Introduction

The AEO (Authorized Economic Operator) is the Status certification that provides international recognition to a business entity involved in the international supply chain. It certifies an entity as a secure and reliable trade partner. There are the four AEO Tier introduced under the AEO Programme team- AEO T1, T2, T3 for the importer and exporter, and AEO LO for logistic providers. The mode for AEO application for all tiers is Online application on AEO Portal aeoindia.gov.in. In this article, we will have an in-detail discussion about background with features, Aim of AEO, Eligibility criteria, benefits, the required documents for AEO application form for grant of AEO status & finally few FAQs on AEO.

Background and Features

- AEO is a trade facilitation programme worldwide through close partnership between customs and business entities.

- It is a voluntary programme

- This programme earlier known as ACP (Accredited Client Programme)

- After suicide terrorist attack on Sept 11 , 2001 (9/11) at World trade center, Pentagon and federal government building WCO (World Customs Organization) comprising of 184 customs administration worldwide adopted in 2005 the SAFE framework of standards to secure and facilitate international movement of goods.

- In India AEO came in force 23/08/2011 vide CBEC Circular No. 37/2011- Customs. The same was amended and the revised final AEO programme was introduced vide Circular No. 28/2012 dated 16.11.2012.

- It ensures security in global supply chain from the point of origin i.e. the point of export to the point of import in the receiving country.

- AEO (Authorized Economic Operator) scheme is aimed to give extra facilities to genuine parties dealing in import or export. In simple terms, this scheme is similar to Green Channel facility.

- AEO provides faster customs clearances and simplified customs procedures to the operators.

- Today, the programme has a membership of nearly 5,000 AEO entities.

- Limited intervention in a low-risk environment is a central part of the modern customs approach; it not only allows for cost-effective border management but also allows for trade facilitation, so important to the growth of the economy.

Aims of AEO Programme

- To provide business entities with an internationally recognized certification;

- To recognize business entities as “secure and reliable” trading partners;

- To incentivize business entities through defined benefits that translate into savings in time and cost;

- Secure supply chain from point of export to import;

- Minimal security related disruption to flow of cargo;

- Reduction in dwell time and related costs

Core Elements of SAFE Framework

- It harmonizes the advance electronic cargo information requirements on inbound, outbound and transit shipments

- Each country that joins the SAFE Framework commits to employing a consistent risk management approach to address security threats

- At the reasonable request of the receiving nation the sending nation’s Customs administration will perform an outbound inspection of high-risk cargo and/or transport conveyances.

- The SAFE Framework suggests benefits that Customs will provide to businesses that meet minimal supply chain security standards and best practices

- It promotes close cooperation with other governmental agencies representing different regulatory areas, in order to keep societies safe and secure while facilitating the movement of goods

Pillars of SAFE Framework

The SAFE Framework rests on the three pillars of Customs-Customs network arrangements, Customs-to-Business partnerships and Customs-to-other Governments Agencies co-operation.

a) Customs to Customs partnership

- protect the global supply chains ,

- detect and flag in real time high-risk consignments,

- effective monitoring and detection of prohibited material

a) Customs to Business partnership

- reduce the amount of intervention by Customs in the importation/exportation process

- reducing costs to deliver desired levels of profitability.

- make easier for buyers and sellers to move goods across borders

a) Customs-to-other Governments Agencies co-operation

- avoid duplication of requirements and inspections,

- streamlining processes

- ultimately working toward global standards that secure the movements of goods in a manner that facilitates trade

Partners in AEO

Eligibility Criteria for AEO Certificate

CBIC circular dated 22nd July 2006 provides the eligibility criteria and conditions for granting AEO certificates

- Any business entity that is part of the international supply chain; involved in the cross-border movement of goods and required to fulfill obligations under the Customs law in India, only can apply for AEO status.

- Established in India;

- Business should be involved in Customs related activity;

- Should have dealt with minimum 25 Customs documents (either Bill of Entry or Shipping Bill) in the last FY

- Should have been in business activity for last 3 Financial Years.

- AEO certification is not required for organizations that are not involved in customs-related work. Thus Banks, insurance companies, consultants and the rest other business organization may not apply for AEO certification

- The most important legal requirement is that the business must not have been issued any show cause notice in the last three financial years

- The firm shouldn’t be involved in fraud, forgery, outright smuggling, clandestine removable of excisable goods

- There must not be any case of prosecution

- A review would be taken for the cases and the decision would be taken on issuance by the AEO Program Manager in case of a show cause notice of an active legal matter, if the ratio of the disputed duty demanded or drawback demanded with respect to the total duty paid and drawback claimed during the said period is more than 10%.

- The applicant should be financially solvent during at least three financial years, preceding the date of application

- The applicant should not have defaulted in payment of customs duties during the past three years.

- The applicant should submit solvency certificate duly issued by the statutory auditors of the applicant.

- The applicant should have appropriate internal controls and measures to ensures safety and security of his business and supply chain.

- The applicant should have guidelines on procedures to be followed to take care of the cargo when it is his custody and during transport.

- There should be proper documentation of management procedure

- Buildings that are used in operations must be free from unlawful entry.

- There must be adequate lighting arrangements for entrance , exits , cargo handling, storage areas, fence lines and parking areas

- The applicant must follow appropriate measures for the handling of goods, protection against loss and also tampering with cargo units.

- The applicant should have a well-defined method to ensure identification of his business partners.

- The applicant should ensure that the conveyances to be used in connection are handled in a manner , that will ensure the cargo is safe and secured.

- The application of AEO does not cover a group of companies but only the legal entity of the applicant.

- The AEO certification is open to micro, small and medium enterprises as well.

- The size of the business does not matter

- The eligibility conditions and criteria for granting AEO Status has been listed in the Section 3 of the AEO Circular No. 33/2016 dated 22nd July,2016 as amended by Circular No. 3/2018-Customs dated 17th January, 2018

- There is no provision to grant specific AEO status to a branch of a legal entity . AEO certification is entity wise not branch wise, location wise and Group wise. If a group of company have 5 companies then all company will have to apply separately.

- A legal entity falling under three tier AEO programme as an importer/ exporter and single tier AEO programme as a logistics provider can not apply for single accreditation of AEO T1/T2/T3 or AEO LO. Such economic operator should apply separately for any of the three tier AEO programme of importer/exporter (AEO T1/T2/T3) or single tier AEO LO status

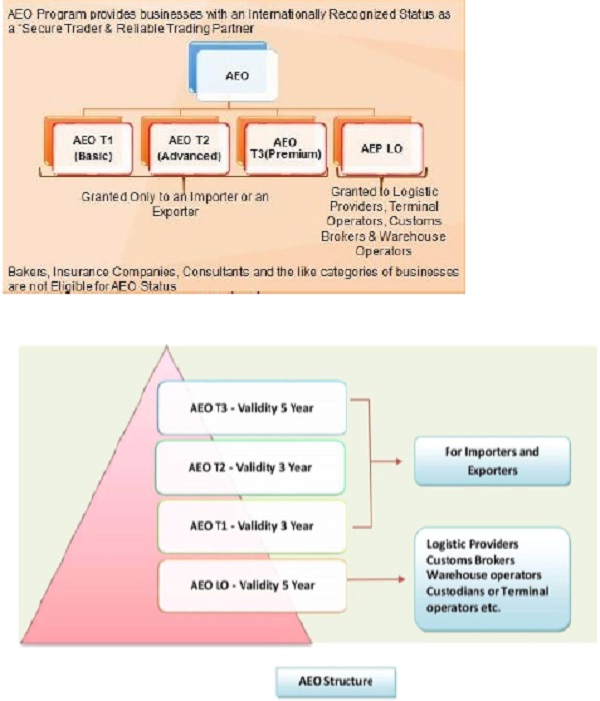

Structure of Indian AEO programme

There is a three-tier programme for importers and exporters (AEO T1, AEO T2 , AEO-T3) and there is single Tier AEO Programme (AEO LO) for Logistics Providers, Custodians or Terminal Operators, Customs Brokers and Warehouse Operators.

Status of AEO-T1

AEO-TI status holder are eligible for 24/7 cargo clearance, exemption from payment of merchant overtime fee, separate space in custodian’s premises and facility of Direct Port Delivery (DPD) for import and export consignments.

Status of AEO-T2

AEO-T2 certificate holder will have the facility of self-sealing of export goods without seeking case to case permission from the authority.

Status of AEO-T3

If the applicant has continuously held an AEO-T2 status for two or more years, he will be issued an AEO-T3 Certificate within 30 days of applying.AEO-T3 is the highest level of accreditation.

Type & Applicability & renewal of AEO Certification

| Type of Certificate | Applicability | Validity | Time limit before lapse |

| AEO-T1 Certificate |

Only Importer and Exporter | 2 years | 30 days |

| AEO-T2 Certificate |

Only Importer and Exporter | 3 years | 60 days |

| AEO-T3 Certificate |

Only Importer and Exporter but applicant must have continuously enjoyed the status of AEO-T2 for at-least a period of two years preceding the date application for grant of AEO-T3 status | 5 years | 90 days |

| AEO-LO Certificate |

Other than Importer and exporter | 5 years | 90 days |

Benefits under Indian AEO programme

| Benefits | AEO-T1 | AEO-T2 | AEO-T3 |

| High level of facilitation | Yes | Yes | Yes |

| Direct Port delivery Import/export container | Yes | Yes | Yes |

| ID cards to authorized personnel for hassle free entry to Customs Houses, CFS and ICDs | Yes | Yes | Yes |

| Separate space earmarked in Custodian’s premises | Yes | Yes | Yes |

| Reduction on Bank Guarantee | 50%

reduction |

75%

reduction |

100% reduction |

| Investigations, if any, would be completed, in six to nine months | Yes | Yes | Yes |

| Disputes resolution within six months | Yes | Yes | Yes |

| E-mail regarding arrival/departure of the vessel carrying their consignments | Yes | Yes | Yes |

| 24/7 clearances on request at all sea ports and airports | Yes | Yes | Yes |

| Seal verification/scrutiny of documents by Custom officers would be waived | Yes | Yes | Yes |

| Deferred payment of Duty | No | Yes | Yes |

| BEs/SBs will be processed on priority | Yes | Yes | Yes |

| Faster completion of Special Valuation Branch (SVB) | Yes | Yes | Yes |

| Shorter cargo release time | Yes | Yes | Yes |

| Paperless declarations with no supporting documents in physical form | Yes | Yes | Yes |

| Expedite refund of IGST | 45 days | 30 days | |

| No Merchant Overtime Fee (MOT) | No | Yes | Yes |

| Recognition worldwide as safe, secure and compliant business partners in international trade | Yes | Yes | Yes |

| Faster disbursal of drawback amount | Yes | Yes | Yes |

| Fast tracking of refunds and adjudications | Yes | Yes | Yes |

Benefits to AEO-LO- Logistic Service Providers, Custodians of Terminal Operators, Custom Brokers, Warehouse Operators

- Waiver of bank Guarantee in case of trans-shipment of goods Imported

- Facility of Execution of running bond

- Exemption from permission in case of transit of goods

- Faster approval of new warehouse within 7 days

- Waiver of solvency certificate

- Waiver of security for obtaining an extension in the warehousing period

- Waiver from fee for renewal of license

- Facility for faster approval of new warehouse within a period of 7 days

- Facility of waiver of security required for warehousing of sensitive goods

- Facility of extension of validity of licenses

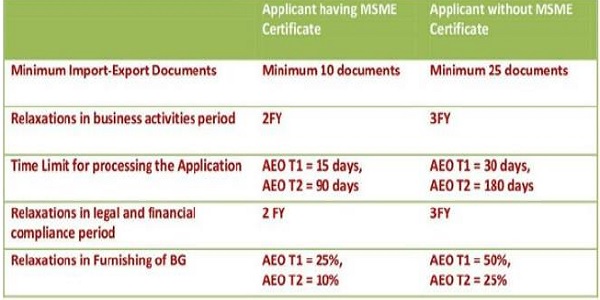

Benefits to MSME under Indian AEO programme

- The condition that the business must have handled a minimum of 25 customs documents in the last financial year was relaxed. The MSME handling ten documents (five documents each half-year) are eligible and can apply for an AEO certificate.

- The condition of business carrying out customs-related activities for the last three financial years is reduced to last two financial years .

- The condition of not receiving a show-cause notice during the last three financial years is reduced to last two financial years

- The condition of financial solvency during the last three financial years is relaxed to last two financial years.

- The time limit for processing the MSME AEO T1 and MSME AEO T2 is reduced to 15 working days (usually 30 days) and 90 working days (usually six months ).

- The benefit of relaxation in furnishing a bank guarantee for the AEOs for MEME AEO T1 AND MEME AEO T2 is further relaxed to 25% from 50% and 10% from 25% required to be furnished by an exporter /importer who is not an AEO certificate holder.

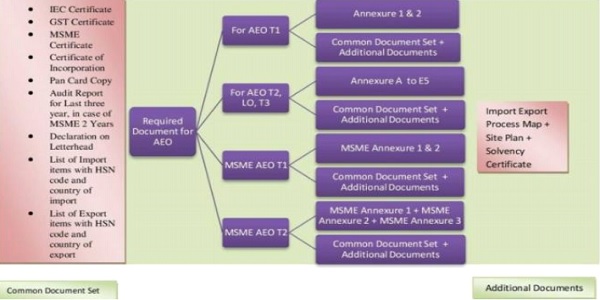

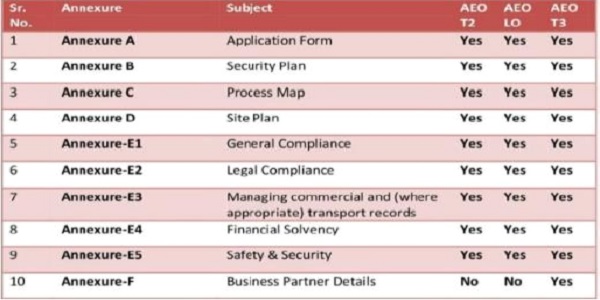

Documents required for AEO programme

AEO certification needs a common set of documents and a list of additional documents which would be the same for each tier. Application forms would be different for AEO T1 from the other remaining three tiers.

Documents required for AEO TI

- Common Document Set

- Application Form:- Annexure 1 and Annexure 2

- Additional Documents :- Import-Export Process Map + Site Plan+ Solvency Certificate with undertaking & Declaration

Documents required for AEO T2, AEO T3 & AEO LO

- Common Document Set

- Annexure A to Annexure F

Common set of Documents for AEO T1, AEO T2, AEO T3 and AEO LO

- IEC Certificate

- GST Certificate

- MSME Certificate

- Certificate of Incorporation

- Pan Card Copy

- Audit Report for Last three years

- Declaration on Letterhead

- List of Import items with HSN code and country of import

- List of Export items with HSN code and country of export

Annexure 1 and Annexure 2 for AEO T1

Annexure-1

- Company name

- Rejection Letter (If the AEO application ever got rejected)

- Enter the Registered Address/Branch Address

- Nature of business: Manufacturer, Trader, Importer or Exporter

- Details of contact person

Annexure-2

- Declare if there is any case of violation of customs & allied laws

- Mention if SCN(Show cause Notice) is issued by Customs or GST authorities. If yes , specify the reason

- Provide break-up of Contingent liability in Audit report for last three years

- Other details e.g.- any insolvency, bankruptcy or liquidation proceeding, Net current assets for last three years, Net worth for last three years, procedure for back-up and recovery of business records, procedure to ensure the protection of computerized system from unauthorized actress, procedure for verifying the accuracy of customs declaration, administering license and administering commercial records.

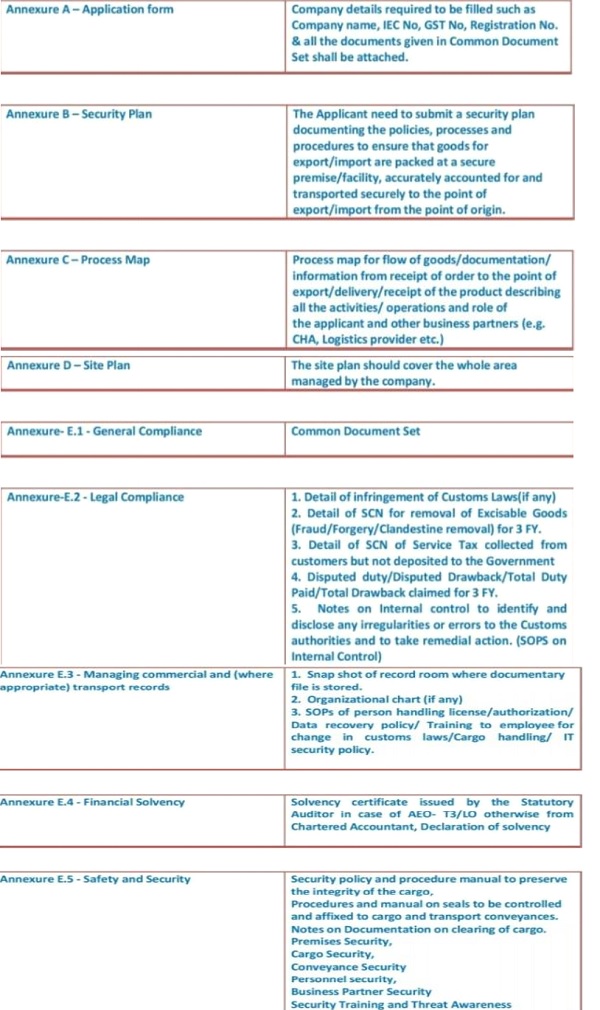

Annexure A to Annexure E for AEO T2, AEO T3 and AEO LO

Annexure F for AEO T3

Business Partners Details

Furnish list of all the business partners of the applicant, who are in any manner involved in the international supply chain, as under:

- Name and Address

- Nature of Business ((Logistics Service providers, Custodians/Terminal operators, Customs Brokers or Warehouse operators)

- Whether holder of AEO-T2 certificate

FAQ on Indian AEO programme

Q.1 Is AEO mandatory for businesses involved in the supply chain?

No. The AEO scheme is purely an optional scheme.

Q.2 Whether AEO certificate is valid at all Customs stations across India?

Yes, it is valid at all Customs stations in India. In other words, an AEO status holder shall get the AEO benefits at all Customs ports/ airports/ Land Customs stations.

Q.3 How can an AEO avail the facility of deferred payment of duty?

As per Rule 4 of the Deferred Payment of Import Duty Rules, 2016 an eligible importer who intends to avail the benefit of deferred payment has to intimate his intent to the jurisdictional Principal Commissioner of Customs or the Commissioner of Customs and get registered on the ICEGATE site www.icegate.gov.in.

Q.4 Whether all AEO operators are entitled for DPD /DPE facility?

Yes, all AEO T1/T2/T3 status holders are entitled for DPD/ DPE facility. However, they have to apply for the Direct Port Delivery permission to the concerned Chief Commissioner and also register themselves with the port authority for DPD facility.

Q.5 What is deferred payment of duty scheme?

It is based on the principle ‘Clear First-Pay later

Q.6 Whether facilitation benefits will be available to Indian AEOs in foreign countries?

Yes, the facilitation benefits will be available in countries with whom India has signed Mutual Recognition Agreement (MRA).

Q.7 What are the due dates for payment in respect of deferred payment of duty?

As per Notification No. 134/2016 Cus (NT) dated 02.11.2016 as amended by Notification No. 28/2017 –Cus(NT) dated 31.03.2017,the Deferred Payment of Import Duty time lines are as below:

Q.8 What exactly is a mutual recognition agreement/ arrangement (MRA)?

Mutual Recognition Arrangements/ Agreements (MRA) are bilateral understandings between two Customs Administrations which allow one business partnership program to recognize the AEO validations of the other country’s program and extend reciprocal benefits to each other’s AEO.

Q.9 Whether benefit of AEO LO status granted to a Customs Broker will also be given to its clients i.e. importers or exporters?

No. The AEO LO status will only be valid and applicable for the applicant and not for his importers or exporters. They need to apply separately for AEO status

Q.10 Where should applications for AEO be submitted?

The application should be sent to the office of the jurisdictional Chief Commissioner of Customs with copy to AEO Programme Manager, Directorate of International Customs: 10th Floor, Tower II, Jeevan Bharti Building, Connaught Place, New Delhi – 110001

Q.11 Who is AEO programme manager for Indian AEO Programme?

The Principal Commissioner, Directorate of International Customs, having office at 10th floor, Tower-2, Jeevan Bharati Building, Connaught Place, New Delhi-110001

Q.12 Whether an economic operator whose application is once rejected under the current scheme, can apply again for AEO status?

Yes, the application can be filed again if grounds on which the application was rejected are no longer valid and the applicant is otherwise eligible for AEO status.

Q.13 Can an existing AEO status holder file application for higher AEO status? If yes, what is the time limit for filing such application?

An existing AEO certificate holder can apply for higher AEO status. There is no time limit for filing higher status application except in case of AEO-T3. In case of AEO-T3, either the entity should have had AEO-T2 status continuously for two years or when all its business partners in international supply chain have acquired either AEO-T2 or AEO-LO status.

Q.14 Can a consultant be appointed as the contact person or the authorised person for filing application?

No. The applicant has to nominate the contact person/ authorised representative from company’s own administration only

Q.15 Whether a newly established company can apply for AEO Status?

As per the Indian AEO requirements, the applicant should have business activities for at least three financial years preceding the financial year of date of application. However, in exceptional cases, on the basis of physical verification of internal controls of a newly established business entity, the AEO Programme Manager can consider it for certification.

Q.16 Whether a legal entity falling under three tier AEO programme as an importer/ exporter and single tier AEO programme as a logistics provider can apply for single accreditation of AEO T1/T2/T3 or AEO LO?

No, such economic operator should apply separately for any of the three tier AEO programme of importer/exporter (AEO T1/T2/T3) or single tier AEO LO status.

Q.17 What are the documents to be submitted as proof of having business activity for the last three financial year preceding the date of application?

The documents /evidence include Certificate of Incorporation, Import-Export Code (IEC), balance sheets for three-years etc

Q.18 In case where applicant does not have audited balance sheet, what documents are to be submitted in its place?

In cases where the statute exempts the applicant from statutory audit, the applicant can submit balance sheet certified by both the proprietor/partner/MD and any chartered accountant (CA) stating the profit /loss and net worth for the purpose of AEO application.

Q.19 What documents are needed to be submitted by a business as proof of having its own accounts?

The documents/ evidence required as a proof about the business of a company having its own accounts include cancelled cheque, account statement, audited balance sheets

Q.20 Whether the applicant having ratio of duty demanded and total duty paid/drawback claimed more than 10% are not eligible for AEO accreditation?

Yes. In case the ratio is above 10%, the AEO programme envisages examination of the nature of cases of duty demand. The decision for issue or continuance of AEO status is at the discretion of AEO programme manager based on examination of the Show Cause Notices issued.

Q.21 What accounting system is required to be followed by an AEO ?

Any accounting system consistent with Generally Accepted Accounting Principles (GAAP) / International Financial Reporting Standards (IFRS)

Q.22 How will the AEO status be renewed?

The AEO status is renewed against application for the same made before lapse of their validity

Q.23 Whether the AEO status is subject to Review?

Yes. The AEO team is mandated to review the AEO status periodically to ensure that the AEO client continues to adhere to the condition of AEO accreditation.

Q.24 What are the timelines for review of AEO status?

The frequency of review of AEO status are same for AEO T-1 and AEO T-2 i.e. once in three years. The same is five years for AEO T-3 /LO status.

Q.25 Can the AEO application be filed on-Line?

Yes. An on-line website (domain name: aeoindia.gov.in) has been created for filing and processing of AEO application.

Q.26:What is the first step of filing on-line application for AEO T-1 status?

The applicant has to first register themselves at the AEO website www.aeoindia. gov.in by furnishing the information asked for in the Registration window and to create user id and password for logging into the website to file AEO T1 application.

Q.27: Whether the amount of Bank Guarantee in case of T1,T2 and T3 is reduced to 50%, 25% and NIL respectively in all cases of dispute between Customs and AEO status holder?

No. The CBIC Circular No. 38/2016 dt 22.08.2016 list out the situations where amount of BG is reduced to 50%,25% and NIL.

Q.28: What is AEO T3 certification?

The circular provides for a three tier AEO Status for Exporters and Importers. The three tiers are AEOT1,AEO T2, AEO T3, where AEO T3 is the highest level of accreditation.

Q.29: Is there any format for the undertaking regarding solvency and for the solvency certificate?

No, there is no format in AEO Circular No. 33/2016-Customs. The only requirement is that the certificate should be for last three financial years (Each year) based on books of accounts and financial statements, tax returns etc.

Q.30: In what cases is the application for AEO accreditation not processed or returned for rectification?

The application for AEO accreditation is not processed in following cases:

1. When application is incomplete. The application may be resubmitted with the complete information.

2. Where the application has not been made by a legal person. The same can be resubmitted by the concerned legal entity.

3. Where no responsible person is nominated as the Point of Contact.

4. Where the applicant is subject to bankruptcy proceedings at the time the application is made. The application can be resubmitted when the applicant becomes solvent.

5. Where a previously granted AEO status has been revoked -The application can be submitted only after one year, in case of AEO T-1 & T-2 and after three years in case of AEO T-3 and LO, from the date of revocation.

Q.31: When application for AEO will be rejected?

The application shall not be accepted in any of the cases:

(i) Where the applicant is not eligible for grant of AEO status, or

ii) Where the deficiency noticed in the application cannot be remedied.

Q.32: How AEO status is maintained?

1. After obtaining AEO status, the AEO status holder should maintain their eligibility by adhering to the appropriate standards.

2. The holder of a Certificate of AEO Status is required to notify any significant change in business and processes which may affect the AEO status at least within 14 days of the change taking place

Q.33: How review of AEO status is conducted?

The AEO Programme Team will review AEO status periodically to ensure continued adherence to the conditions and standards of grant of Certificate of AEO Status.

Q34: Under what conditions AEO status is suspended or downgraded?

1. Where any non-compliance with the conditions or criteria for the Certificate of AEO Status has been detected

2. In the case of a Custodian or Custom Broker or Warehouse Operator, where the basic license as a Custodian or Custom Broker or Warehouse Operator has been suspended by the competent authority

3. In the case of an AEO importer or an AEO exporter, if any show cause notice has been issued alleging infringement of Customs/Central Excise/Service Tax law AEO Programme Manager may downgrade the status of an AEO-T3 to AEO-T2 or AEO-T1, or downgrade the status of an AEO-T2 to AEO-T1, or suspend the status of the AEO

Q35: What is process of restoration suspended / downgraded AEO status?

1. Where AEO status had been suspended on account of detection of any non- compliance -if the AEO holder takes the necessary remedial measures to the satisfaction of the AEO Programme Manager within 60 days of suspension, the AEO Programme Manager may restore the AEO status from a date to be notified by him.

2. Where AEO status had been suspended on account of suspension of the basic license as a Custodian or Custom Broker or Warehouse Operator- the AEO Programme Manager may consider restoration of AEO status may restore the AEO status from a date to be notified by him.

3. Where AEO status had been suspended on account of issue of a show cause notice- the AEO Programme Manager may consider restoration of AEO status the AEO status from a date to be notified by him.

4. In case an AEO status has been downgraded, it shall be open to the entity to apply again for higher status as and when the eligibility conditions and criterion are met by it.

Q.36: When AEO status is revoked?

1. Where the Certificate of AEO Status is already suspended and the AEO holder fails to take the remedial measure within 60 days to have the suspension withdrawn

2. Where there is a reasonable belief that an act has been perpetrated that is liable to lead to prosecution and /or is linked to an arrest of person under Customs Act, 1962

3. A show cause notice has been issued to them involving fraud, forgery, outright smuggling, clandestine removal of excisable goods or cases where Service Tax has been collected from customers but not deposited to the Government

4. Where the AEO status holder requests the authorization be revoked

Q.37: How do Parent/Subsidiary companies apply for AEO?

Multinational companies usually consist of a parent company and subsidiary companies or/and branches. A subsidiary is an individual legal person, i.e. an individual legal person or an association of persons. Therefore if a parent company wishes to achieve AEO status for a part or all of its subsidiaries, AEO applications must be submitted by all the separate subsidiary companies wishing to achieve AEO status.

A “branch”, on the other hand, is a simple sub office of the company itself and forms part of the company’s total assets and thus is not an individual legal person. In this case a single application has to be submitted by the parent company wishing to acquire AEO status.

Q.38: What Indirect benefits offer by AEO programme?

In addition to the direct benefits provided for in the legislation, an AEO may derive benefits that are not directly linked to the customs side of their business.Some examples of the indirect benefits that may result from these positive effects could be as follows: –

– reduced theft and losses;

– fewer delayed shipments;

– improved planning;

– improved customer service;

– improved customer loyalty;

– improved inventory management

– improved employee commitment;

– reduced security and safety incidents;

– lower inspection costs of suppliers and increased co-operation;

– reduced crime and vandalism;

– improved security and communication between supply chain partners.

Q.39:Is Company involved in Merchanting Trade can apply for AEO certification?

No. The company is not involved in customs related activities and not required to fulfill obligations under Customs Law.

Q.40: Why relaxation is given to MSME sector for AEO package?

Recognizing their critical contribution in supporting the economy especially during the present difficult times of COVID-19 pandemic, Central Board of Indirect Taxes & Customs (CBIC) has taken a new initiative to introduce its flagship “Liberalized MSME AEO Package” for Micro Small and Medium Enterprises (MSMEs).

Key takeaway of AEO programme

- AEO is a trade facilitation programme worldwide through close partnership between customs and business entities.

- It is a voluntary programme

- The business entity must be established in India

- It ensures security in global supply chain from the point of origin i.e. the point of export to the point of import in the receiving country.

- AEO provides faster customs clearances and simplified customs procedures to the operators.

- Minimal security related disruption to flow of cargo;

- Reduction in dwell time and related costs

- Provide business entities with an internationally recognized certification

- Protect the global supply chains

- Effective monitoring and detection of prohibited material

- Reduce the amount of intervention by Customs in the importation/exportation process

- Make easier for buyers and sellers to move goods across borders

- Ultimately working toward global standards that secure the movements of goods in a manner that facilitates trade

- Any business entity involved in Customs related activity and involved in the cross- border movement of goods only can apply for AEO status.

- Should have dealt with minimum 25 Customs documents (either Bill of Entry or Shipping Bill) in the last FY

- Should have been in business activity for last 3 Financial Years.

- The most important legal requirement is that the business must not have been issued any show cause notice and shouldn’t be involved in fraud , forgery, smuggling, clandestine removal of excisable goods, no case of prosecution in the last three financial years.

- Duty paid and drawback claimed should not be more than 10%

- The applicant should be financially solvent and should not have defaulted in payment of customs duties during the past three years.

- To fulfil required criteria for AEO certificate, the applicant will need to ensure that different security protocols:-

a) Procedural Security: the applicant should have appropriate internal controls and measures to ensure safety and security of his business and supply chain. He should have detailed guidelines on procedures to be followed to take care of the cargo. There should be proper documentation of management procedure.

b) Premises Security

c) Cargo Security

d) Conveyance Security

e) Personnel Security: The applicant must conduct, as far as possible screening of employees

posted in sensitive areas and carry out periodic background checks.

f) Business Partner Security i.e. clear identification of his business partners