Case Law Details

Amit Kumar Vs Commissioner of Customs (Delhi High Court)

Delhi High Court Orders Customs To Release Traveler’s Gold Worth 20 lakh, iPhone, Play station & More Over Failure To Issue SCN

Delhi High Court in its recent decision dated 06.02.2025 pronounced in the case of Amit Kumar v. The Commissioner of Customs, W.P.(C) 15973/2024, directs the customs department to release detained without issuing SCN by holding that printed waiver of SCN cannot be considered to be an oral SCN.

The case of Amit Kumar v. The Commissioner of Customs (W.P.(C) 15973/2024) was heard by the Delhi High Court on February 6, 2025. The petitioner, Amit Kumar, filed a writ petition under Article 226 of the Constitution, seeking the release of goods detained by the Customs Department under Section 110(2) of the Customs Act, 1962. He contended that no Show Cause Notice (SCN) had been issued within the prescribed six-month period, rendering the continued detention of the goods unlawful. The petitioner also sought a direction to the Commissioner of Customs to bear the storage charges for the detained goods held at the Central Warehousing Corporation, IGI Airport.

The case stemmed from an incident on March 3, 2024, when Amit Kumar arrived at IGI Airport, New Delhi, from Dubai, traveling with his wife. While crossing through the Green Channel, he was intercepted by Customs officials, who detained several high-value items in his possession. The seized goods included a gold chain, a three-layered gold chain with black beads and a pendant, four cut pieces of a gold bar, a Sony PlayStation 5, a Versace Ladies Cosmetic Set, a Meta Quest-3 gaming device, a Xerjoff-K Jabir Perfume, and an iPhone 15 Pro (256 GB). A detention receipt (DR No. 3927) was issued on the same day.

Following the seizure, Kumar formally requested the release of his detained goods on March 20, 2024, by signing a standard printed form titled Request for Release of Detained Goods. The Customs Department appraised the detained items on March 21, 2024, valuing them at approximately ₹20 lakhs—₹14,25,390 for the gold and ₹5,89,248 for the other goods. The petitioner argued that despite the passage of six months from the appraisement date, no written SCN had been served upon him, which, under Section 124 of the Customs Act, mandates an SCN before confiscation.

During the court proceedings, the Customs Department, represented by Senior Standing Counsel Mr. Gibran Naushad, contended that an SCN need not be in writing and that an oral SCN sufficed as per the first proviso to Section 124. Furthermore, the respondent asserted that Amit Kumar had signed the waiver form at the time of his request for the release of detained goods, thereby relinquishing his right to a written SCN and a personal hearing. It was also argued that, with respect to the gold articles, the discretion of release rested with the authorities, while the other detained goods were permitted to be redeemed upon payment of ₹85,000.

The High Court, presided over by Justice Prathiba M. Singh and Justice Dharmesh Sharma, critically examined the Customs Department’s reliance on the waiver form. The Court held that such a printed form, containing a blanket waiver of an SCN, personal hearing, and acknowledgment of an oral SCN, could not be considered a conscious or informed waiver of statutory rights. The Court emphasized that individuals whose goods have been detained cannot be expected to comprehend complex legal consequences merely by signing a standardized document, particularly in a stressful situation at an airport.

In analyzing Section 124 of the Customs Act, the Court noted that even when an oral SCN is issued, authorities have the discretion to issue a supplementary notice. The statutory framework demands that an SCN be served with due process, ensuring that the affected party is given a fair opportunity to respond. The Court further stated that the standard printed form used by the Customs Department effectively forced individuals to waive their rights unknowingly, which amounted to a violation of natural justice principles. The Court observed that natural justice must be upheld in both letter and spirit and that procedural fairness cannot be compromised through arbitrary forms.

To substantiate its ruling, the Court referred to the decision in Mohammad Zaid Saleem v. The Commissioner of Customs (Airport & General) (W.P.(C) No. 2595/2019), where it was held that if an SCN is not issued within six months of the seizure, the detained goods must be released. The Court reiterated that issuing an SCN within the stipulated timeframe is mandatory and that any failure to do so renders the continued detention of goods unlawful.

In light of these findings, the High Court ruled in favor of Amit Kumar, declaring that no valid SCN had been issued, and as a result, the detention was contrary to law. Consequently, the Order-in-Original dated November 29, 2024, was set aside. The Court directed that the detained goods be released to the petitioner but specified that he would be responsible for bearing the storage charges.

Beyond the immediate case, the Court recognized systemic flaws in the Customs Department’s practices and directed the Central Board of Indirect Taxes and Customs (CBIC) to review and revise all forms used for detention, appraisal, and waiver of rights to ensure compliance with legal principles. The Court also mandated the establishment of a structured procedure for issuing SCNs in cases of detained goods.

Additionally, the Court acknowledged that issues surrounding the Baggage Rules, 2016 were already under judicial scrutiny in the case of Qamar Jahan v. Union of India, where concerns were raised about outdated baggage regulations, particularly in light of the rising value of gold. The Court ordered that a copy of its judgment in Amit Kumar’s case be placed in the record of the Qamar Jahan matter, which was scheduled for further hearing on March 27, 2025.

The Court concluded by directing that a copy of the judgment be forwarded to the CBIC’s legal division for compliance and necessary action. The matter was also to be communicated to the concerned customs officials to ensure adherence to the revised procedural norms in future cases.

FULL TEXT OF THE JUDGMENT/ORDER OF DELHI HIGH COURT

1. This hearing has been done through hybrid mode.

2. The Petitioner has filed the present writ petition under Article 226 of the Constitution seeking release of the detained goods under Section 110(2) of the Customs Act, 1962 (hereinafter ‘Act’), on the ground that no Show Cause Notice (hereinafter ‘SCN’) was issued. The prayer in the present petition also seeks direction to the Respondent-The Commissioner of Customs to pay storage charges to Central Warehousing Cooperation, IGI Airport.

3. It is the case of the Petitioner that the Show Cause Notice has not been issued within the period of 6 months from the date of appraisement of the said goods.

4. When the matter was listed on 11th December 2024, the Customs Department informed the Court that the Order-in-Original has now been passed in the case. The said Order-in-Original dated 29th November 2024 was then handed over to the ld. Counsel for the Petitioner and then brought on record.

5. The brief background of this case is that the Petitioner arrived from Dubai in Terminal-3, IGI Airport, New Delhi on 3rd March, 2024. He was traveling with his wife and was crossing through Green Channel, when he was intercepted and the following goods were detained by the Customs Official:-

(i) One gold chain

(ii) One three layered gold chain with black beads and gold pendant

(iii) Four cut pieces of gold bar

(iv) Sony PS5 Play Station

(v) One Versace Ladies Cosmetic Set

(vi) Meta Quest-3 Gaming Device

(vii) Xerjoff-K Jabir Perfume

(vii) I PHONE 15 PRO 256 GB

6. The detention was effected on 3rd March, 2024 and a detention receipt was issued bearing DR No.3927.

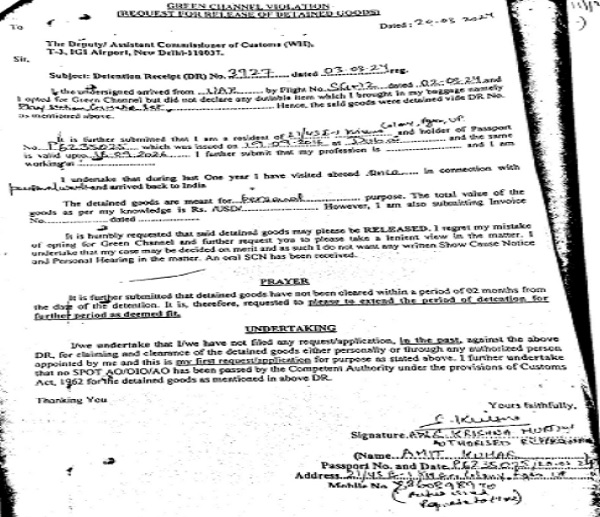

7. The Petitioner had made a request for release of detained goods on 20th March, 2024. A printed form of “Request for release of detained goods” was signed by the Petitioner. The said form is extracted below:

8. On 21st March, 2024, the appraisal of the gold was done, which included one gold chain, one three layered gold pendant chain with black beads and gold pendant and four cut pieces of gold bar along with a carton containing miscellaneous electronic items. Total of all the detained items was appraised at approximately Rs. 20 lacs. The break-up of the value is as under:

- Gold – Rs. 14,25,390/- and

- Other Goods -Rs. 5,89,248/-.

9. The stand of the Petitioner is that no SCN was issued and no opportunity was accorded for even a hearing. Further, it is argued by learned Counsel that under Section 124 of the Act, the SCN has to be issued within a period of six months which was not done in the present case and therefore the goods are liable to be returned.

10. Mr. Naushad, ld. Counsel for the Respondent submits that the SCN could be even oral as per the first proviso to Section 124 of the Act. In the application for release of detained goods, the Petitioner has signed an undertaking that he does not want a written SCN or even a personal hearing.

11. It is further submitted that insofar as gold is concerned, the discretion vests with the authorities whether to release or not release the gold articles, insofar as the other articles are concerned, the same have been permitted to be redeemed by paying a sum of Rs. 85,000/-.

12. The Court has considered the matter. The main plank of the Respondent’s submission is on the basis of the Standard Printed Form which is titled Green Channel Violation (Request for Release of Detained Goods) which has been extracted hereinabove.

13. A perusal of the above would show that in Printed Form, the following has been included:-

“It is humbly requested that said detained goods may please be RELEASED. I regret my mistake of opting for Green Channel and further request you to please take a lenient view in the matter. I undertake that my case may be decided on merit and as such I do not want any written Show Cause Notice and Personal Hearing in the matter. An oral SCN has been received.”

14. When a request for release of goods is being made by the person whose goods have been detained, the said person cannot be expected to read a printed form, where –

- waiver of Show Cause Notice has been agreed to,

- waiver of personal hearing has been agreed to and

- it has also been recorded that an oral SCN has been received.

Such signing of the standard form would not be in compliance with the principles of natural justice, inasmuch as, the waiver under Section 124 of the Act would have to be a conscious wavier and an informed wavier.

15. A perusal of Section 124 of the Act would show that even after an oral show cause notice is given, the authority has the discretion to issue supplementary notice under circumstances which may be prescribed. For ready reference, Section 124 of the Act is set out below:-

“124. Issue of show cause notice before confiscation of goods, etc.—No order confiscating any goods or imposing any penalty on any person shall be made under this Chapter unless the owner of the goods or such person—

(a) is given a notice in [writing with the prior approval of the officer of Customs not below the rank of [an Assistant Commissioner of Customs], informing] him of the grounds on which it is proposed to confiscate the goods or to impose a penalty;

(b) is given an opportunity of making a representation in writing within such reasonable time as may be specified in the notice against the grounds of confiscation or imposition of penalty mentioned therein; and

(c) is given a reasonable opportunity of being heard in the matter:

Provided that the notice referred to in clause (a)

and the representation referred to in clause (b) may, at the request of the person concerned be oral.

[Provided further that notwithstanding issue of notice under this section, the proper officer may issue a supplementary notice under such circumstances and in such manner as may be prescribed.]”

16. A perusal of Section 124 of the Act along with the alleged waiver which is relied upon would show that the oral SCN cannot be deemed to have been served in this manner as is being alleged by the Department. If an oral SCN waiver has to be agreed to by the person concerned, the same ought to be in the form of a proper declaration, consciously signed by the person concerned. Even then, an opportunity of hearing ought to be afforded, inasmuch as, the person concerned cannot be condemned unheard in these matters. Printed waivers of this nature would fundamentally violate rights of persons who are affected. Natural justice is not merely lip-service. It has to be given effect and complied with in letter and spirit.

17. The three-pronged waiver which the form contains is not even decipherable or comprehensible to the common man. Apart from agreeing as per the said form that the oral SCN has been served, the person affected has also waived a right for personal hearing. Such a form in fact shocks the conscience of the Court, that too in cases of the present nature where travellers/tourists are made to run from pillar to post for seeking release of detained goods.

18. A Co-ordinate Bench of this Court recently in Mohammad Zaid Saleem vs. The Commissioner of Customs (Airport & General) [W.P.(C) No. 2595/2019], has held clearly that if a SCN is not given within six months of the seizure, the goods would be liable to be released. The relevant portion of the above stated judgment is extracted below:

“Before parting with this petition, it is pertinent to note that the matters in issue in the present matter are squarely covered by decision in the case of Chaganlal Gainmull v. Collector of Central Excise, where it was held that if the show cause notice was not issued within six months from the date of seizure, the consequence would be that the person from whom the gold was seized would become entitled to its return. Although the aspect of extension of period of detention for another six months vide the Proviso to Section 110(2) of the Act was introduced w.e.f 29.03.20184 the ratio still holds sway to the effect that issuing of notice to the owner for detention of seized goods is mandatory and the Apex Court frowned upon the fact that no explanation was offered by the Respondents as to why they were constrained to dispose of the seized gold, when it was neither perishable nor hazardous, and there was no answer as to why the gold was disposed of without any notice being issued to the person from whom it was seized.”

19. This Court is of the opinion that the printed waiver of SCN and the printed statement made in the request for release of goods cannot be considered or deemed to be an oral SCN, in compliance with Section 124.

The SCN in the present case is accordingly deemed to have not been issued and thus the detention itself would be contrary to law. The order passed in original without issuance of SCN and without hearing the Petitioner, is not sustainable in law. The Order-in-Original dated 29th November, 2024 is accordingly set-aside.

20. The detained goods are directed to be released to the Petitioner. The storage charges of the detained goods shall however be borne by the Petitioner.

21. In order to avoid such situations in future, let this matter be referred to Central Board of Indirect Taxes and Customs (hereinafter ‘CBIC’) for undertaking a review of the various forms including Detention receipts, Requests for appraisal and connected documents. Let the same be duly changed in accordance with law and in compliance with the principles of Natural Justice. In addition, let a procedure be prescribed for issuance of show cause notices after detention of goods by customs.

22. Issues relating to the Baggage rules are already being considered by this Court in the Qamar Jahan Vs. Union of India, 2025:DHC:174-DB where the Court opined that the Baggage Rules of 2016 are required to be re-looked by the Central Board of Indirect Taxes and Customs, considering the price of gold which has increased over the years. The said matter is listed on 27th March, 2025. A copy of this order be placed in the said case as well.

23. Copy of this order be sent to CBIC. Registry is directed to communicate this order to the OSD (Legal), CBIC through email (Osd-legal@gov.in) for necessary information and compliance. Let Mr. Gibran Naushad, ld. Counsel, also communicate this order to the OSD (Legal), CBIC for necessary information and compliance.

24. The petition is allowed in the above terms.

Notes:

1 5973/2024