable under head “0044 – Service tax – Deduct Refunds”.

(ii) Amount credited to the account of the claimant as per the details below :

| Amount refunded | |

| Account Number | |

| Reference No. of transfer | |

| Name of the Bank | |

| Address of the Branch | |

| IFSC code |

| Date | d | d | m | m | y | y | y | y |

|

Chief Accounts officer

|

||||||||

[F.No. 354 /247/ 2012-TRU]

(Akshay Joshi)

Under Secretary to the Government of India

Is there a separate system of claiming refund by advocates?