Customs Tariff (Determination of Origin of Goods under the India-Australia Economic Cooperation and Trade Agreement) Rules, 2022- Notification No. 112/2022-Customs (N.T.), Dated: 22.12.2022

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF INDIRECT TAXES AND CUSTOMS)

New Delhi, the 22nd December, 2022

Notification No. 112/2022-Customs (N.T.)

G.S.R. 897(E).—In exercise of the powers conferred by sub-section (1) of section 5 of the Customs Tariff Act, 1975 (51 of 1975), the Central Government hereby makes the following rules, namely: –

1. Short title and commencement.- (1) These rules may be called the Customs Tariff (Determination of Origin of Goods under the India-Australia Economic Cooperation and Trade Agreement) Rules, 2022.

(2) They shall come into force on the 29th day of December, 2022.

2. Definitions.- (1) In these rules, unless the context otherwise requires, –

(a) “Agreement” means the India-Australia Economic Cooperation and Trade Agreement;

(b) “aquaculture including mariculture” means the farming of aquatic organisms including fish, molluscs, crustaceans, other aquatic invertebrates and aquatic plants from seed stock, including seed stock imported from non-parties, such as eggs, fry, fingerlings, or larvae, by intervention in the rearing or growth processes to enhance production such as regular stocking, feeding, or protection from predators;

(c) “CIF value or Cost, Insurance and Freight value” means the price actually paid or payable to the exporter for a good when the good is loaded out of the carrier, at the port of importation, including the cost of the good, insurance, and freight necessary to deliver the good to the named port of destination;

(d) “competent authority” means the Department of Commerce, for India;

(e) “customs administration” means,-

(i) the Department of Home Affairs and its successors, for Australia; and

(ii) the Central Board of Indirect Taxes and Customs (CBIC), for India;

(f)“Customs Valuation Agreement” means the Agreement on Implementation of Article VII of the General Agreement on Tariffs and Trade 1994, set out in Annex 1A to the WTO Agreement;

(g) “days” means calendar days, including weekends and holidays;

(h) “FOB value or Free-On-Board value” means the price actually paid or payable to the exporter for a good when the good is loaded onto the carrier at the named port of exportation, including the cost of the good and all costs necessary to bring the good onto the carrier;

(i) “fungible goods or materials” means goods or materials that are interchangeable for commercial purposes and whose properties are essentially identical;

(j) “GATT 1994” means the General Agreement on Tariffs and Trade 1994, set out in Annex 1A of the WTO Agreement;

(k) “Generally Accepted Accounting Principles” means those principles recognised by consensus or with substantial authoritative support in the territory of a Party with respect to the recording of revenues, expenses, costs, assets and liabilities; the disclosure of information; and the preparation of financial statements. These principles may encompass broad guidelines for general application, as well as detailed standards, practices and procedures;

(l) “goods” means any merchandise, product, article or material;

(m) “Harmonized System (HS)” means the Harmonized Commodity Description and Coding System defined in the International Convention on the Harmonized Commodity Description and Coding System, including its General Rules of Interpretation, and legal notes which includes Section Notes and Chapter Notes, as adopted and implemented by the Parties in their respective laws;

(n)“indirect materials” means a material used in the production, testing or inspection of a good but not physically incorporated into the good; or a material used in the maintenance of buildings or the operation of equipment, associated with the production of a good, including,-

(i) fuel, energy, catalysts and solvents;

(ii) equipment, devices and supplies used to test or inspect the good;

(iii) gloves, glasses, footwear, clothing, safety equipment and supplies;

(iv) tools, dies and moulds;

(v) spare parts and materials used in the maintenance of equipment and buildings;

(vi) lubricants, greases, compounding materials and other materials used in production or used to operate equipment and buildings; and

(vii) any other material that is not incorporated into the good but the use of which in the production of the good can reasonably be demonstrated to be a part of that production;

(o) “issuing body or authority (as appropriate)” means the body or authority designated by each Party for issuance of Certificates of Origin, as notified from time to time;

(p) “material” means a good that is consumed in the production, physically incorporated or used in the production of another good;

(q) “non-originating good or non-originating material” means a good or material that does not qualify as originating in accordance with these rules, which includes a good or material of undetermined origin;

(r) “originating good or originating material” means a good or material that qualifies as originating in accordance with these rules;

(s) “packing materials and containers for transportation and shipment” means goods used to protect another good during its transportation, but does not include the packaging materials or containers in which a good is packaged for retail sale;

(t) “Parties” means the Government of the Republic of India (“India”) and the Government of Australia (“Australia”);

(u) “Party” means the Government of the Republic of India (“India”) or the Government of Australia (“Australia”);

(v) “producer” means a person who engages in the production of a good;

(w) “production” means operations including growing, cultivating, raising, mining, harvesting, fishing, trapping, hunting, capturing, collecting, breeding, extracting, aquaculture, gathering, manufacturing, processing or assembling a good;

(x) “preferential tariff treatment” means the customs duty rate applicable to an originating good, pursuant to each Party’s Tariff Commitments;

(y) “qualifying value content (QVC)” means the qualifying value content of a good, expressed as a percentage;

(z) “territory” means,-

(i) in respect of Australia, the territory of Australia,-

(A) excluding all external territories other than the Territory of Norfolk Island, the Territory of Christmas Island, the Territory of Cocos (Keeling) Islands, the Territory of Ashmore and Cartier Islands, the Territory of Heard Island and McDonald Islands, and the Coral Sea Islands Territory; and

(B) including Australia’s territorial sea, contiguous zone, exclusive economic zone and continental shelf over which Australia exercises sovereignty, sovereign rights or jurisdiction in accordance with international law including the United Nations Convention on the Law of the Sea, done at Montego Bay on 10th December, 1982; and

(ii) in respect of India, the territory of the Republic of India, in accordance with the Constitution of India, including its land territory, its territorial waters, and the airspace above it and other maritime zones including the Exclusive Economic Zone and continental shelf over which the Republic of India has sovereignty, sovereign rights, and/or exclusive jurisdiction, in accordance with its laws and regulations in force, and international law, including the United Nations Convention on the Law of the Sea, done at Montego Bay, 10th December, 1982;

(za) “value of non-originating materials” means the value of non-originating materials, including materials of undetermined origin, used in the production of the good;

(zb) “value of originating materials” means the value of originating materials used in the production of the good in the territory of one or both Parties;

(zc) “WTO” means the World Trade Organization; and

(zd) “WTO Agreement” means the Marrakesh Agreement Establishing the World Trade Organization, done at Marrakesh on the 15th April, 1994.

(2) For the purposes of these rules,-

(a) the basis for tariff classification is the Harmonized System; and

(b) any cost and value referred to in these rules shall be recorded and maintained in accordance with the Generally Accepted Accounting Principles applicable in the territory of the Party in which the good is produced.

3. Originating Goods.- Except as otherwise provided in these rules, a good shall be regarded as originating if it is,-

(a) wholly obtained or produced in the territory of one or both of the Parties, as provided for in rule 5; or

(b) produced entirely in the territory of one or both of the Parties, using non-originating materials, provided the good satisfies all applicable requirements of rule 4 or Product Specific Rules of Origin in Annexure-B.

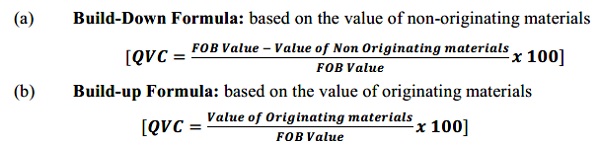

4. Goods not Wholly Produced or Obtained.– For goods that do not have originating status under clause (a) of rule 3 and are not covered under Annexure-B, a good shall be considered originating if all non-originating materials have undergone at least a change in tariff sub-heading (CTSH) level of the Harmonized System, and the QVC of the good is not less than thirty-five per cent. of the FOB value as per build-up formula or forty-five per cent. of the FOB value calculated as per build-down formula under rule 7:

Provided that the final production process of the manufacture of the good is performed within the territory of the exporting Party.

5. Wholly Obtained or Produced Goods.- For the purposes of clause (a) of rule 3, the following goods shall be considered to be wholly obtained or produced in the territory of one or both of the Parties, namely:-

(a) plant and plant goods, including fruit, flowers, vegetables, trees, seaweed, fungi, algae and live plants grown and harvested, picked, or gathered there;

(b) live animals born and raised there;

(c) goods obtained from live animals born and raised there;

(d) goods obtained by hunting, trapping, fishing, aquaculture, gathering, or capturing there;

(e) minerals and other naturally occurring substances, not included in clauses (a) to (d), extracted or taken from the soil or waters, seabed or subsoil beneath the seabed there;

(f) fish, shellfish, and other marine life extracted or taken from the sea, seabed or subsoil beyond the outer limits of the territories of each Party and, in accordance with international law, outside the territorial sea of non-parties by vessels that are registered, listed or recorded with a Party and entitled to fly the flag of that Party;

(g) goods produced on board a factory ship registered, listed or recorded with a Party and entitled to fly the flag of that Party from the goods referred to in clause (f);

(h) goods other than fish, shellfish and other marine life extracted or taken from the sea-bed or subsoil beneath the sea-bed outside the territorial sea of a Party:

Provided that the Party has rights to exploit such sea-bed or subsoil beneath the sea-bed in accordance with relevant international law;

(i) waste and scrap derived from production or consumption there:

Provided that such goods are fit only for the recovery of raw materials, or for recycling purposes; and

(j) goods produced in the territory of one or both Parties solely from products referred to in clauses (a) to (i) or from their derivatives at any stage of production.

6. Accumulation.- Goods and materials originating exclusively in the territory of a Party under the terms of these rules, and incorporated in the production of a good in the territory of the other Party shall be considered to originate in the territory of the other Party.

7. Calculation of Qualifying Value Content.- (1) Where a qualifying value content requirement is specified in these rules, including related Annexures, to determine whether a good is originating, the qualifying value content shall be calculated using one of the following methods, namely:-

(2) All values for the purposes of calculating qualifying value content shall be determined in accordance with the Customs Valuation Agreement.

(3) All costs shall be recorded and maintained in conformity with the Generally Accepted Accounting Principles applicable in the territory of a Party where the good is produced.

(4) If a non-originating material is used in the production of a good, the following may be added to the value of originating materials in determining whether the good meets the QVC requirement,-

(a) the value of production of the non-originating materials undertaken in the territory of one or both Parties; and

(b) the value of originating materials used in the production of the non-originating material in the territory of one or both Parties by one or more producers.

(5) The value of the materials used in production shall be,-

(a) for imported materials, the CIF value;

(b) for materials obtained within the territory of a Party,-

(i) the price paid or payable by the producer in the Party where the producer is located;

(ii) the value as determined for an imported material in clause (a); or

(iii) the earliest ascertainable price paid or payable in the territory of the Party; and

(c) for materials that are self-produced, all the costs incurred in the production of the material, which includes general expenses.

(6) For originating materials, the following expenses may be added to the value of the material, if not included under sub-rule (5),namely :-

(a) the costs of freight, insurance, packing, and other transport-related costs incurred in transporting the good to the location of the producer of the good;

(b) duties, taxes, and customs brokerage fees on the material, paid in the territory of a Party, other than duties that are waived, refunded, refundable, or otherwise recoverable, which includes credit against duty or tax paid or payable; and

(c) the cost of waste and spoilage resulting from the use of the material in the production of the good, less the value of reusable scrap or by-product.

(7) For non-originating materials or materials of undetermined origin, the following expenses may be deducted from the value of the material, namely :-

(a) the costs of freight, insurance, packing, and other transport-related costs incurred in transporting the good to the location of the producer of the good;

(b) duties, taxes, and customs brokerage fees on the material, paid in the territory of a Party, other than duties that are waived, refunded, refundable, or otherwise recoverable, which includes credit against duty or tax paid or payable; and

(c) the cost of waste and spoilage resulting from the use of the material in the production of the good, less the value of reusable scrap or by-product.

(8) Where the expenses listed in sub-rules (5) to (7) are unknown or evidence is not available, then no adjustment is allowed for those costs.

8. Minimal Operations.- (1) Notwithstanding any provisions of these rules, the following operations when undertaken on non-originating materials to produce a good shall be considered as insufficient working or processing to confer on that good the status of an originating good, namely:-

(a) preserving operations to ensure that the good remains in good condition for the purposes of transport or storage;

(b) packaging or presenting goods for transportation or sale;

(c) simple processes, consisting of sifting, screening, sorting, classifying, sharpening, cutting, slitting, grinding, bending, coiling, or uncoiling;

(d) for textiles: attaching accessory articles such as straps, beads, cords, rings and eyelets; ironing or pressing of textiles;

(e) affixing or printing of marks, labels, logos, or other like distinguishing signs on goods or their packaging;

(f) mere dilution with water or another substance that does not materially alter the characteristics of the good;

(g) disassembly of products into parts;

(h) slaughtering of animals;

(i) simple painting and polishing operations;

(j) simple peeling, stoning, or shelling;

(k) simple mixing of goods, whether or not of different kinds; or

(l) any combination of two or more operations referred to in clauses (a) to (k).

Explanation.- For the purpose of this sub-rule (1),-

(a) “simple” describes activities which need neither special skills nor machines, apparatus or equipment especially produced or installed for carrying out the activity.

(b) “simple mixing” describes activities which need neither special skills nor machines, apparatus or equipment especially produced or installed for carrying out the activity. However, simple mixing does not include a chemical reaction. Chemical reaction means a process, including a biochemical process, which results in a molecule with a new structure, by breaking intra-molecular bonds and by forming new intra-molecular bonds, or by altering the spatial arrangement of atoms in a molecule.

(c) “slaughtering” means the mere killing of animals.

(2) All operations carried out in a Party on given good shall be considered together when determining whether the working or processing undergone by that good is to be regarded as insufficient within the meaning of sub-rule (1).

9. De Minimis.- (1) A good, except for those falling within chapters 50 to 63 of the Harmonized System, that does not satisfy a change in tariff classification pursuant to Annexure-B shall nonetheless be an originating good if the value of non-originating materials used in the production of the good does not exceed ten per cent. of the FOB value of the good as defined under rule 2 and the good meets all of the other applicable requirements in these rules.

(2) A good classified in Chapters 50 to 63 of the Harmonized System that does not qualify as originating good because certain non-originating materials used in the production of the good do not fulfil the requirements set out in Annexure-B, shall nonetheless be an originating good if the total weight of all such material does not exceed ten per cent. of the total weight of that good.

(3) If a good described in sub-rule (1) or (2) is also subject to a qualifying value content requirement, the value of those non-originating materials shall be included in the value of non-originating materials for the applicable qualifying value content requirement.

10. Treatment of Packaging Materials and Containers for Retail Sale.- (1) Packaging materials and containers in which a good is packaged for retail sale, if classified with the good, shall be disregarded in determining whether the non-originating materials used in the production of the good have satisfied the applicable process or change in tariff classification requirement set out in Annexure- B, or whether the good is wholly obtained or produced.

(2) If the good referred to in sub-rule (1) is subject to the qualifying value content requirement, the value of such packaging materials and containers shall be taken into account as value of the originating or non-originating materials, as the case may be, in calculating the qualifying value content of the good.

11. Treatment of Packing Materials and Containers for Transportation and Shipment.- Packing materials and containers for transportation and shipment of a good shall not be taken into account in determining whether the good is originating.

12. Accessories, Spare Parts and Tools.- (1) The origin of the accessories, spare parts or tools presented with a good,-

(a) shall be disregarded if the good is subject to a change in tariff classification requirement or production process requirements for origin specified in Annexure-B; and

(b) shall be taken into account as originating or non-originating materials, as the case may be, in calculating the qualifying value content of the good, if the good is subject to a qualifying value content requirement.

(2) Sub-rule (1) shall only apply where,-

(a) the accessories, spare parts, tools and instructional or other information materials presented with the good are not invoiced separately from the originating good; and

(b) the quantities and value of the accessories, spare parts, tools and instructional or other information materials presented with the good are customary for that good.

13. Indirect Materials.- An indirect material shall be considered to be originating without regard to where it is produced.

14. Fungible Goods.- (1) Fungible goods or materials shall be treated as originating based on the,-

(a) physical separation of the good or material; or

(b) use of any inventory management method recognised in the Generally Accepted Accounting Principles of the Party where the production is performed, if originating and non-originating fungible goods or materials are commingled:

Provided that the inventory management method selected is used throughout the fiscal year of the person that selected the inventory management method.

(2) An inventory management system under clause (a) of sub-rule (1) must ensure that no more goods or materials receive originating status than would have been the case if the fungible goods or materials had been physically segregated.

15. Consignment.- (1) A good shall retain its originating status as determined under rule 3 if either of the following conditions have been met, namely:-

(a) the good has been transported directly from the exporting Party to the importing Party; or

(b) the good has been transported through one or more non-Parties:

Provided that the good has not undergone any subsequent production or other operation outside the territories of the Parties other than unloading, reloading, storing, repacking, relabelling in accordance with the laws and regulations of the importing Party, splitting up of loads, consolidation of loads or any other operation necessary to preserve it in good condition or to transport the good to the territory of a Party and the good has remained under customs control in the non-Parties.

(2) Compliance with clause (b) of sub-rule (1) shall be evidenced by presenting the customs administration of the importing Party either with customs documents of the non-Parties, or with any other appropriate documentation on request of the customs administration of the importing Party.

(3) Appropriate documentation referred to in sub-rule (2) may include commercial shipping or freight documents such as airway bills, bills of lading, multimodal or combined transport documents, a copy of the original commercial invoice in respect of the good, financial records, a non-manipulation certificate, or other relevant supporting documents as may be requested by the customs administration of the importing Party.

16. Certificate of Origin.- (1) The Certificate of Origin shall be issued by an issuing body or authority, as appropriate, of an exporting Party, upon an application by an exporter, producer, or their authorised representative.

(2) It shall bear an authorised signature and official seal of the issuing body or authority, as appropriate. The signature and seal shall be applied manually or electronically.

(3) A Certificate of Origin shall:

(a) be in writing or electronic format;

(b) be in the English language;

(c) specify that the good is originating and meets the requirements of these rules;

(d) contain information, as set out in Annexure-A (Minimum Information Requirements) and presented in the same format as provided for in Annexure-A ;

(e) remain valid for twelve months from the date on which it is completed or issued;

(f) apply to single importation of one or multiple goods:

Provided that each good qualifies as an originating good separately in its own right; and

(g) bear a unique Certificate of Origin number, affixed by the issuing body or authority, as appropriate, in the exporting Party.

(4) A Certificate of Origin may indicate two or more invoices issued for single importation.

17. Certification Procedures.- (1) The Certificate of Origin shall be forwarded by the exporter or producer to the importer. The customs administration may require the original copy.

(2) Neither erasures nor superimposition shall be allowed on the Certificate of Origin. Any alterations shall be made by striking out the erroneous material and making any addition(s) that may be required. Such alterations shall be approved by a person authorised to sign the Certificate of Origin and certified by the appropriate issuing body or authority. A new certificate may be issued to replace the erroneous one. Unused spaces shall be crossed out to prevent any subsequent addition(s).

(3) The Certificate of Origin shall be issued prior to or within five working days of the date of exportation. However, under exceptional cases, where a Certificate of Origin has not been issued at the time of exportation or within five working days from the date of shipment due to involuntary errors or omissions, or any other valid reasons, the Certificate of Origin may be issued retrospectively, bearing the words “ISSUED RETROSPECTIVELY” in the Certificate of Origin, with the issuing body or authority also recording the reasons in writing on the exceptional circumstances due to which the certificate was issued retrospectively. The Certificate of Origin can be issued retrospectively no later than twelve months from the date of shipment.

(4) In cases of theft, loss or accidental destruction of a Certificate of Origin, the exporter, producer or an authorised representative thereof may, within the term of validity of the original Certificate of Origin, make a written request to the issuing body or authority that issued the original certificate for a certified copy. The certified copy shall bear the words “CERTIFIED TRUE COPY”. The certified copy shall have the same term of validity as the original Certificate of Origin.

18. Application for Certificate of Origin.- (1) For the issue of a Certificate of Origin, the exporter or producer of the goods shall present, or submit electronically through the approved channel, to the issuing body or authority of the exporting Party the following, namely:-

(a) an application, together with appropriate supporting information and documents for proving origin, including but not limited to, the breakup of costs and any other relevant elements such as profits;

(b) information outlined in Annexure-A and consistent with the description in the invoice; and

(c) the corresponding commercial invoice and other documents necessary to establish the origin of the good.

(2) Multiple items declared on the same Certificate of Origin shall be allowed:

Provided that each item must qualify separately in its own right.

(3) Each Party may, in accordance with its domestic procedures and if it deems appropriate, allow its issuing body or authority to apply a risk management system to selectively conduct pre-export verification of the minimum information requirements filed by an exporter or producer.

(4) The issuing body or authority, as appropriate, may, to the best of their competence and ability, carry out proper examination of each application for a Certificate of Origin to ensure that,-

(a) the application has been duly completed and signed by the authorised signatory;

(b) the origin of the good is in conformity with the requirements of these rules; and

(c) the information furnished in the Certificate of Origin corresponds to supporting information and documents submitted.

19. Non-Party Invoicing.- (1) An importing Party shall not deny a claim for preferential tariff treatment for the sole reason that an invoice was not issued by the exporter or producer:

Provided that the goods meet the requirements of these rules.

(2) The exporter of the goods shall indicate “non-party invoicing” and the name, address, and country of the company issuing the invoice shall appear in a separate column in the Certificate of Origin.

20. Authorities.- (1) The Certificate of Origin shall be issued by an issuing body or authority, as appropriate.

(2) Each Party shall, within thirty days of the date of entry into force of these rules, inform the customs administration of the other Party of the issuing body or authority, as appropriate, and contact details of the authorised persons of such body or authority, designated to issue Certificates of Origin under these rules.

(3) The Parties shall exchange specimen seals and signatures of the authorised signatories issuing Certificates of Origin.

(4) Each Party shall promptly notify the other Party of any change to its issuing body or authority, as appropriate, and the names, designations, addresses, specimen signatures of authorised persons or seals of such issuing body or authority.

21. Claims for Preferential Tariff Treatment.- (1) Except as otherwise provided in rule 28, each Party shall grant preferential tariff treatment in accordance with these rules to an originating good on the basis of a Certificate of Origin.

(2) Unless otherwise provided in these rules, for the purposes of claiming preferential tariff treatment, an importing Party shall provide that an importer,-

(a) make a declaration that the good qualifies as an originating good;

(b) have a valid Certificate of Origin in its possession at the time the declaration referred to in clause (a) is made;

(c) provide a copy of the Certificate of Origin to the importing Party if required by the Party; and

(d) if required by an importing Party, demonstrate that the requirements in rule 15 have been satisfied.

(3) An importing Party may require that an importer who claims preferential tariff treatment shall provide documents and other information to support the claim.

22. Record Keeping Requirements.- (1) Each Party shall require that,-

(a) its exporters, producers and issuing bodies or authorities, as appropriate, retain for at least five years from the date of issuance of the Certificate of Origin, or a longer period in accordance with its relevant laws and regulations, all records necessary to prove that the good for which the Certificate of Origin was issued was originating; and

(b) its importers retain, for at least five years from the date of importation of the good, or a longer period in accordance with its relevant laws and regulations, all records necessary to prove that the good for which preferential tariff treatment was claimed was originating.

(2) The records referred to in sub-rule (1) may be maintained in any medium that allows for prompt retrieval, including in digital, electronic, optical, magnetic, or written form, in accordance with the Party’s laws and regulations.

23. Waiver of Certificate of Origin.- A Certificate of Origin shall not be required if the importing Party has waived the requirement or does not require the importer to present a Certificate of Origin, as per their national laws.

24. Obligations of Exporter or Producer.- (1) The exporter or producer shall submit the minimum information requirements, as referred to in Annexure-A, and supporting information and documents, as referred to in rule 18 for the issuance of a Certificate of Origin pursuant to the procedure established by the issuing body or authority, as appropriate, in the exporting Party, consistent with the provisions of these rules.

(2) Any exporter or producer who incorrectly represents any material information relevant to the determination of origin of a good may be liable to be penalised under the laws and regulations of the exporting Party.

(3) The exporter or producer shall keep the minimum required information, and supporting documents for a period no less than five years, starting from the end of the year of the date of issue of the Certificate of Origin.

(4) For the purpose of determination of origin, the exporter or producer applying for a Certificate of Origin under these rules shall maintain appropriate commercial accounting records for the production and supply of goods (as well as relevant records and documents from the suppliers) qualifying for preferential treatment and keep all commercial and customs documentation relating to the material(s) used in the production of the good, including but not limited to breakup of costs relating to material(s), labour, other overheads and any other relevant elements such as profits and related components for at least five years from the date of issue of the Certificate of Origin. The exporter or producer shall, upon request of the issuing body or authority, of the exporting Party or the customs administration of the importing Party, make available records for inspection to enable verification of the origin of the good.

(5) If the exporter or producer has reason(s) to believe that the Certificate of Origin is based on incorrect information that could affect the accuracy or validity of the Certificate of Origin, they shall be obliged to immediately notify the importer, the issuing body or authority and the customs administration of the importing Party in writing of any change affecting the originating status of each good to which the Certificate of Origin applies.

25. Post Importation Claim for Preferential Tariff Treatment.- (1) An importer may apply for preferential tariff treatment and a refund of any excess duties paid for a good if the importer did not make a claim for preferential tariff treatment at the time of importation:

Provided that the good would have qualified for preferential tariff treatment when it was imported into its territory.

(2) As a condition for preferential tariff treatment under sub-rule (1), the importing Party may require that the importer, not later than twelve months after the date of importation or a longer period if specified in the importing Party’s laws and regulations, to,-

(a) make a claim for preferential tariff treatment;

(b) where applicable, provide a copy of Certificate of Origin; and

(c) provide such other documentation relating to the importation of the good as the importing Party may require.

(3) If the importer has reason(s) to believe that the claim for preferential tariff treatment is based on incorrect information that could affect the accuracy or validity of the Certificate of Origin, the importer shall correct the importation document, and pay any customs duty and, if applicable, penalties owed.

(4) When considering imposing a penalty in relation to a claim for preferential tariff treatment, the customs administrations of the Parties are encouraged to consider a voluntary notification given prior to the discovery of that error by the Party and in accordance with sub-rule (3) or sub-rule (5) of rule 24, as a mitigating factor:

Provided that in the case of a notification given by an importer, the importer corrects the error and repays any duties owed.

26. Verification of Origin.-

Initiating a verification of origin

(1) For the purposes of determining whether goods imported into the territory of a Party from the territory of the other Party qualify as originating goods, the customs administration of the importing Party may conduct a verification process by proceeding in sequence, when required, with,-

(a) a written request or written requests for information from the importer of the good;

(b) a written request or written requests for information from the competent authority and issuing body or authority, as appropriate, of the exporting Party where the customs administration of the importing Party considers the information obtained under clause (a) is not sufficient to make a determination and requires additional information including the breakup of costs and any other relevant elements such as profits;

(c) a written request or written requests for information from the exporter or producer of the goods, where the customs administration of the importing Party considers the information obtained under clause (a) and (b) is not sufficient to make a determination and requires additional information including the breakup of costs and any other relevant elements such as profits for the determination of origin of the good under rule 3 and rule 4 irrespective of the method adopted under rule 7;

(d) visits to the premises of an exporter or a producer in the territory of another Party; or

(e) any other procedures to which the Parties may agree.

(2) A verification under sub-rule (1) may be conducted at the time that the customs import declaration is lodged, or before or after the release of the good by the customs administration of the importing Party.

(3) For the purposes of clause (b) of sub-rule (1), the customs administration of the importing Party,-

(a) may request the competent authority or the issuing body or authority, as appropriate, of the exporting Party to assist it in verifying,-

(i) the authenticity of a Certificate of Origin;

(ii) the accuracy of any information contained in the Certificate of Origin; or

(iii) the authenticity and accuracy of the supporting information and documents, which may relate to the breakup of costs and any other relevant elements such as profits for the determination of origin of the good under rule 4 irrespective of the method adopted; and

(b) shall provide the competent authority or the issuing body or authority, as appropriate, with,-

(i) the reasons why such assistance is sought;

(ii) the Certificate of Origin, or a copy thereof; and

(iii) any information and documents as may be necessary for the purpose of providing such assistance.

(4) Where a written request is made under clause (c) of sub-rule (1), the customs administration of the importing Party shall,-

(a) ensure that the information requested is limited to information pertaining to the fulfilment of the requirements of these rules as follows,-

(i) Certificate of Origin;

(ii) information supporting a claim that the good is originating under rule 3;

(iii) information on any tolerances relied on under rule 9; and

(iv) information confirming compliance with the non-alteration provisions under rule 15;

(b) allow the exporter or producer at least thirty days from the date of receipt of the request to provide the requested information; and

(c) notify the customs administration of the exporting Party of the request.

Release of goods subject to verification

(5) During verification, the importing Party shall allow the release of the good, subject to payment of any duties or provision of any security as provided for in its laws and regulations. If as a result of the verification, the importing Party determines that the good is an originating good, it shall grant preferential tariff treatment to the good and refund any excess duties paid or release any security provided, unless the security also covers other obligations as provided for in the Party’s laws and regulations.

27. Procedure for Verification.- (1) Any request for information made by the customs administration of the importing Party pursuant to rule 26 shall be in accordance with the following procedures, namely:-

(a) if requested, the issuing body or authority, as appropriate, of the exporting Party shall provide the following information within ninety days,-

(i) a confirmation pertaining to the authenticity or otherwise of the Certificate of Origin along with a copy of the minimum required information; and

(ii) if the request is on the grounds of suspicion of the accuracy of the determination of origin of the good, this period can be extended for a period of no more than sixty days;

(b) if the importing Party is not satisfied with the verification undertaken in accordance with clause (a) to (c) of sub-rule (1) of rule 26, it may, under exceptional circumstances, request the exporter or producer for a verification visit. The importing Party shall notify in writing the exporter or producer whose premises are to be visited, the issuing body or authority, the customs administration of the exporting Party and the importer of its intention to conduct the verification visit.

(2) The importing Party shall obtain the written consent of the exporter or producer whose premises are to be visited. When a written consent from the exporter or producer is not received within thirty days of receipt of the written request, the importing Party may deny preferential treatment on goods subject to the verification visit.

(3) The written notification shall include the name of the exporter or producer whose premises are to be visited, the proposed date and time of visit, the purpose for the visit, reference to the goods subjected to verification, and a list of officials participating and their designations.

(4) The exporter or producer shall identify two or more independent witnesses to be present during the verification visit.

(5) The importing Party conducting the verification visit shall provide the exporter or producer as well as the issuing body or authority of the exporting Party with a written determination of whether the good qualifies as an originating good.

(6) The verification visit process including the actual visit and notification of written determination of the origin of the good shall be completed within a maximum period of six months from the date when the verification visit was conducted.

Completion of verification procedure

(7) The customs administration of the importing Party shall,-

(a) endeavour to make a determination following a verification as expeditiously as possible and in accordance with its laws and regulations; and

(b) provide the importer with a written determination of whether the good is originating that includes the basis for the determination.

28. Denial of Preferential Tariff Treatment.- (1) The importing Party may deny a claim for preferential tariff treatment if,-

(a) it determines that the good does not qualify as originating within the terms of these rules or does not satisfy the requirement(s) of these rules;

(b) pursuant to a verification under rule 26, it has not received sufficient information, including minimum required information as provided in Annexure-A, to determine that the good qualifies as originating;

(c) the exporter or producer fails to respond to or refuses a written request for information in accordance with rule 26;

(d) the exporter or producer fails to comply with any of the relevant requirements for obtaining preferential tariff treatment;

(e) the exporter or producer or the issuing bodies or authorities, as appropriate, of the exporting Party fail to provide sufficient information and documents, within the timelines specified in clause (b) of sub-rule (4) of rule 26 or sub-rule (1) of rule 27. This may include but not be limited to the breakup of costs and any other relevant elements such as profits that the importing Party requested in order to determine that the good qualifies as originating, pursuant to initiation of verification under rule 26; or

(f) the exporter or producer fails to give consent or respond to a request for a verification visit within thirty days of receipt of a request pursuant to sub-rule (2) of rule 27.

(2) If an importing Party denies a claim for preferential tariff treatment, it shall issue a determination to the exporter or producer that includes the reasons for the determination.

29. Temporary Suspension of Preferential Treatment.- (1) The importing Party may suspend the tariff preference in respect of a good originating in the exporting Party, when the suspension is justified due to persistent failure to comply with the provisions of these rules by an exporter or producer or a persistent failure on part of the competent authority or the issuing bodies or authorities, as appropriate, of the exporting Party to respond to a request for verification.

(2) Upon receipt of the notification of suspension, the exporting Party may request consultations through the Joint Technical Subcommittee established under the Agreement.

(3) Pursuant to consultations between the Parties, and such measures as the Parties may agree, the Parties may resolve to extend preferential benefit to the good with retrospective or prospective effect.

30. Non-compliance of Goods with Rules of Origin and Penalties.- (1) If the verification under rule 26 establishes non-compliance of the goods with the rules of origin, duties shall be levied in accordance with the laws and regulations of the importing Party.

(2) Each Party shall also adopt or maintain measures that provide for the imposition of civil, administrative, and, where appropriate, criminal sanctions for violations of its customs laws and regulations, including those governing rules of origin, and the entitlement to preferential tariff treatment under these rules.

31. Goods in Transport or Storage.- In accordance with rule 25, the customs administration of the importing Party shall grant preferential tariff treatment for an originating good of the exporting Party which, on the date of entry into force of these rules,-

(a) is in the process of being transported from the exporting Party to the importing Party; or

(b) has not been released from customs control, including an originating good stored in a bonded warehouse regulated by the customs administration of the importing Party.

32. Minor Discrepancies or Errors.- A Party shall not reject a Certificate of Origin due to minor errors or discrepancies, such as slight discrepancies between documents, minor omissions of information, spelling, typing or formatting errors, or protrusions from the designated field:

Provided that these minor discrepancies or errors do not create doubt as to the originating status of the good.

ANNEXURE – A

[see clause (d) of sub-rule (3) of rule 16]

Minimum Required Information

| 1. Exporter’s Name, Address, and Country: | Certification No. | Number of pages | |

| 2. Producer’s Name, Address, and Country: | INDIA-AUSTRALIA ECONOMIC COOPERATION AND TRADE AGREEMENT CERTIFICATE OF ORIGIN |

||

| 3. Importer or Consignee’s Name, Address, and Country: | |||

| 4. Transport details: | |||

| 5. Item number (as necessary); Marks and numbers; Number and kind of packages; Description of good(s); HS Code (six-digit level) | 6. ORIGIN criterion (see overleaf note) Cumulation (if applicable) | 7. Gross Weight or other Quantity | 8. Invoice number (s) and date(s) |

| 9. Remarks: (if applicable)

ISSUED RETROSPECTIVELY |

10. Non-Party Invoicing Name, Address, and Country (if applicable) | ||

| 11. Declaration by the exporter:

I, the undersigned, declare that: – the above details and statement are true and accurate; – the good(s) described above meet the condition(s) required for the issuance of this certificate; and – the country of origin of the good(s) described above is:______ Place and Date: Signature: Name (printed): Company: |

12. Certification

It is hereby certified, on the basis of control carried out, that the declaration by the exporter is correct. Export Document Number: Issuing Authority: [Stamp] Place and Date: Signature: |

||

Overleaf Notes –

1. The following origin criterion code should be inserted in Box 6:

(i) “WO” for wholly obtained or produced goods as provided in rule 5.

(ii) For goods that qualify originating status under product specific rules as provided in Annexure-B read with clause (b) of rule 3:

(a) “WO” for goods listed as “WO” in Annexure-B; or

(b) “PSR” for all other goods listed in Annexure-B.

(iii) For goods that qualify originating status under rule 4, “CTSH + QVC 35 Build-up” or “CTSH + QVC 45 Build-down”, as the case may be.

(iv) There is no need to indicate ‘%’ sign while writing qualifying value content in Box 6.

2. In Box 12, “Export Document Number” is applicable only for retrospective issuance of certificate of origin and following should be inserted:

(i) Shipping Bill (Export Declaration) Number and date; or

(ii) Bill of lading/ Airway Bill Number and date.

ANNEXURE – B

[see clause (b) of rule 3]

PRODUCT SPECIFIC RULES OF ORIGIN

Section A

Headnotes to the Annexure

1. For the purposes of this Annexure,-

(a) “chapter” means the first two digits of the tariff classification number under the Harmonized System;

(b) “heading” means the first four digits of the tariff classification number under the Harmonized System;

(c) “section” means a section of the Harmonized System; and

(d) “sub-heading” means the first six digits of the tariff classification number under the Harmonized System.

2. The product specific rule, or set of product specific rules, that applies to a particular sub-heading is set out immediately adjacent to the sub-heading. All HS codes not listed in this Annex are subject to the general rule outlined in sub-rule (1) of rule 4.

3. A requirement of a change in tariff classification applies only to non-originating materials.

4. If a chapter, heading or sub-heading is excluded as part of a change in tariff classification rule, it means that non-originating materials of that chapter, heading or sub-heading may not be used to meet the change in tariff classification rule. All materials that are excluded must be originating goods.

5. Where a heading or sub-heading is subject to alternative product specific rules, the requirements of this Annexure will be considered to be satisfied if a good satisfies one of the alternative rules.

6. If a good is subject to a product specific rule that includes multiple requirements, the requirements of this Annexure will be considered to be satisfied for that good only if the good satisfies all applicable requirements.

7. For the purposes of Section B of this Annexure,-

(a) “WO” means that good must be wholly obtained in the territory of one or both of the Parties within the meaning of rule 5;

(b) “CC” means that all non-originating materials used in the production of the good have undergone a change in tariff classification at the two-digit level;

(c) “CTH” means that all non-originating materials used in the production of the good have undergone a change in tariff classification at the four-digit level;

(d) “CTSH” means that all non-originating materials used in the production of the good have undergone a change in tariff classification at the six-digit level;

(e) “QVC (X)” means that the good must have a qualifying value content as calculated under rule 7 of not less than (X) per cent whether using the build-up method or build-down method; and

(f) “melt and pour” in one or both of the Parties means that the product must have been melted and poured in one or both of the Parties wherein the raw material is first produced in an iron or steel-making furnace in a liquid state, and then poured into its first solid shape.

Section B: Product Specific Rules

[F. No. 20000/2/2015-OSD (ICD)]

HARISH KUMAR, Under Secy.